Forex, Gold, Oil and Indices Spread Review - 15th September to 19th September

2025-09-22 15:36:22

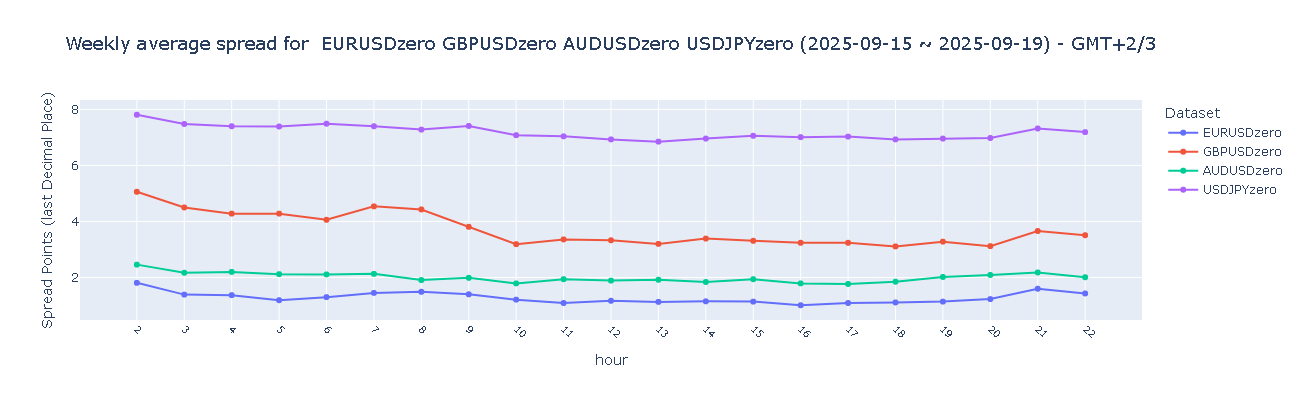

Chart I. Weekly Average Spread for Major Currency Pairs (EURUSD, GBPUSD, AUDUSD, USDJPY)

(Note: The below chart excludes the spread data of the first two hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

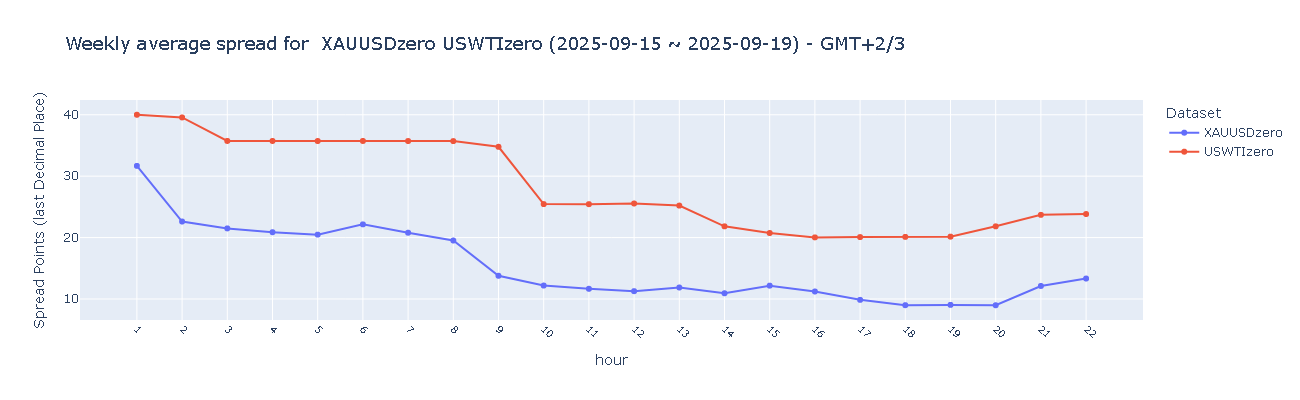

Chart II. Weekly Average Spread for Gold and US Crude Oil (XAUUSD, USWTI)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

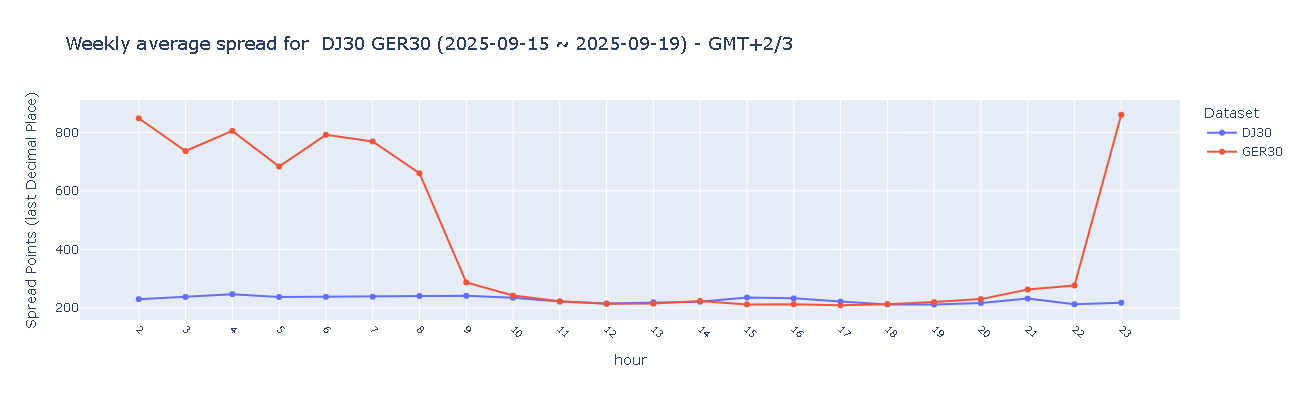

Chart III. Weekly Average Spread for German 30 Index and Dow Jones 30 Index (GER30, DJ30)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

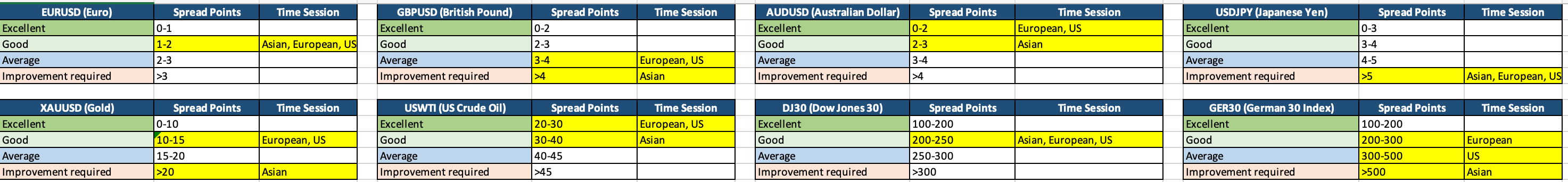

Weekly Average Spread Review Results:

Majors Currency Pairs:

EURUSD (Euro) maintained Good spreads (1–2 points) across Asian, European, and US sessions. This reflects consistently favorable trading conditions across all major sessions.

GBPUSD (British Pound) spreads widened to Average (3–4 points) during the European and US sessions, and further to Improvement Required (>4 points) in the Asian session, showing elevated trading costs in Asia.

AUDUSD (Australian Dollar) achieved Excellent spreads (0–2 points) during the European and US sessions, and maintained Good spreads (2–3 points) during the Asian session. Indicating stable across global markets.

USDJPY (Japanese Yen) consistently experienced Improvement Required conditions (>5 points) across the Asian, European, and US sessions, highlighting persistent spread volatility and higher transaction costs across all trading hours.

Gold and US WTI Oil:

XAUUSD (Gold) maintained Good spreads (10–15 points) in the European and US sessions. In the Asian session, spreads widened to exceeded >20 points, placing them in the Improvement Required category, indicating weaker trading conditions in Asia.

USWTI (US Crude Oil) offered Excellent spreads (20–30 points) during the European and US sessions, and Good spreads (30–40 points) in the Asian session.

Dow Jones 30 and German 30 Indices:

DJ30 (Dow Jones 30) maintained Good spreads (200–250 points) consistently across the Asian, European, and US sessions, reflecting robust liquidity throughout global trading hours.

GER30 (German 30 Index) recorded Good spreads (200–300 points) during the European session, while spreads widened to Average (300–500 points) in the US session. In the Asian session, spreads exceeded >500 points, falling into the Improvement Required category, showing significant sensitivity to time-zone liquidity.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know