US Equities Fundamental & Technical Analysis: In Motion or Erosion?

2025-03-18 10:39:13

Overview

Markets are experiencing a healthy correction, with volatility easing and investors recalibrating expectations. While trade policy adjustments provide optimism, economic challenges and interest rate dynamics continue to shape sentiment.

1. Fundamentals – Market Correction & Trade Policy Adjustments

- Scott Bessent views the correction as a necessary reset, eliminating excess speculation and strengthening long-term market foundations.

- U.S. trade policy adjustments ease investor concerns, stabilizing market sentiment after tariff-related uncertainties.

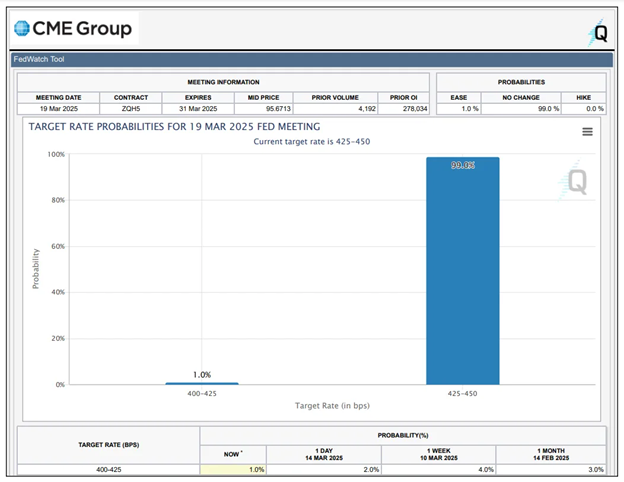

- The Federal Reserve’s decision to hold rates at 4.25% supports business growth and consumer spending.

2. Volatility & Yields – Fear Eases, but Uncertainty Remains

- VIX declines from 26 to 21, signaling a calmer risk environment.

- US 10-year yields hit 4.25%, attracting investors to bonds amid economic uncertainty.

3. Dow Jones – Incomplete Recovery

- Despite positive momentum, only 18 out of 30 stocks show quarterly gains.

- Daily: Below the range, requiring sustained upside for a reversal.

- 4-Hour: Needs sideways consolidation before a potential bullish transition.

4. Nasdaq – Tech Strength vs. Tesla Drag

- Apple, Microsoft, and Nvidia support gains, while Tesla’s drop pressures the index.

- Daily: Holding above key support after a 0.3% gain.

- 4-Hour Scenarios:

- Bullish: Break of 19,940 could trigger upside.

- Bearish: Break below 19,110 could accelerate selling.

5. S&P 500 – Rally Faces Headwinds

- Market rebounded 0.6%, but full recovery remains uncertain.

- Economic Signals:

- Retail sales up 0.2%, signaling cautious consumer spending.

- Manufacturing activity weak, raising concerns.

- 4-Hour Scenarios:

- Bullish: Staying above 5,644 and breaking 5,703 supports further upside.

- Bearish: Break below 5,594 weakens outlook, 5,502 confirms further downside.

Scott Bessent: Market Correction Is Healthy and Necessary

Renowned investor Scott Bessent has weighed in on recent market volatility, emphasizing that the current correction is not a sign of weakness but rather a healthy and necessary phase for long-term stability. As markets adjust after extended rallies, Bessent sees this as an opportunity for investors to recalibrate expectations, reassess valuations, and prepare for the next growth cycle.

Key Takeaways from Bessent’s View on the Correction:

- A Natural Reset for Markets

- Bessent argues that after a prolonged bullish run, a pullback is expected and necessary to avoid overheating.

- Excessive speculation often leads to unsustainable valuations—corrections help restore balance.

- Stronger Foundations for Future Growth

- A cooling-off period allows markets to digest gains and reprice assets more fairly.

- Healthy corrections eliminate weaker hands and speculative excesses, making room for long-term investors.

- Smart Investors See Opportunities, Not Fear

- Market dips often provide attractive entry points for high-quality stocks at discounted valuations.

- Investors with a disciplined, long-term approach can take advantage of the reset to accumulate assets.

- Macroeconomic Adjustments Are in Play

- Recent interest rate expectations, inflation concerns, and Fed policy shifts have contributed to volatility.

- Bessent believes corrections allow the market to properly price in economic realities rather than irrational exuberance.

- Institutional Perspective: Staying Resilient Amidst Volatility

- Bessent suggests that institutional investors don’t panic during downturns but rather adjust positioning.

- Portfolio managers see corrections as a chance to reposition for the next market cycle.

U.S. Trade Policies: Striving for Stability Amid Tariff Challenges

After weeks of market uncertainty, signs of a potential recalibration in U.S. trade policy sent a wave of optimism through Wall Street. Investors welcomed news that the U.S. Trade Representative is pushing for a more structured approach to recent tariff rollouts, alleviating fears of further economic disruptions. With global supply chains on edge, any hint of trade stability is a green light for risk-on sentiment—and last night’s rally reflected that enthusiasm.

The U.S. administration is actively working to stabilize trade policies following a series of tariff announcements that have unsettled markets and created uncertainty among businesses. Key aspects include:

- Leadership Initiatives: The U.S. Trade Representative is leading efforts to streamline the implementation of new tariffs, aiming to minimize market disruptions and provide clearer guidance to industries affected by these changes.

- Business Concerns: Companies are seeking clarity on tariff regulations to make informed operational decisions, underscoring the importance of effective communication from policymakers.

Volatility Index: US Market Fear Dissipation

Market concerns are dissipating as the Volatility Index or Fear Gauge dies down from a 26 level and currently at the 21 level. This tells us that the market is calming down with hints of readiness for a risk-on market.

US 10-Year Yields 4.25% target hit

As previously mentioned on our previous forecast on 10-year yields, https://acy.com/en/market-news/market-analysis/usd-decline-yen-gains-geopolitical-risks-j-o-02262025-110404/, 4.125% is our target which has now been tapped.

Yields are now climbing with hopes that investors will turn to bonds amidst US economic uncertainty. As yields rise, this encourages and attracts investors to invest on safe assets like the government bonds.

Caveat: Despite the Rally, Full Recovery Remains Distant

While U.S. equities have staged an impressive rally, it’s important to recognize that the market is not out of the woods yet. Despite the optimism, several factors suggest that a full recovery is still far from complete.

Key Risks to Consider:

- Inflation remains above the Fed’s target.

- Markets may be pricing in too much optimism without a clear trajectory for sustainable profit growth.

- Ongoing trade tensions, including tariff uncertainties and global supply chain disruptions, pose threats to corporate stability.

The recent market momentum is encouraging, but investors should remain cautious. A true, long-lasting recovery requires economic stability, stronger earnings, and a more predictable policy environment. Until these conditions materialize, markets remain vulnerable to potential pullbacks. Staying selective and risk-aware is key in this environment.

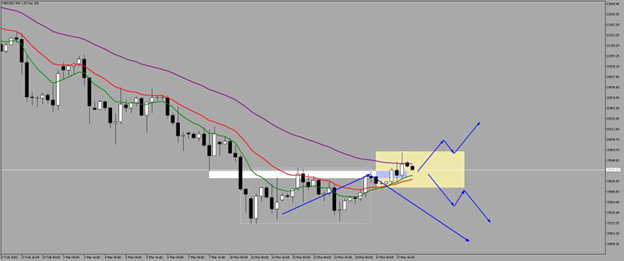

DJI: Remains Incomplete Despite Positive Momentum

Despite recent market optimism, the Dow Jones Industrial Average (DJIA) is still far from a full recovery, with only 18 out of 30 stocks posting positive performance on a quarterly basis. While investor sentiment has improved, key economic and market conditions suggest that challenges remain.

Daily

The Dow is still yet to recover as an upside rebound must needs to be sustained for a potential reversal.

Another thing to note is, we already broke down below the Daily range.

4-Hour

For a healthy transition from bearish to bullish, a sideways market must occur first:

- Structure creates Foundation.

- Structure hints us if the market is ready for a transition or a potential continuation.

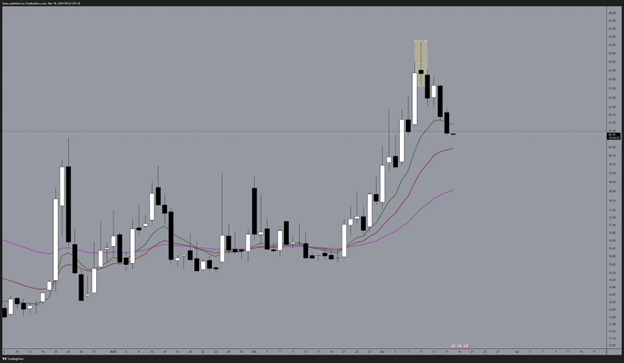

NAS: Momentum in Action or Just a Reaction?

While big tech names like Apple, Microsoft, and Nvidia remain market leaders, Tesla’s sharp decline has added pressure on the index.

Tesla's recent stock decline reflects a confluence of internal challenges and intensifying external competition, particularly from Chinese electric vehicle (EV) manufacturer BYD.

Growth stocks, which typically thrive in low-interest-rate environments, continue to struggle as investors shift towards value stocks and defensive sectors.

Daily

On March 17, 2025, the Nasdaq-100 rose 0.3%, closing at 17,808.66, showing some resilience after recent losses.

4-Hour

Scenarios:

- Bullish

- Breakout of the range could push a recovery to NASDAQ.

- A break of 19940 could trigger an upside move.

2. Bearish

- Breakdown of the range could increase sell-off on NASDAQ.

- Breakdown of 19110 could send the index to further downside.

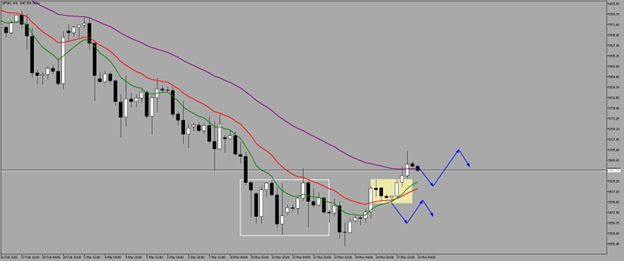

S&P Rallies Amid Volatility: Is the Worst Over or More Turbulence Ahead?

The firm has revised its year-end target for the S&P 500 to 6,200, down from a previous estimate of 6,500, citing economic challenges impacting profit forecasts.

Analysts anticipate a modest 7% return for the S&P 500 in 2025, suggesting more muted gains compared to previous years.

4-Hour

On March 17, the index rose by 0.6%, reflecting a partial recovery amid ongoing market volatility.

- Retail Sales*: * February saw a modest increase in retail sales by 0.2%, suggesting cautious consumer spending.

- Manufacturing Activity*: * March reported a significant decline in New York factory activity, raising concerns about the manufacturing sector's health.

Ongoing uncertainties surrounding trade tariffs, especially those involving major partners like China, Canada, and Mexico, have contributed to market instability.

Scenarios:

- Bullish Scenario

- Stay above of 5644 level

- Break of 5703 level

- Stay above 20-50-Day Moving Averages

2. Bearish Scenario

- Moving average resistance

- Break of 5594 level for further weakness

- Break of 5502 level for further downside

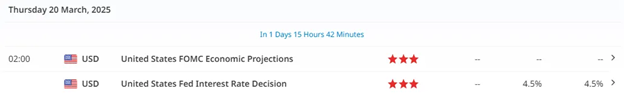

News Ahead: Could Inject Volatility in the Market

With a rate pause of 4.25%, this could bring optimism on US companies as:

- Lower rates reduce borrowing costs for businesses, allowing them to expand, invest, and boost earnings.

- Consumers also borrow and spend more, driving corporate revenue growth.

- Lower rates make stocks more attractive compared to bonds, leading to increased equity investments.

Final Takeaway: Optimism vs. Reality

While equities have gained momentum, investors should stay cautious. Macroeconomic risks, earnings concerns, and trade policy uncertainty remain key factors.

Short-Term Upside Possible, but Long-Term Recovery Still in Question.

Are we witnessing the start of a sustained bull run, or just another bounce before more volatility?

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know