Why Gold Is Considered a Safe Haven Asset (and When That Changes)

2025-07-18 11:16:19

Have You Ever Been Trading Gold… and Then the World Shifts?

Have you ever been trading gold and, out of nowhere, a war breaks out? Or maybe Trump fires off a tweet, or the Fed chair makes an offhand remark and suddenly, gold becomes wildly volatile, smashing through resistance levels and hitting new highs by the hour?

No technical indicator can hold it back. No fundamental forecast was prepared for that kind of move.

That’s the power of understanding Risk-On and Risk-Off market regimes. When you can recognize the shift in sentiment before the charts explode, you don’t just react you prepare. You capitalize.

To trade gold and forex effectively through CFDs, you need to understand why gold is considered a safe-haven asset (and when that changes), how capital flows respond to global fear or confidence, and what really drives FX pairs beyond short-term news.

Let’s break it down in real-world terms, with practical strategies so you can build a long-lasting edge.

What Is Risk-On vs. Risk-Off?

Markets don’t move in a straight line they shift based on sentiment. These shifts are often categorized as:

Risk-On Markets

This is when confidence reigns. Investors feel optimistic about the economy, company earnings, or global recovery. As a result, capital flows into riskier, growth-oriented assets:

- Stock indices rise (S&P 500, DAX, Nikkei)

- Commodity currencies like AUD, NZD, and CAD strengthen

- Emerging markets attract more capital

- Gold and safe havens like the USD or CHF often weaken

- The VIX (volatility index) tends to fall

Risk-Off Markets

This is when fear or uncertainty takes over from geopolitical conflict, inflation shocks, pandemics, or financial instability. Investors move into capital protection mode, favouring safe havens.

- Money flows into the USD, JPY, CHF, and Gold

- Equities sell off

- Emerging markets suffer capital outflows

- The VIX spikes

- Gold prices often rally aggressively

Being able to identify which regime the market is in and when it’s about to shift is one of the most powerful skills a CFD trader can build.

Risk-On vs. Risk-Off Market Conditions

| Indicator | Risk-On Market | Risk-Off Market |

|---|---|---|

| Investor Sentiment | Optimistic, confidence in growth, recovery, and earnings | Fearful – uncertainty from macro or geopolitical stress |

| Stock Indices | Rise (e.g., S&P 500, DAX, Nikkei) | Sell off, sharp declines |

| Currencies (FX) | AUD, NZD, CAD strengthen | USD, JPY, CHF strengthen |

| Emerging Markets | Attract capital inflows | Suffer capital outflows |

| Gold | Typically weakens | Rallies as a safe haven |

| Volatility Index (VIX) | Falls, low market fear | Spikes, rising market stress |

| Bond Yields (optional) | Rise, investors rotate into risk assets | Fall, flight to safety boosts bond demand |

| Commodity Prices | Often rise with growth optimism (e.g., oil, copper) | Can fall on global slowdown fears |

| Typical Causes | Economic recovery, tech innovation, strong earnings | War, inflation shocks, pandemics, banking crises |

Why Gold Shines During Risk-Off

Gold has a centuries-old reputation as a store of value. But in the modern CFD world, it’s more than that it’s a real-time gauge of global fear.

Here’s why gold typically outperforms when markets are in chaos:

- Gold is uncorrelated to risk assets: Unlike equities, gold doesn’t rely on earnings or corporate performance so no type of stocks release will interfere on it.

- No counterparty risk: In times of financial crisis, confidence in currencies or banking systems weakens. Gold doesn’t rely on anyone’s balance sheet. Therefore, whenever there is chaos on central banks or even banks crashing like we did had on COVID and 2023, it’s normal to see gold rising!

- Dollar hedge: Gold is priced in USD, so when the dollar weakens (or global faith in fiat currencies wavers), gold becomes a natural alternative.

But gold isn’t always bullish that’s key.

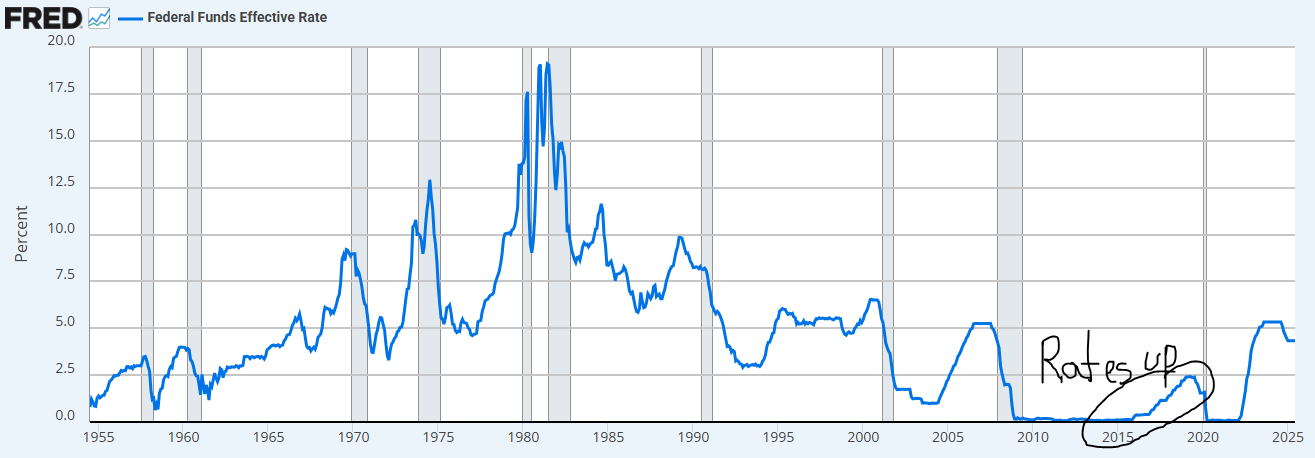

When real interest rates rise and central banks tighten aggressively, gold can underperform, even during volatile times. That’s why gold’s role as a safe haven isn’t fixed it’s conditional on broader economic forces.

How Capital Flows Drive These Regimes

One of the best ways to understand risk sentiment is to look at where money is flowing across countries, institutions, and individual investors.

Central Banks

- Adjust interest rates, driving capital toward or away from specific currencies.

- Accumulate or offload gold reserves often for strategic, long-term positioning.

- Use quantitative easing or tightening, which adds or removes liquidity from global markets.

When a central bank like the Fed raises rates sharply, global capital often floods into USD, especially during market stress. But when rates stabilize and inflation looms, central banks including China and Russia may increase their gold holdings, supporting prices.

Institutional Investors & Foreign Direct Investment (FDI)

- In risk-on environments, capital flows toward equity markets, growth currencies, and riskier regions.

- In risk-off phases, money repatriates into safer economies or is rotated into commodities and hard assets.

For example, hedge funds might reduce equity exposure and shift into gold ETFs or futures during volatile periods. That movement drives CFD volumes and influences price action.

High Net-Worth Individuals (HNIs) & Retail Capital

- HNIs often allocate 5–15% of their portfolios to gold as a long-term hedge.

- During inflation or crisis cycles, demand for both physical gold and CFDs spikes.

- Retail traders also seek refuge in gold CFDs when equities become too volatile to trade confidently.

Together, these flows create powerful waves of buying or selling and traders who recognize those tides early are in the best position to profit.

Key Indicators to Monitor for Sentiment Shifts

So how can you tell when the tide is turning? Here are the most reliable tools to track:

- Volatility Index (VIX): Rising VIX = rising fear = likely risk-off.

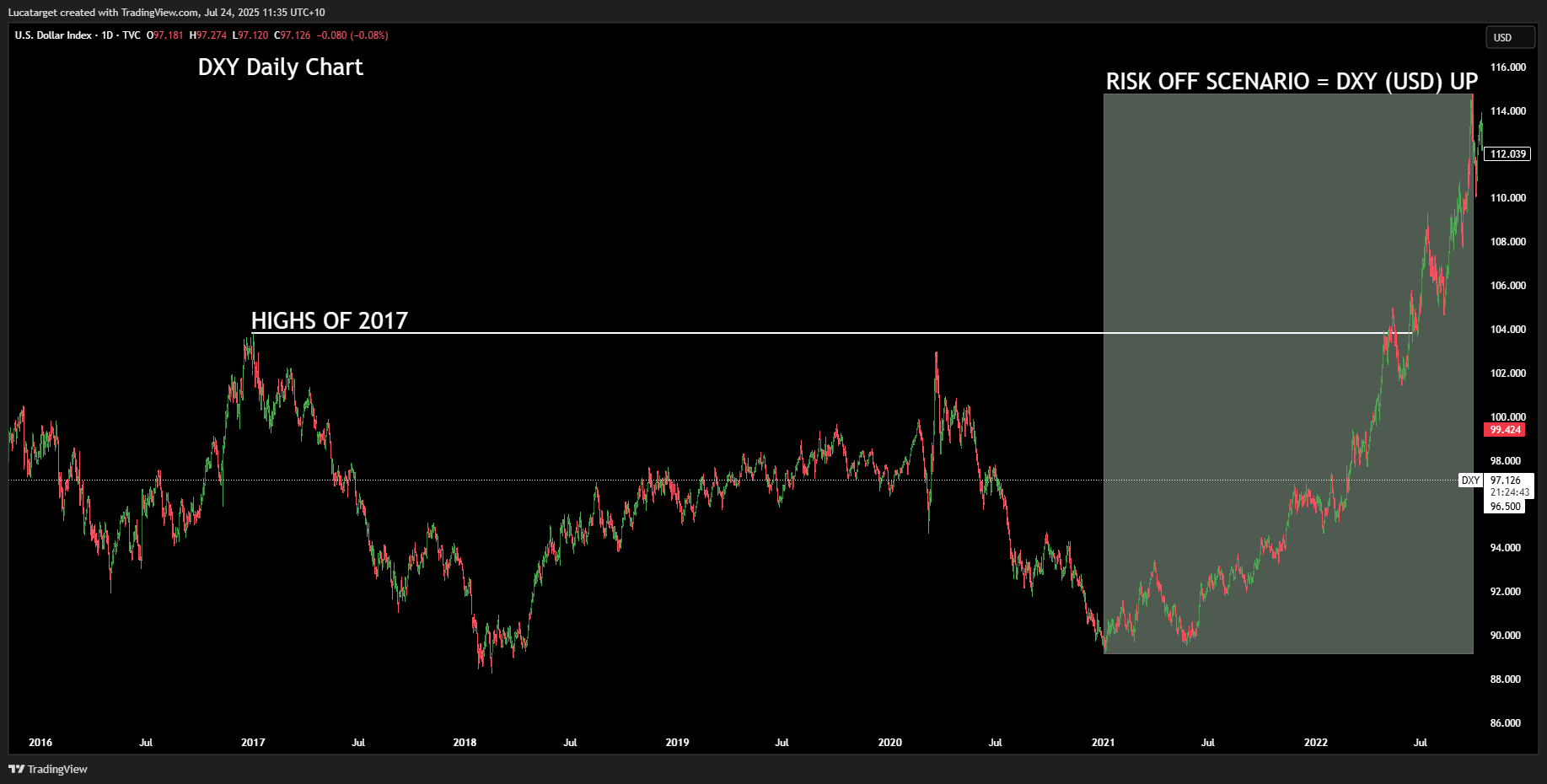

- USD Index (DXY): When DXY surges, gold often dips unless fear is overwhelming.

- Bond Yields & Real Rates: Rising real yields (interest rate minus inflation) tend to pressure gold; falling real yields support it.

- Economic Data: CPI, NFP, FOMC meetings can trigger sentiment shifts instantly.

- News & Geopolitics: Sudden escalations or policy shocks can spark rapid transitions from risk-on to risk-off.

Practical Trading Implications for CFD Traders

Let’s look at how this all plays out in real trades.

Scenario 1: Inflation Surprise

CPI comes in hotter than expected. Markets fear the Fed will respond aggressively. Yields rise, and the USD spikes.

How to trade:

- Long USD/JPY CFDs (safe-haven strength)

- Watch gold closely if yields spike too fast, gold may dip temporarily

- Prepare for gold rebound once inflation fear outweighs rate pressure

Scenario 2: Geopolitical Escalation

Military tensions or global conflict increases. Equities sell off. VIX spikes.

How to trade:

- Long XAU/USD CFDs

- Short AUD/USD or other risk-sensitive FX pairs

- Avoid overleveraging during extreme volatility

The best CFD traders don’t just react to volatility they anticipate it. By understanding risk-on and risk-off market dynamics, and by recognizing gold’s unique role within that structure, you gain the ability to trade ahead of the crowd.

So, the next time gold starts flying higher after a tweet, war, or inflation scare ask yourself not “what just happened?” but “was I positioned for this?”

Because with the right macro lens and risk sentiment awareness, you can stop chasing the move and start capturing it.

Q1: Why is gold considered a “safe haven” during times of market uncertainty?

A: Gold is seen as a safe haven because it has intrinsic value, no counterparty risk, and historically performs well during crises. When trust in currencies, financial institutions, or central banks erodes as during inflation shocks or geopolitical events investors often rotate into gold to preserve capital. Unlike stocks, gold doesn't depend on earnings or corporate health, making it more stable during systemic stress.

Q2: Can gold prices fall even during a crisis?

A: Yes, and that’s a key nuance. While gold often rallies during risk-off events, it can underperform if real interest rates are rising. When central banks like the Fed hike aggressively, higher yields make bonds more attractive relative to non-yielding assets like gold. In such environments, even amid uncertainty, gold may stagnate or decline temporarily.

Q3: What’s the difference between “Risk-On” and “Risk-Off” in financial markets?

A: “Risk-On” refers to periods of investor confidence capital flows into equities, emerging markets, and riskier currencies like AUD or NZD. “Risk-Off” signals fear or instability money shifts into safe havens like gold, USD, JPY, and bonds. Identifying these shifts helps traders position ahead of volatility, rather than reacting after the fact.

Q4: How do central banks and institutions influence gold through capital flows?

A: Central banks influence capital flows through interest rate policy, liquidity management, and gold reserve adjustments. For example, aggressive rate hikes by the Fed typically attract capital into USD, which may pressure gold. Conversely, institutions often increase gold exposure via ETFs or futures during instability amplifying gold’s movement in CFD markets.

Q5: What indicators should CFD traders watch to anticipate gold moves?

A: Key indicators include the VIX (for volatility), DXY (for dollar strength), real bond yields, and macro releases like CPI or FOMC statements. Sharp movements in these metrics often precede regime shifts. For instance, a spike in the VIX or a geopolitical escalation could be a signal that gold is about to enter a risk-off rally phase.

Further Reading: Deepen Your Trading Knowledge

Continue sharpening your market analysis and trading strategies with these hand-picked guides across gold, macroeconomics, risk sentiment, and trading psychology that I’ve wrote!

Gold Trading & Strategy

- Gold in War Times – XAUUSD Historical Guide

- Gold & CPI/NFP – Sentiment and Trader Insights

- XAUUSD Forecast: CPI, NFP and Outlook

- When to Trade XAU/USD – Time Zones & Sessions

- Why Fundamentals Matter in Gold Trading

- XAUUSD vs Cryptocurrency – Safe Haven Comparison

- China Reserves, Basel III and the XAUUSD Structure

- Geopolitical Conflicts and Gold in 2025

- XAUUSD in Market Crashes and Surge Conditions

Risk Sentiment & Global Events

- How to Trade Risk-On and Risk-Off Markets

- Global Events Impacting Financial Markets

- Israel-Iran Conflict and Oil Price Impact

- Understanding Market Context – Why It Matters

- Trading News Events – How the Market Reacts

- Sentiment Analysis – A Trader’s Strategy Guide

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next