Gold Retreats from $3500 Peak as Dollar Rebounds on Strong US Data, fears dissipates, and Market Relief

2025-04-25 13:47:33

Gold Retreats from $3500 Peak as Dollar Rebounds on Strong US Data, fears dissipates, and Market Relief

As the week wraps up, global markets are experiencing relief and fears are, somehow, dissipating after weeks of continued trade tensions, escalations, and retaliations between the United States and its counterparts.

- Gold retreats to $3300 after sliding down from the new all-time high level sitting at $3500.

- US robust data suggests a resilient US economy and dollar strength amidst global tensions.

- Market fears dissipating as VIX trends below 30 level, indicating calmness and potential risk-on sentiment.

Gold thrives during periods of heightened risk and uncertainty. In recent weeks, it has been trending higher, reaching targets between $3000 and $3500 - levels previously forecasted by top institutions such as Citi, JPMorgan, and Bank of America.

Trump’s tariff relief efforts, including a 90-day pause and steps toward trade resolutions, brought temporary relief to the markets. As a result, Gold paused its rally, with investors taking a breather from weeks of escalations and retaliations.

Gold Retreats to $3300 After Spiking to $3500 Amidst Tariff Relief & Market Fear Dissipation

On April 22, Gold soared to a record high of $3500 per ounce, making $3500 the new All-Time High Level, driven by investor fears over the weakening of the dollar and economic policies. But this quickly dissipated as global tariff tension eases.

Previous US data also suggests that despite the losing appeal of US markets, US is experiencing a relief after a continued pressure.

U.S. Dollar Regains Strength on Positive Economic Data

Amid a backdrop of political tension with the Fed, rising recession fears, trade tensions, the United States economy just offered a surprisingly upbeat snapshot.

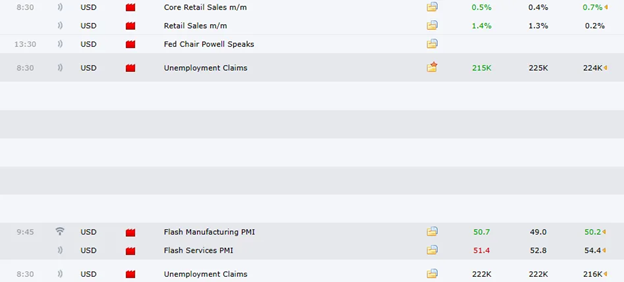

- Core Retail Sales (m/m): 0.5% actual vs. 0.4% forecast

- Retail Sales (m/m): 1.4% actual vs. 1.3% forecast

- Unemployment Claims: 215K actual vs. 225K forecast (previous: 224K)

- Flash Manufacturing PMI: 50.7 actual vs. 49.0 forecast

- Flash Services PMI: 51.4 actual vs. 52.8 forecast

Key data releases showed the US consumer and labor market remain resilient, providing the dollar with a much-needed boost, just what the dollar bulls are looking for.

The dollar is rebounding as recent US data provides support for the greenback. With strong economic prints, we could see further potential upside momentum especially if it breaks above the 100 level.

Volatility Index Trends Lower: Market Fears Calming Down

After tapping the extreme levels above the 40 level, the VIX is currently trending below the 30 level indicating that the market fears are dissipating, and investors are now adjusting.

With the VIX going down, the Dollar rebounding, this suggests that we might see a slowdown on Gold as the markets calm down.

Key Scenarios:

- If we break the $3370 level and get sustained, with renewed tariff tension developments, we might see a boost in Gold for upside potential.

- If we breakdown of the nearest support level sitting at $3305 - 3256 level, continued Dollar strength, we might see a risk-on sentiment, favoring risk assets over Gold, making the bullion trade lower.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

Join me in Discord: https://discord.gg/G8f7a5RnaF

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next