The Ultimate Guide to MetaTrader Tools: From Indicators and Scripts to Fully Automated Trading

2025-09-24 16:40:17

This article is reviewed annually to reflect the latest market regulations and trends

TL;DR (Too Long; Didn’t Read)

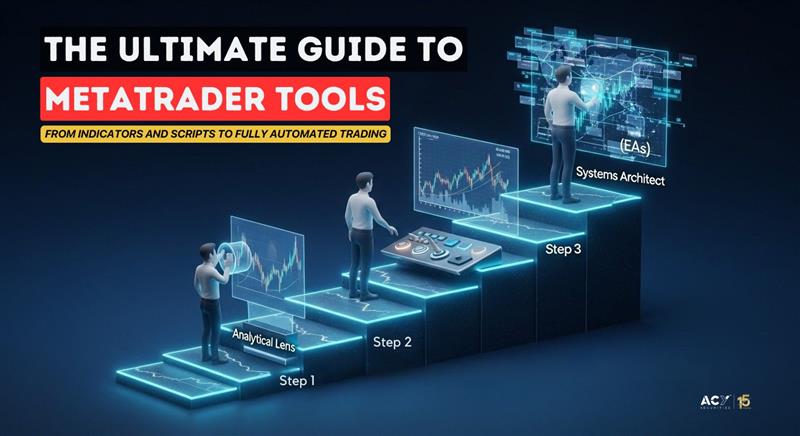

- Understand the Tool Hierarchy: Indicators are for analysis, Scripts execute single tasks for efficiency, and Expert Advisors (EAs) fully automate entire trading strategies. Knowing the difference is crucial.

- Process Over Promises: The best MetaTrader tools for beginners are those that enforce discipline and automate risk management (like lot size calculators), not those that promise magical "buy/sell" signals.

- Automation Doesn't Eliminate Psychology: Automated trading transforms fear and greed from the trade level to the system level. Managing an EA in drawdown can be more stressful than managing a single manual trade.

- Vetting is a Survival Skill: Learn to spot scam EAs by identifying impossible promises and demanding verified, third-party track records (like Myfxbook). Use the Strategy Tester to expose fake "repainting" indicators.

- Become a Systems Architect, Not a Tool User: True lifestyle freedom comes from building, testing, and deeply understanding your own trading system, using automation as a tool for execution, not a replacement for strategy.

"The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor." - Jesse Livermore

The Ultimate Guide to MetaTrader Tools: Why Are We So Obsessed with Automated Trading?

The world of financial trading pulls us in with a powerful promise: a life of wealth, sophistication, and intellectual challenge. For the modern trader, this allure is magnified by technology. The image of an automated trading robot working tirelessly to generate profits taps into a deep-seated desire to "work smarter, not harder," transforming the chaotic, high-pressure world of trading into an elegant, solvable puzzle. This is the core appeal of MetaTrader tools, they represent a path to control, efficiency, and mastery over one's financial destiny.

This journey often begins after a painful lesson in the psychology of manual trading. Aspiring traders quickly learn their greatest enemy isn't the market, but their own emotional responses. Fear causes us to exit winning positions too early, while greed convinces us to hold losing trades far too long. The promise of "emotion-free trading" offered by tools like Expert Advisors (EAs) is therefore incredibly compelling. The idea of outsourcing discipline and patience to software that feels no fear or greed is the solution many desperately seek.

This quest is also fueled by the dream of "Lifestyle Freedom." The forex market never sleeps, and a manual trader can feel chained to their screen, leading to immense stress and burnout. Automation offers an escape, freeing you to focus on high-level strategy rather than the grueling demands of constant vigilance.

Ultimately, mastering these tools is an entrepreneurial endeavor. It’s a shift from being a passive market participant to actively building a personalized, systematic trading business. This guide is the definitive roadmap for that journey. We will deconstruct the technology, demystify the processes, and provide a clear framework for transforming the dream of automated profits into a sustainable trading career.

The Trader's Toolkit: What's the Real Difference Between Indicators, Scripts, and EAs?

The MetaTrader ecosystem is filled with powerful tools, but for newcomers, the terminology is a minefield. "Indicators," "scripts," and "Expert Advisors" are not interchangeable. They represent fundamentally different tools with distinct purposes and, most importantly, different levels of autonomy. Understanding this taxonomy is the most critical first step.

Indicators: Your Analytical Lens

At the most basic level are Indicators. These are analytical tools that perform calculations on price and/or volume data and then display the results visually on your chart. Their only purpose is to provide insight and help you make more informed decisions. Crucially, indicators are not automated trade execution tools; they generate signals and data, but they cannot place, manage, or close trades. They are your analytical lens, revealing patterns you might otherwise miss.

Indicators generally fall into four categories:

- Trend Indicators: (e.g., Moving Averages, Bollinger Bands) Help identify the market's direction and strength.

- Momentum Indicators (Oscillators): (e.g., RSI, Stochastic, MACD) Measure the speed of price movements to identify overbought or oversold conditions.

- Volatility Indicators: (e.g., Average True Range - ATR) Measure the magnitude of price fluctuations, helping you gauge risk.

- Volume Indicators: (e.g., On-Balance Volume - OBV) Analyze transaction volume to confirm the strength of a price trend.

With an indicator, you retain 100% of your decision-making power. The tool provides information; the interpretation and action are entirely up to you.

Scripts: Your Efficiency Engine

The next level of automation is found in Scripts. A script is a program designed to perform a single, specific, one-off task when you manually activate it. Unlike an indicator that runs continuously, a script executes its function once and then immediately removes itself from the chart. Think of it as a one-click macro for a repetitive trading action.

Scripts are tools of intent, designed to execute your decisions with speed and precision, removing manual error and emotional hesitation. Their primary purpose is to enhance efficiency and enforce discipline.

Common uses include:

- Trade Execution: Open a market order with a predefined stop-loss and take-profit in a single click.

- Bulk Order Management: A "Close All Orders" script can liquidate all open positions instantly, which is invaluable for managing risk before a major news event.

- Risk Calculation: Automatically calculate the correct lot size based on your account balance, risk percentage, and stop-loss.

With a script, you delegate a task for efficiency, but you remain firmly in control of the strategy.

Expert Advisors (EAs): The Autonomous Strategist

At the highest level of automation are Expert Advisors (EAs), also known as trading robots. An EA is a program that runs continuously on a chart, analyzing the market tick-by-tick to fully automate an entire trading strategy without any manual intervention.

An EA is the embodiment of algorithmic trading. It is programmed with a specific set of rules based on indicators or price action.

When market conditions align with its rules, it can automatically:

- Open new buy or sell orders.

- Place initial stop-loss and take-profit levels.

- Manage open positions with trailing stops.

- Close trades when exit conditions are met.

With an EA, you relinquish direct control over individual trades, elevating your role to that of a system supervisor. Your job becomes selecting, configuring, monitoring, and knowing when to turn the EA off. This complete delegation of agency is what makes EAs both incredibly powerful and potentially dangerous.

How Do I Choose the Right Tool for My Trading?

The choice between these tools is not just technical; it's a strategic decision that shapes your entire development as a trader. A beginner's biggest challenge isn't finding the perfect entry signal; it's mastering the non-negotiable fundamentals of risk management and emotional control. Therefore, the most valuable tools for a novice are not those that replace their thinking, but those that help them build better habits.

To illustrate this, the table below compares foundational tools with specialized scripts that offer granular control over every aspect of trade management.

Comparison of Popular MetaTrader Tools & Utilities

| Tool Category | Example Tool & Function | Strategic Benefit |

| Foundational Risk | ACY Calculate Your Lots: Calculates lot size based on your risk %. | Automates the single most critical risk management task, preventing catastrophic losses from oversized positions. |

| Bulk Order Management | Close All Orders: Instantly closes all open market and pending orders. | Provides a critical "panic button" to exit the market cleanly before news or at the end of the day. |

| Profit & Loss Control | Close All Profit or Close All Loss: Selectively closes only winning or losing trades. | Allows you to secure profits across the board or cut losses decisively without manual intervention. |

| Partial Exits | Partial Close 50% or Custom %: Closes a predefined portion of a trade. | Enables advanced trade management, letting you lock in partial profits while reducing risk on the remainder. |

| Risk Elimination | Move to Breakeven: Moves the SL to the entry price once a trade is in profit. | A fundamental technique to create a "risk-free" trade, ensuring a winning position cannot turn into a loser. |

| Profit Maximization | Trailing Stop: Automatically trails the stop-loss behind price. | A dynamic way to protect unrealized profits, allowing a trade to capture the majority of a trend. |

| Advanced Orders | OCO Orders or Grid Scripts: Set up complex order types. | For advanced traders looking to automate sophisticated entry strategies like breakouts or scaling into positions. |

| Trade Re-entry/Reversal | Re-Open Last Trade or Reverse Position: Quickly re-enter or flip a position. | Offers high-speed execution for discretionary traders who need to react instantly to market changes. |

| Trade Stealth | Hide SL/TP: Keeps your stop-loss and take-profit levels hidden from the broker. | For traders concerned about stop-hunting, this utility manages exits virtually on the client side. |

An analysis reveals a key philosophical difference. The ACY toolkit is designed to build a better trader. Tools like "Calculate Your Lots" don't make decisions for you; they empower you to execute your own decisions with professional-grade discipline.

They automate the tedious and emotionally charged parts of the trading process, forcing you to adopt sound risk management from day one. This fosters skill and self-reliance. Conversely, a suite of specialized scripts like those from TradingByte gives a discretionary trader immense control and efficiency, allowing them to manage a complex portfolio of trades with precision.

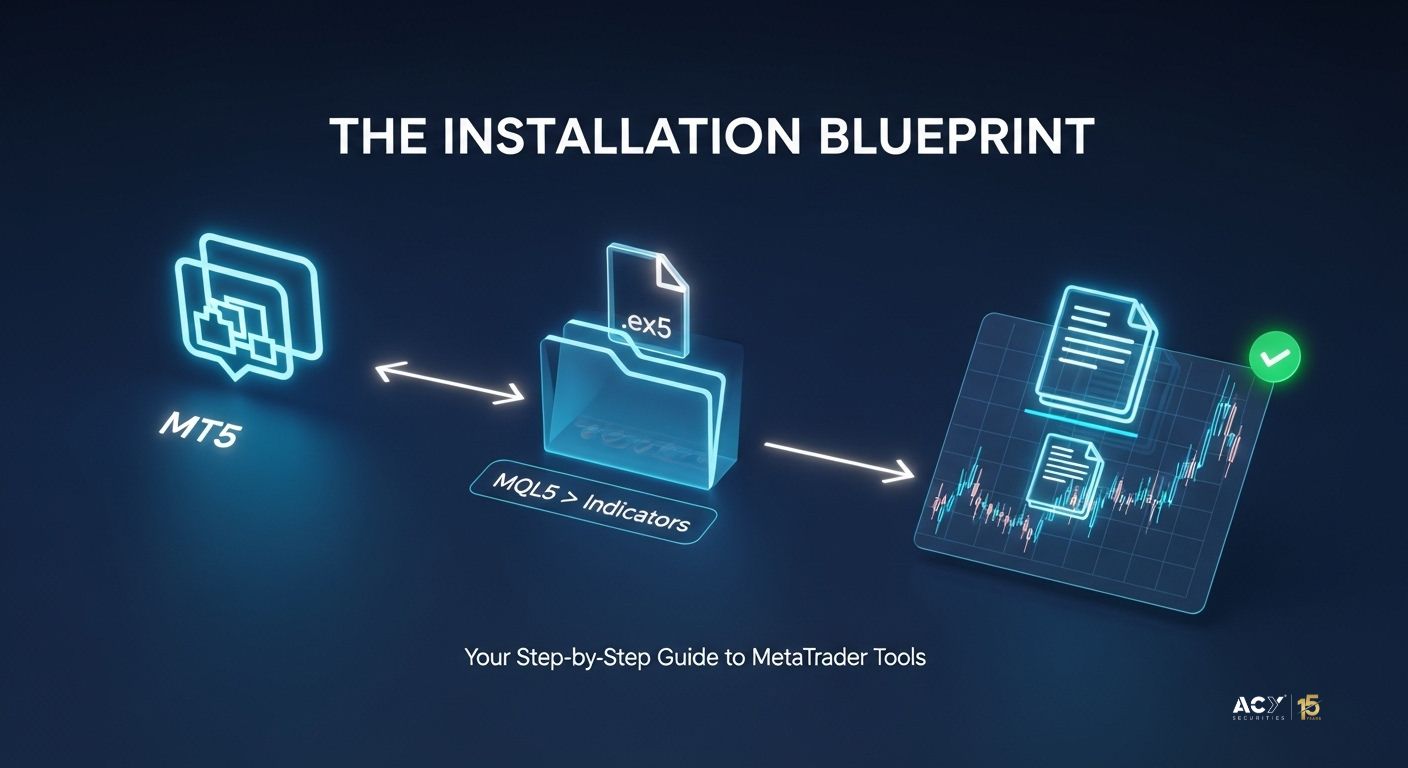

How Do I Install MetaTrader Tools? A Step-by-Step Guide

The power of MetaTrader lies in its open architecture, but the installation process can be intimidating. Follow these steps to confidently manage your platform.

It's critical to know that the process differs slightly between MetaTrader 4 (MT4) and MetaTrader 5 (MT5) due to their different folder structures.

You will also encounter two file types:

- .mq4 / .mq5: The source code. It's transparent, as you can view the logic in the MetaEditor.

- .ex4 / .ex5: The compiled, executable file. This is a "black box," and you cannot see its internal workings, which introduces risk if the source isn't reputable.

Here is the universal installation process:

Step 1: Locate Your MetaTrader Data Folder

This is the central hub for all your custom tools.

- Launch your MT4 or MT5 platform.

- In the top menu, click File → Open Data Folder.

- A window will open to the root directory. This is the only foolproof way to find it.

Step 2: Navigate to the Correct Subfolder

Inside the Data Folder, you will see a folder named MQL4 (for MT4) or MQL5 (for MT5).

Open it. Inside, you will find several crucial subfolders:

- Experts: For Expert Advisor files (.mq4/.ex4 or .mq5/.ex5).

- Indicators: For custom Indicator files.

- Scripts: For Script files.

Placing a file in the wrong folder will cause it not to function.

Step 3: Copy and Paste the Tool Files

- Locate the tool file(s) you downloaded.

- Right-click and Copy the .mq4, .ex4, .mq5, or .ex5 file.

- Navigate back to the correct destination folder (e.g., MQL5\Indicators).

- Right-click inside the folder and select Paste.

Step 4: Refresh Your Navigator Window

MetaTrader needs to be prompted to find the new files.

- Return to the MetaTrader platform.

- Find the Navigator window (if it's not visible, press Ctrl+N).

- Right-click anywhere in the Navigator and select Refresh.

- Your new tool should now appear. If not, simply restart the platform.

Step 5: Attach and Configure the Tool

- For Indicators/Scripts: Find the tool in the Navigator and drag it onto the chart you want to use it on.

- For Expert Advisors: Drag the EA from the Navigator onto a chart.

- A properties window will pop up.

- Common Tab: For EAs, you must check the box for "Allow Algo Trading" (or "Allow automated trading" in MT4).

- Inputs Tab: This is where you configure all the tool's settings, like risk percentages or moving average periods.

- Click OK. For an EA to run, you must also ensure the main "Algo Trading" button in the top toolbar is enabled (it should be green). A smiling face icon in the top-right corner of the chart confirms the EA is active.

The Human Element: Can an EA Really Conquer Fear and Greed?

The marketing around automated trading tools paints a picture of effortless, emotion-free profits. The reality is far more psychologically demanding. EAs do not eliminate the pressures of trading; they transform them.

The illusion is that an EA removes fear and greed. In truth, it transfers these emotions from the micro-level of a single trade to the macro-level of system management. A manual trader fears a losing trade. An automated trader fears their entire strategy is broken when the system enters a drawdown. This anxiety can be far more potent. Greed is transferred from "I should hold this trade longer" to "I should increase the risk on my profitable EA," an impulse that has destroyed countless accounts.

Online forums like Reddit are filled with cautionary tales. A common story involves a trader who finds an EA with spectacular demo results, deploys it on a live account with too much leverage, and gets wiped out overnight. These blow-ups are often caused by hidden high-risk strategies like Martingale (doubling down on losing trades), which look invincible until they catastrophically fail.

In stark contrast, the success stories share a universal theme: they are born from immense personal effort. Successful automated traders are almost always those who have invested thousands of hours learning to code, developing unique strategies, and rigorously testing them. The consensus is clear: there is no "set-and-forget" path to riches. Successful automated trading is not passive; it is an active, high-skill endeavor.

Vetting & Safety: How to Spot a Scam EA or a Fake Indicator

The MetaTrader market is rife with scams preying on the hopes of new traders. The key to survival is to equip yourself with a robust vetting framework.

5 Red Flags of a Scam Forex Expert Advisor

Recognizing these predictable patterns is your first line of defense.

- Impossible Promises: Any language guaranteeing profits or claiming a system is "risk-free" is a lie. Trading is probabilistic and always involves risk.

- Lack of Verified Proof: Scammers use doctored screenshots. Demand a live, third-party verified track record from Myfxbook or FxBlue. Ensure it has green checkmarks for "Track Record Verified" and "Trading Privileges Verified." Hidden stats like drawdown are a massive red flag.

- The "Secret Algorithm" Black Box: A vendor who won't explain the basic trading logic (e.g., is it a trend-following or a mean-reversion system?) is likely hiding a high-risk Martingale or Grid strategy.

- The Price Doesn't Make Sense: If an EA could print money, why would they sell it for $99? The real business model is often selling products to traders, not trading.

- Tied to an Unregulated Broker: A vendor who insists you use a specific, unregulated offshore broker is a major danger sign. This exposes you to severe counterparty risk.

How to Expose a Fake "Repainting" Indicator

A "repainting" indicator is a fraudulent tool coded to retroactively alter its historical signals to create a perfect, but fake, track record. It waits for the price to move and then goes back in time to place a perfect "BUY" arrow at the absolute low.

Here’s how to use MetaTrader’s Strategy Tester as a lie detector to expose them:

- Open the Strategy Tester (Ctrl+R).

- Select the indicator you want to test.

- Choose a symbol and date range.

- Crucially, check the box for "Visual mode."

- Run the test. If you see any past signals (arrows, dots, etc.) disappear, move, or change their position on closed candles as new bars are added, you have definitive proof the indicator repaints.

Jesse Livermore's Ghost: What Would the Market Master Think of MetaTrader Tools?

Jesse Livermore, the legendary trader of the early 20th century, operated on intuition, tape reading, and an iron will. He had no charts, no indicators, and certainly no automated robots. What would he think of the modern trader's toolkit?

He would likely have viewed it with extreme skepticism, seeing tools not as solutions, but as potential traps for the lazy and undisciplined.

- On Indicators and Signals: Livermore believed in understanding the "behavior of the market." He would have seen indicators as a crude, lagging summary of the price action he could read directly from the tape. He famously said, "The market is never wrong, opinions often are." He would argue that relying on a crossover signal from a moving average is just another "opinion", a mathematical one, that can be just as wrong as a gut feeling. He would have despised "buy/sell" arrow indicators, viewing them as the ultimate "tip," which he considered poison for a speculator.

- On Scripts for Execution: This is where Livermore might have seen value. He was a master of execution, understanding the critical importance of getting in and out at the right price. A script that could execute a complex order instantly,buy, set a stop, and define a target,would have appealed to his desire for precision. A "Close All" script would have been a powerful tool for a man who believed in cutting losses without hesitation: "It is what people did not do that cost them money."

- On Expert Advisors (EAs): Livermore would have seen fully automated EAs as an abdication of a speculator's primary responsibility: thinking. His entire method was based on forming a grand thesis about the market's direction and then patiently waiting for the market to confirm his judgment. The idea of handing this critical thinking process over to a pre-programmed "black box" would have been horrifying to him. He would argue that no algorithm could account for the human element, the fear, greed, and hope that truly drive markets, and that any rigid system was doomed to fail when market conditions inevitably changed.

For Livermore, the tools wouldn't be the problem; the reliance on them would be. He would have advised the modern trader to use them as a mechanic uses a wrench, for a specific job, but never to let the wrench tell them how to build the engine.

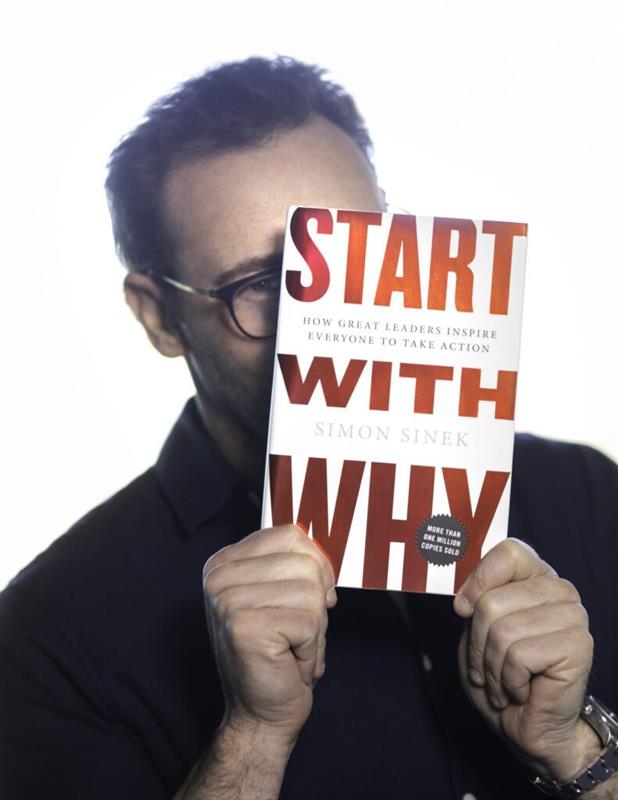

The Golden Circle of Trading: Applying "Start with Why" to Your Tools

In his seminal book "Start with Why," Simon Sinek explains that the most successful organizations and leaders think, act, and communicate from the inside out. They start with their WHY (their purpose or belief), then move to their HOW (the actions they take), and finally their WHAT (the results of those actions).

Most struggling traders do the opposite. They start with the WHAT.

- WHAT: "I want to make 10% a month." "I want a 'money-printing' robot."

- HOW: "I'll buy this EA that promises high returns." "I'll use this indicator that claims 90% accuracy."

- WHY: (Often unasked) "Because I want to get rich quick."

This approach is doomed because it lacks a foundational belief or strategy. When the tool (the "how") fails, the trader has nothing to fall back on.

A successful, systems-oriented trader starts with WHY.

- WHY: "I believe that markets trend and that I can profit by systematically capturing the middle portion of major moves while aggressively cutting losses."

- HOW: "I will implement this belief by using a dual moving average crossover system on the daily chart to define the trend. I will use the ATR to set a dynamic stop-loss. I will risk no more than 1% of my capital on any single trade."

- WHAT: "The tools I need are: a Moving Average indicator to see the trend, an ATR indicator for my stop-loss, and a Risk Calculator script to ensure my position size is always correct. I might eventually build an EA to automate this entire process."

When you approach your tools this way, the decision-making process becomes clear. You don't ask, "Which is the best EA?" You ask, "Which tool will best help me implement my WHY?"

This simple shift in perspective is the difference between being a gambler chasing a "what" and an entrepreneur building a system based on a "why." It allows you to simplify your charts and focus on a process, not just signals, which is the key to stress-free trading.

Conclusion: Evolving from Tool User to Systems Architect

The journey into MetaTrader tools begins with the dream of automated success. As this guide has shown, the path to realizing that dream is not a shortcut paved with purchased "holy grails," but a challenging and rewarding entrepreneurial endeavor.

The ultimate goal is not to become a passive user of a black-box tool, but to evolve into a sophisticated systems architect,a trader who leverages technology with precision, discipline, and a deep understanding of both the markets and themselves.

The most effective model is a hybrid one, combining human intelligence with machine efficiency. In this model, you are the strategist. You do the creative, big-picture analysis. The machine, in the form of well-vetted scripts and EAs, acts as the flawless tactician, executing your plan with unwavering discipline.

This systematic approach is the only sustainable path to the "Lifestyle Freedom" that so many traders seek. True freedom comes not from a magic algorithm, but from building a robust, deeply understood trading process you can trust. It is the confidence in your system,a system you built, tested, and know inside and out,that finally liberates you from the screen.

Frequently Asked Questions (FAQ)

Q1: Are Forex robots (Expert Advisors) a scam?

Not all of them, but the market is filled with fraudulent products. A legitimate EA is simply a tool to automate a pre-defined strategy. The scam lies in the marketing, which often promises unrealistic, guaranteed returns from a "secret" algorithm. Always demand a multi-year, live, third-party verified track record before considering any purchase.

Q2: What's the main difference between tools for MT4 versus MT5?

MT4 and MT5 use different programming languages (MQL4 and MQL5, respectively). Therefore, an indicator, script, or EA written for MT4 will not work on MT5, and vice versa. You must ensure the tool you acquire is compatible with your specific platform version.

Q3: Can I really make money with an EA while I sleep?

Yes, it is technically possible for an EA to execute profitable trades while you are asleep. However, the idea of "set-and-forget" passive income is a dangerous myth. Successful automated trading requires constant monitoring, performance analysis, and the discretionary judgment to know when to turn the system off due to changing market conditions.

Q4: Should I use free tools or paid tools?

This depends on the tool's purpose. For foundational tasks like risk management and objective analysis, high-quality free tools (like ACY.com's toolkit) are often superior because they are designed to build good habits. Paid tools can be valuable if they solve a highly specific problem within a pre-existing, profitable strategy, but they should never be seen as a shortcut to success.

Q5: How can I learn to create my own MetaTrader tools?

Learning the MQL4 or MQL5 programming language is the best way to gain full control and transparency. There are numerous free resources on the official MQL5 community website, as well as paid courses online. Starting with simple scripts to automate basic tasks is an excellent way to begin the learning process.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next