How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

2025-05-15 11:01:54

Goal of This Lesson:

To teach you how to trade breakouts with precision by using key level marking, multi-timeframe confirmation, and session-based timing—instead of chasing impulsive price moves like retail traders.

By the End of This Lesson, You Should Be Able To:

- Understand the difference between real and fake breakouts

- Know how to mark key levels that matter for breakout setups

- Use higher timeframe context to confirm breakout direction

- Time breakouts during Kill Zones in lower timeframe to increase your accuracy and confirmation

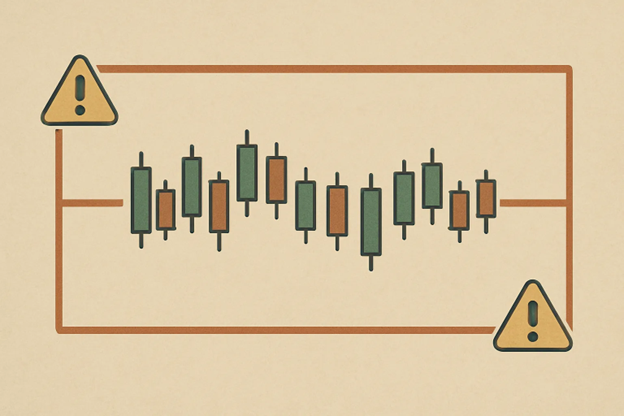

Understand the Difference Between Real and Fake Breakouts

When price touches a key level, it can do one of two things:

- Break through it (real breakout)

- Bounce off it (fake breakout)

Knowing which one is happening in real time separates smart traders from stop-loss donations.

Here’s how to tell the difference:

| Breakout | Fakeout |

|---|---|

| Happens during Kill Zones | Happens outside major sessions |

| Backed by displacement (strong move) | Weak, hesitant candles |

| Confirmed by HTF bias (H1, M15 trend alignment) | Goes against HTF trend |

| Breaks cleanly, leaves a Fair Value Gap (FVG) | Breaks briefly, immediately retraces |

| Volume and momentum increase | Thin, choppy price action |

Real-Life Analogy: Breaking Through the Door

Imagine standing in front of a locked door with 10 people pushing behind you. If the hinges are weak, and the pressure builds long enough, the door bursts open—clean and unstoppable.

But what if the people behind you were distracted, or not ready? You might push first, only to bounce back and fall. That’s what a fake breakout feels like.

Breakouts need pressure, alignment, and timing. Without those, you’re just hitting resistance—not breaking it.

Step 1: Mark Key Breakout Levels - Levels That Have Not Been Visited Yet

A breakout is meaningless if it doesn’t occur at a key level. That means you need to mark zones where institutions are likely active.

Use these levels as potential breakout zones or liquidity traps:

| Key Level | Description |

|---|---|

| Previous Day High/Low | External liquidity anchor |

| Previous Session High/Low | Intra-day liquidity pockets |

| Support & Resistance Levels | Swing highs / lows |

Breakouts mean nothing without context. Mark these zones every session.

GOLD

Mark Key Levels on H1 / M15 timeframe:

- Asian High / Low

- Previous Day High / Low

There’s no London High / Low yet since we are look for potential trades during that time. We can refer to those levels during New York session.

Wait for price to reach a key level during a key session.

Step 2: Wait for Levels During Kill Zones

In this case, we are currently testing the Asian high and Previous Day High, either price breaks or fakes.

Smart money doesn’t break levels at random times. They do it when:

- Volume is high

- Retail traders are active

- Liquidity is present

That’s why your breakout trades should only be taken during:

| Kill Zone | Time (EST) | What to Expect |

|---|---|---|

| London Session | 12AM – 6AM | Sweeps, setups begin forming |

| Pre-New York Open | 6:00AM - 9:30AM | Sweeps of Asian, London Highs / Lows (Best for Currencies) |

| New York AM | 9:30AM – 12PM | Breakouts, displacements, execution zone (Best for US Indices) |

| New York PM | 1PM – 4PM | Reversals, stop runs, trap breakouts |

Outside these zones? Expect low volume, false moves, or no continuation.

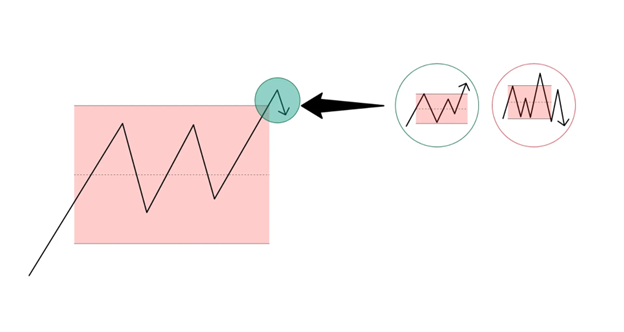

Once price reaches this levels, go to lower timeframe to confirm if a level is willing to break or fake.

Step 3: Use Multi-Timeframe Confirmation

Breakouts on lower timeframes often mislead unless confirmed by higher timeframe intent. Before trading a breakout on M1 or M5, confirm bias on H1 or M15.

Here’s how:

- Start with H1 or M15: Define bias based on structure (HH/HL or LH/LL)

- Drop to M5 or M1: Identify breakouts aligned with that bias. Validate if price is willing to break or fake.

M5 and M1 confirms that we are ready to go to the upside as it break another range at a lower timeframe.

The Key: Whenever price reaches a key level, observe price action at the lower timeframe. In this scenario, we are using M5 / M1 as a confirmation if it would breakout off the range.

The next step is to wait for a momentum candle or a displacement (strong move to a certain direction) to confirm that the there’s traction either upside or downside.

- Look for Displacement & MSS: Confirm breakout is backed by institutional movement

The 3 candles are tagged as displacement candles because it engulfed the series of candles, signifying a renewed bullish momentum.

It also left a fair value gap for entry.

✅ A breakout with HTF confirmation = continuation

❌ A breakout against HTF bias = likely trap or false move

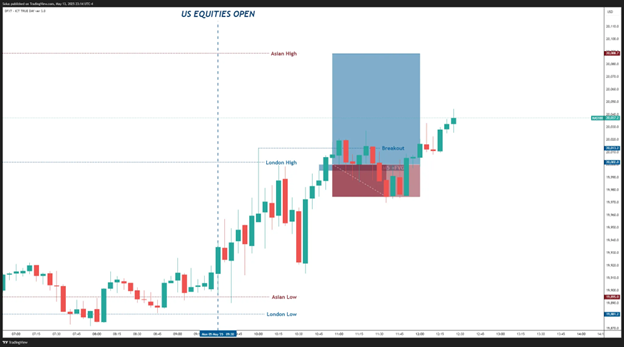

NASDAQ

1. Mark Key Levels

Key Levels:

- Previous Day High / Low

- Asian High (Asian Low is not included since it has been traded already.)

- London High / Low

2. Wait for Levels During Killzone

Since we are using Nasdaq as an example for a trade idea, we’d like to wait for the US equities open at 9:30AM EST before we look for trades. We need momentum to inject first.

3. Use Multi-Timeframe Confirmation

Looking at M5 chart, there’s no willingness for the HTF (Higher Timeframe) to go to the upside. We wait for a LTF (Lower Timeframe) breakout.

Stops can be placed below the 1st candle of the 3 candle FVG pattern.

In this case, you got stopped out. That’s totally fine. We can look for another opportunity.

Another breakout opportunity with targets at the Asian High.

Another opportunity has presented itself: Asian High breakout. Now, we need to make sure if the LTF agrees to push price to the upside by looking for a confirmation.

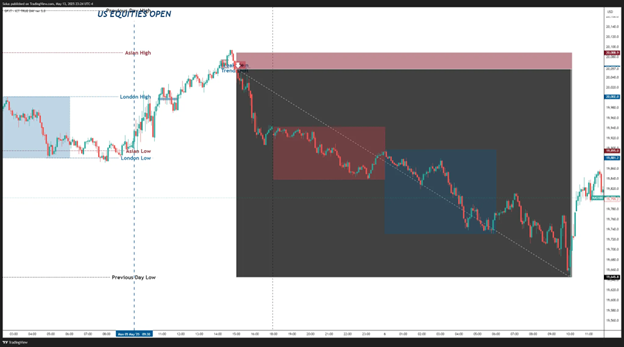

Failed Breakout Opportunity

Looking at price action, there’s no willingness for price to push to the upside. We can now look for short opportunities as price presents a potential reversal play with confluences of:

- Asian High (Key Level)

- Break of Recent Low (Trend Shift

- Bearish FVG

We look for execution at the FVG with target at the Previous Day Low. Why? It’s the only Key Level on the downside that has not been traded yet.

This trade actually extended until the next day. After price reached the Previous Day’s Low, it bounced right off the bat.

Key Principle in Trading Breakouts:

- Whenever price reaches a key level at a key session, observe price action by looking at confirmations at the Lower Timeframes.

Breakout Trading Model – Confirmation Approach

Here’s your breakout plan using SMC tools:

- Mark Key Levels (PDH/PDL, Session High/Low, major swing levels)

- Check HTF Bias (M15–H1 must show bullish or bearish intent)

- Wait for Kill Zone to activate market participants

- Drop to LTF (M1–M5) and look for:

- LTF Range Breakout

- Displacement / Breakout Candle

- Fair Value Gap (Entry Level)

- Entry: Enter on pullback to FVG or breakout candle body

- SL: Below the range

- TP: Next liquidity pool (e.g. previous session high/low or swing)

Checklist to Spot a Real Breakout

Before you jump into a breakout trade, ask yourself:

- Is it happening at a key level?

(PDH/PDL, Session High/Low, Major Swing)

2. Is it during a Kill Zone?

(London Open, New York AM, Pre-NY Open)

3. Is there displacement and follow-through?

(One strong move with multiple bullish/bearish candles)

4. Is HTF (H1/M15) supporting the move?

(Higher timeframe structure must align)

5. Is there an FVG or liquidity gap left behind?

(Institutional footprints = real move)

✅ If all answers are YES → trade the breakout.

❌ If any answer is NO → it's likely a trap. Stand aside or look for a reversal.

Beginner Mistake to Avoid:

❌ Chasing a candle that breaks a level with no context

✅ Instead: Wait for confirmation that the level is actually going to break. If it fakes, look for reversal opportunities.

Remember:

A real breakout is not just a candle breaking a line.

It’s pressure + timing + confirmation coming together.

"A breakout is a moment of decision—not just a bigger candle."

If you master this filter, you won’t just chase breakouts...

You'll trade WITH smart money, not against it.

Final Thought: Breakouts Are Traps Until Confirmed

Most traders lose money on breakouts not because they’re wrong—but because they enter without structure, time, or confirmation.

In the Smart Money model, a breakout is a part of the trap, not the beginning of the move. Your job isn’t to catch every breakout. Your job is to wait for the ones engineered by real money—and trade them with discipline.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next