Simple Forex Trading Strategy Revealed

2021-11-03 15:44:07

Bollinger bands are a forex trading strategy that forex traders have been using for years. The idea behind this forex trading strategy is to use Bollinger bands to enter and exit the market at the right time.

This forex trading strategy entry technique will show you how to take advantage of opportunities in forex markets, while minimizing risk. Join Duncan Cooper in the video below, as he outlines a strategy you can backtest across multiple timeframes and calculate your risk reward on each trade.

In this video, Duncan will demonstrate how this strategy for forex trading can be used on a daily chart as well as a 4-hour chart. You will also see both winning and losing trading scenarios, so your expectations for the strategy are consistent with recent price action.

The Importance of Finding Solid Risk Reward Trading Opportunities

Finding solid risk reward trading strategies is crucial because forex traders are always looking for the highest reward possible given the risk taken.

Trading forex with Bollinger bands can potentially put the odds in your favour when trading forex by offering entry opportunities that have a high probability of yielding favourable results.

The two most important components to finding solid forex trading opportunities is to find trending markets and to limit your risk.

Trading forex with Bollinger bands can help forex traders find trending markets by using this forex trading strategy entry technique to identify market extremes and breakouts.

Trading forex is not just about finding opportunities, it's also important the reward outweighs the risk being taken on for each opportunity found.

This forex trading strategy, combining both entries and exits, can help forex traders limit their risk by using Bollinger bands to set their stop losses.

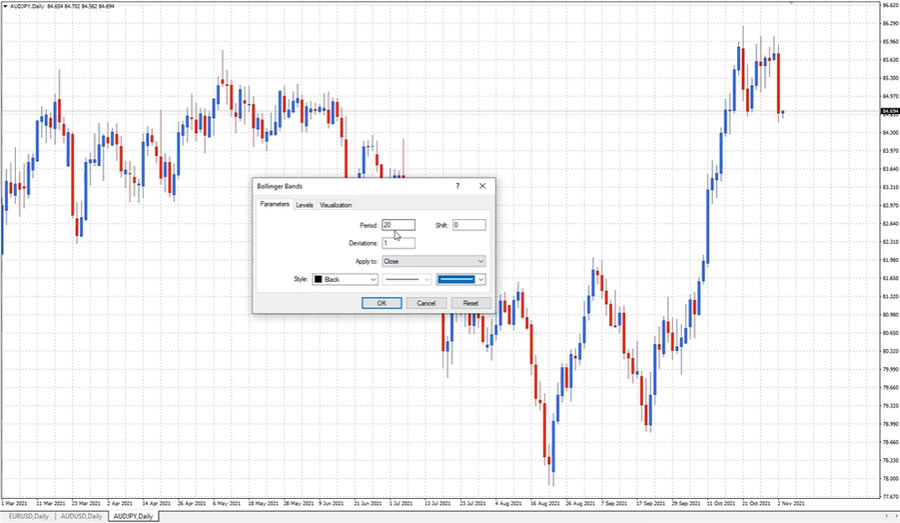

In the video, Duncan doesn't use the standard settings for this simple forex strategy. Instead, he changes the number of standard deviations.

Let's dive into some details on Bollinger bands.

Forex Trading Strategy: How to Trade Forex with Bollinger Bands

Bollinger bands are one of the most popular technical indicators in forex trading. These bands show traders where prices have been and where they might be going by drawing a line two standard deviations away from a simple moving average.

This is why Bollinger bands can help traders identify trends before they happen.

In this post, we’ll give you 3 reasons why it's important to use Bollinger bands when trading forex, plus step-by-step instructions on how to read them.

Top Three Reasons Traders Use Bollinger Bands

There are many benefits to using Bollinger bands when trading forex, and these Bollinger bands can be used in any time frame. Here are the top three reasons traders use Bollinger bands in their trading plan.

- Identifying support and resistance levels in the market

- Finding volatility areas to trade (expansion or contraction)

- Showing overbought/oversold conditions for an asset.

What is a Bollinger band?

A Bollinger band is a technical indicator, which draws upper and lower limits on price movement.

Bollinger bands are used to help identify emerging trends in the market as well as volatility levels for trading decisions. They can also be used to determine overbought or oversold conditions of an asset.

Who created the Bollinger band?

John Bollinger created Bollinger bands in the early 1980s, and they quickly became popular as a technical analysis indicator. John wrote a comprehensive book on them as well.

How do Bollinger bands work?

A Bollinger band is comprised of three components:

- an upper limit (Upper BB);

- lower limit (Lower BB); and

- a simple moving average line (Middle BB).

When the Bollinger bands are placed around a price chart, they help to identify areas of support and resistance. The Bollinger band width changes based on volatility.

The Bollinger bands expand or contract as volatility increases or decreases respectively, so traders can know what range prices have been trading within most recently.

Traders can also use Bollinger bands to identify overbought or oversold conditions in the market.

Step-by-step instructions for reading Bollinger bands:

Traders should first find a chart that they want to read Bollinger bands on, then choose an asset and timeframe that will provide useful information when studying Bollinger bands.

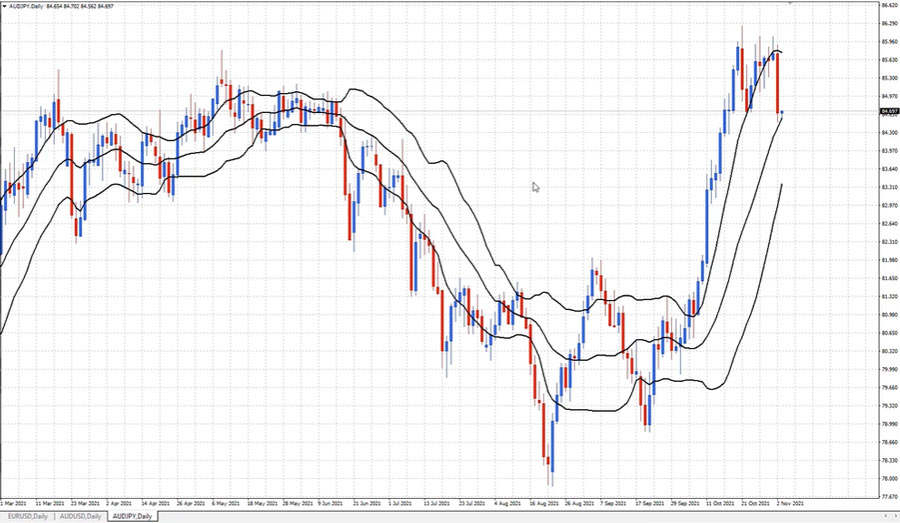

You will see in the video above, Duncan uses the AUDJPY pair on a daily chart before moving to a 4-hour chart.

Upper Bollinger band:

The middle of the upper Bollinger band is created by drawing a simple moving average across n number of periods, usually 20 to 50. If you are looking at an hourly chart, you would use a 20-period simple moving average.

You can choose any time period you like, and it is always good to experiment based on your preferred time frame.

The upper Bollinger band is then drawn two standard deviations away from the middle Bollinger band, which creates a channel on either side of the moving average. Remember, Duncan is using 1 standard deviation.

When prices are trading within this range (upper Bollinger band), it indicates that volatility has been relatively low.

Middle Bollinger band:

The Bollinger bands are created by drawing a simple moving average across n number of periods. Traders can choose any time period they like for this and then add the deviation (i.e. upper Bollinger + two standard deviations).

Lower Bollinger band:

This is pretty simple because all you need to do is draw a simple moving average across n number of periods, in the same way as you did for the Bollinger bands. Then add two standard deviations to it (lower Bollinger + two standard deviations).

3 Reasons to use Bollinger Bands in your Trading System

Traders use Bollinger bands to help identify low and high volatility areas of a market. This can be very helpful when there might not be any clear lines on the price chart that show where support or resistance levels are for an asset.

When Bollinger bands contract, it suggests prices are in consolidation and could be ready to break out of that consolidation.

Identifying strong trending opportunities

As you can see in the video, we don't know when a market is going to trend strongly. But using Duncan's method of entry, confirming a close above the upper band, it is possible we capture the start of a strong uptrend.

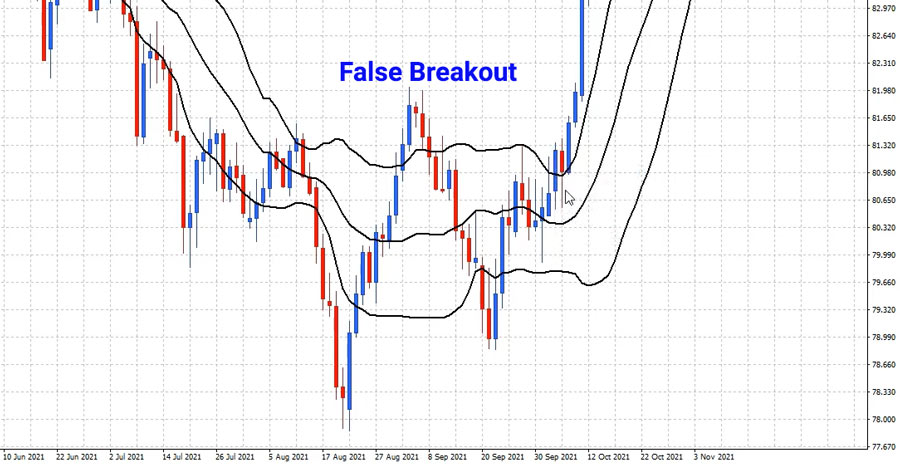

Will you encounter false breakouts? Yes.

But that is why the stop loss strategy, and a sensible position size strategy will help potentially put the odds in your favour.

The key is, when you get a sell signal, you take action and exit the trade. This keeps your level of risk in check and living to fight another day.

Identifying Overbought and Oversold Marketing Conditions

Bollinger bands can also help traders detect overbought and oversold market conditions. Many traders use oscillators like the stochastic or RSI, but you can also use Bollinger bands in a similar way.

You will notice when a market is range-bound and going sideways that the market sells from the upper band and often moves down through the middle band to the lower band.

This could also be a good way to identify range-bound trading opportunities.

What to do next with this Forex trading strategy

Now you have the trading strategy, it is time for you to backtest it. Grab a demo account and start your backtesting.

By testing your forex trading strategy on historical data, you will be able to see the actual performance of this forex trading system and whether it is worth using in live market conditions.

If you haven't already, then you can grab a live MetaTrader 4 or MT5 trading account and start placing real trades with low levels or risk and build your confidence.

And expand your reach by testing it on indices, gold, share CFDs and digital currencies.

To register for Duncan's extensive trading education webinars and to get access to his indicators, go to https://acy.com/en/education/webinars

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next