Trump’s Copper Tariffs Ignite Fresh Inflation Fears and Market Volatility

2025-07-10 11:02:00

President Trump’s recent decision to impose sweeping tariffs on imported copper marks yet another escalation in his trade strategy, one that could have significant implications for inflation, industry costs, and market sentiment.

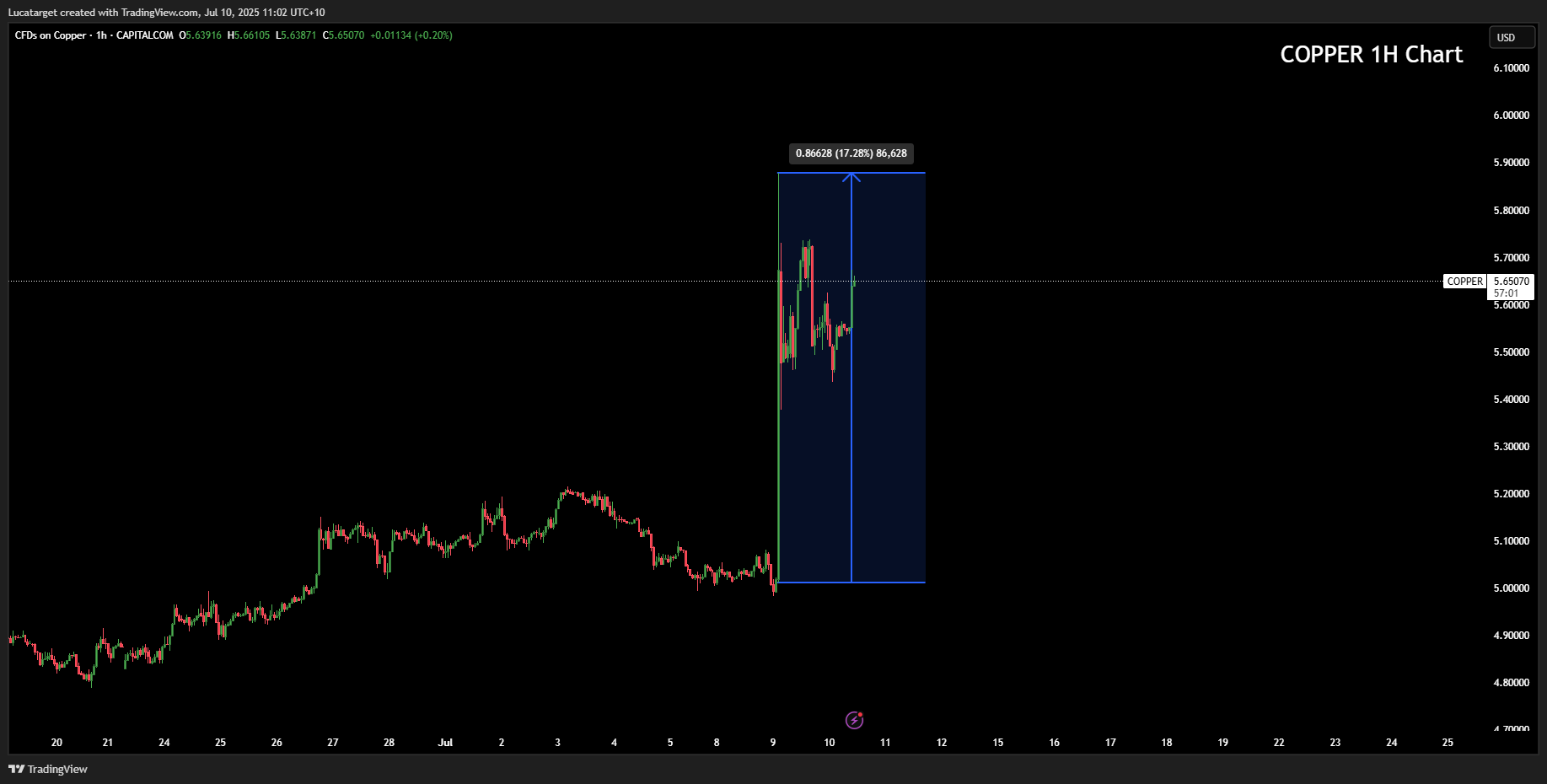

On Tuesday, copper futures surged over 13%, marking a record one-day gain following Trump's announcement of a proposed 50% tariff on imported copper.

While details remain sparse true to the administration’s usual style the market’s reaction has been anything but muted. The surge reflects both the surprise factor and the anticipation of ripple effects across multiple sectors of the economy.

Why Copper Matters

Copper is a cornerstone commodity, deeply embedded in the infrastructure of modern life. From construction and electronics to electric vehicles and renewable energy systems, copper is essential.

The United States imports nearly half of the copper it consumes, with Chile and Canada alone accounting for over 75% of those imports.

This means there’s limited ability to quickly pivot to domestic sources or alternative suppliers without significant cost implications.

By targeting such a critical input, the administration risks accelerating input costs across multiple industries. It’s not just the raw material that will become more expensive downstream sectors such as housing, manufacturing, and technology will feel the pinch.

This could ultimately be passed on to consumers, raising prices just as inflationary pressures had started to show signs of stabilizing.

A Strategic Shift or Economic Gamble?

While Trump has previously taken a more cautious tone with reciprocal tariffs, the aggressive stance on copper and possible future measures on pharmaceuticals point to a bolder sector-specific strategy.

The use of Section 232 which allows tariffs based on national security concerns offers a stronger legal footing and bypasses some of the international pushback seen in prior trade disputes.

However, this also raises questions about the broader inflation trajectory and the political motivations behind the move.

At a time when the Federal Reserve is already under pressure, Trump's attacks on Fed Chair Powell calling him a “whiner” and demanding rate cuts appear designed to shift blame for any future economic strain.

Yet pushing tariffs that raise input costs while demanding lower interest rates creates an inherent contradiction in policy direction.

Market Reaction: Contained for Now

Interestingly, markets have not yet fully priced in the potential inflationary wave. Treasury yields have been relatively stable, and the U.S. dollar has not reacted dramatically likely due to its already steep first-half decline. But this could change quickly.

Should more concrete tariff timelines emerge, or if pharma and other sectors are pulled into the fray, we may see a swift repricing across rates, commodities, and currency markets.

The FX market in particular could face renewed volatility. A significant increase in core goods inflation could complicate the Fed’s policy path, force a repricing of rate expectations, and weigh on investor confidence.

Given the dollar’s 10.7% slide in H1 2025 the worst on record any new inflation impulse risks igniting renewed downside pressure or chaotic repositioning.

The proposed copper tariffs are not just another headline they are a shot across the bow of global trade dynamics and a potential trigger for broader economic consequences.

Markets are currently in a wait-and-see mode, but as more details emerge, the risk of volatility is rising.

If these policies are enacted as signaled, they could mark a turning point reviving inflation concerns, forcing the Fed into a corner, and reshaping both U.S. industrial strategy and global commodity flows.

Q1: Why did copper prices spike so dramatically this week?

A: Copper futures surged more than 13% after President Trump announced a proposed 50% tariff on imported copper. This unprecedented move created immediate concerns over supply constraints and inflationary spillovers, particularly since the U.S. depends heavily on copper imports from Chile and Canada.

Q2: What sectors are likely to be most affected by these copper tariffs?

A: Construction, electronics, and automotive industries are among the most exposed. Copper is a key input in wiring, infrastructure, electric vehicles, and consumer electronics. The tariffs could increase production costs and lead to higher consumer prices across these sectors.

Q3: Could this lead to higher inflation in the U.S.?

A: Yes. With nearly half of U.S. copper consumption sourced from imports, the tariffs are likely to drive up input costs. This inflation could feed through to core goods prices, especially if companies pass the increased costs on to consumers.

Q4: What is Section 232 and why is it important in this context?

A: Section 232 allows the U.S. government to impose tariffs on the grounds of national security. Its use gives the administration a stronger legal position to justify the tariffs and reduces the need for Congressional approval. It also makes international challenges to the policy more difficult.

Q5: How have markets reacted so far?

A: Despite the sharp move in copper prices, broader financial markets have remained relatively calm. Treasury yields and the U.S. dollar have not reacted significantly suggesting markets are still waiting for more clarity before repricing the inflation outlook or Fed policy trajectory.

Q6: Why is this move considered contradictory to Trump’s call for lower interest rates?

A: Tariffs that raise production costs could fuel inflation, making it harder for the Federal Reserve to justify rate cuts. Trump’s push for cheaper borrowing while simultaneously inflaming inflation risks creates mixed signals for monetary policy and adds uncertainty for investors.

Q7: Could other tariffs follow?

A: Yes. There are signs the administration may also target the pharmaceutical sector and potentially other strategic industries. Trump stated that seven new reciprocal tariff letters were being sent out, suggesting more announcements could come soon.

Q8: What might this mean for the U.S. dollar in the coming months?

A: While the dollar has already suffered its worst H1 on record (-10.7%), a new wave of inflation risk could prompt additional downside, especially if it triggers Fed hesitation or global investors question the direction of U.S. policy. However, any panic reaction would depend on the scale and enforcement of the new tariffs.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know