The Dollar’s New Path Internal Pressure, Global Pushback, and a Post-Tariff World

2025-05-12 13:45:30

The U.S. dollar, once the dominant force in global markets, is showing signs of systemic fatigue. What began as a gradual downtrend in 2022 now looks more like a structural shift driven by a mix of persistent inflation, destabilizing trade policy, and assertive fiscal agendas from other global powers. As we move deeper into 2025, the outlook for the dollar continues to deteriorate, with former President Trump’s return to the global stage adding a fresh layer of uncertainty.

DXY H4 Chart

In recent days, Trump claimed to have had a "great conversation" with China’s Vice Premier. Both sides acknowledged the constructive dialogue, and in a surprising move, Trump floated the idea of cutting tariffs on Chinese goods from 145% to 80%. This follows a similar gesture toward the United Kingdom, where tariffs were trimmed from 25% to 10%. While the final call on tariffs rests with the Treasury Secretary, Trump made clear he supports the reduction pending some form of reciprocal action from Beijing. That likely means more Chinese investment or trade commitments in the U.S., which may also be a veiled critique of the current imbalance: American corporations operate heavily in China, yet that openness isn’t always mirrored.

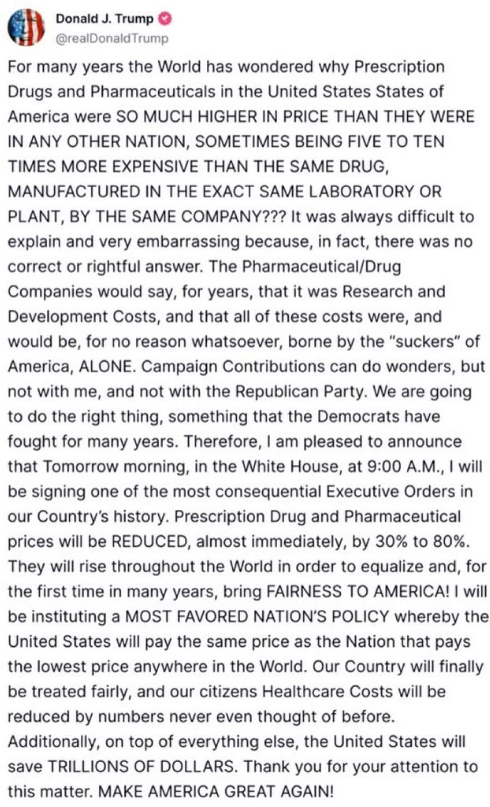

At the same time, Trump has indicated that he wants to increase tariffs on India and Pakistan a sharp contrast that underscores the erratic nature of the trade outlook. In another announcement through Truth Social, he teased a “major” update and then proposed tariff cuts on medications. While positive for the pharmaceutical sector, the real impact may be limited.

From a monetary perspective, I believe the Federal Reserve is leaning more hawkish again, signalling concern about inflation and hinting at a “higher-for-longer” stance on interest rates. In contrast, the European Central Bank is sounding more dovish, opening the door to monetary easing amid weaker activity across the eurozone.

For now, risk sentiment is firmly in “risk-on” mode. That supports pro-cyclical currencies those tied to global growth and investor appetite at least through the day and potentially into tomorrow. But this calm may not last.

The latest MUFG report paints a stark picture: investors are starting to price in a prolonged downturn for the dollar. This isn’t just about rate differentials or short-term positioning it’s about confidence. And right now, confidence in “U.S. exceptionalism” is fading fast. Real yields are softening, not just because of the Fed, but because of Trump’s inflationary trade policies, which risk pushing up prices while undermining growth. The U.S. labour market is showing cracks, with expectations for future job losses hitting the highest levels since the Global Financial Crisis.

Markets have already responded: we’ve seen a rare episode of “triple selling” in U.S. bonds, equities, and the dollar—something that last occurred at this scale during the post-9/11 period. Such broad-based selling is usually a vote of no confidence, and it likely pushed Trump to tone down his trade rhetoric last weekend.

There’s even talk in the financial community of a so-called “Mar-a-Lago Accord” a modern-day echo of the Plaza Accord of 1985, which famously led to sharp appreciation in the yen. This time, the U.S. might be implicitly encouraging a weaker dollar to improve its trade position. But China, already flirting with deflation, is unlikely to sign on to anything that echoes Japan’s lost decades.

Meanwhile, both Europe and China are stepping up their own domestic stimulus efforts. Germany is planning to launch a €500 billion infrastructure fund, while also loosening constitutional fiscal constraints to ramp up defence spending. The total stimulus could surpass €1 trillion an enormous injection that could lift eurozone GDP by 1–1.5% per year.

China, for its part, is targeting 5% growth and boosting broad fiscal support to 8% of GDP. It’s cutting rates, supporting high-tech sectors, and expanding consumer trade-in programs. The message is clear: both regions are preparing to decouple from U.S. economic volatility and support their own growth engines.

All this plays directly into the FX space. As U.S. uncertainty mounts and yields adjust downward, the euro has become more attractive not just versus the dollar, but also across the broader G10 complex. Capital is returning to eurozone bonds, especially now that negative yields are a thing of the past. Meanwhile, USD/CNY is being carefully managed, but the pressure is building. Volatility is rising in both G10 and Asian FX, and we’ve seen record daily moves in pairs like USD/TWD.

Even the yen is quietly regaining its defensive allure. As U.S. recession risks grow and Treasury yields fall, USD/JPY is losing its carry appeal. The yen thrives in uncertain environments and right now, uncertainty is everywhere.

In sum, the tide is clearly turning. The Trump narrative marked by headline-driven trade moves, fiscal populism, and strategic ambiguity is accelerating the decline of the dollar. Markets are adjusting. Investors are repositioning. And a new FX regime may be just beginning.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know