USA NFP Weakness and Market Implications

2025-09-08 11:18:35

The start of September has once again placed the U.S. labor market in the spotlight, and the results were far from reassuring.

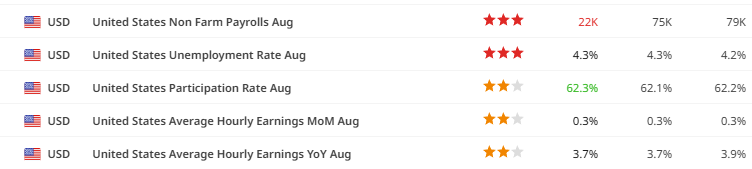

On Friday, the Bureau of Labor Statistics reported that the U.S. economy added just 22,000 nonfarm payroll jobs in August, well below the consensus expectation of 75,000 and marking a sharp slowdown from July’s upwardly revised 79,000.

At the same time, the unemployment rate ticked up to 4.3%, signaling that labor market momentum is losing steam. For investors and policymakers alike, these numbers serve as both a warning and a signal: the U.S. economy is showing signs of fatigue, and the Federal Reserve will likely be forced to act.

By the Numbers

August’s jobs print was not only disappointing, it was dismal in terms of breadth. Healthcare (+31,000) and social assistance (+16,000) were the few sectors providing meaningful gains, while manufacturing shed 12,000 jobs, and government employment fell by 15,000, primarily at the federal level.

This uneven distribution reinforces the idea that job creation is increasingly concentrated in a few resilient industries, while cyclical sectors tied to trade and industrial production are buckling under the weight of a slowing global economy.

The uptick in the unemployment rate to 4.3% reflects both weaker hiring and the inability of prior labor market strength to sustain itself. Average hourly earnings growth, steady at 0.3% month-on-month but softer at 3.7% year-on-year, also suggests wage pressures are cooling, a sign that inflationary risks from the labor market are fading.

What’s Behind the NFP Numbers?

The underlying story is twofold. On one hand, the continued strength in healthcare and social assistance underscores long-term structural demand in sectors relatively insulated from cyclical downturns. On the other, the contraction in manufacturing and federal jobs illustrates the sensitivity of employment to external shocks.

Tariff disputes, weaker global demand, and volatile commodity prices are weighing on industrial output, while the fiscal environment is forcing cutbacks in government staffing.

This is not merely a blip. The slowdown is consistent with other recent releases: the ISM employment indices for both manufacturing and services weakened, while the ADP report and JOLTS job openings confirmed a cooling labor market. Taken together, these indicators point to a broader deterioration that cannot be ignored.

Market Implications & Policy Outlook

Markets reacted swiftly to the data. Bond yields fell as investors priced in a higher probability of Federal Reserve rate cuts, while the U.S. dollar weakened across G10 peers, and equity futures rallied on the prospect of easier monetary policy. The consensus now points to at least a 25 basis point cut at the September 16–17 FOMC meeting, with some analysts arguing that a 50 basis point move is on the table if the deterioration persists.

What is striking is how asymmetric the market’s sensitivity has become: a weak labor print sparks sharp moves on dovish expectations, while stronger-than-expected data delivers more muted reactions. This dynamic reflects not just economic conditions, but the credibility challenge facing the Fed in navigating a slowing economy while maintaining inflation near its target.

Data Integrity and Long-Term Thinking

Beyond the numbers, there are growing concerns about the reliability and politicisation of U.S. jobs data. Questions surrounding the accuracy of the BLS methodology, particularly in election years, add another layer of uncertainty for investors.

For those of us operating in the FX and broader macro space, this underscores the importance of triangulating labor market signals with other datasets, from corporate earnings and consumer sentiment to private-sector surveys.

For the long-term investor, the message is clear: tactical opportunities will emerge around Fed policy shifts, but structural fragility in the U.S. labor market requires more caution than complacency.

Looking Ahead

The August payrolls report highlights a labor market losing momentum at a delicate moment for both the U.S. economy and global markets. With unemployment on the rise and job creation slowing, the stage is set for the Federal Reserve to deliver additional rate cuts. Whether the Fed opts for a measured 25bps move or something more aggressive will hinge on how incoming data, particularly inflation and consumption, evolves in the weeks ahead.

For now, the balance of risks is tilting toward looser policy and a softer dollar. But as recent market moves have shown, the reaction function is increasingly shaped by expectations rather than surprises. Investors must stay nimble, attentive not only to economic prints but also to the broader global backdrop.

Q1: Why was the August Nonfarm Payrolls report such a disappointment?

The economy added only 22,000 jobs compared to expectations of 75,000. This weak print, combined with a rise in the unemployment rate to 4.3%, signals a clear slowdown in labor market momentum.

Q2: Which sectors performed well, and which struggled?

Healthcare and social assistance showed resilience, adding +31,000 and +16,000 jobs respectively. Manufacturing lost 12,000 jobs, while government employment declined by 15,000, underscoring fragility in cyclical and policy-driven sectors.

Q3: How did markets react to the report?

Bond yields fell, equities rallied, and the U.S. dollar weakened across G10 currencies as investors positioned for imminent Fed easing. The probability of a rate cut at the September FOMC has risen sharply.

Q4: What does this mean for Federal Reserve policy?

The Fed is now widely expected to cut rates at its upcoming meeting. A 25bps move is the baseline, but a 50bps cut remains possible if incoming data continues to deteriorate.

Q5: Should investors trust the jobs data?

While the BLS remains the benchmark source, concerns over reliability and politicisation are growing. Investors should triangulate labor data with private-sector surveys, corporate earnings, and broader macro indicators to form a complete picture.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know