Germany’s Fiscal Revolution Growth Potential Amid Rising Global Risks

2025-03-25 08:21:18

The German economy is entering a transformative phase with the recent approval of a major fiscal reform package. This substantial shift in policy, cantered on debt-financed investment, is expected to reinvigorate growth prospects, although challenges remain.

GER30 H4

Germany’s Fiscal Expansion: A Game Changer?

The newly approved 500 billion EUR infrastructure fund marks a historic shift in Germany’s economic policy. For years, the country has operated under stringent fiscal constraints, but this package will allow for significant public investment. A substantial portion of these funds 100 billion EUR will be directed toward the Climate Transition Fund (KTF), while the remaining allocations will bolster federal and state-level projects, emphasizing infrastructure, defence, and digitalization.

Additionally, a major revision to Germany’s debt rules will exempt defence spending above 1% of GDP from the constitutional debt brake. This effectively removes the cap on military expenditures, enabling the government to pursue a more ambitious defence strategy. However, key details, such as the timeframe and specific budgetary allocations, remain uncertain.

Economic Impact: Optimism Amid Risks

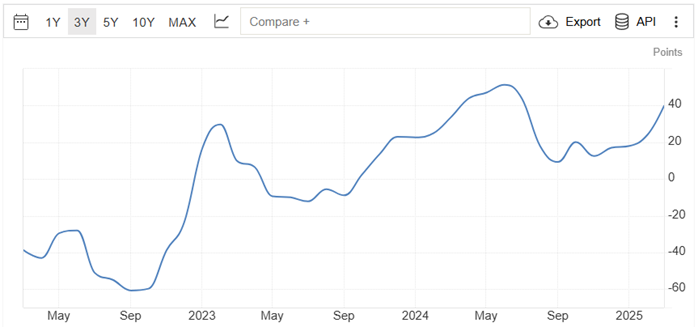

The shift in fiscal strategy has already bolstered business confidence, with indicators like the ZEW expectations index reaching a three-year high. Initial projections suggest that German GDP growth could rise to 1.7% in 2026, a notable improvement from the earlier forecast of 1.1%.

Europe ZEW 3 Years

However, growth risks remain skewed to the downside. One immediate concern is the looming introduction of new U.S. tariffs on European goods, expected on April 2. The policy, which aims to match foreign trade barriers with reciprocal tariffs, could strain EU-U.S. trade relations, particularly given the bloc’s significant trade surplus with the U.S. If these measures escalate into a broader trade dispute, Germany’s export-driven economy could face renewed headwinds.

Another factor to watch is the health of the U.S. economy itself. Weakening consumer demand and ongoing inflationary pressures in the U.S. could dampen European export prospects, even in the absence of a trade war. Additionally, Germany’s labour market dynamics pose a unique risk: many firms have avoided layoffs despite stagnation, banking on a future recovery. Should demand conditions worsen, a wave of delayed job cuts could materialize, further challenging growth momentum.

Balancing Growth and Uncertainty

Germany’s fiscal shift undoubtedly represents a pivotal moment for the European economy. The injection of public investment could provide much-needed stimulus, especially in infrastructure and digitalization. However, the success of this initiative will depend on how swiftly and effectively funds are deployed.

Looking ahead, the balance between fiscal stimulus and external risks will define Germany’s economic trajectory. If the government moves decisively in implementing its spending plans while mitigating trade-related risks, the country could be positioned for a stronger-than-expected recovery. Conversely, delays in execution or escalating trade tensions could temper the anticipated benefits of the fiscal expansion.

In the coming months, all eyes will be on Berlin not just for budget allocations but for signs of how quickly this policy shift translates into tangible economic gains.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next