Do Custom MT4/MT5 Indicators Make You a Smarter Trader?

2025-09-09 15:29:55

This article is reviewed annually to reflect the latest market regulations and trends

TL;DR (Too Long; Didn’t Read)

- Process Over Prediction: A "smarter trader" masters their process, not predicts the market. The best custom MT4/MT5 indicators are tools that enforce discipline, automate risk management, and improve analytical efficiency, rather than just generating buy/sell signals.

- Systematic Risk Management is Non-Negotiable: True profitability comes from capital preservation. Use scripts like a Position Size Calculator to automate risk calculations and tools like the Average True Range (ATR) indicator to set intelligent, volatility-based stop-losses for every trade.

- Automation Equals Freedom: Leverage MT5 alerts and scripts to create a "set it and forget it" system. Automate trade management with tools like "Close All Positions" and "Move SL to Breakeven" to reduce screen time, eliminate emotional errors, and build a scalable trading business, not a high-stress job.

- Beware the "Magic Bullet": The unregulated market for custom indicators is filled with scams. "Repainting" indicators that show a perfect but fake history and poorly coded tools can crash your platform. Always source your indicators from a trusted, curated provider to avoid financial loss and security threats.

- Build Your Analytical Cockpit: A smarter trader creates a personalized workspace. Use a unique chart template with a consistent set of vetted indicators to streamline your analysis, reduce cognitive load, and apply the same objective framework to the market every single time.

"Risk comes from not knowing what you're doing." – Warren Buffett

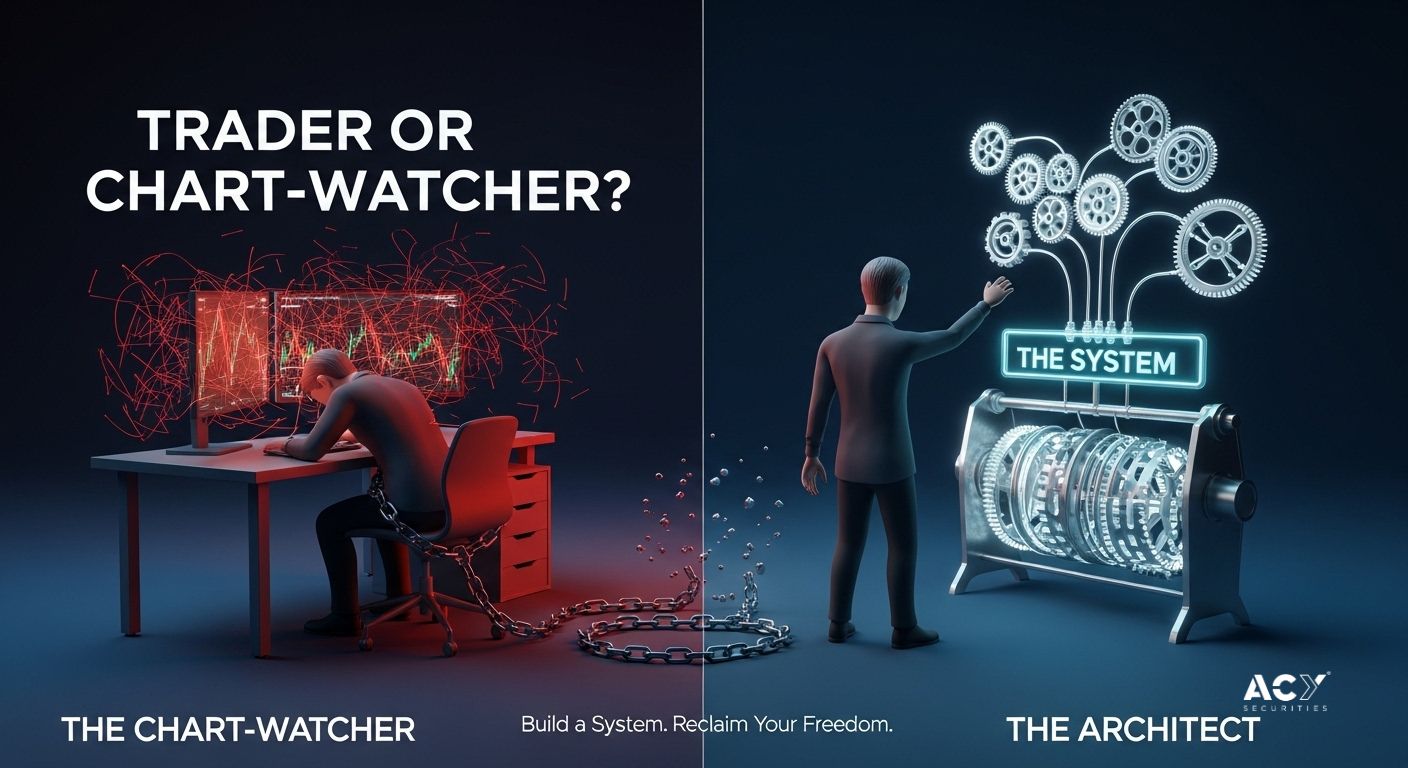

Custom MT4/MT5 Indicators: Are You a Trader or Just a Full-Time Chart-Watcher?

You pictured a life of financial control and flexibility. Instead, you're chained to your desk, eyes burning from hours of chart-watching, your stomach in knots with every market swing. You're hunting for the perfect signal, the one magic arrow that will unlock consistent profits, but all you've found is burnout and an account that goes nowhere.

What if the entire premise is wrong? What if becoming a "smarter trader" has nothing to do with finding a better signal and everything to do with building a better system?

This is the paradigm shift that separates struggling retail traders from calm, profitable professionals. It’s a strategic move from being a stressed-out market participant to a liberated systems architect. This guide will show you how to use the powerful, and often misunderstood, world of custom MT4/MT5 indicators not as a crystal ball, but as the toolkit to build that system,a system that executes flawlessly, manages risk automatically, and finally gives you what you came for: less screen time and more freedom.

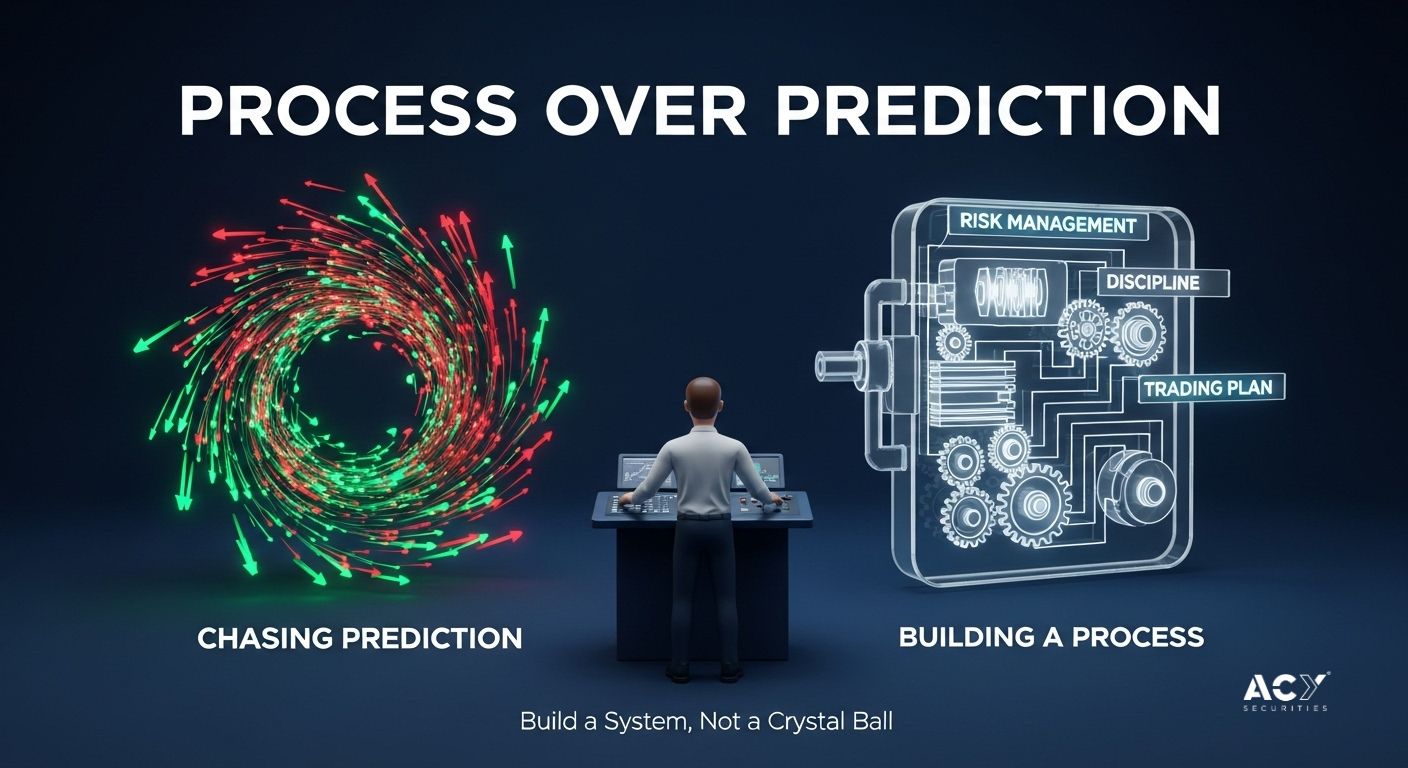

Redefining the 'Smarter Trader', Why Your Process is Your Edge

The pursuit of becoming a "smarter trader" is often misconstrued as a quest for a predictive tool. The internet is a minefield of vendors promising "99% accuracy" from a secret algorithm that can unerringly forecast market movements. This report posits a different definition: a smarter trader is not one who predicts the future, but one who masters their own process.

The most significant and sustainable gains in trading performance are derived from improvements in process, not from the discovery of a superior signal. This process-oriented approach prioritizes discipline, rigorous risk management, and emotional control over the futile search for certainty. As experts point out, it's crucial to understand how to use MT4/MT5 indicators for risk management, not just signals.

The value of a custom tool is therefore measured by its ability to reinforce this process.

- A well-designed Risk Reward Indicator can prevent emotion-based trading by embedding your plan directly onto the chart, showing you instantly if a setup meets your 1:2 risk-reward rule.

- A simple "Close All" script can enforce discipline with mechanical precision, ensuring your plan to exit before a major news event is followed without deviation.

This reframes "smarter trading" from a predictive exercise to a disciplinary one. The goal is not to find a tool that makes money, but a tool that enforces a plan that does.

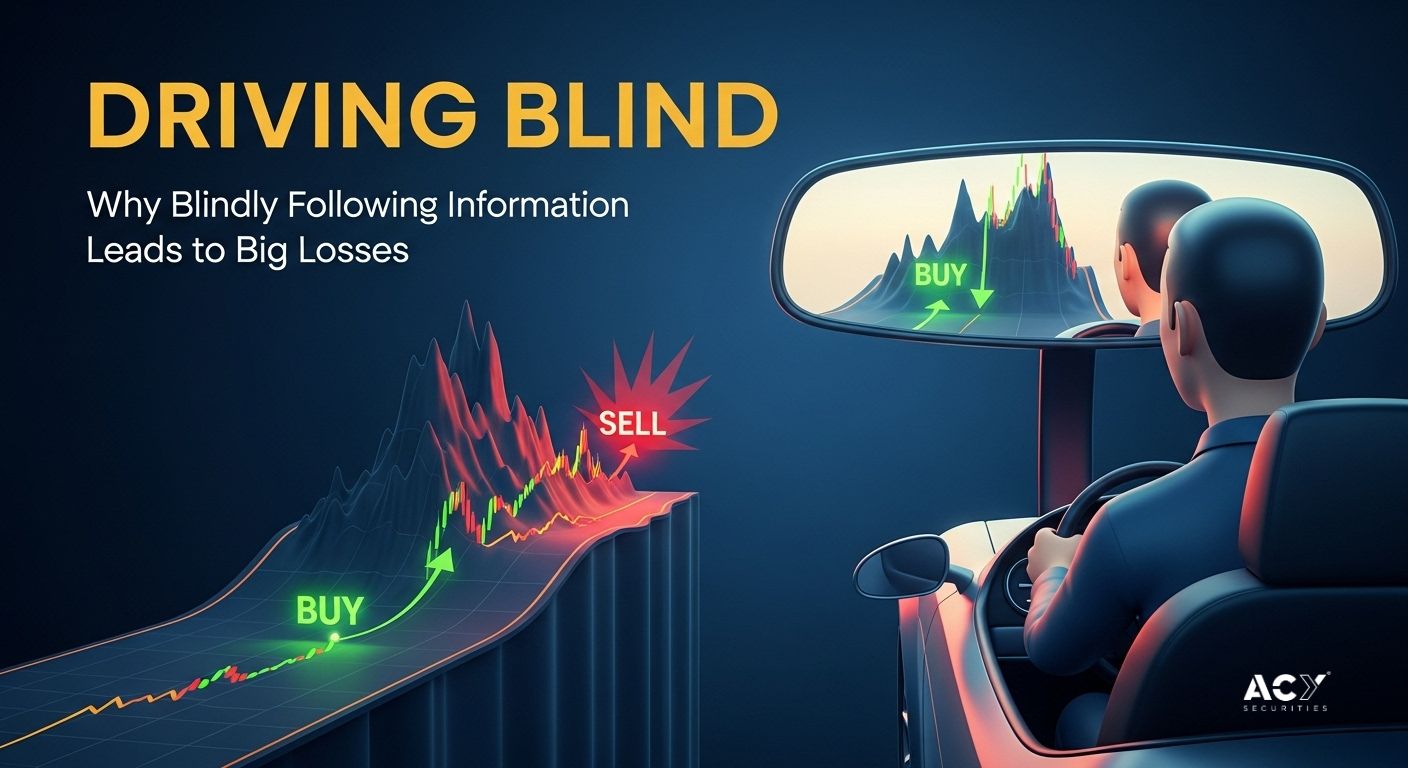

How Blindly Following Arrows Leads to Big Losses

Imagine a traffic light: green for buy, red for sell. Many novice traders approach indicators with this simplistic mindset, believing a moving average crossover is a definitive signal. This is a fast track to ruin due to two fundamental flaws:

- False Signals & Whipsaws: Indicators are derived from past price data; they are mathematical interpretations, not crystal balls. A "false signal" occurs when an indicator suggests a move that quickly reverses, leading to a "whipsaw" that drains your account. Relying on a single signal without understanding the broader market context is a gamble.

- Lagging Information: Most indicators are lagging. A 50-period moving average reflects the average price of the last 50 candles, not the immediate price action. By the time a crossover signal appears, a significant portion of the move might already be over, leaving you with a late, high-risk entry.

Blindly following these arrows is like driving while looking only in the rearview mirror. You're reacting to what's already happened. A smarter trader uses indicators for context and confirmation within a broader, risk-managed strategy.

How Would Steve Jobs Think About Custom Indicators?

Steve Jobs wasn't a trader, but his philosophy on tools, design, and systems offers a powerful lens through which to view custom indicators. He believed that the best tools were extensions of the user, designed with intention, simplicity, and a deep understanding of the craft.

Applying his principles, here’s how Jobs might approach this topic:

- It’s About the Ecosystem, Not the App: Jobs didn’t just sell a phone; he sold an integrated ecosystem where hardware and software worked seamlessly. A smarter trader doesn’t hunt for a single "app" (indicator); they build an ecosystem (a chart template and a set of rules) where their tools work in harmony to provide a clear, uncluttered view of the market.

- Insanely Great Design is About Clarity: Apple's design philosophy is about removing the superfluous to achieve clarity. A cluttered chart with ten different indicators is the opposite of this. A Jobs-approved trading setup would use only a few well-chosen custom indicators that synthesize complex information into a simple, actionable visual. For example, a single indicator that combines RSI, MACD, and a moving average to produce one clear signal.

- Build Tools for Craftsmen: Jobs believed in empowering creative professionals. A professional trader is a craftsman. Their tools shouldn't be a black box; they should be instruments that give them more control and insight. A custom indicator that visualizes market structure or calculates position size is a craftsman's tool. It doesn’t do the thinking for you; it helps you think better.

- It Just Works: This was the ultimate goal of Apple products. Your trading system should "just work." This means using reliable, well-coded indicators from a trusted source that won't crash your platform in the middle of a volatile move. A tool that introduces instability is fundamentally broken, no matter how good its signals are.

From a Jobsian perspective, a custom indicator only makes you smarter if it simplifies your process, enhances your clarity, and integrates seamlessly into a well-designed trading system.

What Can a Custom Indicator Show You That Standard Ones Can't?

Standard indicators like a Moving Average or RSI provide a basic toolkit. Custom indicators, however, offer a level of specificity that allows you to build a personalized analytical environment. Their power lies in transforming your subjective trading rules into objective, visual elements on the chart.

- Synthesize Information: A custom script can combine signals from multiple standard indicators. For instance, it could generate a single alert only when the RSI is overbought, the MACD histogram is declining, and the price is at a key resistance level. This converts a multi-step manual check into one automated signal, reducing chart clutter and simplifying your decision-making.

- Visualize Multi-Timeframe Analysis: A professional trader always checks the higher timeframe trend. A custom indicator can plot a 200-period moving average from the daily chart directly onto your 1-hour chart. This provides immediate, constant context, helping ensure your short-term entries are aligned with the dominant long-term trend.

- Make Abstract Concepts Tangible: Custom tools can automatically identify and plot key market structures like support and resistance zones, order blocks, or fair value gaps. A Risk Reward Indicator is a prime example; it visually displays your risk-to-reward ratio in real-time as you drag your stop-loss and take-profit levels, converting a crucial manual calculation into an intuitive visual aid.

- Provide Niche, Contextual Data: Some of the most valuable custom indicators don't generate signals at all. Informational indicators can display the current spread, the time remaining in the candle, or highlight the active trading session (e.g., London, New York). These tools enhance situational awareness and improve the precision of your execution.

A custom indicator provides a unique lens to view the market. It’s the bridge between your written trading plan and live market execution, converting abstract rules into concrete, real-time feedback.

The Foundational Choice: MT4 vs. MT5,Which Workshop Fits Your System?

Before choosing your tools, you must choose your workshop. The selection between MetaTrader 4 (MT4) and MetaTrader 5 (MT5) defines your technological ecosystem and strategic capabilities.

- MetaTrader 4 (MT4): The Forex Workhorse: Released in 2005, MT4 is the industry standard known for its simplicity and massive library of legacy indicators and Expert Advisors (EAs). Its primary focus is on Forex and CFDs.

- MetaTrader 5 (MT5): The Multi-Asset Powerhouse: Launched in 2010, MT5 is technologically superior, offering more timeframes (21 vs. 9), more built-in indicators (38 vs. 30), and a far more powerful backtesting engine. It was designed for a multi-asset world, including stocks and commodities. One user on Quora highlighted a key advantage: the ability to create custom timeframes like 8-hour or 12-hour charts, revealing patterns invisible on standard settings.

The critical difference is the programming language: MT4 uses MQL4, while MT5 uses the more advanced MQL5. They are not backward-compatible. The vast library of MT4 tools will not work on MT5 without being completely rewritten.

Analyst Recommendation: For a beginner aiming to become an expert, starting with MT5 is the more strategic long-term choice. Its superior power, multi-asset capabilities, and advanced MQL5 language provide a better foundation for developing sophisticated, systematic trading strategies.

The Dark Side, What Are the Dangers of Unknown Indicators?

The unregulated online marketplace for custom indicators is fraught with peril. Sourcing tools from unvetted third parties exposes you to financial scams, platform instability, and serious security threats.

- The "Repainting" Hoax: This is the most deceptive scam. A "repainting" indicator alters its historical signals to create a flawless but entirely fake track record. After a market bottom forms, it will go back and place a "BUY" arrow at the perfect low. In real-time, that signal never existed. It’s a hindsight hoax designed to lure you into a system guaranteed to fail.

- Platform Instability: A poorly coded indicator can consume excessive CPU and memory, causing your MetaTrader platform to lag, freeze, or crash entirely. A platform freeze during a volatile market can be catastrophic, preventing you from managing your trades.

- Security Threats & Malware: Custom indicator files, especially those requiring a .dll file, can pose a direct threat. A malicious .dll can contain code to log your keystrokes, steal account passwords, or compromise your entire computer. The warning is paramount: "Don't use .dlls from untrusted sources."

This high-risk environment creates a powerful incentive to find a trusted, curated source for your tools. A broker like ACY.com provides a free library of professionally developed and vetted MetaTrader scripts and indicators, fundamentally de-risking the process of tool acquisition.

Your Analytical Cockpit How to Safely Install Indicators & Build a Template

A professional's workspace is deliberately constructed for efficiency and consistency. In trading, this means a personalized chart template and a rigorous procedure for installing third-party tools.

How Can Building a Unique Chart Template Give You an Edge?

A chart template is more than a cosmetic preference; it is a tool for enforcing a consistent analytical process. By setting up your chart with your chosen indicators, parameters, and color scheme and saving it as a template, you create your unique "analytical cockpit."

This provides two key benefits:

- Efficiency: It saves a significant amount of time, allowing you to apply your entire analytical framework to any new chart with a single click.

- Discipline: By committing to a standard template, you ensure you are applying the same analytical lens to the market every single time, fostering the consistency that is foundational to a robust trading system.

A Step-by-Step Guide to Safe Installation

- Download from a Trusted Source: Only download indicators from reputable developers or a curated source like the one provided by your broker. The file will be in either .mq4/.mq5 (source code, safer) or .ex4/.ex5 (compiled code, less transparent) format.

- Open the Data Folder: In your MetaTrader terminal, click File > Open Data Folder.

- Navigate to the Indicators Folder:

- For MT4: Open the MQL4 folder, then the Indicators folder.

- For MT5: Open the MQL5 folder, then the Indicators folder

- Copy the Indicator File: Paste the .mq4/.ex4 or .mq5/.ex5 file into this folder.

- Refresh or Restart: Return to the MetaTrader terminal. In the "Navigator" window, right-click on "Indicators" and select "Refresh." The new indicator will now appear in your list.

How Do You Use Indicators for Advanced Risk Management?

Professional trading prioritizes capital preservation through systematic risk management, moving beyond the flawed pursuit of perfect entry signals. This is where MT4/MT5 tools provide their greatest value by automating discipline.

The Cornerstone: Automated Position Sizing

The most critical component of long-term success is correct position sizing, yet it's a step many beginners neglect. The manual calculation is prone to error in fast-moving markets.

A Position Size Calculator script automates this entire process. By simply inputting your desired risk percentage (e.g., 1%) and dragging your stop-loss level on the chart, the tool instantly calculates the precise lot size for your trade. This transforms risk management from a manual chore into an immutable law of execution. The "Calculate Your Lots" script provided by ACY.com is a prime example that allows beginners to adopt expert habits from day one.

Using Volatility Indicators for Smarter Stop-Losses

Instead of using arbitrary fixed-pip stops, you can use indicators to set data-driven stop-losses that adapt to the market.

- Average True Range (ATR): The ATR is the ultimate volatility indicator. A common professional technique is to place your stop-loss at a multiple of the current ATR (e.g., 2x ATR) away from your entry. This automatically gives your trade more room to breathe in volatile markets and tightens your risk in calm markets.

- Bollinger Bands: The width of the bands directly reflects volatility. When the bands are wide (high volatility), you might reduce your position size. In a ranging market, a logical stop-loss can be placed just outside the opposite band.

Less Screen Time, More Freedom: How Can Scripts Automate Your Trading Day?

The "set it and forget it" trading philosophy is a disciplined process where you pre-define your entire trade plan and then let it play out without manual tinkering. This approach frees you from the screen and is powered by automation.

- Powerful Alerts: MT5’s native alert system can send push notifications to your phone when a price level is hit. For more complex, multi-indicator conditions, you can write a custom MQL5 script or use a TradingView webhook. The goal is to be notified only when your perfect setup occurs.

- Trade Management Scripts: Once a trade is live, scripts can manage it with emotionless precision

- "Move SL to Breakeven": A script that automatically moves your stop to your entry price after a certain profit is reached, creating a "risk-free" trade.

- "Partial Close": Systematically lock in profits by closing a percentage of your position at a key level while leaving the rest to run.

- "Close All": The ultimate risk management tool. Flatten your account with one click before major news or at the end of your trading day to prevent emotional decisions.

By embracing this mindset, you can build a trading business, not a high-stress job.

The Professional's Toolkit,A Curated List of Smarter Trading Tools

An advanced trader's toolkit focuses on trade management, risk control, and situational awareness. Here is a matrix of tools that contribute to a more professional trading approach, with many powerful MetaTrader scripts available from trusted providers.

| Tool Category | Specific Examples & Function | Contribution to 'Smarter' Trading |

| Trade & Risk Management | Position Size Calculator: Calculates lot size based on account balance, risk %, and stop distance. <br> Trade Manager EAs: Automate order placement with predefined SL/TP. <br> "Close All" Script: Closes all open market and pending orders instantly. | Enforces Unwavering Discipline: Eliminates manual calculation errors and emotional interference in trade management. Ensures every trade adheres to a strict risk plan. |

| Advanced Charting & Visualization | Colorful MACD: Enhanced MACD that uses color variations to visually display changes in momentum and trend strength. <br> Trend Ribbon: Uses multiple moving averages to create a colored "ribbon" that clearly defines the trend direction. | Improves Analytical Clarity: By filtering out insignificant price fluctuations and enhancing visual cues, these tools provide a more objective and less ambiguous view of the underlying trend. |

| Market Structure & Level Analysis | Advanced Pivot Points: Automatically plots daily/weekly support and resistance levels based on previous price action. <br> Donchian Channel: Identifies the highest high and lowest low over a period, excellent for breakout strategies. <br> Periodic Separator: Draws vertical lines for different time periods (weekly, monthly) to help with cyclical analysis. | Provides an Objective Framework: Replaces subjective line-drawing with data-driven levels. This highlights high-probability reaction zones and helps set realistic profit targets. |

| Situational Awareness Dashboards | Time Zone Indicator: Visually displays the trading sessions for different markets (Asia, London, NY) on the chart. <br> Spread Indicator: Visually tracks the current spread in real-time to avoid trading during illiquid, high-cost periods. <br> Quickly Close Charts Script: A script to close all charts for a specific symbol or all charts at once to clean the workspace. | Enhances Real-Time Decision-Making: Provides crucial context at a glance, preventing costly errors like entering a trade just before a major news release or during wide-spread conditions. |

Mastering Your Inner Game,10 Lessons from "The Mental Game of Trading"

Jared Tendler's book provides a system for solving the psychological problems that plague traders. Custom indicators and scripts can serve as the structural enforcement for his mental game lessons.

- Map Your Patterns: Tendler says to identify the specific patterns of your emotional errors. A Drawdown Limiter EA is the perfect tool to structurally block your pattern of "revenge trading" after a loss.

- Inject Logic at the Point of Decision: Emotions hijack your logical brain. A Risk-Reward indicator injects logic right on the chart, forcing you to see if a trade is objectively worth it before your greed takes over.

- Recognize the Early Signs of Tilt: If you know you get reckless after three straight losses, a Trade Counter script can alert you or even disable trading for the day.

- Build a Strategy for Your A-Game: Your A-game is systematic and disciplined. Tools like a Position Size Calculator ensure you are always playing your A-game when it comes to risk.

- Shrink the Problem: Feeling overwhelmed? A "Delete all Objects" script instantly cleans your chart, shrinking the visual noise so you can refocus on one setup at a time.

- Trust the Process: The goal is to trust your system's edge over many trades. An automated trailing stop helps you trust the process by managing a winning trade according to your rules, not your fear of giving back profits.

- Know Your Emotional Tipping Point: A "Close All" script is your emergency eject button. When you feel emotionally compromised, you can exit the market instantly and preserve your mental and financial capital.

- Separate Performance from Results: You can have a good process and still lose a trade. By automating execution with scripts, you ensure your performance (following your rules) is perfect, regardless of the outcome of a single trade.

- Create a Warm-Up Routine: Part of a professional routine is setting up your workspace. A custom chart template is your warm-up, ensuring your analytical environment is consistent every single day.

- Find the Root Cause: If the root cause of your losses is inconsistent position sizing, a script that automates it is the direct solution. It fixes the underlying problem at the system level.

Why a Trusted Source is Your Biggest Edge

The journey from novice to expert is about building a robust system and cultivating discipline. Custom tools are a powerful component, but only when they are safe, reliable, and designed to enforce that system. The open market for indicators presents too great a risk for the developing trader.

Therefore, the most intelligent choice is to partner with a broker that acts as a trusted curator. By providing a secure ecosystem of professional-grade risk management and analytical tools, ACY.com removes the largest obstacles to success.

It allows a new trader to bypass the dangerous learning curve of tool selection and immediately begin building the habits of an expert. By providing essential, vetted tools like the "Calculate Your Lots" script and multi-timeframe indicators for free, ACY.com demonstrates a commitment to building knowledgeable, sustainable traders. For these reasons, it is the clear winner for beginners who are determined to master the craft of trading.

Frequently Asked Questions (FAQ)

Q1: What is the single most important custom script for a beginner?

A1: The Position Sizing Calculator script is the most crucial. It automates the single most important aspect of risk management, ensuring you never risk more than your plan allows on a single trade. ACY.com offers a highly effective "Calculate Your Lots" script for free.

Q2: Can I use custom indicators on the MT4/MT5 mobile app?

A2: No, custom indicators and scripts can only be installed and used on the desktop versions of MetaTrader 4 and MetaTrader 5. The mobile and web-based platforms do not support them.

Q3: What's the difference between a script and an Expert Advisor (EA)?

A3: A script executes a single task once when you activate it (e.g., "Close All Positions"). An Expert Advisor (EA) runs continuously on a chart, constantly monitoring conditions and managing trades automatically (e.g., a dynamic trailing stop-loss).

Q4: How can I tell if an indicator is "repainting"?

A4: The best way to test for a repainting indicator is to run it in MetaTrader's Strategy Tester in "visual mode." Watch closely to see if past signals (like arrows or dots) move, change, or disappear as new price bars are formed. If they do, it's a repainting scam.

Q5: Why does my MetaTrader platform crash after installing a new indicator?

A5: Platform lag or crashes are often the result of a poorly coded or resource-intensive indicator. It may be stuck in an infinite loop or consuming too much memory. You should remove the indicator immediately to restore platform stability. This highlights the importance of using tools from trusted sources.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next