Learn Trading From Scratch: Clean, Simple, Zero-Noise

2025-11-21 12:51:56

If you are starting from scratch, the goal is not to become a pro in one week. Your first win is building a clear beginner trading learning path so you know what to learn first, what can wait, and how not to blow yourself up along the way. Think of this as your stripped down roadmap: fewer moving parts, more focus, just the essentials that move you forward.

Step 1: Start With Market Basics

Before thinking about “setups,” you need a basic feel for how price moves. A great first stop is The Ultimate Guide to Understanding Market Trends and Price Action, which explains trends, swings, and structure in plain language.

Once you understand uptrends, downtrends, and ranges, charts stop looking like chaos and start looking like a map.

Step 2: Pick One Beginner-Friendly Strategy

Do not collect ten strategies. Choose one structured framework and stick with it for a while. The easiest entry point is something like Forex Trading Strategy for Beginners, which walks you through pairs, timeframes, and basic rules.

At this stage, your focus is:

- What to trade

- When to trade

- Where to place stop loss and take profit

Nothing fancy. Just a repeatable blueprint.

Most beginners get overwhelmed because they try to learn everything at once: SMC, indicators, candlesticks, breakouts, scalping, swing trading… it’s too much.

The minimalist approach is simple:

- Choose one market.

- Learn one beginner-friendly strategy for that market.

- Stick to it for 4–6 weeks.

Below is a clean breakdown of the easiest strategies to begin with, depending on the market you choose.

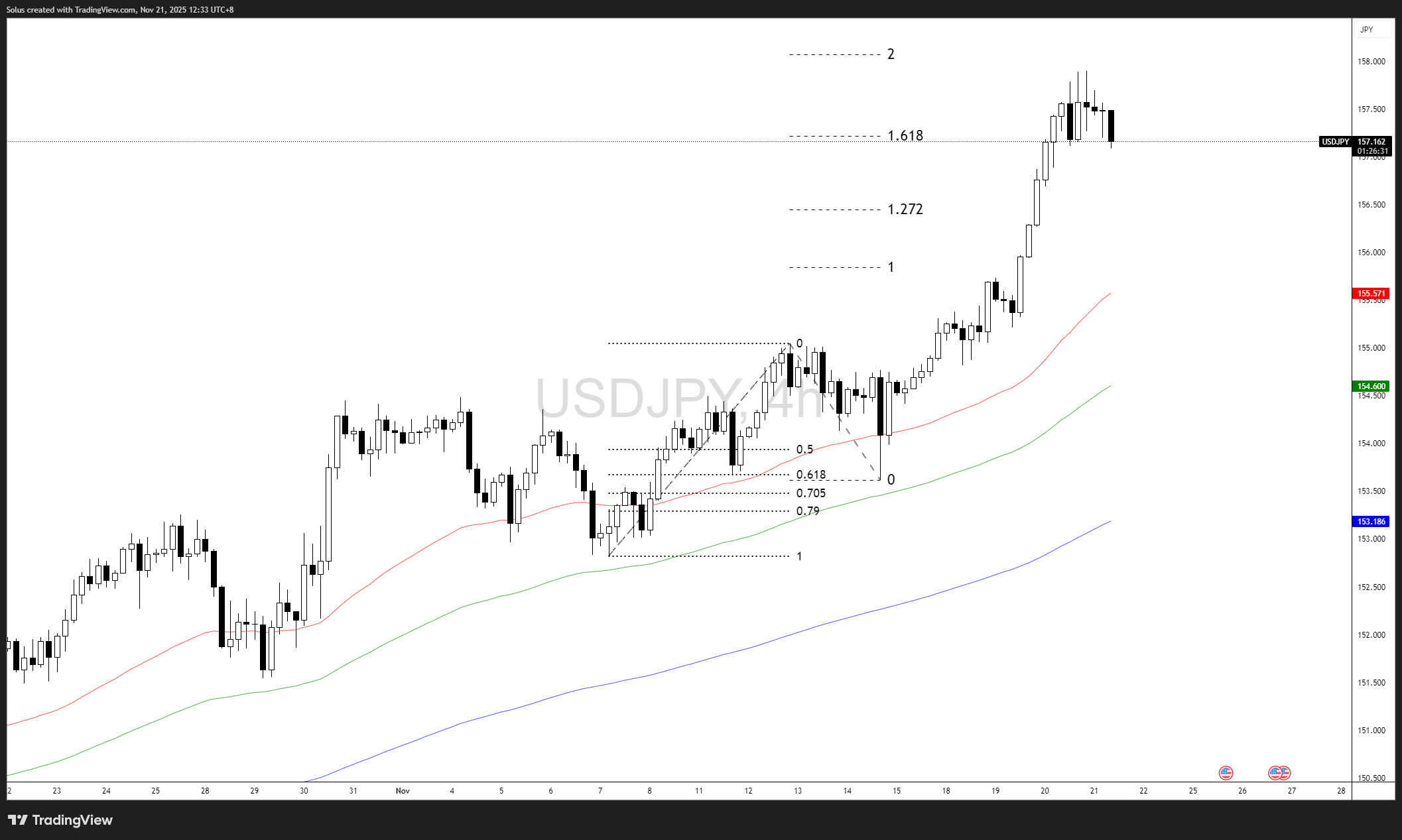

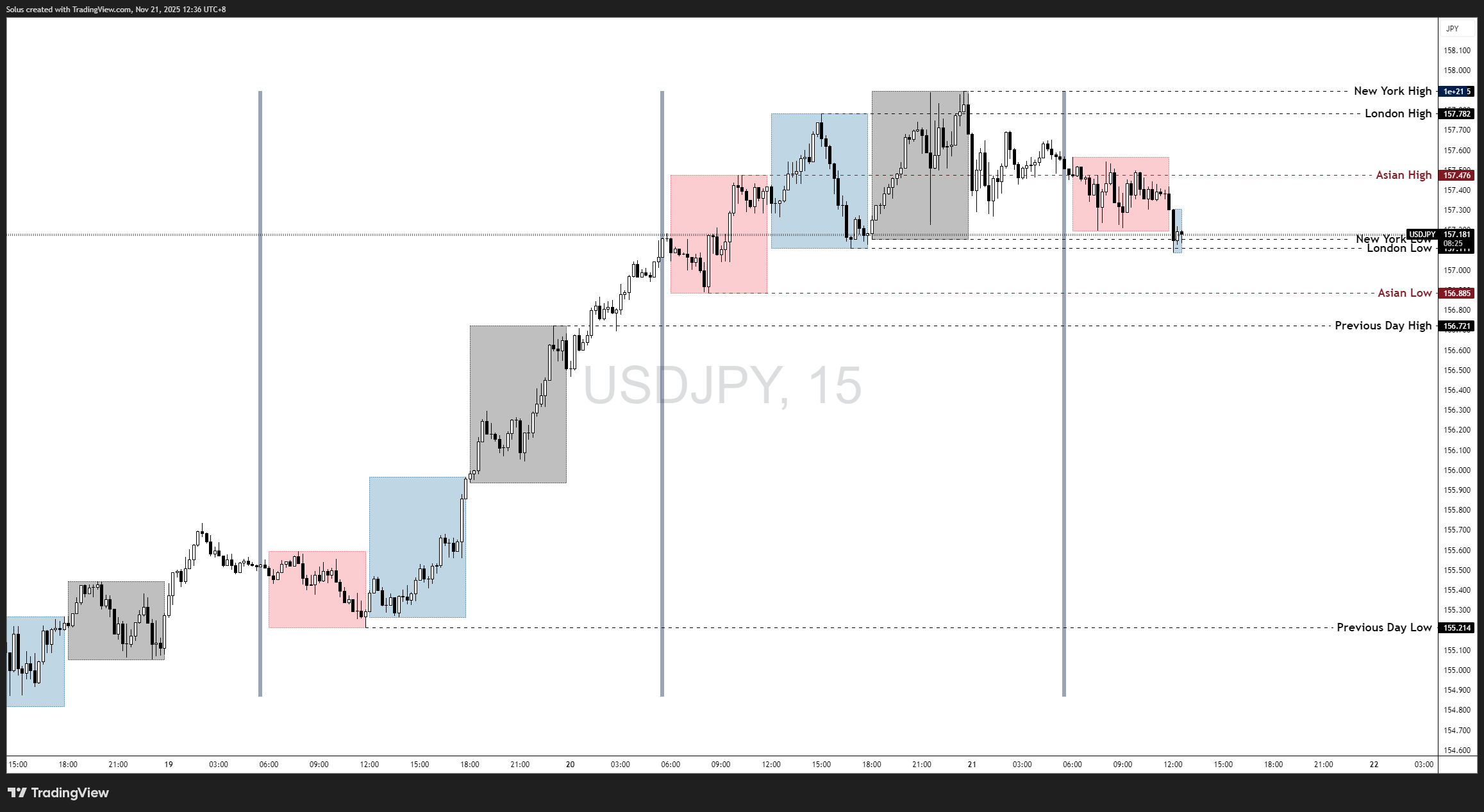

A. If You Want to Start With FOREX

Forex moves cleanly, trends well, and has predictable sessions - perfect for beginners.

1. Beginner Trend-Following Strategy

Uses trend structure, basic support & resistance, and clean entries.

Learn it here:

Forex Trading Strategy for Beginners

Why this works for beginners:

- Clear rules

- Easy to spot trends

- Simple stop-loss logic

- Works on all major pairs (EUR/USD, GBP/USD, USD/JPY)

2. Retest + Breakout Confirmation Strategy

Enter after a breakout retests the level, not before.

Learn it here:

Mastering Retests: How to Enter With Confirmation After a Breakout

Beginners love this because the retest gives you time to think before entering.

3. Price Action at Key Levels Strategy

Trading reversal or continuation signals at strong levels.

Learn it here:

Mastering Price Action at Key Levels

Use this if you prefer slow, structured setups.

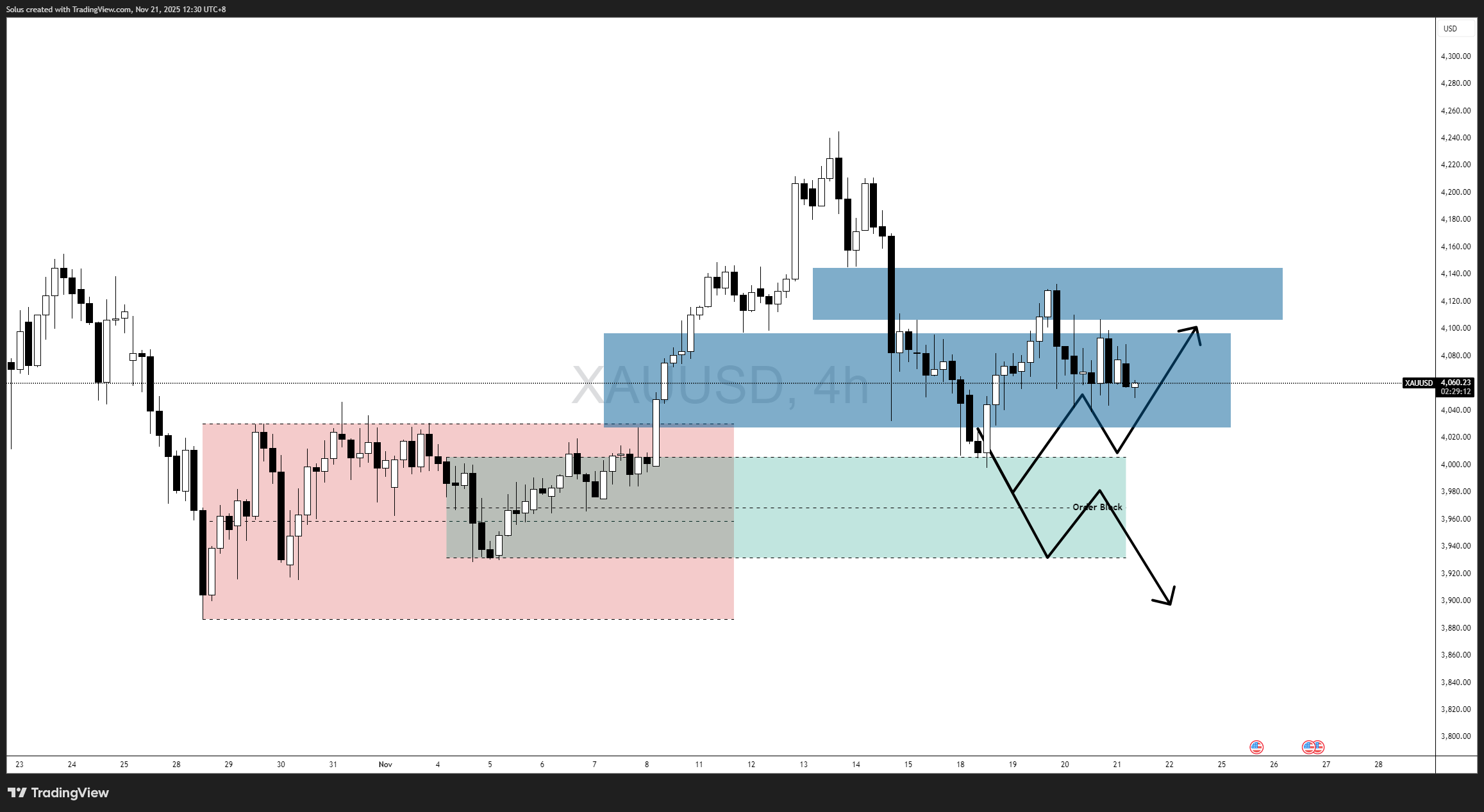

B. If You Want to Start With GOLD (XAU/USD)

Gold moves faster, so the key is structure + confluence.

1. Basic Gold Day Trading Strategy (Beginner SMC)

A clean step-by-step guide with clear rules and screenshots.

Learn it here:

Complete Step-by-Step Guide to Day Trading Gold

This is ideal for beginners because it simplifies SMC without overwhelming you.

2. Swing Trading Gold for Beginners

For those who prefer slower, relaxed trading.

Learn it here:

How to Swing Trade Gold Using Smart Money Concepts

3. RSI or Stochastic Confluence Strategy

Great for new traders who want indicator-based confirmation.

RSI Divergence Strategy:

RSI Divergence Trading Strategy for Gold

Stochastics 2R–3R Strategy:

Gold Trading Stochastics Strategy

Use this if you prefer visual, indicator-supported entries.

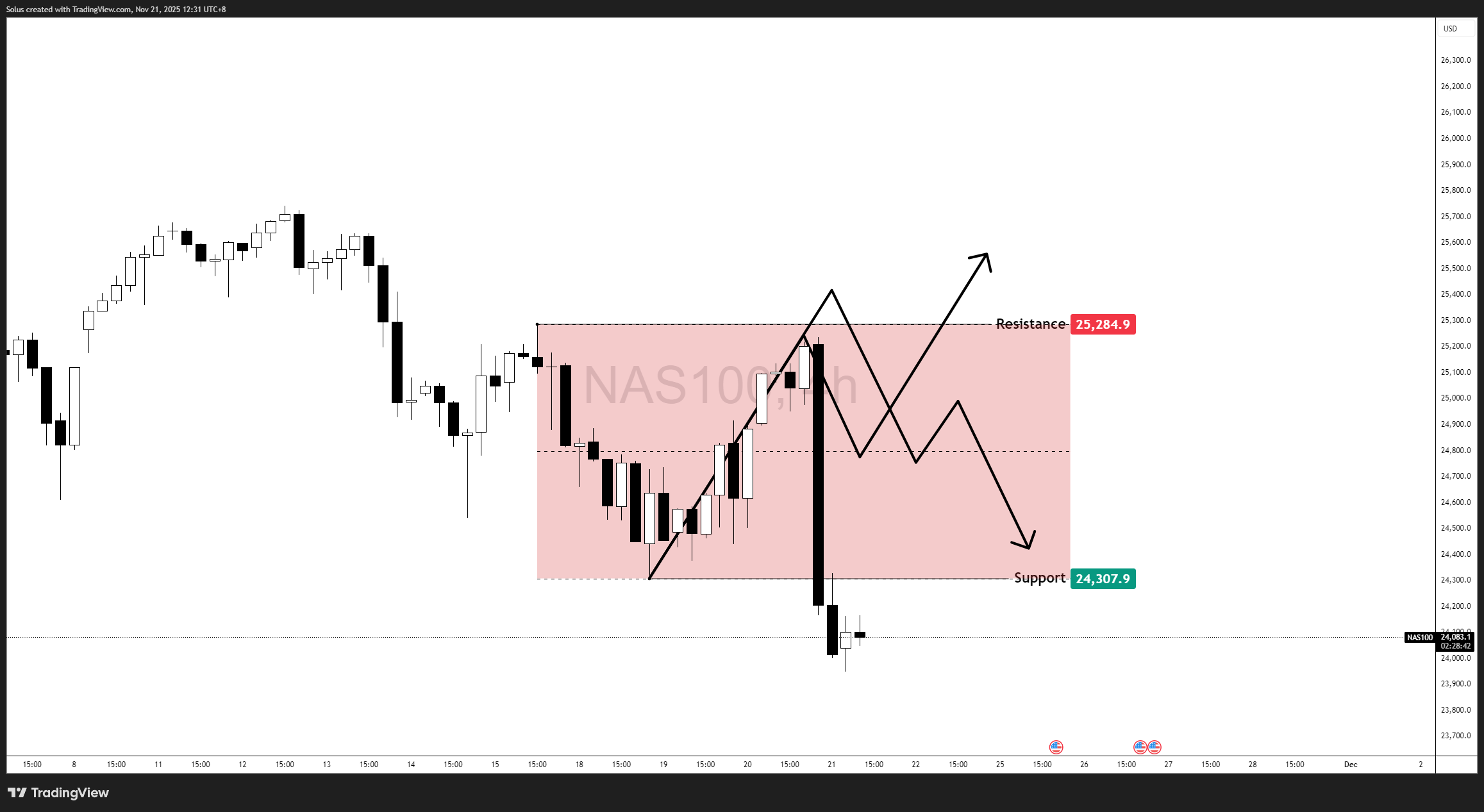

C. If You Want to Start With INDICES (NASDAQ, S&P 500)

Indices move with clean momentum during their sessions - beginners just need structure.

1. The NASDAQ Open Scalping Strategy (Beginner SMC)

One of the most popular guides ever published.

Learn it here:

How To Trade & Scalp Indices at the Open Using SMC

Why it’s beginner-friendly:

- Same pattern repeats daily

- Clear high/low formation

- Small timeframe = more practice

2. Breakout + Confirmation Strategy (Indices Edition)

Perfect for beginners who want clean, no-noise rules.

Learn it here:

How to Trade Breakouts Effectively in Day Trading

3. Multi-Timeframe Trend Strategy

If you want a bit more structure but still beginner-safe.

Learn it here:

The Power of Multi-Timeframe Analysis in SMC

D. If You Want a Universal Starter Strategy That Works On All Markets

Some traders don’t want to commit early - that’s okay.

1. Moving Averages Trend Strategy

Simple. Clean. Beginner-proof.

Learn it here:

Moving Averages Trading Strategy Playbook

2. Fibonacci Targets & Stops Strategy

Works on any chart, any timeframe.

Learn it here:

How to Use Fibonacci to Set Targets & Stops

These are excellent if you want to experiment across different markets but stay structured.

How to Use This (Minimalist Rule)

- Pick only ONE market: Forex, Gold, or Indices.

- Pick ONE strategy from that category.

- Backtest and practice it for 4–6 weeks before touching anything else.

This prevents overwhelm, randomness, and “strategy-hopping”-the #1 beginner killer.

Step 3: Learn Candles and Key Levels Together

Candlesticks are powerful, but only when read at meaningful areas on the chart. Build this skill in two layers:

- First, learn the main patterns with Mastering the Top Japanese Candlesticks.

- Then plug those patterns into real zones using Mastering Price Action at Key Levels.

You are training your eyes to see: “This candle appears here, at this level, in this trend” instead of “This candle appears, so I must trade.”

Step 4: Add Just Two Tools – MAs and Fibonacci

You do not need a full indicator zoo. For a minimalist path, two tools are enough for a long time:

- Use the Moving Averages Trading Strategy Playbook to help you stay with the trend instead of fighting it.

- Use How to Use Fibonacci to Set Targets & Stops to mark logical targets and protective stops.

Everything else is optional. Your chart should look calm, not like a Christmas tree.

Step 5: Install Risk Management and Psychology From Day One

If you skip this, nothing else matters. Learn how much to risk and how to protect your account with Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing. Pair it with Why Risk Management Is the Only Edge That Lasts.

On the mindset side, understand why most traders blow up by reading Why Most Traders Fail - Trading Psychology & The Hidden Mental Game, then build a new mental structure with The Disciplined Trader: The Complete Blueprint for Consistency.

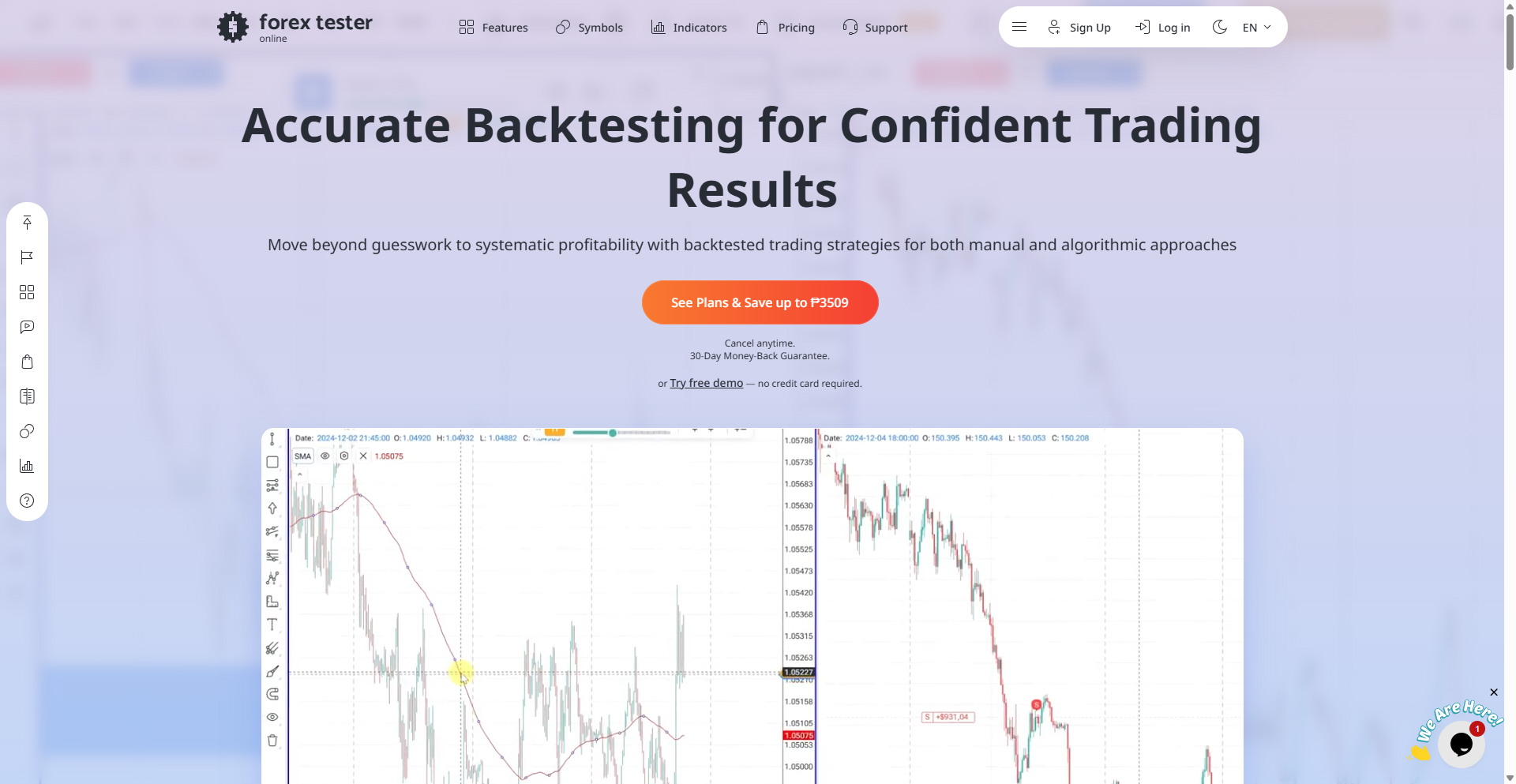

Why Backtesting Accelerates Your Learning (Especially as a Beginner)

One of the fastest ways to build skill - without risking your money - is backtesting. When you’re new, every chart feels overwhelming because you haven’t seen enough repetitions of your setup. Backtesting fixes that.

Instead of waiting days or weeks for live setups to appear, you can replay the market at your own pace and see how your strategy would have performed across hundreds of historical moves. This gives you three advantages:

- Clarity: you stop guessing whether a setup is valid

- Confidence: you see your strategy actually works over time

- Control: mistakes become lessons instead of losses

A powerful tool for this is Forex Tester - which lets you fast-forward, rewind, and practice your strategy as if you were trading live. It’s one of the simplest ways to gain experience quickly, especially when you’re still learning structure, entries, and risk placement.

Backtesting won’t make you perfect, but it will make you prepared - and that alone puts you ahead of most beginners.

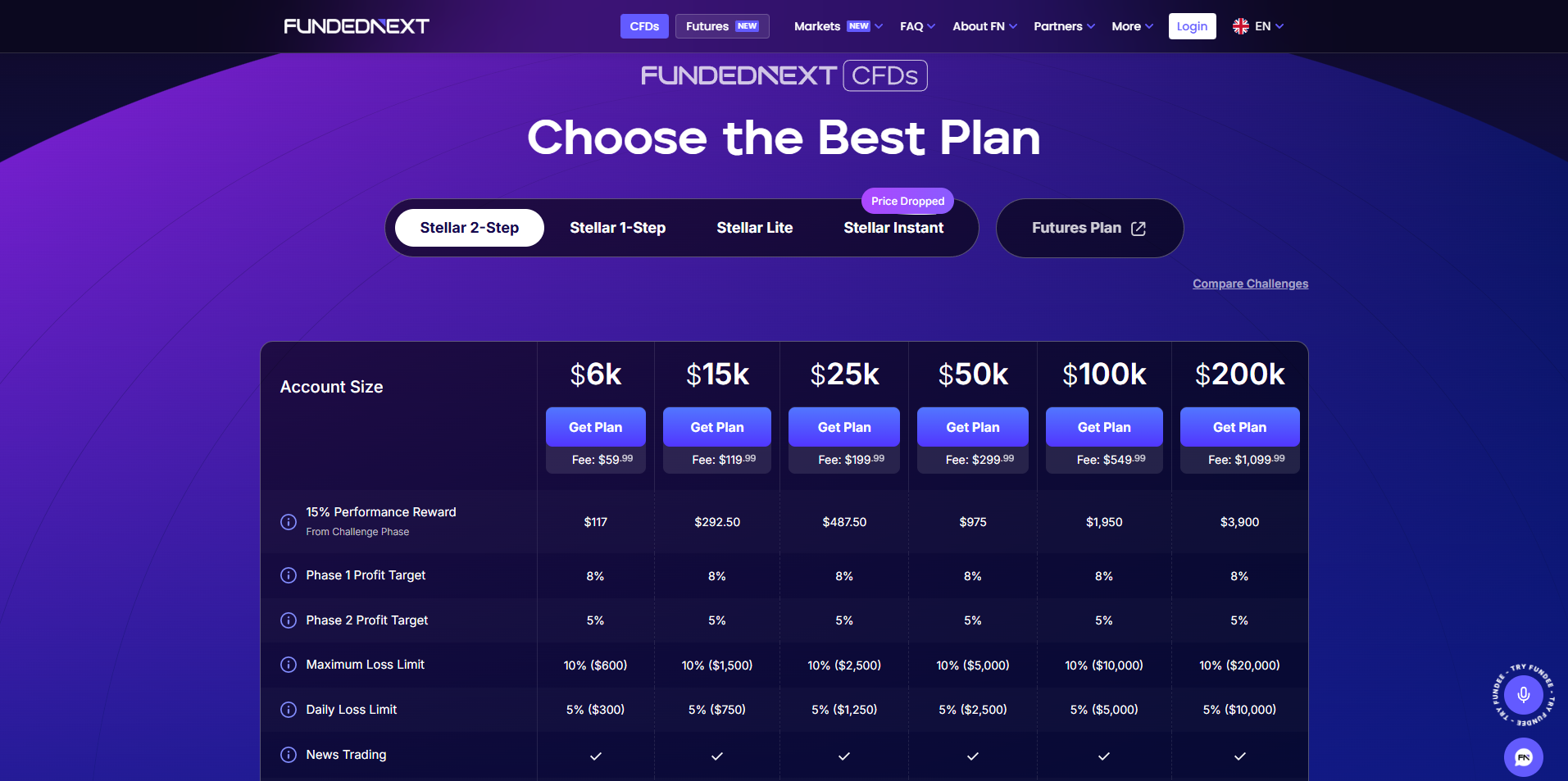

How Beginners Can Get Capital Without Saving for Years

One of the biggest challenges new traders face is capital. Even if you follow the right learning path, it’s hard to grow with a $100 or $200 account. This is why many beginners turn to prop firm funding, where you trade a firm’s capital and keep a share of the profits.

If you already have a structured strategy and can show discipline, funding becomes a realistic next step - and it lets you scale much faster than trading small personal accounts. A reliable place to start is FundedNext, where you can qualify to manage larger capital through their evaluation programs.

Instead of waiting years to build funds, you can focus on building skill - and once you prove consistency, you gain access to real capital to trade with.

FundedNext Features (Beginner-Friendly Breakdown)

Here are the key features that make FundedNext accessible for newer traders progressing through the learning path:

1. Capital Scaling Opportunities

Depending on your consistency, you can grow your funded account over time - helping you trade larger size as your skill improves.

2. High Profit Split (Up to 90%)

You keep a significant share of the profits, which is ideal for traders who want to grow income without large initial capital.

3. Evaluation Models (Choose What Fits You)

FundedNext gives you options, such as:

One-Phase Evaluation (faster funding)

Two-Phase Evaluation (more forgiving and structured)

This helps beginners pick the route that matches their comfort level.

4. Low Entry Cost Compared to Capital Provided

You might pay a small fee upfront, but you’re ultimately accessing tens of thousands of dollars in trading capital.

5. Bi-Weekly Payouts

Consistent traders can withdraw profits frequently - a huge benefit for those using trading as supplemental income.

6. No Hidden Rules

The rules are clearly outlined: max daily loss, max overall loss, and profit targets. This transparency helps beginners stay disciplined and avoid surprises.

7. Community & Support

FundedNext provides educational support, communities, and customer service that help you stay aligned and motivated during the evaluation process.

8. Smooth Dashboard & MT4/MT5 Compatibility

Their dashboard is user-friendly and supports the platforms most traders already know, making the transition easy.

Real Life Analogy: Learning To Drive, Not Drift

Treat this like learning to drive:

- Step 1: You learn pedals, mirrors, and basic control in an empty lot.

- Step 2: You drive slowly on normal roads.

- Step 3: Only later do you try harder conditions or speed.

Articles like 5 Steps to Start Day Trading: A Strategic Guide for Beginners are your driving school. Smart Money Concepts and advanced strategies come later, when you already know how to “drive” safely.

This Week’s Assignment

If you truly want to start, here is your simple challenge for the week:

- Read one article on trends and structure and take handwritten notes.

- Turn Forex Trading Strategy for Beginners into a one page checklist.

- Decide your max risk per trade after reading How Much Should You Risk per Trade?, and write that number at the top of your journal.

No need to rush live trades. Your job this week is to build a small, clear base you can stand on.

Final Thoughts

If there’s one lesson to carry with you, it’s this: trading becomes easier when you keep it simple. Most beginners overload themselves with too many strategies, tools, and opinions. But real progress comes from focusing on one market, one strategy, and one set of rules.

When you strip away the noise, you can finally see the chart clearly. You react less, think more, and build confidence step by step. This path isn’t about speed - it’s about steady, focused growth.

Learn slowly. Practice intentionally. Stay consistent.

Do that, and you’ll be further ahead than most beginners ever get.

Start Trading Live!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

It’s time to go from theory to execution!

Create an Account. Start Your Live Trading Now!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R - 3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels - How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC) - A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

- Learn to Trade News by Backtesting it with Forex Tester

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

- Backtest Gold using Forex Tester Online

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Swing Trading 101

- Introduction to Swing Trading

- The Market Basics for Swing Trading

- Core Principles of Swing Trading

- The Technical Foundations Every Swing Trader Must Master

- Swing Trader’s Toolkit: Multi-Timeframe & Institutional Confluence

- The Psychology of Risk Management in Swing Trading

- Swing Trading Concepts To Know In Trading with Smart Money Concepts

- Becoming a Consistent Swing Trader: Trading Structure & Scaling Strategy

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

- Metals in Risk-On and Risk-Off Environments: How Sentiment Moves Gold and Commodities

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading - Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow - Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

- Anatomy of a Perfect Execution: How SMC Traders Trade with Precision

- Step-by-Step Trading Confirmation Guide for Precise Execution

- Execution Psychology: Turning Hesitation into Confidence

- What Is an Order Block? The Institutional Footprint Explained

- Anatomy of a Valid Order Block in Smart Money Concepts

- How to Draw Order Blocks Accurately - Day Trading Style

- Order Blocks and AMD Market Structure (Smart Money Concepts)

- The Confirmation Model: OB + FVG + Liquidity Sweep (Smart Money Concepts)

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Metals Trading

- Metals Trading: Why Gold and Metals Are Rising Again

- Silver Trading: The Underdog with Dual Identity

- Gold vs Silver: Institutional Demand Breakdown Explained

- How to Day Trade Silver Like a Pro: Smart Money Tactics for XAG/USD

- Platinum & Palladium: The Quiet Power Duo of Industrial Metals

- How to Trade Metals with SMC and Fundamentals - Gold Trading Strategy

- Metals in Risk-On and Risk-Off Environments: How Sentiment Moves Gold and Commodities

- Future of Metals Market: Gold Forecast 2026 & Long-Term Commodities Outlook

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail - Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading - Naming Your Triggers

- Discipline vs. Impulse in Trading - Step-by Step Guide How to Build Control

- Trading Journal & Reflection - The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex - Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

- Mastering Hope in Trading: Replacing Denial With Discipline

- When to Quit on Trading - Read This!

- The Math of Compounding in Trading

- Why Daily Wins Matter More Than Big Wins

- Scaling in Trading: When & How to Increase Lot Sizes

- Why Patience in Trading Fuels the Compounding Growth

- Step-by-Step Guide on How to Manage Losses for Compounding Growth

- The Daily Habits of Profitable Traders: Building Your Compounding Routine

- Trading Edge: Definition, Misconceptions & Casino Analogy

- Finding Your Edge: From Chaos to Clarity

- Proving Your Edge: Backtesting Without Bias

- Forward Testing in Trading: How to Prove Your Edge Live

- Measuring Your Edge: Metrics That Matter

- Refining Your Edge: Iteration Without Overfitting

- The EDGE Framework: Knowing When and How to Evolve as a Trader

- Scaling Your Edge: From Small Account to Consistency

- Trading in the Zone: Execution Through Habit and Structure

- Trading in the Zone: Thinking in Probabilities

- The Inner War: Fear, Greed, and the Illusion of Control

- Detachment Discipline in Trading: How to Let Go of the Need to Be Right

- Trading Hack: Why You Keep Breaking Your Own Rules (And How to Stop)

- Trading Mindset Mastery: Building Confidence Through Data

- Flow State Trading: Entering the Zone Through Structure

- Cognitive Traps in Trading: Overconfidence, Recency Bias & Revenge Trades

- The Psychology of Risk in Trading: Fear of Loss vs Fear of Missing Out

- Self-Trust in Trading – Building Confidence from Repetition, Not Just Results

- The Zen of Trading: Becoming the Observer, Not the Reactor

- The Market Is Always Right: Why You Must Adapt, Not Demand

- The Three Stages to Becoming a Consistent Trader

- The Enemy Within: Limiting Beliefs and Emotional Conflict in Trading

- Self-Discipline in Trading: A Skill, Not a Personality Trait

- Mental Energy Management in Trading: Controlling Impulse, Stress, and Overwhelm

- Creating the Disciplined Trader Identity

- The Disciplined Trader: The Complete Blueprint for Consistency

Market Drivers

- Central Banks and Interest Rates: How They Move Your Trades

- Inflation & Economic Data: CPI Trading Strategy and PPI Indicator Guide

- Geopolitical Risks & Safe Havens in Trading (Gold, USD, JPY, CHF)

- Jobs, Growth & Recession Fears: NFP, GDP & Unemployment in Trading

- Commodities & Global Trade: Oil, Gold, and Forex Explained

- Market Correlations & Intermarket Analysis for Traders

Risk Management

The real edge in trading isn’t strategy - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders - Updated 2026

- Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

- Martingale Strategy in Trading: Compounding Power or Double-Edged Sword?

- How to Add to Winners Using Cost Averaging and Martingale Principle with Price Confirmation

- Managing Imperfect Entries in Trading - How Professionals Stay Composed

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next