U.S. Indices Poised for Breakouts Amid Bullish Momentum

2025-02-18 10:07:44

Overview

- Dow Jones Near ATH: The Dow continues a 5-week bullish streak, hovering just below its all-time high of 45,068.05, awaiting a fresh catalyst.

- Nasdaq and S&P Showing Strength: Nasdaq closed near its ATH of 22,142.40, while the S&P 500 holds steady at 6,125.29, both signaling potential breakouts.

- Dollar Weakness Boosts Equities: A bearish U.S. Dollar is supporting risk-on sentiment, with the upcoming FOMC Meeting likely to be the key market mover this week.

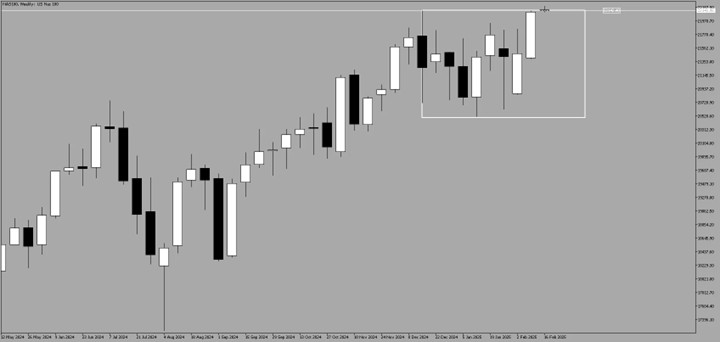

Dow Jones Industrial Average (DJI) Nears All-Time High

The Dow Jones Industrial Average (DJI) is on a steady climb, maintaining bullish momentum for five consecutive weeks without any bearish closes. This sustained upward movement is fueled by a risk-on market sentiment as the U.S. Dollar continued its decline last week.

Currently, DJI is hovering just below its all-time high (ATH) level of 45,068.05, awaiting a fresh catalyst. Monday's trading session was notably quiet due to Presidents Day in the U.S., but the potential for a breakout remains strong.

Nasdaq closed strong a few points near the All-Time High

Following DJI's bullish trend, the Nasdaq closed just a few points below its ATH of 22,142.40. On February 17, 2025, despite the U.S. market holiday, the Nasdaq pierced through this resistance level, showcasing strong bullish momentum.

The tech-heavy index continues to benefit from sustained interest in growth stocks, setting the stage for potential further upside in the coming sessions.

S&P 500 Holding Strong at 6,125.29 – Breakout Imminent?

The S&P 500 is demonstrating similar strength to the Nasdaq, as both indices often move in tandem. Currently trading at 6,125.29, the index is holding its ground and could be on the verge of a breakout.

With continued bullish sentiment in U.S. equities, the S&P 500 is well-positioned for more upside.

Dollar Index (DXY) Remains Bearish – A Boost for U.S. Equities?

The U.S. Dollar Index (DXY) continues its downward trend, reinforcing a bearish stance. This weakness in the Dollar is creating upside opportunities for U.S. equities, as a cheaper Dollar generally supports multinational earnings and risk-on sentiment.

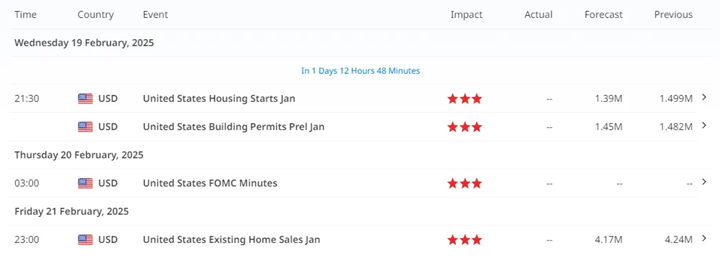

Key Economic Events to Watch: FOMC Decision Looms

This week's main event is the Federal Open Market Committee (FOMC) Meeting, which could significantly influence market direction. Traders are keenly watching for any hints of a potential rate cut or policy shift.

Will the Fed cut rates or maintain its current stance? The decision could be the catalyst that propels U.S. indices to new highs.

Market Outlook

With all major U.S. indices showing bullish momentum and the Dollar on a bearish trajectory, the market is well-positioned for potential breakouts. Traders should keep a close eye on the FOMC decision, as it could set the tone for the rest of the month.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Probeer Deze Vervolgens

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know