Metals Trading: Why Gold and Metals Are Rising Again

2025-10-16 11:12:38

Gold has long anchored global portfolios, but the 2025 tape tells a broader story: capital is rotating across the commodities market-into silver, copper, and even platinum-because price is tracking utility as much as uncertainty.

The moment you see how liquidity and intent drive structure-the core of Smart Money Concepts-the current metals rotation stops feeling random and starts reading like a plan written on the chart. That’s where multi-timeframe alignment sharpens the edge: you map bias on the higher frames, refine risk on the lower, and let the market confirm.

Why Metals Are Rising - Backed by Institutional Accumulation and Rising Technology

1. Gold: Still the Core of Global Confidence

- Central banks purchased over 1,000 metric tons of gold for the third consecutive year - the highest rate in modern history (gold.org).

- Total global central bank holdings now exceed 36,000 metric tons.

- In 2024, these purchases represented over 20% of total global gold demand, double the average share from a decade ago.

- ETF inflows into gold reached US$25 billion year-to-date, confirming ongoing institutional confidence.

Gold remains the ultimate benchmark of trust. When the global financial system wobbles, capital still anchors here first.

2. Silver: The Industrial Underdog

- Global silver ETFs added roughly 95 million ounces in 2025 alone, pushing total assets under management above US$40 billion.

- U.S. ETFs such as SLV and SIVR saw combined inflows of around US$2 billion - small compared to gold, but substantial for silver’s smaller market.

- Silver’s unique appeal lies in its dual role: it thrives in both fear and growth cycles - as a safe haven during volatility, and as a critical material in solar, semiconductor, and EV production.

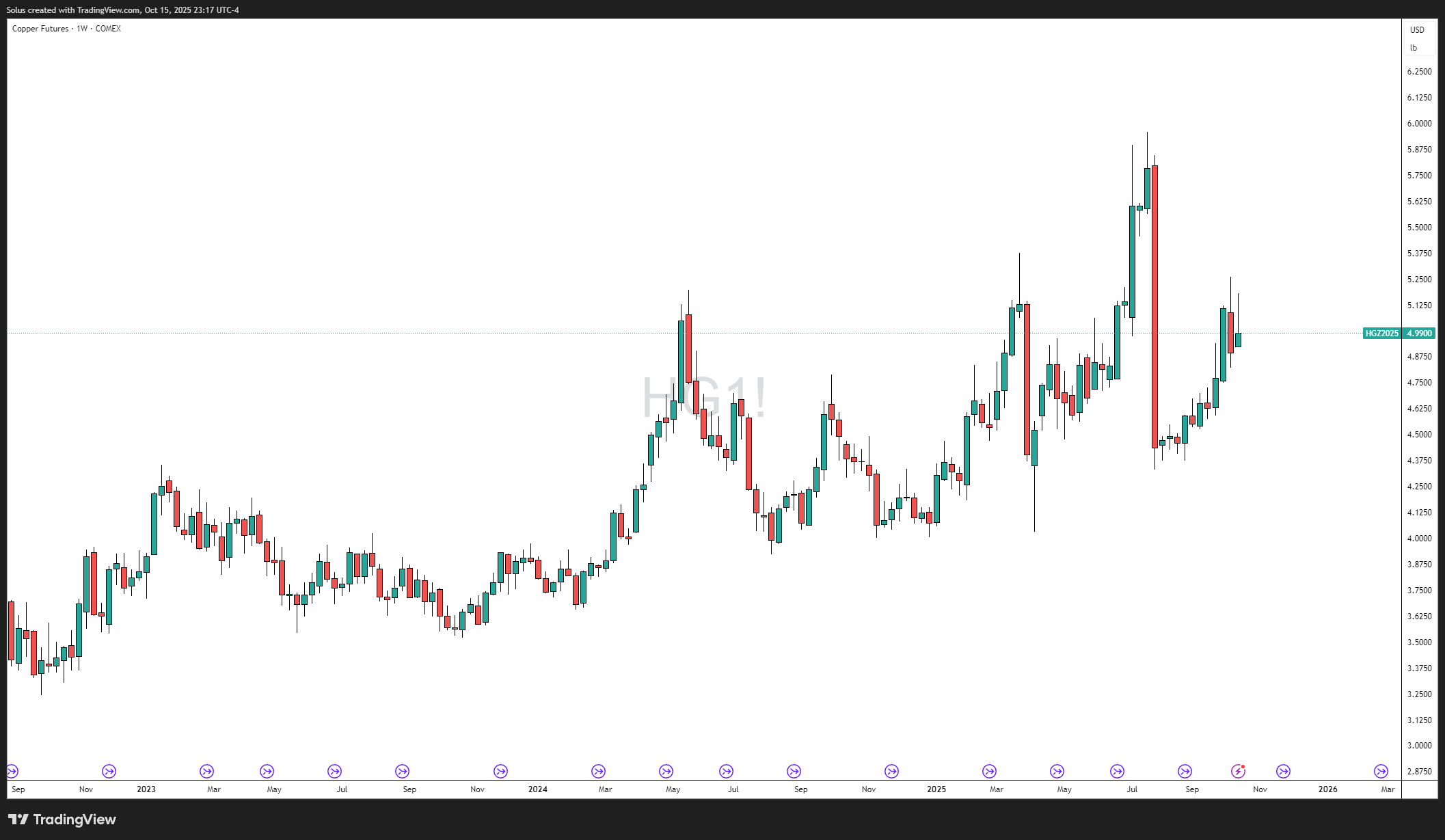

3. Copper: The New Inflation Hedge

- Copper ETFs and futures are drawing new institutional interest as the “metal of electrification”.

- Investment demand is estimated to have grown by 30% year-over-year, the strongest since 2010.

- As a structural asset tied to manufacturing, infrastructure, and AI data centers, copper has become both a growth play and an inflation hedge.

4. Platinum & Palladium: Scarcity Meets Substitution

- Industrial demand for platinum rose 12% year-over-year, led by recovery in automotive manufacturing.

- Supply risks from South Africa and Russia remain elevated, keeping prices supported.

- These metals are now treated by institutions as secondary rotation assets - thinly traded but capable of strong cyclical gains.

From Fear to Function

Past metal cycles leaned on fear-war, inflation, fiscal stress. This one is broader: solar and semiconductors lean on silver; AI build-outs and transmission lines lean on copper; hydrogen applications lean on platinum; and gold still underwrites trust when the dollar narrative wobbles.

Turning that storyline into an actual trade map means you pair the macro with price-action foundations that force you to ask, “Where did the move begin, where did it rebalance, and where is liquidity obvious next?”

How Traders Can Capitalize on the Metals Supercycle

Information is edge only when it controls behavior. Here’s a structure you can run this week.

1. Trade the rotation-don’t just chase the leader

When gold stalls near extremes, performance often rotates to silver or copper. The gold/silver ratio above the high-80s has historically set up meaningful silver mean-reversion; but you still let the chart confirm-sweep, displacement, and then the FVG that brings you in. If your timing model is rusty, the same open-mechanics you use for indices apply here: session liquidity forms, sweeps, and then the move-the logic in the indices open SMC playbook translates cleanly to metals.

2. Fuse fundamentals with SMC for precision

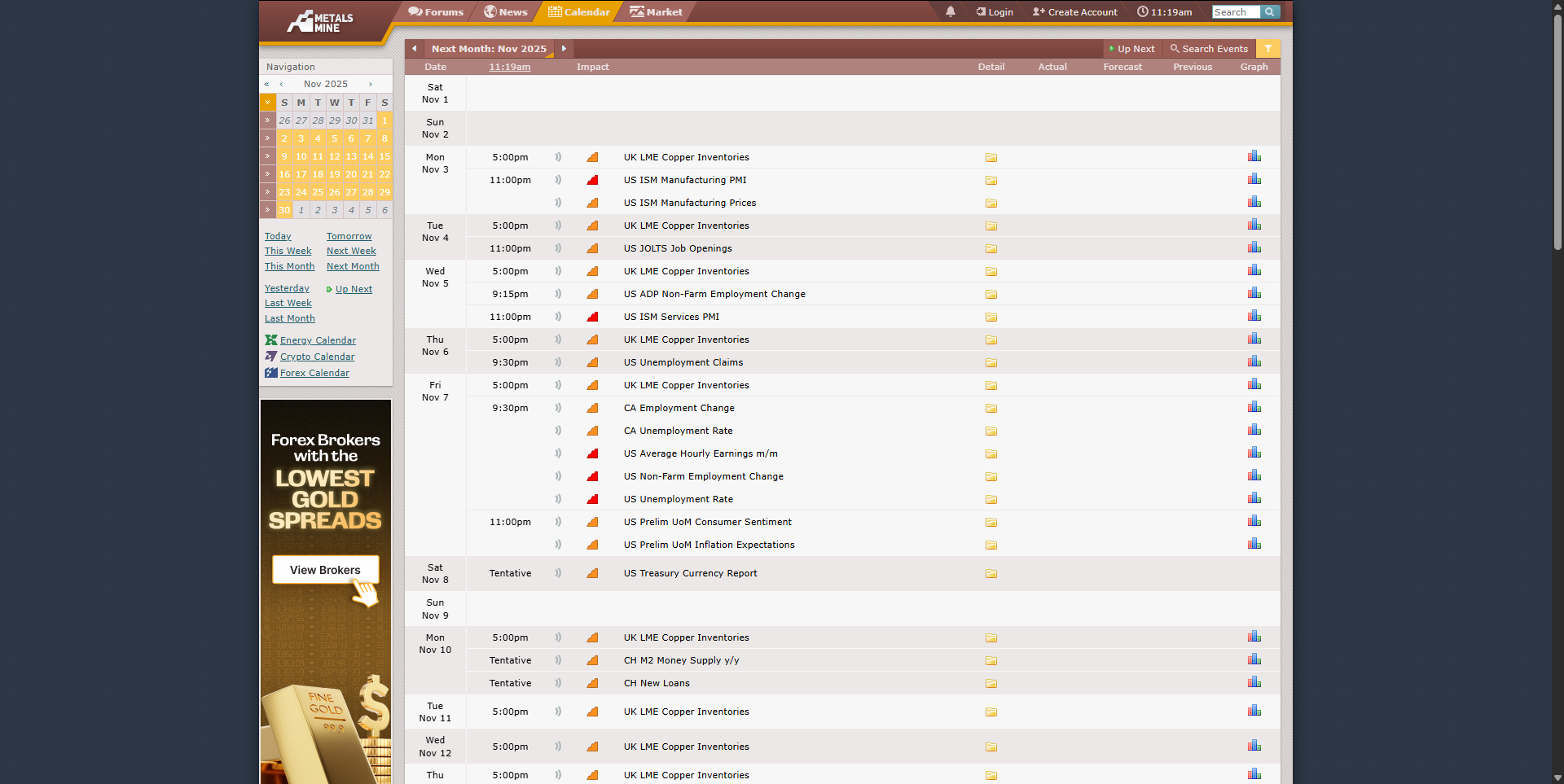

Gold respects policy tone and real yields; copper respects growth and PMIs; silver straddles both. Start with a bias (CPI cools, Fed leans easier-gold tailwind; China stimulus prints-copper tailwind), then require structural proof: external range liquidity gets taken, momentum shifts, and the FVG gives you the fair entry. Risk management remains non-negotiable-codify your tiers and invalidations in a risk management compilation so one headline doesn’t rewrite your plan mid-trade.

3. Let intermarket context do part of the forecasting

Gold tends to inverse DXY; copper hums with global PMIs; silver frequently lags gold by a session or two in strong trends. If you’ve never layered these relationships into your pre-market notes, the intermarket guide is a quick way to turn “interesting” into “actionable.”

4. Build a multi-metal matrix you can maintain daily

A simple table keeps you honest:

| Metal | Timeframe | Primary Catalyst | Setup to Prioritize |

|---|---|---|---|

| Gold | Daily → H1 | Fed tone, CPI | Sweep → displacement → FVG retest |

| Silver | H4 → M30 | Solar/semis demand | Break of structure + retest confirmation |

| Copper | H1 → M5 | PMIs, infra headlines | Impulse + internal FVG continuation |

| Platinum | Daily | Auto output, supply | Liquidity sweep reversal only |

This is how I would approach the markets on a technical standpoint. You could use other approaches that best fit your perspective and experience in the market.

If you need a mental model to move from idea to entry, how a price-action trader thinks-and key-level execution-will keep your notes from turning into bias without trades.

5. Use ETF flows as your “liquidity weather”

GLD, SLV, CPER, PPLT-spikes in inflows often precede continuation after the first rebalance. Instead of buying the breakout, wait for the market to refill the imbalance and use a retest-confirmation process to enter where risk is quantifiable and narrative is already funded.

The Bigger Picture: Gold is the door, not the room

Gold still opens the allocation conversation, but the opportunity set is the room itself-silver’s volatility, copper’s structural bid, platinum’s scarcity premium. To keep your head clear while you scale, couple this framework with a swing-trader confluence toolkit and the routine that makes you repeatable on your best days and survivable on your worst-start with a day-trading routine for consistency and a protocol for managing losses without breaking your system.

Real-Life Analogy: The Trader and the Orchestra

Gold sets tempo. Silver adds melody. Copper drives rhythm. Platinum supplies tone. You don’t need to play every instrument-only to feel which one is about to take the solo, then step in with structure and a stop you respect.

Final Thoughts

Central banks are stockpiling gold at record levels. Institutional money is flowing steadily into silver and copper ETFs. Industrial demand for metals is climbing as technology and green energy reshape the global economy.

The result is a structural migration of capital toward tangible value - assets that cannot be printed, diluted, or replaced.

For traders, this is not just an academic insight. It’s an invitation to trade the world’s next long-cycle theme with precision.

Don’t just watch gold. Read the entire metals ecosystem. Because where liquidity rotates, opportunity follows.

FAQs

1. Why are metals like copper and silver rallying alongside gold?

Because the current rally isn’t fear-based-it’s functional. Silver and copper are integral to renewable energy and electrification, while gold remains a trust anchor. Institutions are hedging both inflation and industrial exposure through metals simultaneously.

2. How can I trade metals using Smart Money Concepts?

Use structure-based confirmations like liquidity sweeps, displacement, and Fair Value Gaps (FVGs). Wait for market structure to align with macro bias before entering-this avoids guessing momentum shifts.

3. Are metals correlated with the US dollar?

Yes, most precious metals like gold and silver move inversely to the dollar index (DXY). When DXY weakens due to rate cuts or liquidity injections, metals often rise in tandem.

4. What’s the best time to trade metals intraday?

Metals are most active during the London–New York overlap (3 PM–12 MN PH time). That’s when global liquidity converges and volatility expands-perfect conditions for setups taught in indices open SMC strategies and applied directly to gold or silver.

Start Practicing with Confidence - Risk-Free!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R - 3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels - How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC) - A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading - Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow - Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail - Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading - Naming Your Triggers

- Discipline vs. Impulse in Trading - Step-by Step Guide How to Build Control

- Trading Journal & Reflection - The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex - Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

- Mastering Hope in Trading: Replacing Denial With Discipline

- When to Quit on Trading - Read This!

- The Math of Compounding in Trading

- Why Daily Wins Matter More Than Big Wins

- Scaling in Trading: When & How to Increase Lot Sizes

- Why Patience in Trading Fuels the Compounding Growth

- Step-by-Step Guide on How to Manage Losses for Compounding Growth

- The Daily Habits of Profitable Traders: Building Your Compounding Routine

- Trading Edge: Definition, Misconceptions & Casino Analogy

- Finding Your Edge: From Chaos to Clarity

- Proving Your Edge: Backtesting Without Bias

- Forward Testing in Trading: How to Prove Your Edge Live

- Measuring Your Edge: Metrics That Matter

- Refining Your Edge: Iteration Without Overfitting

- The EDGE Framework: Knowing When and How to Evolve as a Trader

- Scaling Your Edge: From Small Account to Consistency

Market Drivers

- Central Banks and Interest Rates: How They Move Your Trades

- Inflation & Economic Data: CPI Trading Strategy and PPI Indicator Guide

- Geopolitical Risks & Safe Havens in Trading (Gold, USD, JPY, CHF)

- Jobs, Growth & Recession Fears: NFP, GDP & Unemployment in Trading

- Commodities & Global Trade: Oil, Gold, and Forex Explained

- Market Correlations & Intermarket Analysis for Traders

Swing Trading 101

- Introduction to Swing Trading

- The Market Basics for Swing Trading

- Core Principles of Swing Trading

- The Technical Foundations Every Swing Trader Must Master

- Swing Trader’s Toolkit: Multi-Timeframe & Institutional Confluence

- The Psychology of Risk Management in Swing Trading

- Swing Trading Concepts To Know In Trading with Smart Money Concepts

Risk Management

The real edge in trading isn’t strategy - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders - Updated 2026

- Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

- Martingale Strategy in Trading: Compounding Power or Double-Edged Sword?

- How to Add to Winners Using Cost Averaging and Martingale Principle with Price Confirmation

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next