Gold Price Forecast: XAU/USD Eyes $3,400 Breakout

2025-08-27 13:35:54

- Gold sustains momentum post-Jackson Hole, with XAU/USD holding firm near $3,386–$3,400 after a $50 breakout rally.

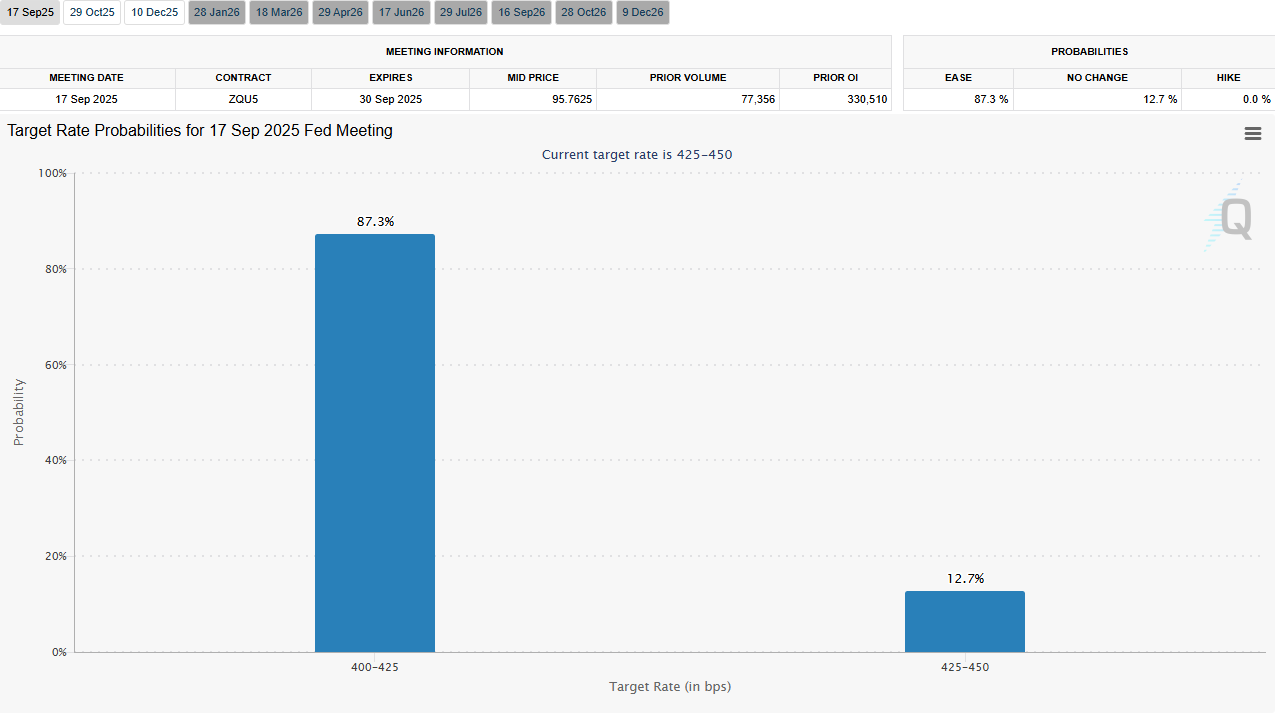

- Fed cut odds near 80–90% and political pressure on the Fed have weakened the dollar, reinforcing the bullish gold price forecast.

- Technical outlook shows $3,400 as the key decision point — a breakout targets $3,420–$3,480, while rejection risks a pullback into the H4 Fair Value Gap.

Gold Sustains a Post–Jackson Hole Bid

Gold’s advance into the $3,380–$3,400 band was fueled by two intertwined forces: (1) markets reading Powell’s Jackson Hole remarks as incrementally dovish; and (2) an unusual Fed-independence shock—the U.S. President’s move against Fed Governor Lisa Cook—that pressured the dollar and nudged haven demand. By Tuesday, bullion held firm just under $3,400, with the prior ~$50 pop from Friday still visible in the tape.

Rate expectations tightened in gold’s favor. Across the week, CME FedWatch probabilities for a September cut swung into a high-confidence range (variously cited around ~83% and ~89% by major outlets), underscoring the market’s conviction that policy easing is near. That USD drift + lower real-rate impulse is the classic cocktail for bullion bids.

Narrative: From Forecast to Fulfillment

In last week’s analysis, Gold Forecast: Jackson Hole Breakout or Breakdown?, we highlighted the two scenarios: a clean break above $3,335–$3,360 would open the path to higher liquidity pools, while failure would risk a deeper pullback.

Fast forward to this week — the bullish roadmap played out almost to the letter:

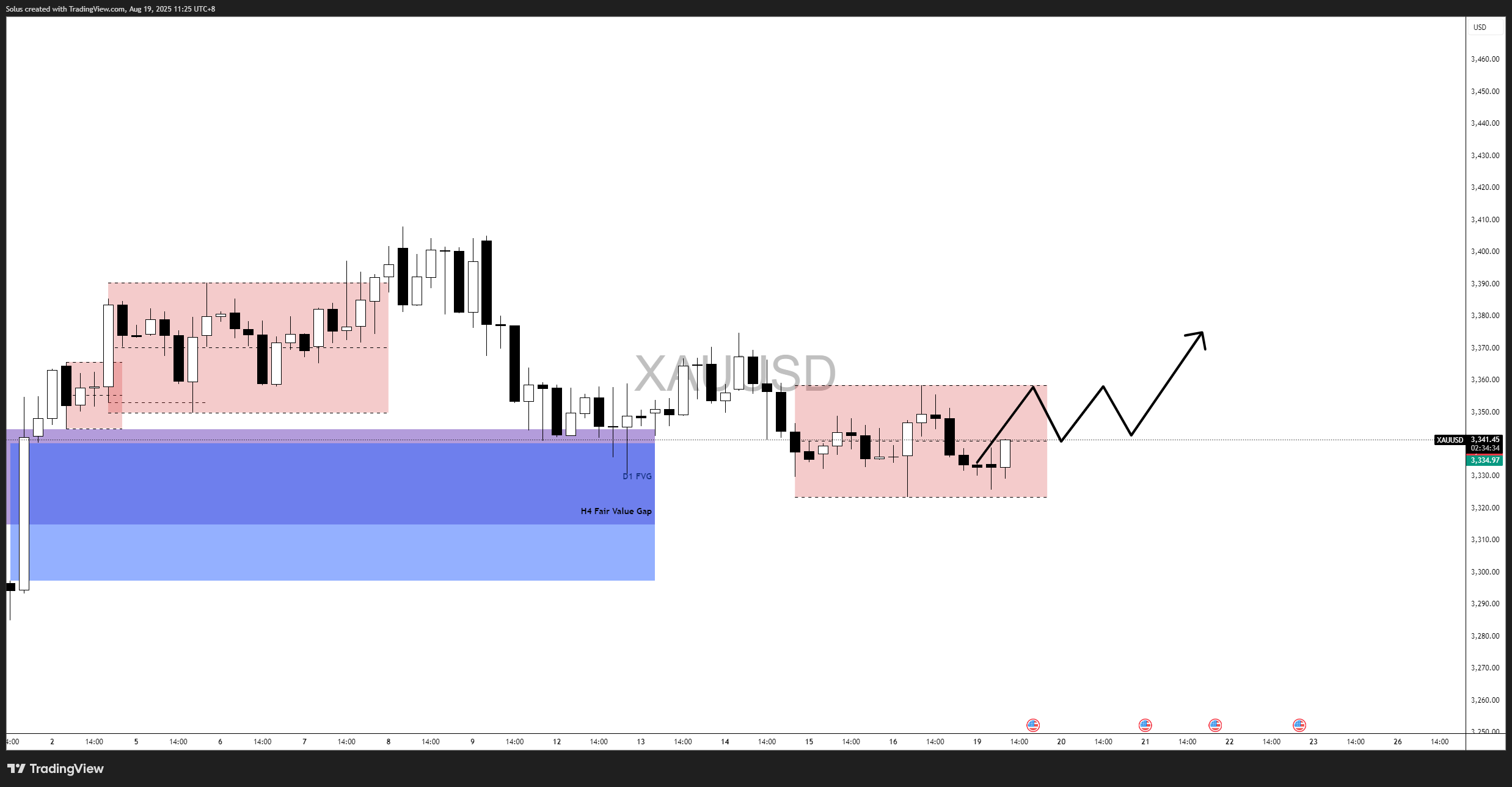

- Gold consolidated within a mid-August range (marked in red box on chart).

- A sweep of range lows was followed by a strong displacement higher — a textbook liquidity grab + breakout sequence.

- The breakout reclaimed structure above $3,335, triggering the momentum surge we forecasted.

- Price is now trading just below the previous day’s high (~$3,388), after respecting the reclaimed structure.

This shows how the technical thesis aligned with fundamentals: Powell’s Jackson Hole remarks softened rate expectations, and the Fed-independence scare added a haven premium, both reinforcing gold’s breakout trajectory.

What Drove Gold This Week (and Why It Matters)

- Powell at Jackson Hole → softer path implied: Markets interpreted the speech as removing hawkish tail risk, lifting bullion alongside lower yields/softer USD.

- Fed-independence scare adds a haven bid: The President’s attempt to fire Gov. Lisa Cook rattled confidence and weighed on the dollar; gold held near $3,400.

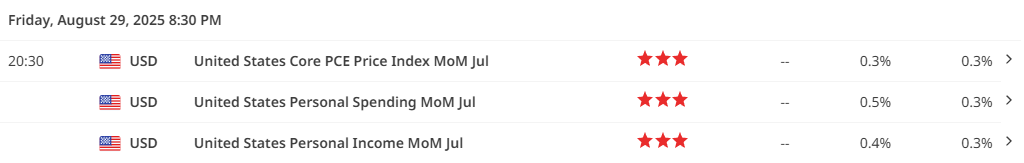

- Breakout risk into PCE: Kitco flagged Core PCE as a potential upside catalyst if it cools; gold is coiling just below a key ceiling.

- Institutional forecast support: BMI (Fitch Solutions) upped its 2025 target to $3,250, reinforcing dip-buying appetite.

Gold Price Forecast: XAU/USD Stalls Below $3,400 at Key Decision Point

Gold’s breakout has materialized, with XAU/USD pushing from the $3,335 base into the $3,386 area, just below the key $3,400 level. The rally left behind a 4H Fair Value Gap (FVG) at $3,351–$3,366, which now acts as the main support zone for this bullish leg.

For the gold price forecast, the outlook is simple: a clean close above $3,400 confirms continuation, opening targets toward $3,420–$3,440 and potentially $3,480. If price slips back into the FVG, a retest of $3,335–$3,320 becomes likely before bulls can attempt another run.

With the Core PCE inflation print due Friday, the market is coiled at a decision point: continue higher into fresh liquidity, or fade back toward the Fair Value Gap.

Bullish Scenario: Breakout Above $3,400

If bulls defend the $3,351–$3,366 H4 Fair Value Gap, structure remains bullish.

- Trigger: Clean break and daily close above $3,400.

- Targets:

- $3,420 → minor liquidity

- $3,440–$3,450 → supply zone

- $3,480 → extension toward ATH territory

- Fundamental Catalyst: A softer-than-expected Core PCE or weaker growth data would boost Fed cut odds further (currently ~80%+), likely triggering safe-haven flows and USD weakness that supports XAU/USD.

Bearish Scenario: Failure to Hold $3,386 → Re-Entry into FVG

Rejection at $3,386–$3,400 and breakdown into the H4 FVG.

- Trigger: A move below $3,351 opens the door for deeper retracement.

- Targets:

- $3,335 → breakout base

- $3,320–$3,300 → corrective pullback zone

- Fundamental Catalyst: A hotter-than-expected Core PCE or upside surprise in U.S. GDP would push real yields higher, strengthening the dollar and capping gold.

Final Thoughts on Gold

This week’s gold technical analysis confirms how the Jackson Hole breakout forecast materialized. Now, with XAU/USD trading just shy of the $3,400 psychological barrier, the market is in balance mode. Whether it extends toward $3,480 or rotates back into the FVG will likely depend on Friday’s Core PCE release, which traders see as the decisive input for September’s Fed meeting.

Start Practicing with Confidence - Risk-Free!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Moving Averages Trading Strategy Playbook

Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

Mastering Price Action at Key Levels – How to Spot, Trade, and Win at the Most Crucial Zones

Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

Advanced Displacement & Imbalance – The Smart Money Concepts Trick Most Traders Miss

Institutional Order Flow – Reading the Market Through the Eyes of the Big Players

Asian Session Secrets: How Smart Money Uses Accumulation & Fake Breakouts

Asian Session Secrets: Will It Consolidate or Break Out? (SMC Blueprint)

London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

Mastering the New York Session - Smart Money Concepts Guide

How to Anticipate the New York Session Price Action

Stop Hunting 101

Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

Outsmarting Stop Hunts: The Psychology Behind the Trap

How to Lessen Risk From Stop Hunts in Trading

How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

Top 10 Trading Rules of the Most Successful Traders

The Best Trading Journals for 2025 and How They Help You Control Risk

Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

Why Most Traders Fail – Trading Psychology & The Hidden Mental Game

Emotional Awareness in Trading – Naming Your Triggers

Risk Management

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

Why Risk Management Is the Only Edge That Lasts

How Much Should You Risk per Trade? (1%, 2%, or Less?)

The Ultimate Risk Management Plan for Prop Firm Traders – Updated 2025

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know