Dollar Resilience Reemerges as Growth Outlook Overshadows Trade Concerns

2025-07-30 11:29:44

The US dollar found fresh momentum to start the week, surging by the largest daily gain since mid-May an indication that FX market focus is shifting decisively back toward America’s underlying economic strength.

This newfound enthusiasm for the greenback comes amid robust corporate earnings and an equity rally that seems to defy earlier anxieties.

Despite political noise and lingering global trade friction, US resilience is shining through. As of last Friday, a substantial portion of S&P 500 companies had already posted better-than-expected results, leading to a stronger consensus on Q2 earnings growth.

That optimism has lifted equity valuations, with forward P/E ratios now exceeding their 5- and 10-year averages a signal that investors are, once again, pricing in a story of American exceptionalism.

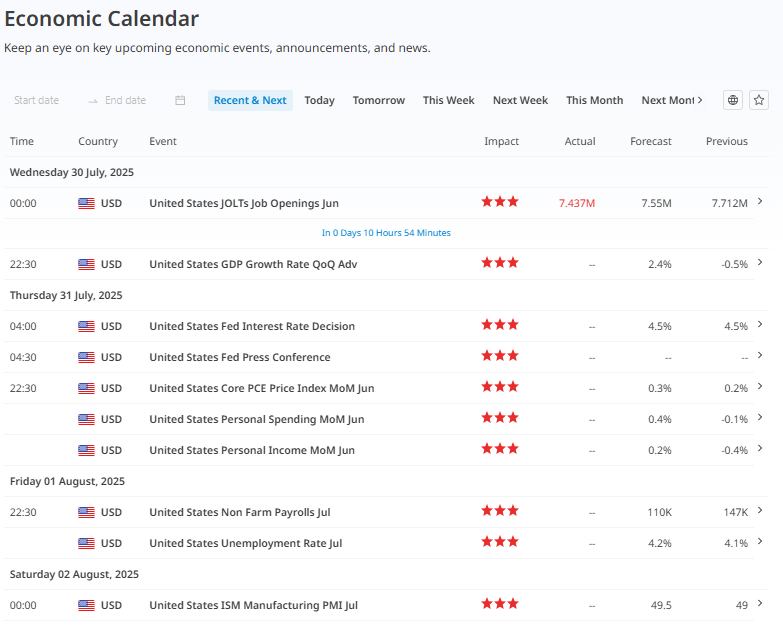

What’s driving this shift? The market appears to be temporarily brushing aside the fog of trade uncertainty and is instead gearing up for a pivotal week in US data releases.

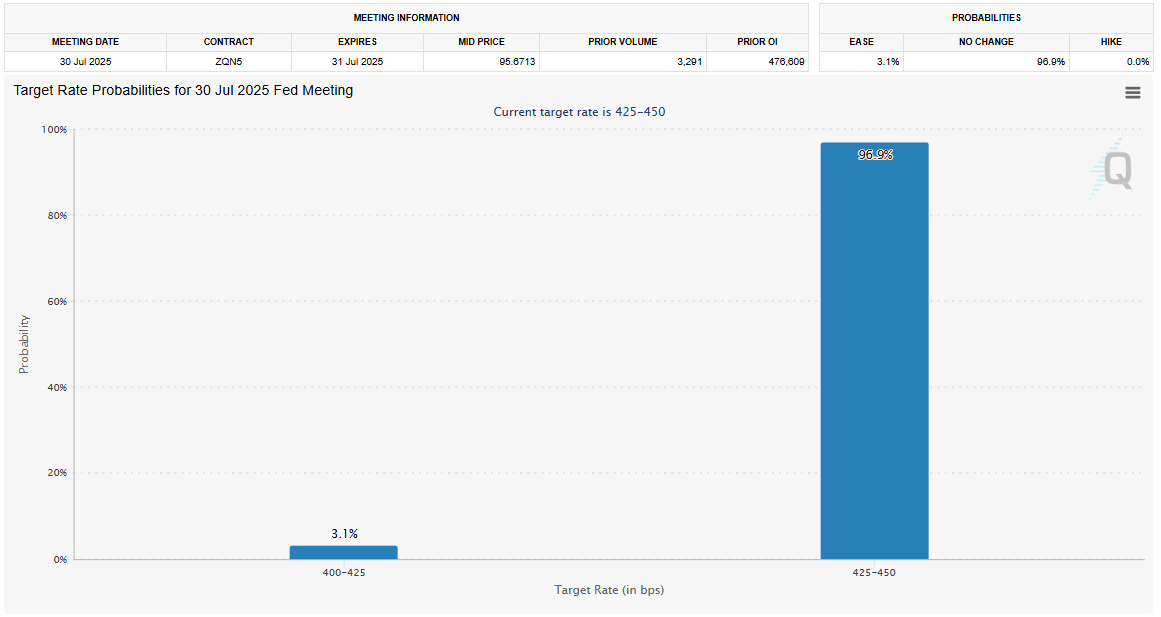

Key labor market figures and the FOMC meeting will dominate attention, especially with the Fed likely to maintain a cautious tone on rate cuts.

A robust readout from the JOLTS report today, paired with firm comments from Chair Powell, could reinforce the bullish USD narrative and potentially trigger further short covering in the dollar.

However, while US growth is stealing the spotlight, the geopolitical backdrop remains volatile. Trade negotiations continue to underwhelm in terms of clarity and execution, and upcoming legal challenges related to tariff implementation could yet disrupt market confidence.

Still, with no sign of immediate labor market weakness and political developments unlikely to surface in this week’s data, traders are currently finding comfort in the numbers.

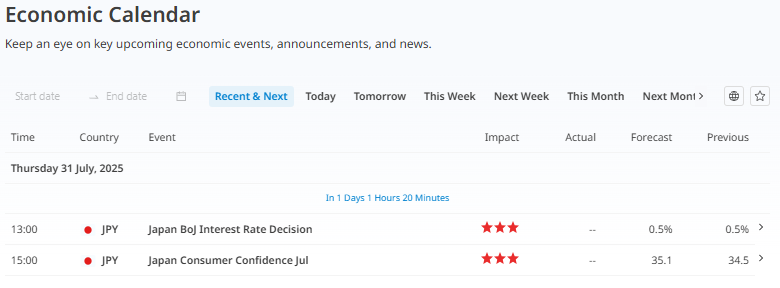

Meanwhile, across the Pacific, the yen remains under pressure dragged down by political turbulence in Japan. Prime Minister Ishiba is clinging to his post despite rising calls for resignation following contentious trade arrangements with the US.

The details of the newly agreed investment fund remain vague, and domestic backlash is growing over fears it may infringe on Japanese sovereignty. Political discontent, coupled with an uncertain central bank outlook, is creating a very bad environment for the yen just as the BoJ prepares for a critical meeting this Thursday.

This week holds added weight for USD/JPY traders, as the combination of Fed messaging, BoJ positioning, and US labor market data could set the tone for a broader breakout.

If Governor Ueda offers a less hawkish stance than his deputy did last week, it could reinforce the perception of policy divergence and invite further yen selling.

In summary, while the global macro environment remains fluid, the near-term FX landscape is increasingly tilting toward a narrative of US resilience.

For the dollar, that means support. For the yen, however, political instability and policy ambiguity may continue to weigh. The tug-of-war between growth optimism and trade uncertainty is far from over but for now, the greenback appears to have the upper hand.

Q1: Why is the US dollar rebounding despite lingering trade tensions?

A1: While trade risks haven’t disappeared, market participants are currently more focused on the strength of US economic data especially corporate earnings and labor market indicators. This pivot in focus is driving renewed confidence in the dollar.

Q2: How do strong earnings reports influence the FX market?

A2: Robust earnings, especially from large-cap tech firms, boost investor sentiment and equity prices. This optimism can spill over into the FX space, reinforcing dollar strength as capital flows into US assets.

Q3: What role does the Fed play in sustaining dollar momentum this week?

A3: A cautious tone from the Fed particularly if it delays rate cuts can help sustain upward pressure on the dollar. Investors tend to reward currencies backed by central banks showing restraint in easing policy amid solid growth.

Q4: Why is the yen struggling despite global uncertainty?

A4: Political instability in Japan and an unclear trade deal with the US are eroding confidence in the yen. Additionally, any dovish signals from the Bank of Japan could widen the policy divergence with the Fed, adding further downward pressure on JPY.

Q5: What levels in EUR/USD or USD/JPY would confirm this USD rally has legs?

A5: A clean break below 1.1500 in EUR/USD or a surge above key resistance at 149.200 in USD/JPY could suggest that recent dollar strength is more than just a short-covering bounce and may reflect a broader repricing of growth and policy expectations.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Încearcă Următoarele

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know