EUR/USD Forecast: Euro Slides -200 Pips as Fed Decision and NFP Loom – Recovery or More Downside?

2025-07-29 15:06:33

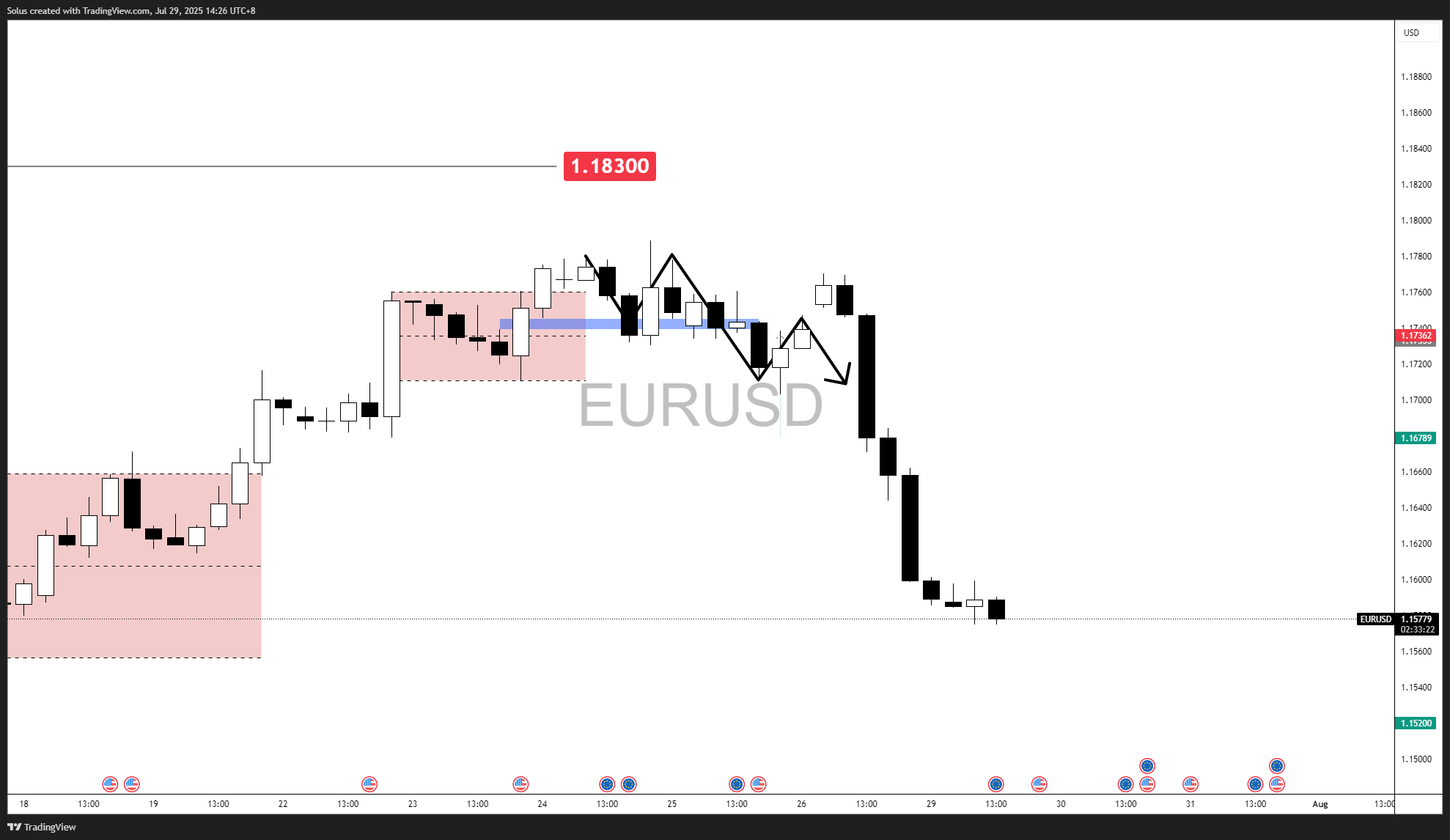

- Euro breaks down -200 pips after invalidating the 4H FVG at 1.1739–1.1745, sliding toward the 1.1556 support zone.

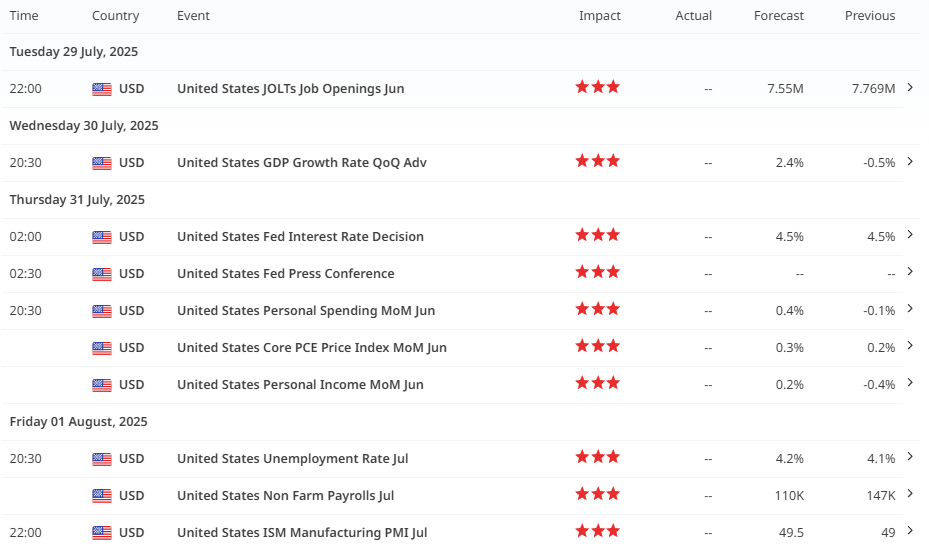

- Rate differentials and strong U.S. data continue to favor the dollar, as the Fed’s 4.50% hold contrasts sharply with the ECB’s 2.15%.

- Fed rate decision and NFP on deck could act as the catalyst for either a euro recovery from 1.1556 or further downside toward 1.1446.

Euro Breaks & Slides Down -200 Pips

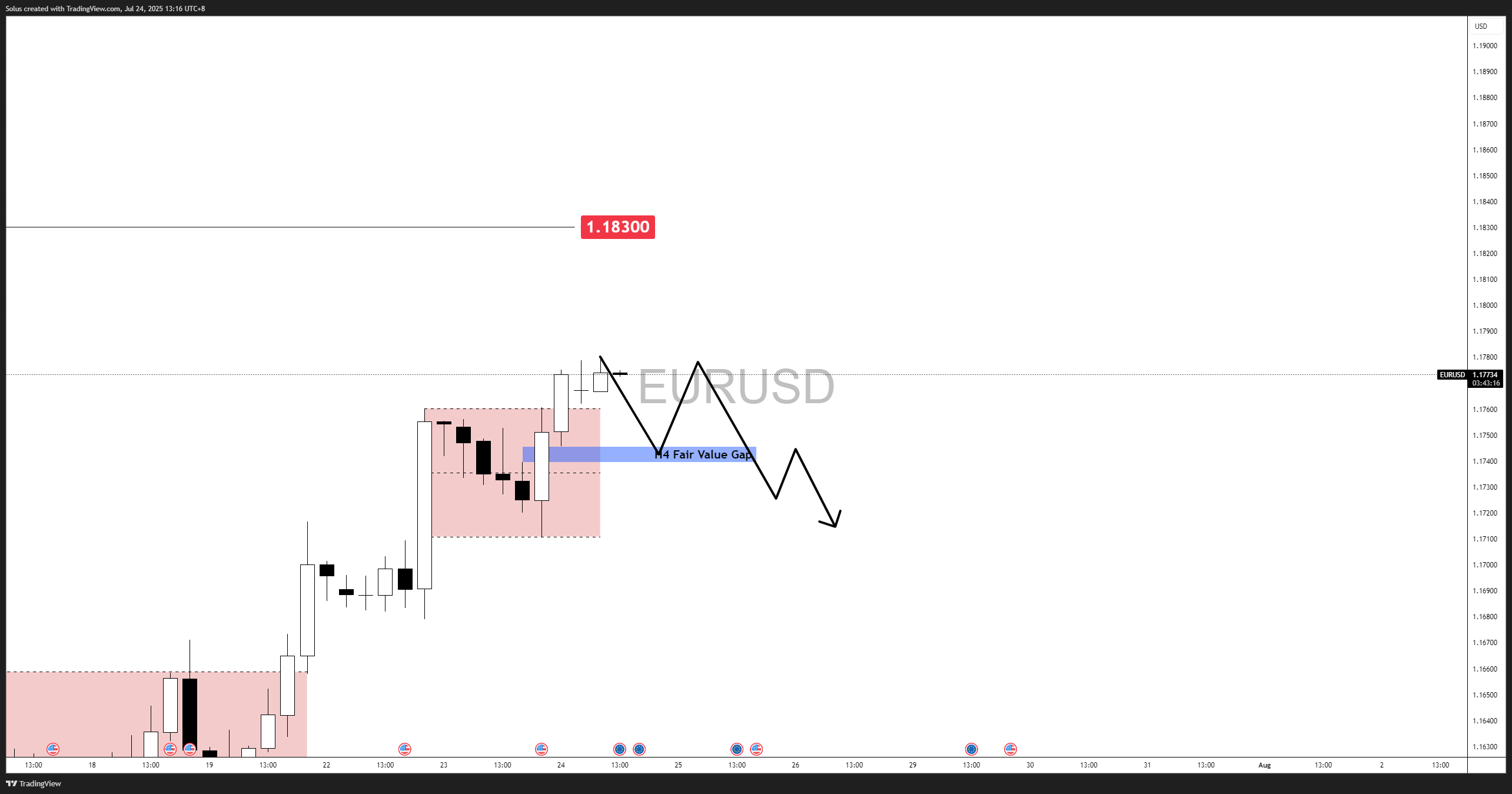

EUR/USD has followed through perfectly on the bearish scenario outlined in our July 24 forecast: EUR/USD forecast: Bullish breakout targets 1.1830 as Dollar weakness deepens.

After sweeping liquidity above the 1.1780 level, EUR/USD failed to hold its gains and reversed sharply, breaking back below at extreme price ranges 1.1600–1.1550. Prior to this move, it invalidate the 4H Fair Value Gap (FVG) resting between 1.17395-1.17457. This failure marked the start of a clean distribution structure, which has now accelerated lower, pushing the pair into deeper downside targets.

This development reflects a shift from the prior accumulation and breakout phase to full bearish continuation as the euro struggles under a backdrop of relative growth divergence, a stronger U.S. dollar, and Fed–ECB policy imbalance.

Drivers Pulling the Euro for Extreme Downside

So, why did EUR/USD roll over so aggressively? Three big macro catalysts helped push it lower:

1. The EU–US Trade Deal Just Didn’t Impress

Yes, the 15% tariff deal grabbed headlines and temporarily reduced trade uncertainty. But markets quickly shrugged it off. Why? Because it doesn’t really solve the bigger picture. Europe’s growth is still sluggish, and capital continues to flow out. That’s not a recipe for a stronger euro.

2. Interest Rate Differentials Are Crushing the Euro

This is the big one. The ECB is holding its benchmark rate at 2.15%, and there’s no clear path for hikes anytime soon. Contrast that with the Fed: markets are fully pricing in a hold at 4.50% in Thursday’s rate decision. That’s a massive 235-basis point gap in favor of the U.S. dollar, making the greenback a far more attractive avenue for yield-seeking capital. Until this differential narrows, EUR/USD will stay under pressure.

3. U.S. Data Keeps Surprising to the Upside

Strong jobless claims and durable goods numbers just reminded everyone that the U.S. economy isn’t slowing as much as some expected. The stronger the data, the more the dollar rallies—and the more pressure there is on the euro.

Technical Outlook

EUR/USD is sitting at a pivotal level around 1.1556, following a sharp breakdown from the 1.1790–1.1830 highs. Euro is currently testing the support level as Dollar continues to weigh down on Euro, making it a key decision point.

- Immediate Support: 1.1556

- Next Downside Liquidity Zone: 1.1446

- Nearest Resistance: 1.1600

Bullish Scenario – Relief Rally from Support

A strong defense and bounce from 1.1556 with clear bullish momentum and a confirmed support will be established if price closes above 1.1600 level, reclaiming the prior breakdown area.

- Targets:

- 1.1678: First key resistance from prior support zone.

- 1.169–1.175: 4H Fair Value Gap level or imbalance

A daily close below 1.1556 would invalidate the bullish setup and shift focus back to the downside.

Bearish Scenario – Continuation Toward Deeper Liquidity

If Euro fails to hold 1.1556, breaking and closing below on strong volume and a retest of 1.1556 as resistance, followed by a rejection, would strengthen the bearish bias.

- Targets:

- 1.1500–1.1480: Short-term profit-taking zone, psych level

- 1.1446: Major liquidity target and next structural support.

A sustained recovery above 1.1620–1.1640 would invalidate the immediate bearish outlook.

Fed Decision and Jobs Report Loom as Key Catalysts for EUR/USD’s Next Move

All eyes now turn to this week’s Fed rate decision and Non-Farm Payrolls report, which could set the tone for EUR/USD. A hawkish Fed and strong jobs data could reinforce the dollar’s dominance and extend the downside, while softer prints may finally give the euro room to recover from its 1.1556 support zone.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Prova Questi Successivi

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know