EUR/USD Forecast: Euro Extends Rally as Dollar Dips - Key Scenarios to Watch

2025-07-02 14:26:32

- EUR/USD hits multi-year highs, driven by dollar weakness and eurozone inflation hitting target.

- U.S. data, Fed signals, and tariff risks pose major catalysts for volatility this week.

- Key inflection zone near 1.1800 could decide whether bulls extend or bears reclaim control.

Dollar Weakness Boosts Euro

The euro continues to climb against a softening U.S. dollar, extending its bullish streak to nine consecutive days—its longest since 2009. Dollar is experiencing a continued slump as it fails to gain traction with bets on a weaker dollar due to impending rate cuts in the coming months, particularly, September and, potentially, October or December.

Fundamentals Driving the USD: Tariff Threats, Soft Data, and Fed Uncertainty

The U.S. dollar remains under pressure amid the “double-threat” of headwinds:

- Trade policy tension: Trump’s looming tariff deadline (July 9) has sparked renewed fears of global trade disruption. Markets are cautious about retaliatory moves, especially from Asia and the EU.

- Fed hesitation: Chair Powell struck a more cautious tone at the Sintra Forum, warning that tariffs are raising inflation risks, making near-term rate cuts less certain despite market expectations.

With EUR/USD breaking above key resistance near 1.1800, the question now: Is this momentum sustainable, or is a short-term pullback due as the dollar fights back on data and macro risk events?

EUR/USD Catches a Tailwind - But Enters Overstretched Territory

EUR/USD surged to fresh multi-year highs near 1.1830, supported by a weakening dollar, stabilizing eurozone data, and growing expectations of a dovish pivot by the Fed. However, as the euro tests levels not seen since September 2021, the pair now enters a high-risk zone for profit-taking or reversal—especially as U.S. data and Fed signals start to re-enter the spotlight.

Note: Overstretched does not mean, market is now up for reversal.

These developments have led to renewed yield curve compression and a retreat in U.S. bond yields, dragging the dollar lower across the board.

Impact on the Euro: Tailwinds from Inflation and Fiscal Shifts

The euro’s rally isn’t just a function of dollar weakness - it’s also being underpinned by improving eurozone fundamentals:

- Eurozone inflation hit 2%, meeting the ECB’s target for the first time in over a year. President Lagarde signaled optimism but warned of volatility from U.S. trade policy and FX movements.

- Fiscal policy shift: Key EU nations, led by France and Germany, are pivoting toward fiscal stimulus especially in defense, infrastructure, and AI—boosting investor sentiment in eurozone assets.

- Relative resilience: With energy prices stabilizing and growth forecasts leveling, the euro is seen as a relatively safe play amid global uncertainty.

Still, ECB policymakers are growing concerned about the euro’s strength up nearly 9% since April which could weigh on exports and trigger verbal intervention if the rally continues unchecked.

Technical Outlook: EUR/USD Bullish Bias but Watch for Pullback

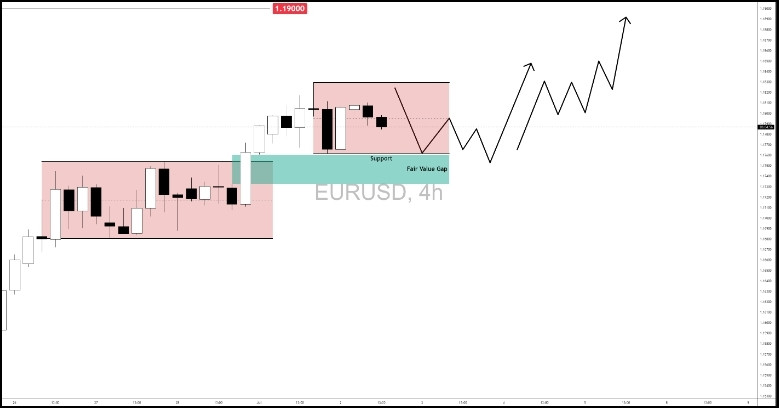

Bullish Scenario

EUR/USD remains in bullish structure on the 4H timeframe and is currently forming a consolidation range just above the Fair Value Gap (FVG) and a prior support zone. Euro upside is still intact with:

- Potential retracement to the FVG + Support Level at 1.17327-1.17607

- Price respects this support and shows signs of bullish rejection

- Euro returns and stays above 1.18 level

Targets:

- 1.183 Resistance Level

- 1.185 Psych Level

- 1.190 Multi-Year High Psych Level

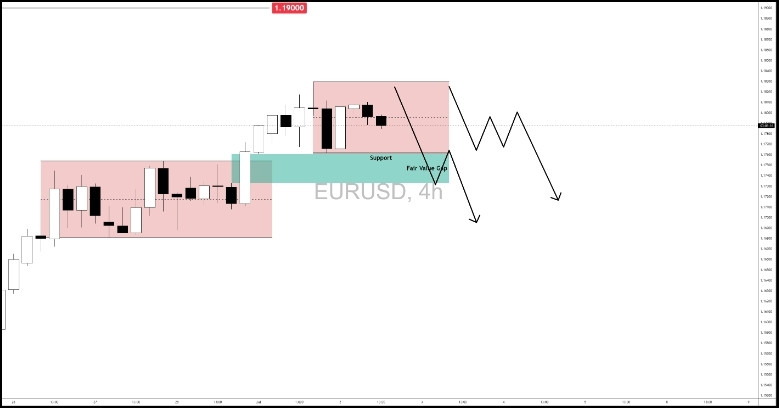

Bearish Scenario

While EUR/USD remains bullish on the higher timeframe, the 4H chart shows signs of distribution within a consolidation range just above the Fair Value Gap (FVG). If:

- Price fails to break and hold above 1.18 level

- Fair Value Gap level breaks 1.17327-1.17607

Targets:

- 1.173 FVG Bottom

- 1.172 Previous Equilibrium Level

- 1.168 Previous Bottom Range Level

Final Thought

The euro may still have room to climb, but downside risks are still on the table. With U.S. data releases, Fed commentary, and trade policy developments all in play, EUR/USD is approaching a critical inflection point above 1.1800, where momentum could either extend or unravel.

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next