Gold Price Update: Is Gold Gearing Up for the Next Bull Run?

2025-03-27 11:34:58

Gold Price Update: Is Gold Gearing Up for the Next Bull Run?

Overview

Gold stayed in a tight range between $3,000 and $3,040 this week — consolidating near record highs with no major macro shock to push it either way. The market is calm, but it’s not asleep.

- Price Action: Sideways between $3,000–$3,040.

- Sentiment: Fed tone neutral, no fresh catalysts.

- Technical Focus: Watch for break above $3,037 to confirm upside.

- Institutional Outlook: Long positions increasing; major banks like BofA and Goldman raised 2025–26 forecasts.

- Risks: Real rate spike or geopolitical cooling could trigger a pullback.

- Trader Focus: $3,000 remains a critical pivot; bias remains bullish while above.

Calm Before the Next Move?

Gold prices spent the week in a tight consolidation phase, hovering between $3,000 and $3,040, as the market caught its breath near record territory. After a sharp rally earlier this month, the yellow metal is now moving sideways — suggesting a potential buildup before the next decisive breakout.

Macro Landscape: Sentiment Suspended

Uncertainty remains a key theme, but this week lacked a clear macro trigger to fuel further upside or downside in gold. Market participants are treading cautiously ahead of next week’s key U.S. economic data and ongoing tariff-related headlines.

Price Action: $3,000 as the New Battleground

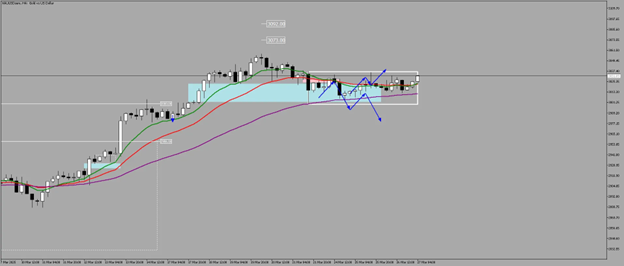

4-Hour

Gold traded in a tight sideways band, consolidating near recent highs. This “wait-and-see” mode could be due to:

- A stronger U.S. dollar (reaching a 3-week high),

- Softening yields,

- And thin trading volume leading into the quarter-end.

A clean break above $3,050 could trigger another leg higher. A loss of $2,980 might open room for a short-term correction.

Institutional View: Long-Term Bullishness Still Intact

While short-term movement is muted, major institutions remain optimistic about gold’s long-term trajectory:

- Bank of America raised its forecast to $3,063 by 2025, $3,350 per ounce in 2026, citing ongoing geopolitical uncertainty.

- Goldman Sachs echoed a similar view, adjusted its end-2025 forecast to $3,300 per ounce, influenced by increased central bank demand and heightened U.S. policy uncertainty.

Additionally, Large Speculators have added long positions with an overall 257,932 Net Positions.

Large players appear to be using this range as an accumulation zone rather than exiting positions.

“The macro case for gold hasn’t gone away — it’s just taking a breather.”

Gold Holding A Bullish Ground Inside the Crossfire Zone

Gold is holding firm near its all-time highs, with $3,000 emerging as the new key level to watch. The current sideways move may frustrate breakout traders, but it reflects strength — not weakness — as the market waits for its next cue.

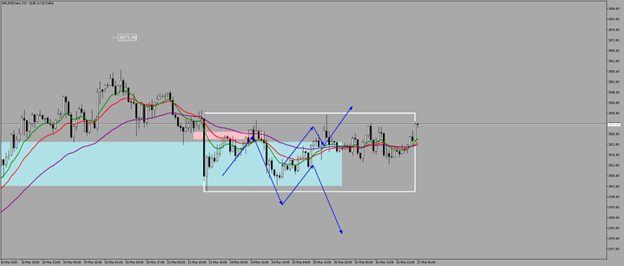

1-Hour

Observing the sideways in the H1 chart, we can clearly see that despite on a sideways, price inside the range is currently consolidating above the 50% or the equilibrium of the whole sideways.

As a precaution, we need to see a break of 3037 level and a close above it to confirm that Gold is now ready for an upside move.

💬 "Sideways near all-time highs isn’t a pause—it’s a power move."

Risks on the Radar

Though bullish sentiment dominates, analysts warn that:

- A cooling of geopolitical tensions

- Or a rise in real interest rates

could spark a short-term correction, potentially dragging prices 10–15% lower. However, for many investors, such dips are seen as strategic re-entry points.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next