Tariffs, Recession Fears, and the Rise of Gold as the Ultimate Safe Haven

2025-04-14 15:21:13

Overview

- Gold Defies Market Chaos – Demand Strengthens Amid Dollar and Bond Weakness

Despite traditional correlations breaking down, gold continues its upward trajectory as global investors seek refuge from U.S. market instability.

- Dollar and bond markets both weakened, yet gold gained — a sign of deep distrust in fiat and debt-based safe havens.

- Fear-driven sentiment, rising volatility, and inflation hedging reinforced gold’s safe-haven bid.

- Dollar No Longer a Haven – Capital Rotates Out

The U.S. dollar failed to attract safe-haven flows as economic data and sentiment weaken in tandem.

- Recession signals flash red: consumer sentiment drops, yield curves flatten, inflation cools.

- Investors rotate out of the dollar into hard assets and safer alternatives like gold and the yen.

- Gold Leads the Narrative – Price Action Signals Institutional Demand

Gold’s reaction shows it’s becoming the preferred hedge when both the dollar and bonds fail to deliver.

- Bullish continuation as gold breaks $3,100 and eyes $3,300 amid macro stress.

- Daily and H4 structure confirm sustained demand with pullback and breakout opportunities.

Revival of Real Safe-Haven Demand

Gold extended its bullish momentum last week, defying traditional expectations even as the U.S. dollar slid and stock markets whipsawed. With rising fears of a global economic slowdown and the reliability of the dollar as a hedge under scrutiny, investors rotated into gold — not away from it. Here’s what’s driving this move.

U.S. Dollar Weakness Deepens on Tariff Escalation

Dollar fails to act as a safe haven amid global uncertainty

- Trump’s new tariffs on Chinese imports scaling up to 125% rattled global markets, but rather than surge, the dollar slid — as traders questioned the U.S.’s credibility in trade and fiscal stability.

- China’s retaliation exhibits strength vs the US. This shows that despite US’ tariff efforts, China is not bothered.

- Recession warnings resurfaced, with declining U.S. consumer confidence and flattening yield curves. This weakened the dollar’s appeal, pushing capital into non-dollar alternatives like gold.

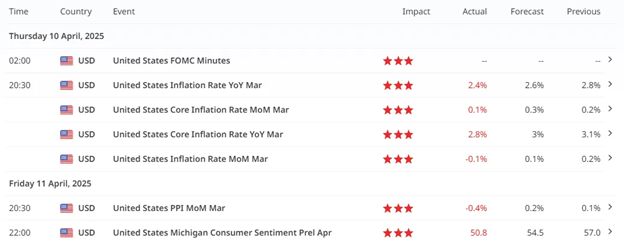

U.S. Red Folders Release Pulled Dollar Lower

While lower inflation is generally positive for economic stability, it can also signal slower growth momentum due to reduced pricing power. Importantly, lower inflation figures also decrease the likelihood of further interest rate hikes which makes investors to flock to alternative assets.

Consumer sentiment also tells us that confidence in the US markets are losing steam with all the tariff policies enacted ever since.

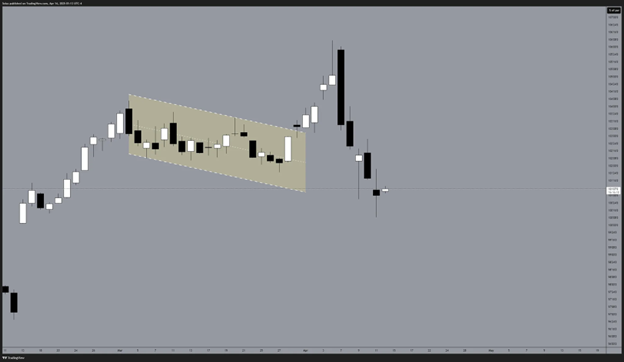

Volatility Index Showing Sustained Concerns

As tariffs continue to rattle global markets, investor fear and distrust toward the U.S. economy remain elevated, with the VIX still holding above the critical 30–35 range.

Despite brief rebounds, tariff-driven uncertainty is likely to persist, keeping pressure on U.S. sentiment and risk appetite.

US 10-Year Government Bonds Losing Steam as Investors Rotate to Other Markets, Safer Markets

US 10-year government bonds continued to edge lower as investors rotate to much safer markets vs the Dollar.

Full Scenario Matrix: VIX, Bonds, and Dollar — What It Means for Markets

| VIX | Bonds | USD | Market Mood | Equity Impact | Gold Impact |

|---|---|---|---|---|---|

| 🟢 | 🟢 | 🟢 | Panic, global flight to safety | Broad sell-off; defensive stocks may hold | Mixed — strong USD caps gold but safe-haven demand supports |

| 🟢 | 🟢 | 🔴 | Fear-driven, Fed may intervene | Sell-off but may bounce on dovish expectations | Bullish — weaker USD + risk aversion support gold |

| 🟢 | 🔴 | 🟢 | Stagflation or policy concern | Stocks drop; yields hurt valuations | Mixed to bearish — rising yields pressure gold |

| 🟢 | 🔴 | 🔴 | Crisis of confidence (risk-off + no faith in USD/bonds) | Severe correction; liquidity issues | Strong bullish — flight to gold over fiat or debt |

| 🔴 | 🟢 | 🟢 | Rate hike regime or economic optimism | Risk-on, equities rotate into value/cyclicals | Bearish — higher yields and USD reduce gold appeal |

| 🔴 | 🟢 | 🔴 | Dovish Fed but cautious optimism | Equities climb; tech may lag slightly | Mildly bullish — weaker USD helps gold, but low fear keeps demand muted |

| 🔴 | 🔴 | 🟢 | Unusual: risk-on but bond sell-off may be inflation-led | Equities may struggle with higher yields | Bearish — gold pressured by rising yields and USD |

| 🔴 | 🔴 | 🔴 | Easy policy, risk-on with liquidity tailwind | Stocks rally strongly | Bullish — gold rises with dollar weakness, even if VIX is low |

- 🟢 = Up

- 🔴 = Down

- VIX 🟢 = Fear

- Bonds 🟢 = Prices up, yields down (safe-haven buying or Fed support)

- USD 🔴 = Weak dollar (bullish for commodities like gold)

Gold Holds Ground as True Safe Haven

Metal sustains strength amid dollar weakness and macro stress

In reference to our previous forecast:

https://acy.com/en/market-news/market-analysis/gold-hits-record-highs-j-o-03312025-171122/

https://acy.com/en/market-news/market-analysis/gold-price-update-next-bull-run-j-o-03272025-113758/

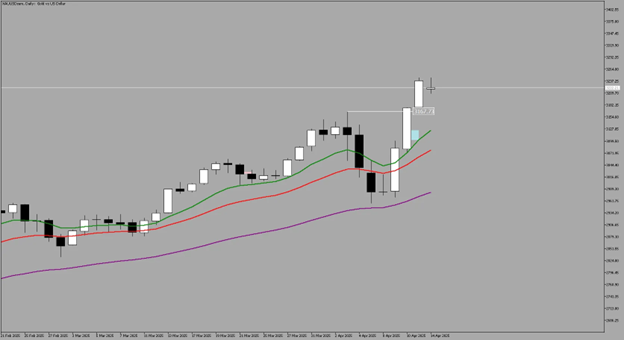

Daily

With all the narrative mentioned about the US market, particularly, on the US Dollar, Gold’s recent behavior suggests that it's decoupling from traditional dollar correlation and moving independently based on fear, inflation hedging, and distrust in fiat credibility.

Gold still remains in a bull run as dollar edges lower and market turmoil continue to persist.

Our targets of $3100 to $3200 has already been hit with the next target on the horizon resting at $3300.

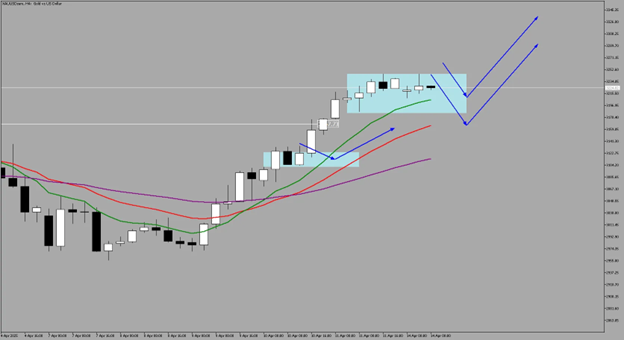

What to expect with Gold?

One thing is clear: If the markets are fearful, Gold upside will continue to be at play.

Potential Opportunities:

- Pullback at $3200 level - look for a bullish sequence.

- Breakout at $3250 level - look for a sustained bullish sequence.

As we continue to dwell on a risk-off sentiment, our goal as traders is to observe the narrative and trade with confirmation. Wait for technical setups. Wait for breaks and fakes. Look for opportunities at key levels.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next