Gold Nears Record Highs as Dollar Weakens, Fuel Outlook on Natural Gas and Brent Crude

2025-02-14 10:52:40

Overview:

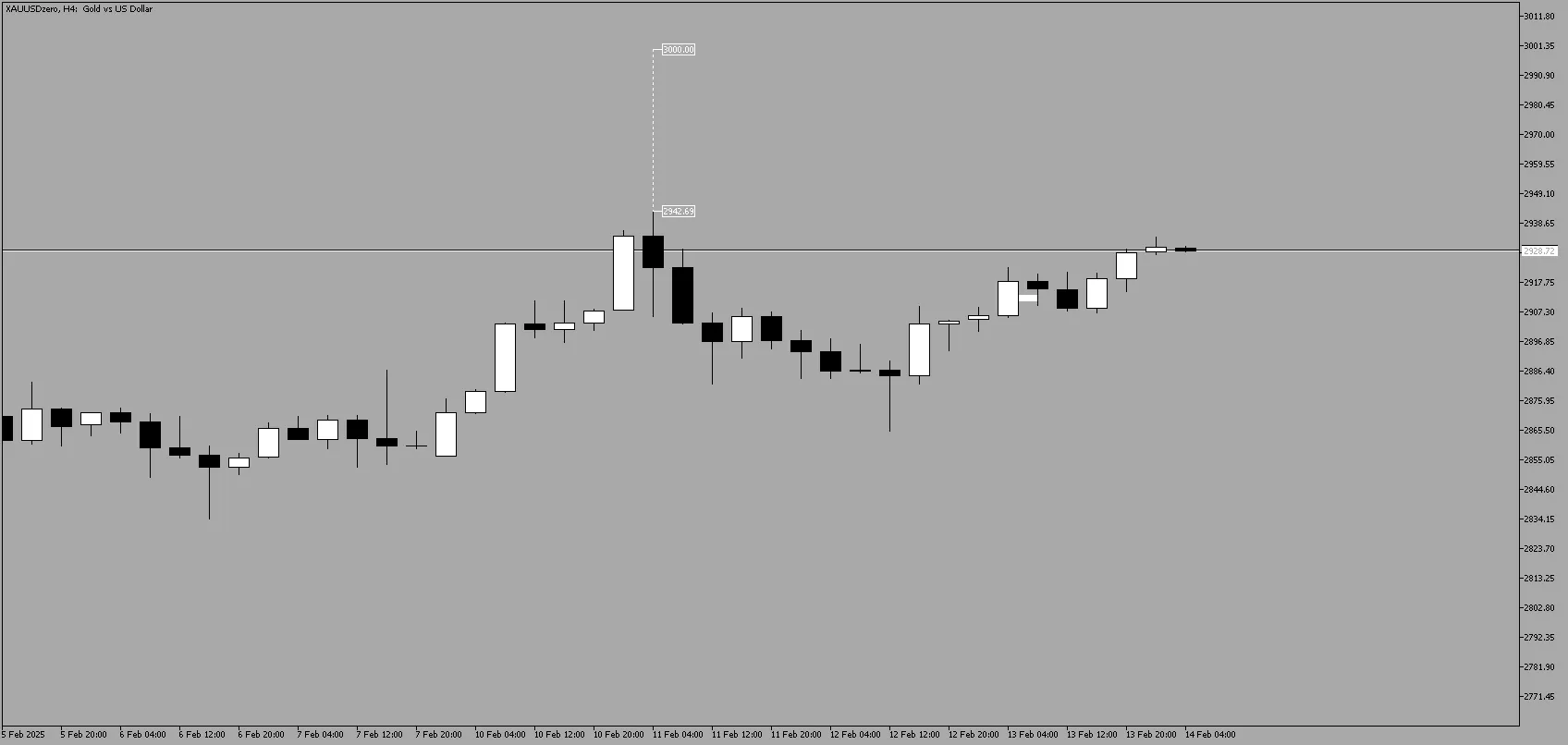

- Gold's Bullish Momentum – Gold approaches a record high of $2,942.69 as the Dollar weakens amid positive CPI and PPI data, with forecasts eyeing $3,000 an ounce.

- Natural Gas Outlook – Prices maintain a bullish direction driven by seasonal demand and geopolitical tensions, targeting levels of 3.849 - 3.958.

- Brent Crude Oil Analysis – Brent remains range-bound, awaiting a breakout above 77.070 for a confirmed bullish move.

Gold Soars to Record $2,928.42 Amid USD CPI and PPI Positive Numbers

Gold maintains its bullish continuation as the Dollar continues to tumble amid positive CPI and PPI results. We are now approaching the 2942.69 level.

Gold hit a record 2942.69 an ounce on Tuesday as President Trump's disruptive trade and geopolitical moves reinforced bullion's appeal as a safe-haven asset in uncertain times. Now, we are set to get back up again at the All-Time High level.

Investors are closely watching how these policies might impact the U.S. economy and influence monetary policy, particularly if they trigger inflation and slow economic growth.

Major banks are now forecasting gold to reach $3,000 an ounce, driven by sustained demand for safe-haven investments. Citigroup Inc. recently projected that gold prices could hit this milestone within three months. Adding to the bullish outlook, central banks — including China’s — have been increasing their gold reserves, while bullion-backed exchange-traded funds continue to expand. These factors have contributed to gold's impressive 12% rise so far this year.

Fuel Outlook

Natural Gas

Natural gas prices have shown volatility due to seasonal demand fluctuations and geopolitical tensions affecting supply routes. We are still seeing a strong bullish direction for GAS.

Levels to Watch:

- Resistance Targets: 3.849 - 3.958Should the bullish momentum continue, we expect natural gas to reach these levels in the short term.

Brent Crude Oil

Brent crude is still inside the range and we are awaiting for reactions either the support and resistance levels.

Technical Outlook:

- For a confirmed bullish move, Brent needs to trade, break through, and stay above the 77.070 level.

- Alternatively, if prices reject this resistance, we could see a continuation of the range-bound pattern.

The Dollar continues its bearish stance amid positive CPI and PPI results, failing to gain traction due to lingering concerns over employment data. This weakness is expected to persist, supporting the bullish outlook for Gold and other major commodities.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next