How to Trade Forex Around Major Elections and Geopolitical Events

2025-07-10 14:33:51

If you've been in the markets long enough, you already know this: some of the biggest opportunities in forex don't come from quite days they come from uncertainty.

And there’s nothing that stirs uncertainty like elections and geopolitical events.

But here’s the mistake most traders make. They get caught chasing moves without understanding the mechanics behind them.

They react to headlines instead of preparing for liquidity shifts, risk repricing, and volatility surges that come in waves not all at once.

In this article, we’ll break down how to properly position, protect, and profit around these high-impact moments.

And we’ll keep it clean no empty forecasting, just structured, strategic trading logic you can rely on.

Why Elections and Geopolitical Events Move the Forex Market

Let’s start with the basics.

Currencies represent countries. And countries run on policy, stability, and power.

So when the balance of any of those shifts as it does during national elections or global conflict the forex market responds.

Here’s how that plays out in real time:

Election outcomes reshape expectations on fiscal and monetary policy.

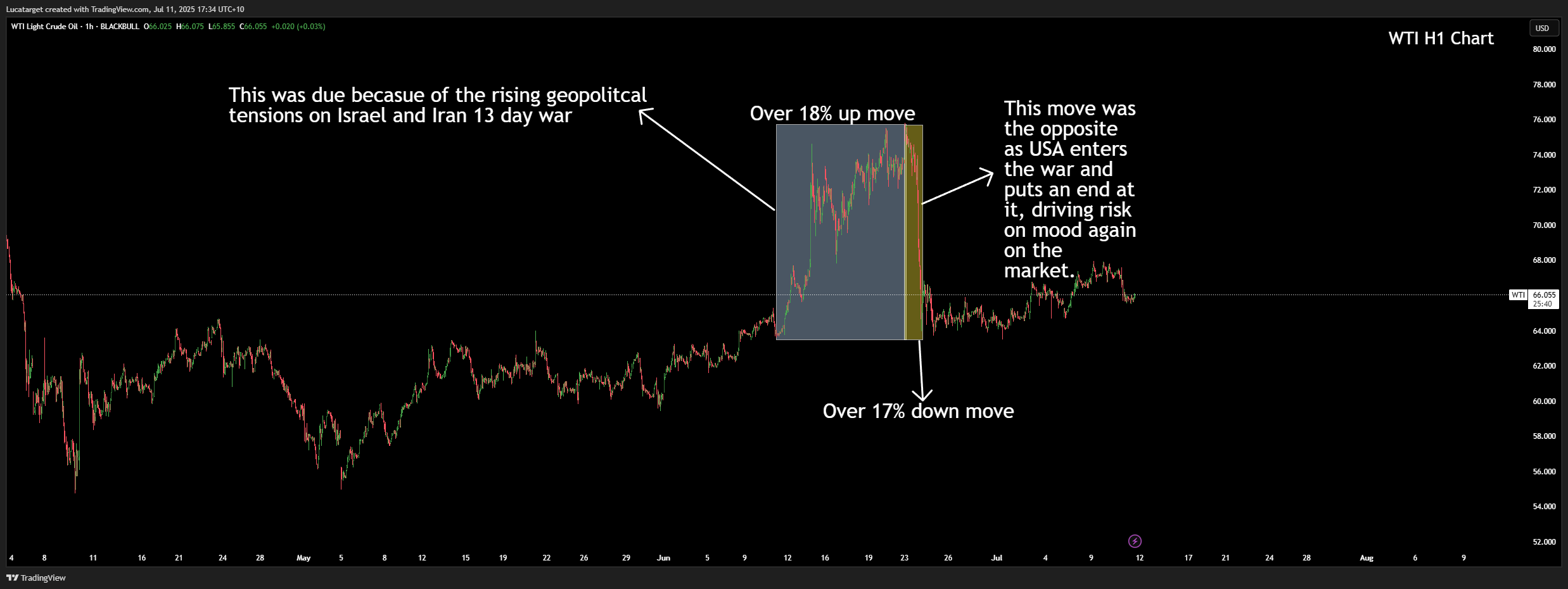

Geopolitical conflicts disrupt trade flows, trigger flight-to-safety behavior, and impact commodities.

Uncertainty increases volatility and volatility attracts liquidity.

This isn't just theory. We've seen it during Brexit, U.S. presidential transitions, European parliamentary shifts, Middle East escalations, and more.

The currency market becomes the front line often reacting before equities or commodities.

Understanding the Risk Environment: Sentiment First, Headlines Second

Before you place a trade during an election cycle or geopolitical event, ask yourself this:

What is the market pricing in, and what is it not expecting?

The actual outcome doesn’t move the market as much as the surprise element does. You’re not trading politics you’re trading the difference between expectation and reality.

For example:

If markets expect a pro-business candidate to win, and they do the move might be muted.

If that same candidate unexpectedly loses, you’ll see immediate repricing especially in currencies closely tied to risk sentiment like AUD, NZD, JPY, EUR, GBP.

The same logic applies to conflicts:

Ongoing tension often gets priced in gradually.

But sudden escalations a surprise missile strike, a change in alliances, sanctions lead to unhedged repositioning.

That’s where opportunity lies in the dislocation.

Currency Behavior Patterns Around Elections and Geopolitical Stress

There are recurring patterns you can watch for:

1. Safe-Haven Demand

Currencies like the USD, CHF, and JPY tend to gain strength when risk sentiment breaks down. These are your go-to hedges during uncertainty but don’t blindly buy them. Wait for confirmation via price action, bond flows, or equity correlations.

2. Local Currency Volatility

The domestic currency of the country facing an election (e.g., MXN, ZAR, GBP, or TRY) often becomes extremely sensitive to polling data, central bank posture, and public unrest. Use event risk modeling and implied volatility pricing to assess risk before trading these pairs.

3. Commodity-Linked Forex Reactions

During geopolitical flare-ups, commodity-linked currencies like AUD, CAD, and NOK can react indirectly via oil, gold, or industrial metals. When conflict disrupts supply chains or shipping lanes, commodities respond and forex follows.

Strategy: How to Trade These Events Without Guessing

You don’t need to predict election winners or troop movements. What you need is a framework.

1. Pre-Event Positioning

In the days leading up to a known election or event, many institutions reduce exposure. That creates choppy, uncertain price action and often shrinks liquidity. Instead of diving in, use this period to:

Study implied volatility across relevant pairs.

Avoid large position sizing think of this as information gathering.

2. Event Reaction Play

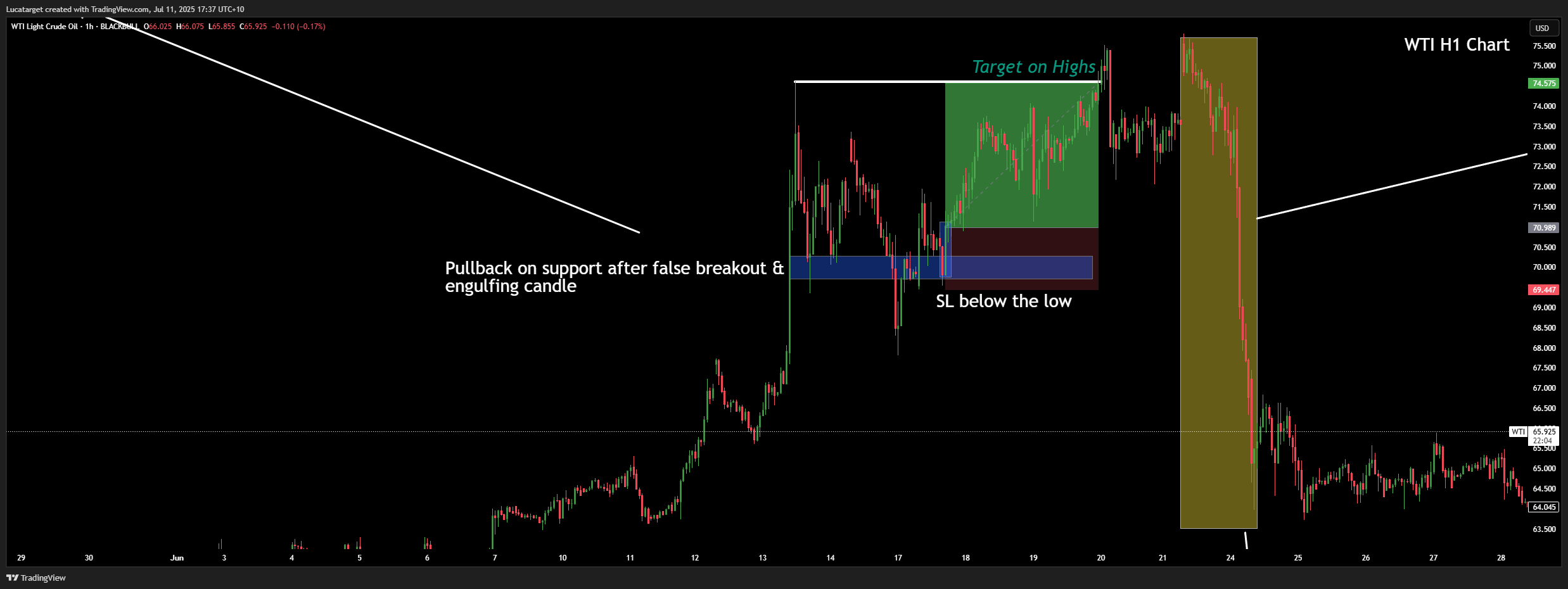

Once results or escalation headlines hit, don’t rush in immediately. The first reaction is usually driven by algos and knee-jerk sentiment. The second and third waves of flow the ones that follow 2–8 hours later are often cleaner.

Look for:

Breakouts from pre-event ranges.

Retests of structural levels with high volume.

Price action that aligns with macro expectations (e.g., high pressure/tension on middle east = WTI/Brent breakout).

3. Post-Event Trend Development

The most consistent trades tend to come after the event, not during it. Once uncertainty resolves, the market chooses direction. Trends emerge. This is where macro alignment, technicals, and sentiment come together.

This is when you want to scale in not when headlines are still flying.

Risk Management: This Isn’t Business as Usual

Trading around elections and geopolitical events carries higher tail risk. Which means position size, leverage, and stop placement need to be adjusted.

Use reduced leverage when volatility is rising into the event.

Avoid placing trades right before key announcements.

Use time-based stops for example, exit trades if no movement occurs 6–8 hours post-news.

Consider hedging exposure through negatively correlated pairs.

If you're not adjusting risk for the environment, you're not trading you're gambling.

It’s easy to get caught in the drama of major political or global news. But here’s the truth: markets move not on the event itself, but on how they feel about it.

That’s why the most profitable forex traders don’t chase headlines they trade reactions. They know where the liquidity is. They understand who’s likely trapped. And they let the market come to them.

If you're approaching elections or geopolitical flare-ups without a framework you're late before you begin. But if you’re ready with sentiment reads, structural setups, and tactical patience?

That’s when you stop reacting and start trading with intent.

Q: Why do elections impact the forex market?

A: Elections shift expectations around fiscal policy, regulation, taxation, and central bank direction. Because currencies reflect national economies, any uncertainty or change in leadership can trigger volatility. Traders aren’t just reacting to outcomes they’re pricing in what the new political environment means for growth, inflation, and stability.

Q: What forex pairs are most sensitive to geopolitical events?

A: Safe-haven currencies like the USD, JPY, and CHF tend to gain during global uncertainty. Pairs involving emerging markets or politically unstable countries like USD/TRY, USD/ZAR, or USD/MXN often see extreme volatility. Commodities-linked currencies like AUD or CAD may also react if the conflict impacts energy or metals markets.

Q: Is it safe to trade during elections or global conflicts?

A: Not unless you’re prepared. These events often cause unpredictable price swings, widened spreads, and sharp liquidity drops. The key is to reduce risk: trade smaller, widen stops if necessary, and wait for clear structure to form after the initial volatility. Often, the cleanest opportunities come after the chaos, not during it.

Q: Should I trade before or after the election results are released?

A: Most professional traders avoid large positions right before an election result. The market is often thin and reactive. Post-event trading once the initial move is made and structure confirms offers more controlled conditions. Focus on identifying the reaction, not predicting the result.

Q: How can I use sentiment analysis around these events?

A: Monitor risk sentiment through indicators like the VIX, bond yields, and equity market behavior. If fear is building, capital typically moves into USD, gold, and other defensive assets. If optimism builds after an election or resolution, risk-on pairs (like AUD/JPY or EUR/USD) may trend higher. Let the market’s tone tell you where capital is going not the news itself.

Gold Trading & Strategy

- Gold in War Times – XAUUSD Historical Guide

- Gold & CPI/NFP – Sentiment and Trader Insights

- XAUUSD Forecast: CPI, NFP and Outlook

- When to Trade XAU/USD – Time Zones & Sessions

- Why Fundamentals Matter in Gold Trading

- XAUUSD vs Cryptocurrency – Safe Haven Comparison

- China Reserves, Basel III and the XAUUSD Structure

- Geopolitical Conflicts and Gold in 2025

- XAUUSD in Market Crashes and Surge Conditions

Risk Sentiment & Global Events

- How to Trade Risk-On and Risk-Off Markets

- Global Events Impacting Financial Markets

- Israel-Iran Conflict and Oil Price Impact

- Understanding Market Context – Why It Matters

- Trading News Events – How the Market Reacts

- Sentiment Analysis – A Trader’s Strategy Guide

Economic Data & Macro Strategy

- Commitment of Traders (COT) Report – Full Guide

- Leading vs Lagging Economic Indicators

- Soft Data vs Hard Data – Trader’s Guide

- How Inflation Data Impacts Markets

- Mastering CPI Inflation – Key to Forex Success

- Fundamental Analysis for Forex Trading

- Understanding Inflation and Forex Impact

- GDP Reports and Their Impact on FX Markets

- PMI Data and the US Dollar Reaction

Trading Skills & Execution

- Risk Management – Stop Loss, Sizing & Strategy

- How to Use an Economic Calendar for Trading

- Central Bank Announcements – Trading Strategies

- How to Trade Interest Rate Decisions

- CPI Trading – A Beginner's Guide

- Mastering Carry Trade in Forex

- Dovish vs Hawkish Comments – FX Impact

- Top Strategies to Trade NFP Events

- Mastering Forex Entry Points

- How to Swing Trade in Forex

- Understanding Market Trends and Price Action

Trading Psychology & Performance

- Forex Trading Psychology – Why Mindset Isn’t Enough

- Grow a Small Trading Account – Practical Guide

- ACY Cast Episode 8 – Forex Market Insights

- Forex Trading with Fundamentals – Essential Guide

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next