Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

2025-07-11 13:11:01

Quick Recap of the Fibonacci Series

Over the last eight lessons, we explored Fibonacci trading not as a standalone tool—but as a multi-dimensional confluence system deeply integrated into smart money logic. Here's what you've learned so far:

1. Beginner's Guide to Fibonacci

You started by learning how Fibonacci retracement and extension levels work and how they reflect natural rhythm and symmetry in price.

2. Confluence & Confirmation Strategy

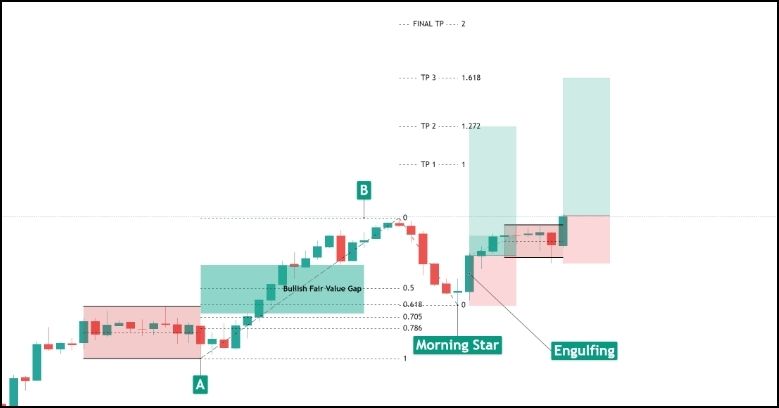

You discovered that Fibonacci is most powerful when paired with structure breaks, fair value gaps, or moving averages—waiting for confirmation is key.

3. Multi-Timeframe Confluence

You learned how institutional traders align Fib levels across higher timeframes and confirm with lower timeframe setups with greater conviction.

4. Golden Ratios & Smart Money

You studied how smart money often accumulates or distributes near key golden zones like 61.8%, 70.5%, and 78.6%, using them to trap emotional traders.

5. Extensions for Targets and Stops

You explored how to use Fibonacci extensions like 1.272 and 1.618 for planning high-probability take-profits and pre-defined stop placements.

6. Price Action + MA Confluence

You combined Fibonacci with dynamic support/resistance from moving averages, engulfing candles, and clean swing highs/lows for sniper entries.

7. Breakout Model with FVGs

Finally, you advanced into breakout logic—waiting for Fibonacci levels to overlap with fair value gaps, displacement moves, and structural shifts, classic smart money concepts.

If you’ve made it here, you already understand Fibonacci technically. But now, it’s time to tackle what actually determines success or failure in real trades: your mindset.

The Mental Game Behind Fibonacci Trading

Fibonacci levels aren’t magic—they’re mathematical reference points. But trading them successfully depends not just on knowing the levels—but on managing your behavior around them.

Goal of This Lesson

To help you master the psychological skills that allow Fibonacci tools to work at their highest potential—from waiting on the right confirmation to detaching emotionally from each trade.

Mindset Shift in Trading Fibonacci

1. The Illusion of Precision: Why Fibonacci Can Feel “Too Perfect”

Many get lured by the symmetry of 61.8%, 70.5%, or 78.6%, thinking price must reverse here.

But the market doesn’t owe you a reaction.

Trap: Entering too early without confirmation or structure shift.

Discipline: Only engage when confirmation or structure aligns with your level.

2. The Golden Pocket Trap: Great Prices Come with Fear

Most high-quality entries form when price looks ugly—deep inside the golden pocket, after a strong sell-off.

Emotion says: “Don’t catch a falling knife.”

But confluence says: “All ideas are aligning. This is the area.”

Rule: Trust the logic, not the fear. Combine with structure and confirmation to silence doubt.

3. Confluence Builds Conviction

Why do institutional traders use multiple elements—Fib + FVG + EMA + structure?

Because it builds layers of psychological confidence.

Tools working together reduce hesitation, revenge trading, and overthinking.

View confluence not just as technical logic—but a mental anchor.

4. Multi-Timeframe Discipline: Avoiding Micro-Impulse Traps

Jumping into M1 setups without checking Daily or H4 is like sailing without a compass.

Use the HTF Fib levels as contextual anchors.

Waiting for higher timeframe alignment builds patience, not paralysis.

5. Targets, Stops & Emotional Detachment

Pre-setting your 1.272, 1.618 targets and stop below/above 78.6 retracement removes on-the-fly emotions.

Emotional traders: Move stops, chase price, cut winners early.

Fibonacci traders: Trust their map. Set it and observe.

Shift: From “How do I feel?” → to “What does my system say?”

Real-Life Analogy: Fibonacci as an Architect’s Blueprint

Would an architect rebuild the plan every time the wind shifts?

No.

Fibonacci is your architectural framework. The market may throw noise, but your system is measured, deliberate, and pre-engineered.

Final Thoughts: Fibonacci Works When You Do

Across this 9-part series, you’ve built a strategic and structured framework rooted in:

- Golden ratio logic

- Smart money principles

- Multi-timeframe structure

- Confluences

- Risk-defined entries and exits

But this last layer—trading psychology—is the cement.

Fibonacci isn’t about perfection. It’s about preparation + confirmation + execution.

Trade the plan. Stay out when it’s not there. And trust the work you've put in.

Action Steps: Trade Like a Fibonacci Architect

- Wait for confluence + confirmation—not guesswork

- Trust the zone but only with structure shift or momentum

- Never move stops or chase trades mid-flight

- Journal not just what happened—but how you felt

- Use demo or small risk to train discipline—not your emotions

Ready to Build and Trade Like a Pro?

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution — risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next