Gold Price Forecast: Will $3,650 Breakout Push XAU/USD to $3,700?

2025-09-09 12:52:20

- Gold consolidates just under $3,650 as traders weigh Fed cut odds and CPI/PPI catalysts.

- Structural bids from central banks and geopolitical risk continue to underpin strength.

- H4 Fair Value Gaps ($3,616–$3,645) define the battleground; breakout above $3,650 opens $3,700, breakdown risks $3,570.

Gold Sustains Record-High Bid as Rate-Cut Odds Surge

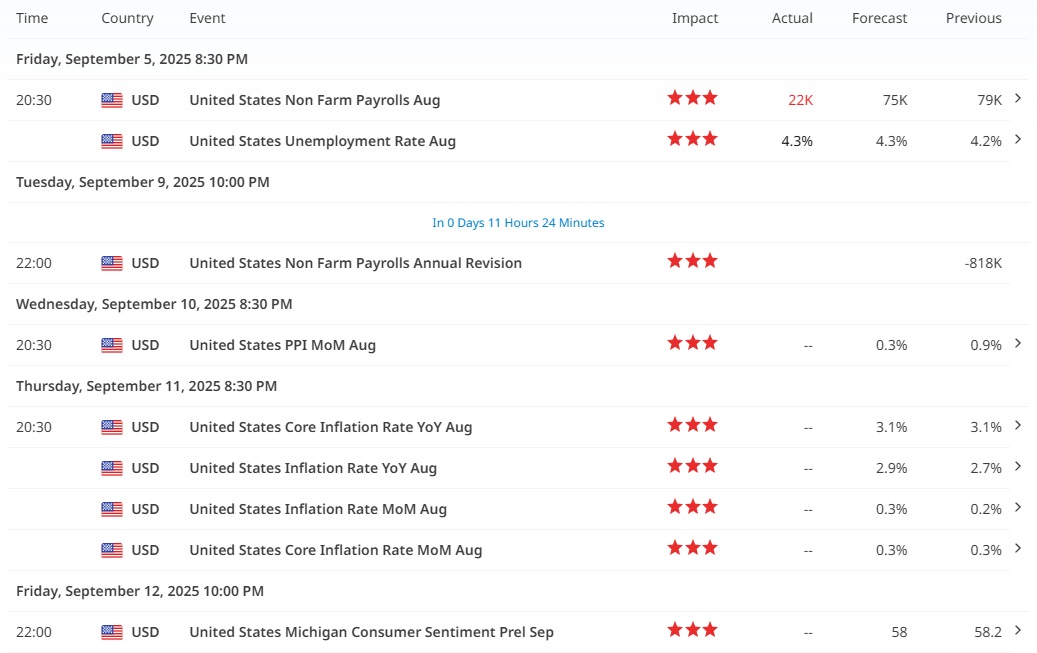

Gold’s latest leg higher came on the back of a decisively weak U.S. August jobs report and a quick repricing toward a September Fed rate cut. Spot gold printed fresh records near $3,600/oz and continues to hover just below that line as traders firm up odds of easing at the upcoming FOMC. Lower policy-rate expectations compress real yields and keep the dollar on the defensive—classic tailwinds for bullion.

Beyond the macro rates impulse, the structural bid is alive: central-bank buying (with fresh headlines pointing to continued PBoC additions in August) and elevated geopolitical risk have reinforced gold’s role as a portfolio hedge. That backdrop helped absorb profit-taking dips into the back half of last week.

What’s Driving Gold Right Now

- Soft NFP seals the deal for September easing. August payrolls rose just 22k, and unemployment ticked up to 4.3%, pushing gold to new highs and cementing a 25 bp cut as the base case.

- Markets sit near records; yields ease. Risk assets’ resilience alongside falling yields reflects a market leaning into easier policy—a mix that historically supports gold.

- Central-bank demand & geopolitics. Reports of China’s PBoC adding to reserves and ongoing conflict risks keep strategic demand firm.

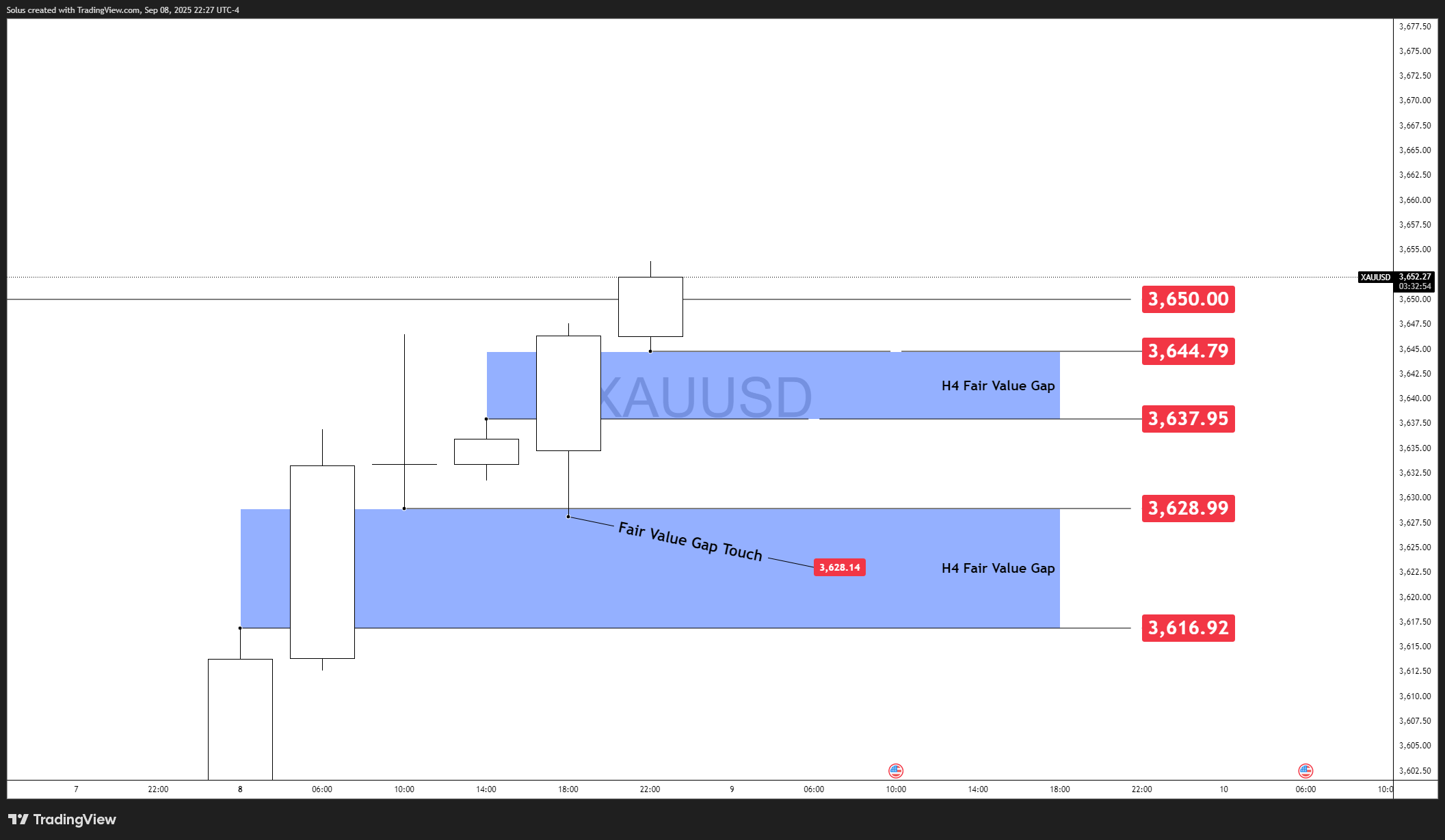

Price Action Follow-Through: From Forecast to $3,650 Test

In Monday’s outlook, we highlighted gold’s ability to reclaim layered H4 Fair Value Gaps as a structural foundation for further upside. That forecast has since materialized: buyers defended the $3,550–$3,560 shelf, and momentum carried price into a clean breakout sequence.

The move extended into the $3,640–$3,650 zone, aligning with our projected bullish continuation path. Each retest of intraday imbalances attracted fresh demand, confirming market conviction that dips remain buying opportunities. The current structure shows price consolidating just under $3,650 - the next pivotal resistance before $3,700 comes into view.

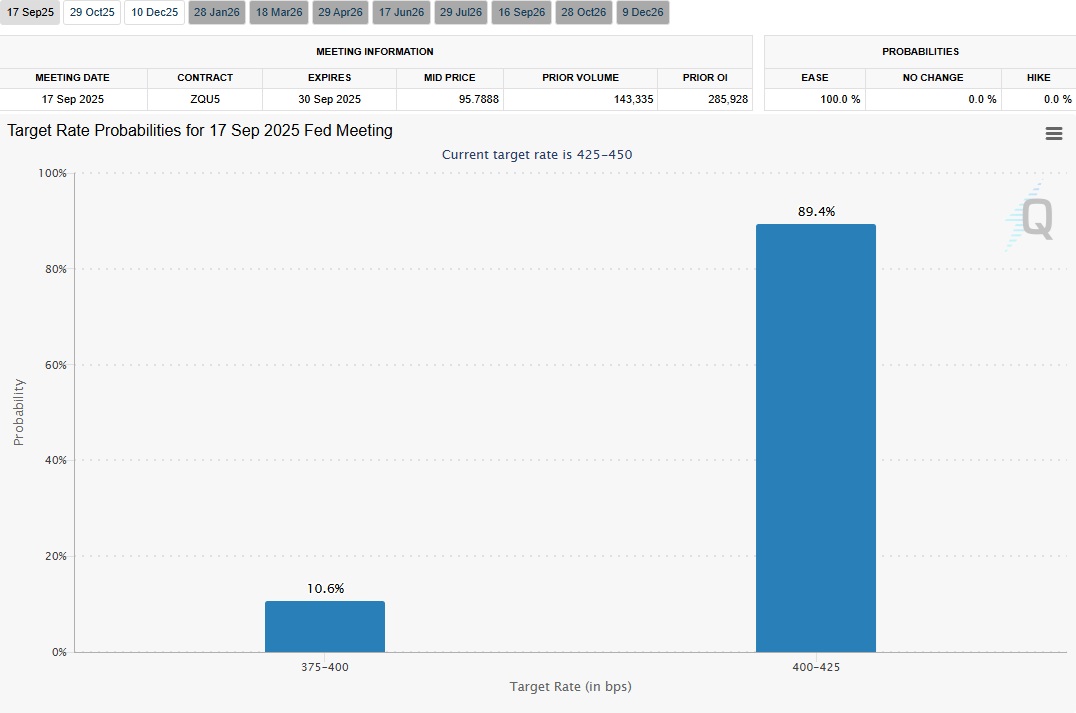

CME FedWatch: 89% Probability of September Cut

The CME FedWatch Tool now prices an 89% probability of a 25 bp Fed rate cut at the September 17 meeting, with a smaller 10% chance of a 50 bp move.

This overwhelmingly dovish repricing is critical for gold. A confirmed rate cut would:

- Lower U.S. real yields, directly reducing the opportunity cost of holding gold.

- Weaken the U.S. dollar, reinforcing gold’s inverse correlation.

- Strengthen haven demand, as easing signals the Fed’s recognition of slowing growth.

Together, these dynamics create a macro backdrop where gold’s floor remains supported, even if technicals temporarily stretch into overbought territory. Traders will watch whether CPI/PPI confirm the Fed’s dovish path—cool inflation could propel gold beyond $3,650 toward the $3,700 target zone.

Overall Narrative: Why the Bid Can Persist

Rate expectations are the beating heart of this move. With FedWatch showing nearly 90% odds of easing, gold has a clear policy-driven tailwind. Pair that with central-bank accumulation and risk-hedging flows, and dips have struggled to develop follow-through. If CPI/PPI confirm a cooling trend, the path of least resistance remains higher into the Fed meeting.

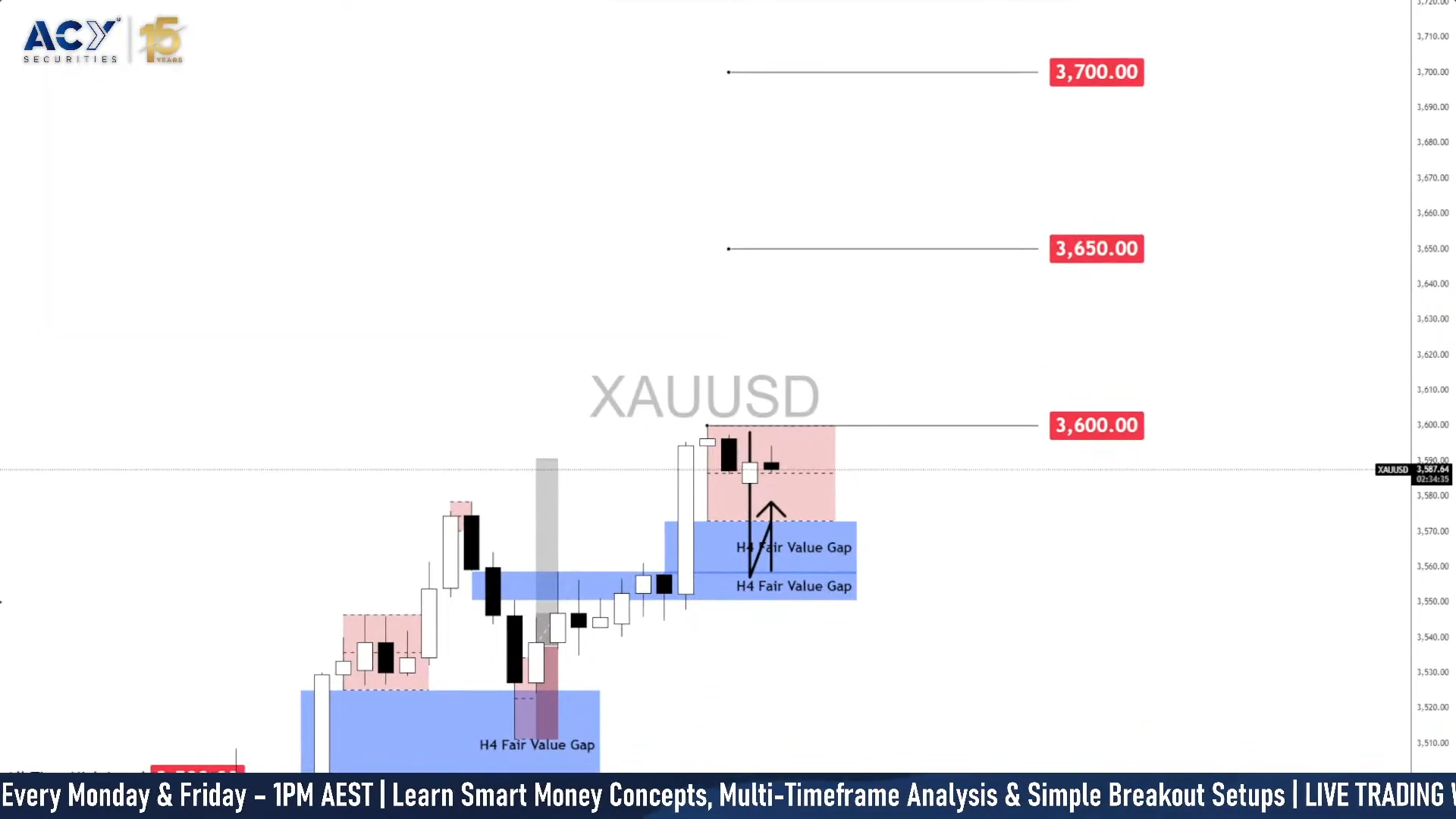

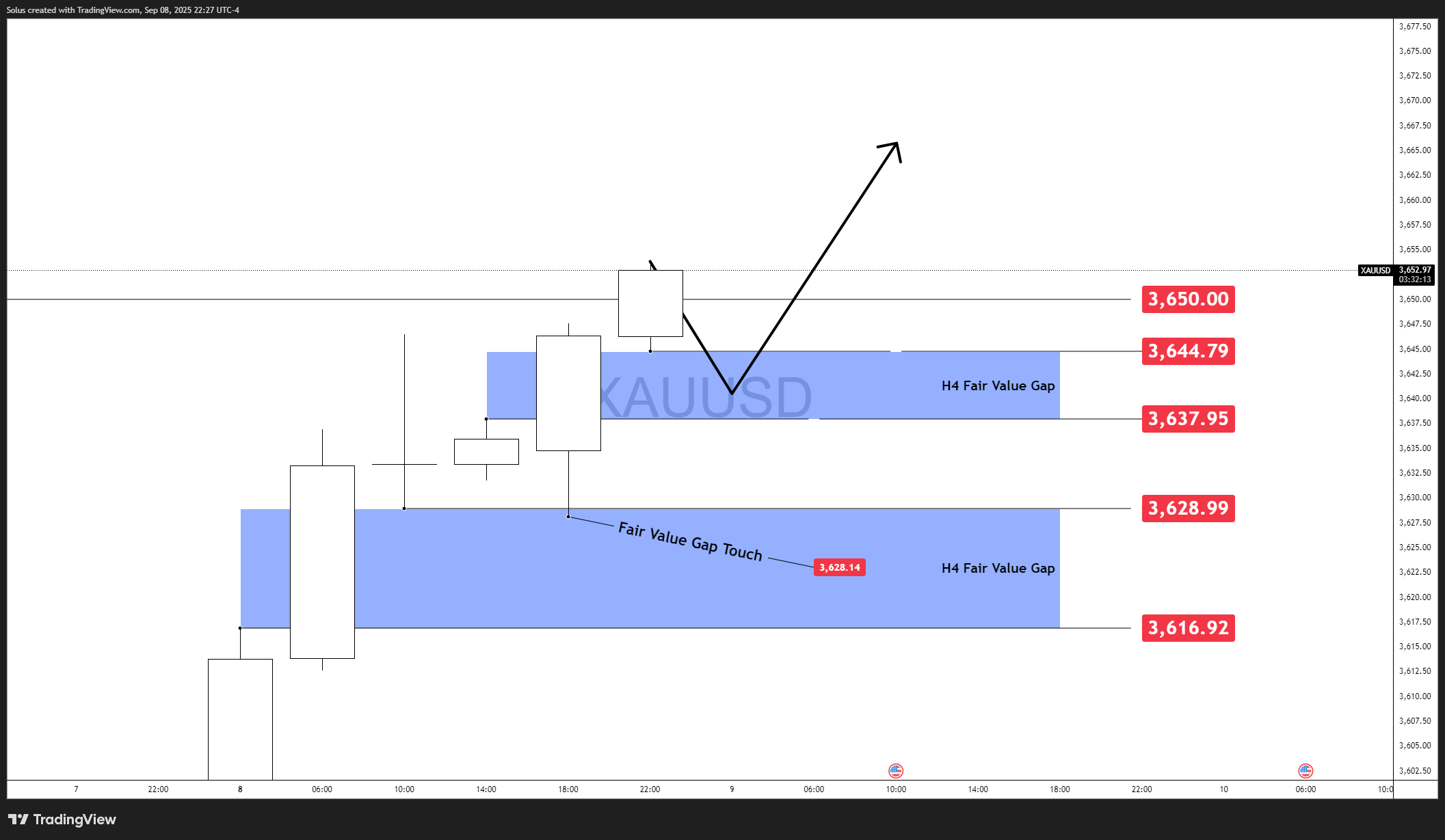

Technical Outlook: XAU/USD Still Hot

Gold’s is consolidating beneath the $3,650 resistance, with multiple H4 Fair Value Gaps (FVGs) forming below current levels.

Prior to this move, the FVG at $3,630 - $3,616 served as a point-of-interest for bounce to the upside.

These FVGs between $3,616 - $3,645 are pivotal zones where buyers may attempt to step back in if price retraces. The reaction at these imbalances will dictate whether gold clears $3,650 for continuation or fades back into deeper retracement.

Bullish Scenario: Reclaim Above $3,650

The bullish case hinges on whether buyers can hold the FVGs and reclaim $3,650 with conviction.

- Price dips into the $3,628–$3,638 FVG zone and finds strong buyer response.

- A breakout and daily close above $3,650 confirms momentum continuation.

- Upside targets: $3,670 first, then $3,700 psychological resistance.

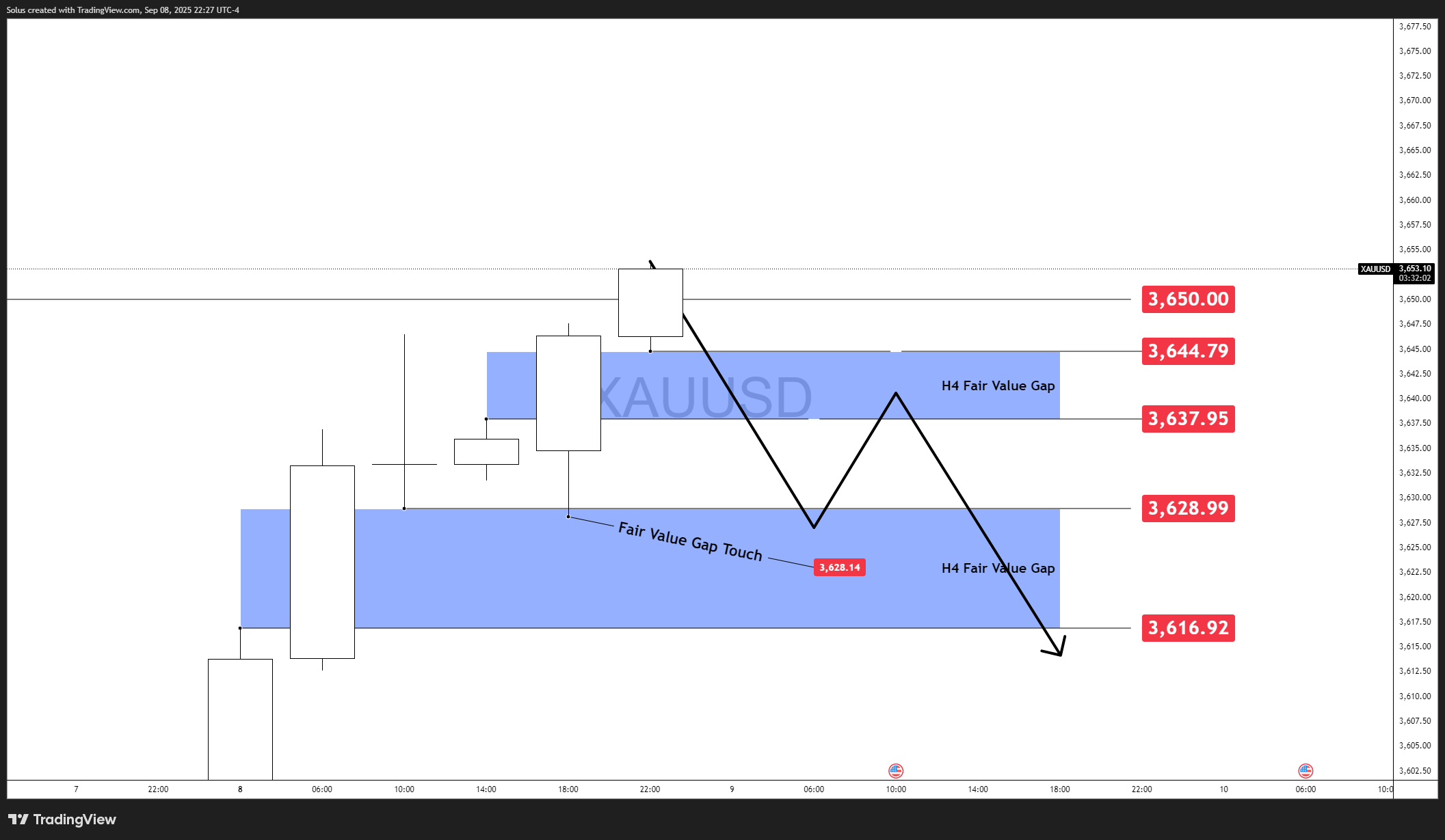

Bearish Scenario: Rejection & Breakdown Through FVGs

Alternatively, a sustained rejection under $3,650 combined with a hot CPI or stronger USD could trigger a deeper pullback.

- Failure to reclaim $3,650 opens the path to revisit the FVGs.

- A clean breakdown through the $3,628–$3,616 FVG cluster signals bearish intent.

- Downside targets: $3,600, followed by $3,580–$3,570 where structural supports align.

Final Note: Wait for Confirmation

While both bullish and bearish paths are clear on the chart, gold is sitting at a pivotal juncture. With CPI/PPI ahead and Fed cut odds already priced, chasing moves without confirmation risks being trapped in volatility. Traders should wait for a confirmed breakout above $3,650 or a decisive breakdown through the $3,628–$3,616 zone before committing to directional trades.

Start Practicing with Confidence - Risk-Free!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels - How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading-Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow - Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail - Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading - Naming Your Triggers

- Discipline vs. Impulse in Trading - Step-by Step Guide How to Build Control

- Trading Journal & Reflection - The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex - Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

- Mastering Hope in Trading: Replacing Denial With Discipline

- When to Quit on Trading - Read This!

- The Math of Compounding in Trading

- Why Daily Wins Matter More Than Big Wins

- Scaling in Trading: When & How to Increase Lot Sizes

Risk Management

The real edge in trading isn’t strategy - - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders - Updated 2025

- Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know