Eurozone Inflation Down, All You Need to Know

2023-06-02 11:30:35

Eurozone: Core inflation on the way down.

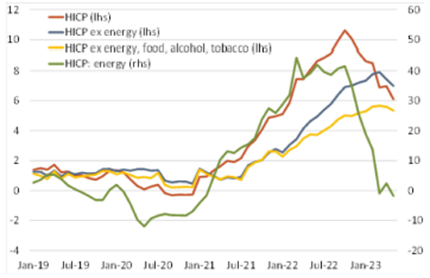

Another big downward step: Eurozone inflation has experienced a significant decline since reaching its peak of 10.6% year on year in October of last year. This descent has been occurring at a similar pace to its earlier surge, as depicted in Chart 1. The recent data from various member states, released earlier this week, indicates a notable drop in Eurozone inflation in May. The rate fell to 6.1% year on year, down from 7.0% in April, which is below the expected consensus of 6.3% reported by Reuters. The diminishing inflation can be attributed to the base effects resulting from last year's price increase, as well as a reduction in price pressures across multiple categories as the impact of imported cost shocks fades away. This trend is expected to continue throughout 2023.

Nevertheless, inflation remains far above the CB's 2% target. I thus expect the central bank to hike interest rates two more times by 25bp each in June and July before keeping them on hold. This would lift the deposit rate to 3.75% and the main refinancing rate to 4.25%.

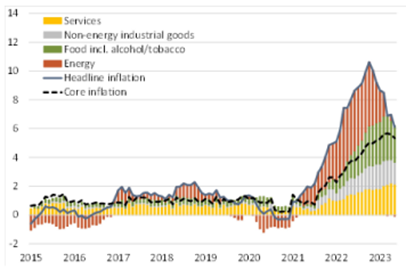

Disinflation broadening: Some consumer price components are exposed more immediately to import cost shocks.

In the previous year, the prices of consumer energy experienced the most rapid increase, closely followed by food prices. However, it took some time for the higher costs to propagate through longer production chains and fully impact consumer prices of other goods. The rise in service prices, overall, took the longest to manifest. The current situation presents a reversal of this trend as prices begin to decline. Initially, energy prices began to decrease, followed by a slowdown in food prices, and subsequently, other goods prices also started to ease. Finally, the year-on-year rate for service prices has also shown a slight decline.

- Energy prices were 1.7% lower in May than one year ago, down from +2.4% yoy in April. Energy is now contributing negatively to headline inflation (Chart 2).

- Prices for food, alcohol, and tobacco - the second volatile, non-core aggregate - continued to slow, to 12.5% yoy in May from 13.5% in April.

- Non-energy industrial goods were 5.8% yoy more expensive in May, down from 6.2% in April.

- Services prices may now also finally have turned the corner - their yoy rate of increase declined to 5.0% in May from 5.2% in April.

- As the pass-through from input costs to goods and services prices is nearing completion, core inflation slowed to 5.3% in May from 5.6% in April, continuing on the way down from the 5.7% peak in March.

Country differences: Inflation rates within Eurozone member states exhibit significant variation, as indicated in the provided table. The rates range from 2.0% year on year in Luxembourg to 12.3% in Latvia. Certain countries were more vulnerable than others to the import price shock originating from gas markets. Additionally, disparities exist in the speed at which higher prices are transferred to consumers, the timing of government interventions to mitigate the inflationary impact, and the statistical methodologies employed to measure energy prices. Nevertheless, in May, inflation rates decreased in nearly all member states, with the exceptions being Malta, where it remained stable, and the Netherlands, where it witnessed a slight increase.

Chart 1: Eurozone inflation (% yoy)

Source: Eurostat

Chart 2: Eurozone HICP inflation: headline and contribution from special aggregates (in % yoy and ppt)

Source: Eurostat

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Încearcă Următoarele

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know