Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

2024-01-31 11:20:44

Key Takeaways:

- Leverage allows you to use a small amount of money to control larger positions.

- In Australia and Europe, you can trade up to 30 to 1 leverage, unless you are a sophisticated investor, where you can apply for up to 500 to 1 leverage.

- Liquid markets, like the Forex Majors, require as little as 0.2% margin at 500 to 1 leverage.

- Margin calls start at 100% and margin call stop out levels are often 30-50%.

Forex Leverage stands as a powerful tool in the arsenal of all Forex traders, offering a pathway to amplify potential gains in the dynamic world of currency trading.

This blog post delves deep into the intricate world of leveraging in Forex, simplifying a complex topic so you can get on with your trading.

Whether you're a seasoned trader or just starting out, the knowledge shared here will demystify leverage and margin and help you balance risk and reward in your Forex trading.

Why would you trade on margin and use leverage in Forex?

For the simple reason, you can trade more money than you have in your trading account. You don't ever have to use maximum leverage, but even using a little leverage in forex will allow you to access more trading opportunities.

Margin trading only requires you to put aside a small initial margin to open a trading position.

Initial margin in forex trading is like a deposit you make to open a position with your broker.

It's a percentage of the total value of the trade you want to make, not the full amount. This allows you to control a larger position than you could with your own capital alone, amplifying your potential profits and losses.

Imagine you want to buy or sell $100,000 worth of Euros or EURUSD.

Your broker might require a 1% initial margin, meaning you'd need to deposit $1,000 to open the position.

You will now control a $100,000 position with only $1,000.

Here are some key points to remember about initial margin:

- It is not a fee: You get the respective amount back when you close the position.

- Margin rates vary based on the currency pair you are trading: More volatile currencies often require higher margins.

- It can be a powerful tool: Leverage can magnify your profits, but it can also magnify your losses.

- Use it responsibly: Only use leverage you understand and can afford to lose. Keep your trade size small when CFD trading and avoid using higher leverage.

Assessing Your Edge in the Forex Market: The Foundation for Using Leverage

Before you even consider trading on leverage, it is wise to work out whether your trading strategy has an edge.

An edge is a probability your system will deliver profits for every dollar you risk. In technical terms, this is known as a positive expectancy.

One reason savvy traders use leverage is to compound the results of their trading system and to make the most of what the Forex market offers.

Using the right leverage ratio across a simple trading system

In the world of Forex trading, leverage can significantly amplify your results, both positive and negative. To understand this concept better, let's explore an example where you have a forex trading strategy that has historically achieved a 10% return per annum with a 4% drawdown.

First and foremost, it's crucial to acknowledge that past performance is not always indicative of future results. Markets evolve, and unforeseen variables can impact your strategy's effectiveness.

Now, suppose you decide to utilise leverage in your Forex trading strategy. With a $50,000 account, applying a 3 to 1 leverage ratio gives you access to $150,000, effectively tripling your trading capacity. This leverage allows you to amplify the scale of your trades, thereby potentially increasing your returns as well as your risks.

Let me explain the impact of applying this leverage in the forex market:

- Without Leverage: With your initial $50,000, achieving a 10% annual return would net you $5,000, increasing your balance to $55,000. The potential drawdown of 4% equates to a risk of losing $2,000, reducing your account to $48,000 in a worst-case scenario.

- With 3 to 1 Leverage: Your effective trading capital now is $150,000. Applying the same 10% return on this amount would potentially increase your earnings to 30% on your original $50,000, translating to $15,000. This boosts your total to $65,000. However, the potential drawdown also triples to 12%, meaning your risk of loss increases to $6,000, potentially reducing your account to $44,000 in adverse market conditions.

This example illustrates how conservative traders might use leverage and trading within their risk tolerance levels.

They apply it to amplify their returns while fully understanding the increased risk of drawdown.

By choosing a leverage ratio that aligns with their risk tolerance and the historical performance of their trading strategy, traders can strategically manage the potential for higher returns against the backdrop of increased risk.

To learn more about using leverage effectively in forex trading, watch the video below. It covers key insights on managing margin and maximising trading opportunities while controlling risk.

What are the risks of leverage and margin in Forex when you make a Forex trade?

Leverage and margin trading are powerful tools in the Forex market, offering the potential for significant profits but also accompanying substantial risks.

Understanding these risks is crucial for every trader, from beginners to the more experienced.

Here's what you need to know about the risks of leverage and margin in Forex trading:

- Starting with Smaller Initial Capital: Leverage allows traders to start with smaller initial capital while giving them the ability to control larger positions. This can be particularly appealing for new traders or those with limited funds, as it enables them to participate in the market more actively.

- Larger Trading Positions: When you trade using leverage, you're able to take on larger trading positions than would be possible with your account balance alone. This amplification of your trading capacity can significantly increase potential returns on successful trades. However, it's this very feature that also escalates the risks involved.

- Volatility Risks: Markets such as Gold, Crude Oil, and Cryptocurrencies are known for their high volatility. In such markets, price swings can be swift and large. While leverage can magnify profits in these markets, it can also amplify losses, sometimes more rapidly than traders might anticipate. This heightened risk underscores the need for caution and meticulous risk management, especially in highly volatile markets. You want to keep your risk per trade small, which is less than 1-2%.

- Potential to Lose More Than Your Initial Deposit: One of the most significant risks associated with leverage is the possibility of losing more than your initial deposit. As leverage increases your exposure to the market, it also increases the potential size of losses, which, in some cases, can exceed the funds you initially had in your trading account.

- Margin Calls and Automatic Position Closure: All Forex brokers will issue a margin call if your account doesn't maintain enough margin to support your open positions. This typically starts when your margin level reaches 100%. If your margin level falls below 50%, the broker will automatically close your worst-performing position to prevent further losses. This mechanism serves as a risk control feature but can also result in the sudden closure of positions, possibly at a significant loss.

The Prudence of Using Less Leverage: Given the risks associated with high leverage, it often makes sense to use less leverage to protect your capital. Lower leverage reduces the size of potential losses and helps in preserving your precious trading capital over the long term. Using less leverage is a prudent approach, especially for those new to trading or when navigating uncertain and volatile market conditions.

Leverage trading and risk management to avoid a Forex margin call

When using leverage, remember your profits, as well as your losses (drawdowns), will be amplified.

So, the greater the leverage used, the higher the profit/loss swings. Leverage is the ultimate double-edged sword.

For this reason, you learn about leverage and different margin requirements, and how they impact your overall trading performance.

Once you are comfortable, you need to work out how you can apply it to your allocation of risk.

Nearly every trader, having made an early initial profit of say $500, has said 'If only I put ten times as much money on this trade, then I would have made $5,000'.

Sure, leverage can increase your returns, but professional traders always focus on protecting the downside.

Successful traders and their early missteps in using leverage

This is the trap many new traders have to come to terms with early in their trading careers.

Many of the world's best traders, as documented in the Jack Schwager Market Wizard book series, have initially blown up their trading accounts due to trading with leverage. Often they did this using Futures or Options, as Schwager's original interviews were before CFD trading was available.

A major mistake made by novice traders is using high leverage to make significant profits quickly.

However, one single change in the market could easily erase all previous gains and wipe out your live account.

Make leverage work for you and use sensible levels of leverage in trading

Utilising leverage in trading effectively hinges on selecting a level of leverage that aligns with your individual needs – including your tolerance for risk, your trading objectives and financial aspirations, your level of experience, your distinctive trading approach, and the amount of trading capital at your disposal.

For instance, seasoned traders who have navigated the markets for several years might leverage margin trading to access substantially larger positions. This can enhance their market exposure significantly.

Additionally, such traders may employ leverage to diversify their trading activities across various markets – for example, Commodities, Indices, or stock trading – all the while adhering to their primary strategy within the Forex markets.

Above all, employing sensible risk management strategies, with a keen focus on the preservation of capital, is crucial. This encompasses setting stop-loss orders, monitoring trades closely, and adjusting leverage based on market conditions and personal risk appetite.

By doing so, traders can make leverage work to their advantage, maximising their trading potential while minimising risks.

Ideas around leverage in Forex trading for the newbie trader

When you are just starting, trade at low levels of leverage on a major currency pair. Your current open positions should always have a good 'sleep at night factor'.

This means when you total all your positions, and if they all turned against you overnight, you would not lose any sleep over the losses made.

And yes, losses are part and parcel of trading. Successful traders know how to keep their losses small relative to their overall account size.

As a beginner, start small and learn the lessons that leverage provide. Learn how leverage can be used and how it impacts your trading, your mindset and your bottom line profits and losses.

It is also wise to use a small amount of leverage to have more room for your positions to evolve without risking too much of your trading capital.

What to take into account when determining how much leverage to use

When you set your leverage ratio, consider a few things, such as the trading conditions (volatility, liquidity, economic calendar, high impact news events), and your risk/reward ratio (stop-loss and take-profit levels).

Determining your leverage ratio means you're controlling your risk to limit potential losses, as well as avoiding major drawdowns in your account.

Once you know the level of your leverage, you should think about position sizing, which is all about deciding how many lots to buy/sell when trading forex.

With ACY Securities as your Forex broker you can trade the following lot sizes:

- A standard lot, which (1 full lot) is $US100,000.

- A mini lot, which is $US10,000.

- A micro lot, which is $1,000.

No matter if you use fundamental analysis, technical analysis or you code Expert Advisors (EAs), you must work very hard to preserve your precious capital.

As you can see, leveraged trading when done in a sensible, risk-averse fashion can potentially help you achieve your financial goals faster.

FAQs

Is it Possible to Use a Forex Leverage Calculator?

Yes, a Forex leverage calculator is a handy tool traders use to determine the leverage ratio they can utilise, the size of the position they can control, and the required margin for their trades. It helps in making informed decisions by calculating potential profits and losses based on different leverage ratios. Professional traders use these tools and some have Expert Advisors built into their MT4 or MT5 that can calculate your position size and margin required.

How Does Margin Relate to Leverage?

Margin is directly related to your leverage. It is the amount of capital required to open and maintain a leveraged position. Essentially, it's a fraction of your trade's full value. Higher leverage allows you to control larger positions with a smaller margin, thereby increasing your buying power in the market.

What is My Initial Margin and How Does it Change Once the Market Starts Moving?

Your initial margin requirement is the initial deposit required to open a leveraged trade. It's a percentage of the full value of your trade. As the market moves, the margin requirement doesn't change, but the equity in your account does. If the market moves against your position, your equity decreases, reducing the margin coverage and potentially leading to a margin call.

What is the Highest Leverage I Can Get with a Forex Broker?

The highest leverage you can get with a Forex broker varies based on the broker's policies and regulatory limitations. At ACY, you get up to 1:500 leverage, but such high leverage significantly increases your risk. In Australia you get a maximum of 1:30 leverage. Traders should choose leverage based on their risk tolerance and experience. If in doubt, reduce the leverage you use on your forex account.

What are the Typical Leverage Ratios Available in Forex Trading?

Typical leverage ratios in Forex trading range from as low as 1:5 to as high as 1:500. Conservative traders often opt for lower ratios like 1:10 or 1:50, while aggressive traders might choose higher ratios. The choice of leverage ratio should align with your risk management strategy and trading objectives.

What Should I Know About Forex Leverage Regulations in Australia and Europe?

Leverage regulations in Australia and Europe are designed to protect traders from excessive risk. The European Securities and Markets Authority (ESMA) has set a maximum leverage limit of 1:30 for major currency pairs for retail traders. In Australia, the Australian Securities and Investments Commission (ASIC) also imposes similar restrictions. These regulations aim to balance offering leverage while protecting traders from significant losses due to high leverage.

What Happens When a Margin Call Occurs?

When a margin call occurs, it means your account equity has dropped to a level where it covers 100% or less of the margin requirement for your open positions. This is a critical point where you need to make a decision to either top up more funds or close some of your positions. This action is necessary to prevent your account from going into a negative balance. If your equity falls further and only covers 50% of the margin requirement, the platform takes an automatic measure to mitigate risk. It will automatically close out your worst offending position, which is the contract with the largest loss. This automatic closure is a protective measure to help manage the risk and prevent further losses in your account.

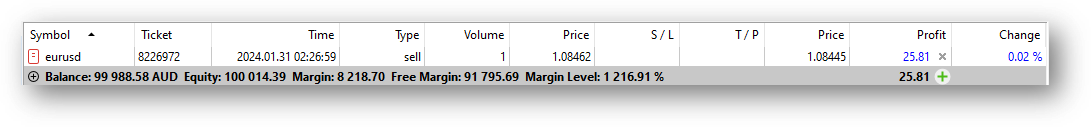

Will the trading platform show my leverage and margin amount?

When you download MetaTrader 4 or MetaTrader 5, you will be able to see your Balance, Equity, Free Margin and Margin Level (expressed as a percentage) when you have open positions. You can right click on any symbol in MT5 and then left click on Specification to view more information about the instrument you are looking to trade. You will be able to view things like Contract Size, Spread, Minimum volume, Maximum Volume, Trading Hours and Swap rates to name a few.

In conclusion, leverage in Forex trading is not just about amplifying potential returns; it's about smartly harnessing opportunities.

With ACY, you gain access to over 2200 instruments, benefit from lightning-fast execution, and can start your journey with as little as $50, choosing between the advanced MT4 or MT5 trading platforms.

Plus, enhance your skills through live weekly trading webinars hosted by our expert team of analysts.

Start with a demo or live account today and experience the ACY advantage.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next