How to Use Moving Averages as Dynamic Support and Resistance Zones

2025-07-23 12:29:52

Anticipate the Bounce. Time the Breakout. Trade with Multi-Timeframe Confidence.

This is Part 3 of our Moving Averages Series

If you’re just joining the series, check out:

Goal of This Lesson

To show you how to anticipate where price is likely to react, bounce, or break — by using the 20 EMA and 50 SMA as dynamic support/resistance zones, combined with multi-timeframe analysis and lower timeframe breakout confirmation.

MAs Are Not Just Trend Tools — They’re Reaction Zones

Most traders use MAs to confirm trend.

But smart traders know that MAs often act as magnet zones — places where price pauses, bounces, or reverses.

Especially the:

- 20 EMA for fast-moving reactions and shallow pullbacks

- 50 SMA for deeper pullbacks, resets, or trend re-entries

These areas often attract:

- Algorithmic reactions

- Smart money scaling in

- Countertrend profit-taking

The Key Is Anticipation — Not Reaction

“Don’t just wait to see if price bounces. Anticipate where and why it might bounce — then look for confirmation.”

This is where multi-timeframe analysis comes in.

Step 1: Use the Higher Timeframe to Find Trend & MA Zones

Go to the H1 or H4 (or Daily if you’re a swing trader):

- Identify the trend

- Are both 20 EMA and 50 SMA sloping in the same direction?

- Is price trending above or below them?

- Are we in a clean structure?

- Mark the zones:

- 20 EMA = first reaction zone

- 50 SMA = deeper pullback zone

These levels become your anticipated bounce areas on the lower timeframes.

Note: You could use a much lower timeframe like the 15-minute to serve as your trend confirmation timeframe and the 5-3-1-minute as your execution if you are executing in a scalping-based approach.

Step 2: Drop to the Lower Timeframe to Confirm the Breakout or Rejection

On the M15 or M5:

- Wait for price to tap the higher timeframe EMA/SMA

- Look for confirmation:

- Bullish/bearish engulfing

- CHoCH or BOS

- Liquidity sweep + internal FVG

- MSS + candle close in trend direction

This combo gives you a multi-timeframe sniper entry — low risk, high precision.

Another secret: Wait for a sideways + breakout at the LTF.

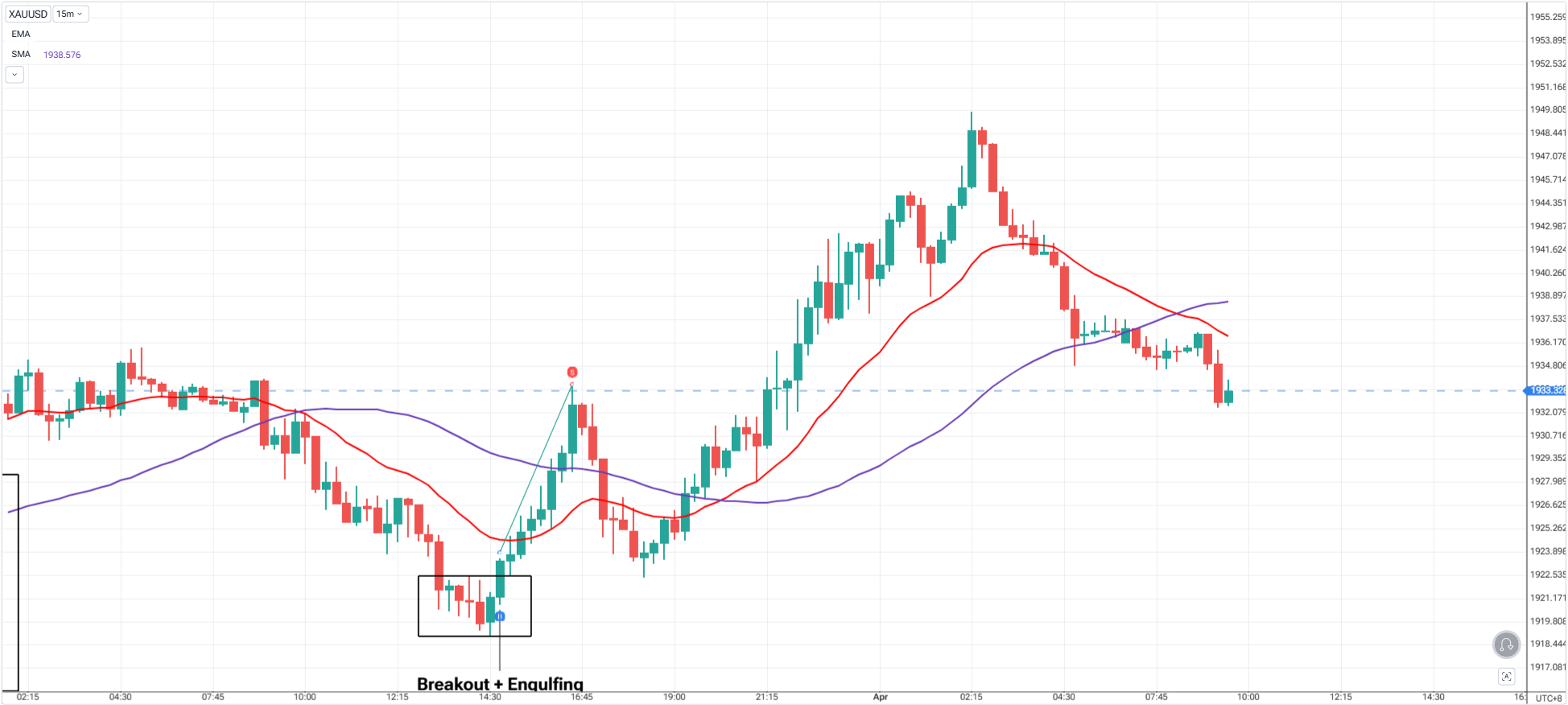

Example Flow: 50 SMA Rejection (H1 + M15 Combo)

1. H1 shows a shift in trend after Gold broke out of the range + above the 20-50 Moving Average

2. Wait for price to pull back and tap the H1 50 SMA

3. Drop to M15 — you see:

- Price forms a consolidation

- Forms bullish engulfing + breaks short-term structure

4. Execute on confirmation

- Entry on M15 candle close

- Stop under M15 range low

- Trail up using 20 EMA or swing lows or set static 2R

From H1’s macro bias → M15’s micro confirmation = precision execution.

Why This Works

| Layer | Purpose |

|---|---|

| Higher TF (H1/H4) | Sets your directional bias and anticipation zones (20/50) |

| Lower TF (M15/M5) | Provides confirmation for bounce or breakout |

| Price Action | Tells you when and how to execute |

You’re stacking logic:

- MA zone + HTF trend + LTF confirmation = high-probability setup

What If the MA Breaks?

Sometimes price won’t bounce — it breaks through the EMA/SMA.

That’s where the moving average flip becomes your role reversal level:

- A broken 20 EMA on H1 can act as resistance on M15

- A violated 50 SMA can become a break-and-retest level

Use the same process:

Let the break happen → wait for LTF confirmation → enter on rejection or retest

How to Tell If the Bounce Is Real or Fake

Look for:

- Rejection candles with wicks + body close away from MA

- Liquidity sweeps into the MA followed by BOS or CHoCH

- No chop — clean, decisive rejection or reclaim

- Strong volume/impulse after price touches the zone

Avoid:

- Flat MAs

- Choppy, sideways candles around the zone

- FOMO entries without structure support

Quick Checklist – MA Bounce + Multi-TF Setup

✅ 20 or 50 MA zone is tested on higher timeframe

✅ Trend and structure support the direction

✅ Price reacts with confirmation on lower TF (engulfing, BOS, MSS)

✅ Entry on breakout candle close or FVG retest

✅ Stop below the range

✅ Trail using structure or 20-EMA

✅ Exit if price closes beyond both MAs or breaks structure

Final Thought

The 20 EMA and 50 SMA are more than trend tools — they’re reaction zones.

Used with multi-timeframe logic and price action confirmation, they let you:

- Anticipate trades

- Time sniper entries

- Avoid emotional chasing

- Stay aligned with the bigger picture

Don’t just trade the bounce. Anticipate it, confirm it, and then take it with precision.

Practice this flow:

- On your higher timeframe (H1/H4), mark the 20 EMA and 50 SMA

- Drop to M15 or M5 when price approaches those levels

- Look for a clear breakout or rejection

- Enter on confirmation — and log your result

Journal:

- Which MA was tested?

- What was your higher timeframe trend?

- What price action confirmed the bounce?

- Did it respect the zone or break it?

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next