Weekly Average Spread Review (3rd April – 7th April 2023)

2023-04-11 11:09:07

Hi Traders, as you know ACY Securities has been providing investors around the world with a wide range of financial trading products with some of the most competitive spreads in the market, starting at 0.0pips. We present to you the review of the average weekly spreads from Monday 3rd April to Friday 7th April 2023.

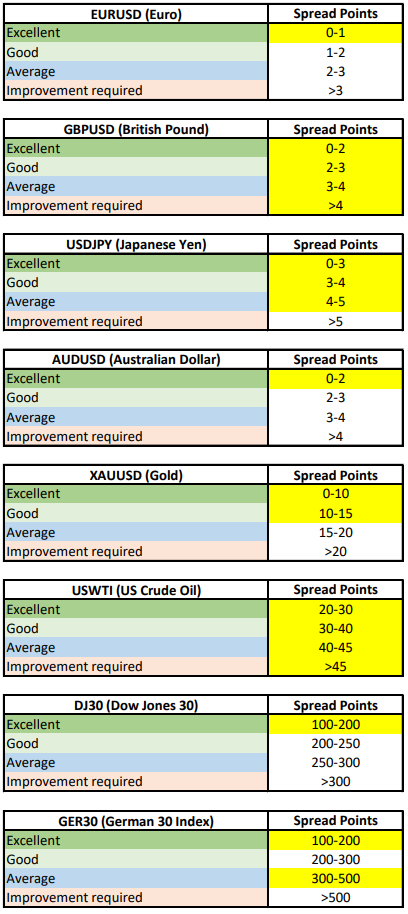

Weekly Average Spread Review Results (highlighted in yellow):

Summary

Towards the end of Easter Friday, 07/04/2023, spreads were much wider than usual and caused the results to be significantly skewed towards the higher end of the spectrum. However, the charts provided this week have excluded the lack of liquidity during the holiday season which is largely inline with the spread from the previous weeks.

Majors Currency Pairs

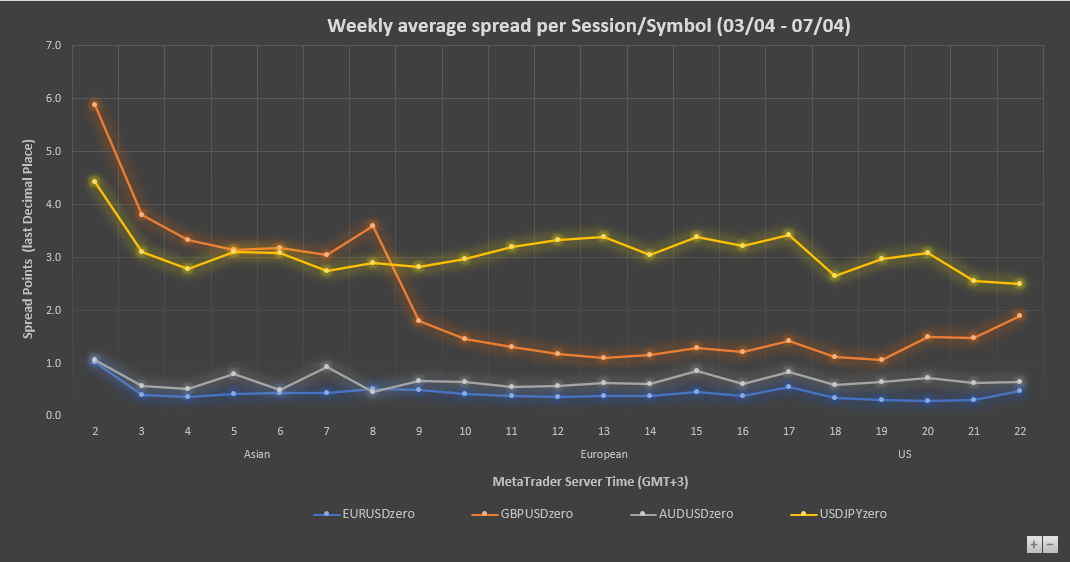

The Major currency spreads were generally performing at ‘Excellent’ level during EU and US session, and ‘Good’ or ‘Excellent’ during Asian session.

Specifically, EURUSD and AUDUSD spreads had been constantly ranging between 0-1 points, which was on ‘Excellent’ level across all trading sessions.

Both GBPUSD and USDJPY’s spread at the open was wider due to market uncertainty and upcoming holiday season and tightened to ‘Good’ or ‘Excellent’.

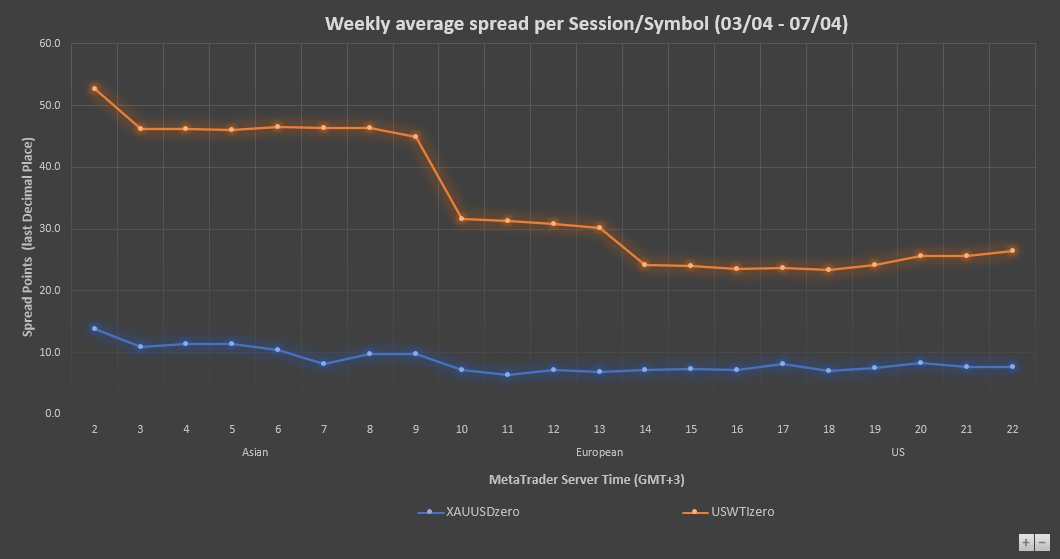

Gold and US WTI Oil

Gold spread had been consistently performing at ‘Excellent’ level with average spread between 7-10 cents during Asian session, and 5-7 cents during EU and US sessions, which is on top level in the industry.

USWTI spread was on ‘Improvement required’ during the early session and eventually tightened to ‘Excellent’ level during EU and US sessions.

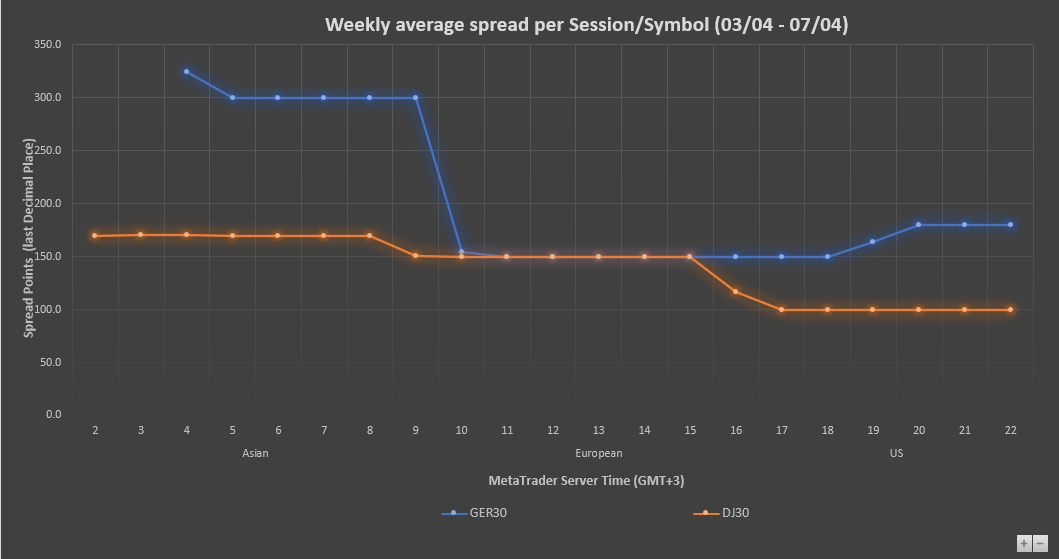

Dow Jones 30 and German 30 Indices

DJ30 spread performed consistently at ‘Excellent’ level across all trading sessions, with average spread between 150-200 points during Asian session and dropped to 100-150 cents during EU and US sessions.

GER30 performed at ‘Average’ level during Asian session due to less trading activity and quite market condition and tightened to ‘Excellent’ level during EU and US sessions.

Chart I. Weekly Average Spread for Major Currency Pairs (EURUSDzero, GBPUSDzero, AUDUSDzero, USDJPYzero)

(Note: The below chart excludes the spread data of the first two hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Chart II. Weekly Average Spread for Gold and US Crude Oil (XAUUSDzero, USWTIzero)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Chart III. Weekly Average Spread for German 30 Index and Dow Jones 30 Index (GER30, DJ30)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know