Gold holding support, more upside ahead as NFP looms

2025-06-02 17:30:28

- Gold holding above 3250 to 3300 support with upside potential toward 3400.

- Weaker NFP could trigger dollar weakness and fuel Gold rally.

- Key breakout above 3330 and Friday's NFP will be crucial for confirmation.

With Gold currently holding the line at the 3250 - 3300 level, we might see renewed strength for upside on Gold. All eyes are now on this Friday’s U.S. Non-Farm Payrolls (NFP) report, which could inject fresh volatility into Gold.

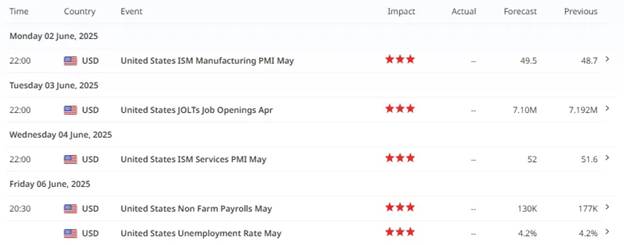

Key red folders for USD this week

A weaker-than-expected NFP could pressure the U.S. dollar and send Gold soaring. Conversely, a hot jobs print may delay rate cuts, capping Gold’s upside. Markets are still pricing in possible Fed easing later this year—any NFP weakness would reinforce that narrative, supporting bullion.

Technical outlook

Daily

As long as the Daily Fair Value Gap holds resting at 3250 - 3285 level, we might see Gold to have the potential to seek upside liquidity above the next high situated at t 3370 level. The sweep below the Daily range also tells us that orders below that range have been taken out. If this is confirmed sweep of liquidity, we don't we price to go under the last candle where the sweep was created and we'd want to see momentum to the upside for potential new highs. NFP print could further add volatility on Gold this coming Friday.

4-Hour

Looking at the 4-Hour timeframe, Gold is still on a range-bound motion. The good thing about this range is its hovering above the 50% level or above equilibrium of the range signifying strength on a premium level. For further upside, we'd like to see a breakout of the 3330 level and a sustained move above it.

Bearish Dollar Could support Gold for upside

Dollar is still experiencing headwinds as it hovers near the immediate support level resting at 99.129 level. If we'd like to see more upside on Gold, we'd want a break on the Dollar, and ultimately, reaching the 2025 All-Time Lows at 97.921 level. Summary of key factors to watch

- Support holding: The 3250–3300 zone remains a strong demand area, where buyers have repeatedly stepped in.

- Dollar sensitivity: A weaker-than-expected NFP could pressure the U.S. dollar and send Gold soaring. Conversely, a hot jobs print may delay rate cuts, capping Gold’s upside.

- NFP to rate expectations: Markets are still pricing in possible Fed easing later this year—any NFP weakness would reinforce that narrative, supporting bullion.

Check Out Our Market Education

How to Trade & Backtest Gold:

Why Gold Remains the Ultimate Security in a Shifting World

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment — With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

Follow me on LinkedIn: Jasper Osita

Join me in Discord: The Analyst Guild

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

次はこれを試してみてください

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know