Manual Day Trading vs. MT5 Automated Trading: Which Style Is Better For Your Trading Style?

2025-09-22 16:19:38

Last Updated: September 22, 2025

This article is reviewed annually to reflect the latest market regulations and trends

TL;DR (Too Long; Didn’t Read)

- Manual Trading's Edge is Adaptability: A manual trader's greatest strength is their intuition and ability to adapt to unexpected news or nuanced market conditions where rigid algorithms might fail.

- Automation's Edge is Discipline: Automated MT5 systems (EAs) provide unwavering psychological discipline, executing trades based on pure logic, speed, and consistency, eliminating costly emotional errors like fear and greed.

- Market Conditions Dictate Success: No single style is superior in all situations. Automated trend-following systems excel in clear, trending markets, while discretionary manual traders often have an advantage in choppy, news-driven, or unpredictable environments.

- Psychology is the Deciding Factor: For most traders, the primary point of failure is not a bad strategy but the inconsistent, emotional application of a good one. Automation's core benefit is managing the trader's own self-sabotaging instincts.

- The Hybrid Approach is Ultimate: The most effective and sustainable path combines human strategic oversight with automated execution. The trader acts as the "strategist," designing the rules, while the machine acts as the "tactician," flawlessly enforcing them.

How to Install Metatrader Scripts in your MT4 Trading Platform

"The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor." - Jesse Livermore

Manual Day Trading vs. MT5 Automated Trading: Are You a Strategist or Just a Button-Pusher?

Is manual day trading a relic of the past, powered by flawed human emotion? Or is automated MT5 trading a rigid, unthinking machine destined to break in the face of market chaos? For years, traders have debated which style is truly more effective. But this question presents a false choice. The battle isn't between human and machine; it's between discipline and impulse, strategy and guesswork.

The uncomfortable truth is that most traders fail not because their strategy is wrong, but because they become the weakest link in its execution. This guide dives deep into the psychological and logical frameworks of both manual and automated trading. We'll explore not just which is better, but for whom, under what conditions, and how the ultimate trader forges an unbeatable edge by combining the best of both worlds into a powerful hybrid system.

What are the Psychological Strengths and Weaknesses of Manual Trading?

Manual trading is the traditional art form of the market speculator. It's an exercise in balancing the brilliant, creative power of the human mind against its most crippling psychological flaws.

The Trader's Edge: Intuition and Supreme Flexibility

The core advantage of a manual trader is something that cannot be coded: intuition. This isn't magic; it's a highly advanced form of pattern recognition developed over thousands of hours of screen time. An experienced trader can sense the "feel" of the market, interpreting subtle nuances in price action that a purely quantitative algorithm would miss.

This strength becomes a critical survival tool during "black swan" events. When unexpected geopolitical news breaks or a central bank makes a surprise announcement, a manual trader can instantly assess the new landscape and adapt. They can choose to cut a position, stay out of the market entirely, or even reverse their stance,a level of dynamic flexibility that rigid automated systems simply cannot replicate.

The Trader's Enemy: Your Own Mind

For every advantage the human mind offers, it lays a dozen traps. The immense pressure of managing real money triggers a predictable set of cognitive and emotional biases that are the primary cause of retail trader failure.

- Emotional Biases:

- Fear and Greed: The two great saboteurs. Fear causes you to snatch small profits from winning trades too early, while greed (and its cousin, loss aversion) convinces you to hold onto losing trades far past your stop-loss, hoping for a miraculous turnaround.

- FOMO (Fear of Missing Out) & Revenge Trading: FOMO pushes you into impulsive, poorly planned trades during a fast-moving market. After a painful loss, the desire to "make it back" can lead to "revenge trading",wild, oversized bets that abandon all strategic discipline, a pattern dangerously similar to problem gambling.

- Fear and Greed: The two great saboteurs. Fear causes you to snatch small profits from winning trades too early, while greed (and its cousin, loss aversion) convinces you to hold onto losing trades far past your stop-loss, hoping for a miraculous turnaround.

- Cognitive Biases:

- Confirmation Bias: Seeking out information that confirms your existing trade idea while ignoring all evidence to the contrary.

- Overconfidence Bias: After a string of wins, your brain tricks you into believing you can't lose, leading to excessive risk-taking and sloppy execution.

- Hindsight Bias: Looking at a past chart and believing an outcome was obvious, which distorts your perception of your actual predictive skill.

- Confirmation Bias: Seeking out information that confirms your existing trade idea while ignoring all evidence to the contrary.

The central paradox of manual trading is this: your discretion is both your greatest strength and your most profound weakness. Under pressure, it's nearly impossible to tell if your "gut feeling" is true market intuition or just your loss aversion talking you into breaking a rule.

What are the Logical Pros and Cons of an Automated Trading System?

Automated trading, typically through Expert Advisors (EAs) on MT5, is a shift from subjective art to objective science. It seeks to replace human psychological frailty with the cold, hard precision of code.

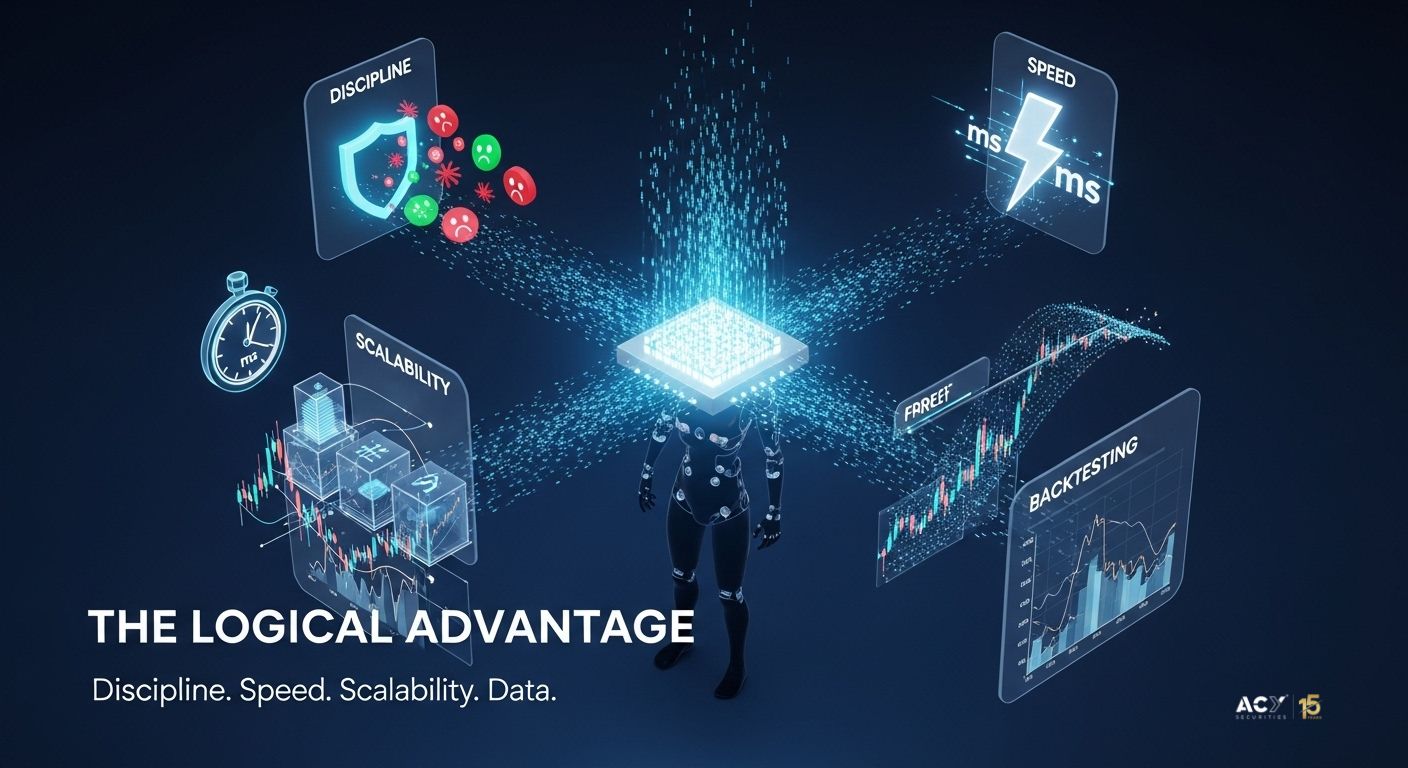

The Logical Pros: Unwavering Discipline, Speed, and Rigorous Backtesting

Automation's advantages are a direct solution to the manual trader's biggest weaknesses.

- Perfect Discipline: An EA executes its strategy 24/5 without fear, greed, hesitation, or fatigue. It enforces your trading plan with absolute consistency, which is the foundation of long-term profitability.

- Execution Speed: In the forex market, milliseconds matter. An EA can react to data and execute an order at a velocity no human can match, minimizing slippage and capturing fleeting opportunities.

- Scalability: A single automated system can scan and trade dozens of currency pairs and strategies simultaneously, a workload impossible for a manual trader.

- The Power of Backtesting: This is arguably automation's greatest strength. Before risking a single dollar, you can test your strategy on years of historical data to understand its statistical performance,win rate, average profit, and maximum drawdown. This data-driven validation is a world away from the manual trader's need to test ideas with real money on the line.

The Logical Cons: Rigidity and Technical Fragility

The strengths of automation are mirrored by its weaknesses.

- Strategic Rigidity: An EA is not intelligent; it is obedient. It cannot adapt to a market event that falls outside its programmed logic. A fundamental shift in market conditions can render its rules invalid, leading to catastrophic failure.

- Over-Optimization (Curve-Fitting): This is the most dangerous trap in automated trading. It involves tweaking an EA's parameters until it produces a perfect backtest on historical data. The result is a system that has been fitted to past random noise, not a robust market edge, and it fails the moment it encounters live market conditions.

- Technical Failure: An automated system is completely dependent on technology. A power outage, loss of internet, or a server failure can lead to disaster if a trade is left unmanaged.

How Would Jesse Livermore View the Manual vs. Automated Debate?

Jesse Livermore, the legendary speculator from the early 20th century, was the quintessential manual trader. He relied on his feel for the market, his immense discipline, and what he called "reading the tape." Yet, if he were trading today, he would likely be a master of the hybrid approach.

Livermore's genius was not in his gut feelings, but in the systematic rules he developed to govern his actions. Consider his core tenets:

- "Markets are never wrong – opinions often are." He waited for the market's action to confirm his thesis before entering. This is the logic of an automated signal,the system waits for predefined conditions to be met before executing.

- "Money is made by sitting, not trading." He fought the urge to trade every day, waiting patiently for the "pivotal points" that offered clear, high-probability opportunities. An automated scanner or alert system perfectly embodies this principle, monitoring the market 24/7 and only notifying the trader when their precise conditions are met.

- "The human side of every person is the greatest enemy." Livermore knew that emotion was the speculator's downfall. He would have immediately recognized the value of an automated execution tool that could place his trades and manage his stops without the interference of fear or hope.

- "Never average losses." This was his cardinal rule. He would have loved automated risk management scripts that enforce perfect position sizing and stop-loss placement, making it impossible to break this crucial rule in a moment of weakness.

Livermore would not have used a "black box" EA to trade for him. His role as the strategist,the one who reads the overall market environment,was paramount. However, he would have embraced automation as the ultimate tool for enforcing the discipline he so famously preached. He would have designed the strategy and let the machine handle the flawless, unemotional execution.

10 Lessons from Van K. Tharp's "Trading Beyond the Matrix"

Dr. Van K. Tharp, a renowned trading coach, took the psychological insights of traders like Livermore and turned them into a science. His book, Trading Beyond the Matrix, is a masterclass in how to engineer trading success. Its lessons are the perfect blueprint for the modern hybrid trader.

- You Don't Trade the Market, You Trade Your Beliefs About the Market: Your results come from your internal state, not external events. The first step is to work on your own psychology.

- You Are 100% Responsible for Your Results: Stop blaming the market, your broker, or "bad luck." Total accountability is the only path to improvement.

- Your Job is to Be a Master of Yourself: The most significant edge you can gain is by understanding and overcoming your own biases, fears, and limiting beliefs.

- Define Your Objectives Clearly: What are you trying to achieve? Your trading system is simply a vehicle to meet those objectives. Without clear goals, you are directionless.

- Achieve Your Objectives Through Position Sizing: Tharp argues that position sizing is the most critical component of any trading system,more important than entries or exits. This is a purely mathematical, rules-based task perfect for automation.

- A Great System Has Six Key Parts: Tharp outlines the importance of having a complete system, including beliefs, setup (opportunity), entry, stop-loss, re-entry, and exit. A hybrid approach allows you to define these parts and have a machine execute them.

- Know Your System's Expectancy: You must have a statistical understanding of your system's performance. This is only possible through rigorous backtesting,a core strength of automated development.

- Transform Yourself to a Higher Level of Consciousness: Move beyond trading from fear and greed and operate from a state of acceptance, clarity, and even joy. Automating the mechanical parts of trading frees up mental energy for this crucial "inner work."

- Mistakes Are Unexecuted Rules: Any time you don't follow your documented trading plan, you have made a mistake. Automation is the ultimate tool for mistake-proofing your execution.

- Transformation is the Goal: The goal isn't just to make money; it's to transform yourself through the metaphor of trading. A well-designed hybrid system is a tool that facilitates this transformation by enforcing discipline and freeing you to focus on high-level strategy and self-development.

In Which Market Conditions Does Each Style Typically Excel?

The profitability of any trading style depends entirely on the current market "regime." The master trader knows which tool to use for the job.

- Clear Trending Markets (Bull or Bear): Automated Systems Win. In markets with strong, sustained directional moves, a simple trend-following EA has a massive edge. It will systematically capture the majority of the move without the emotional temptation to exit too early or the fear of re-entering on a pullback, mistakes manual traders make constantly.

- Choppy, Ranging Markets: Manual Traders Win. Sideways, directionless markets are toxic for trend-following algorithms, which get chopped up by false breakout signals. A discretionary trader can recognize the lack of a clear trend and make the crucial decision to either stay out completely or switch to a range-trading strategy, a nuanced choice that is difficult to code.

- High-Volatility News Events: A Double-Edged Sword. An automated system can react to a data release in microseconds, but this speed is a liability if the event is unprecedented. The manual trader has the critical advantage of context. They can interpret the news, decide to flatten their positions before an announcement, and adapt their strategy to the new reality afterward, making flexibility a key component of risk management.

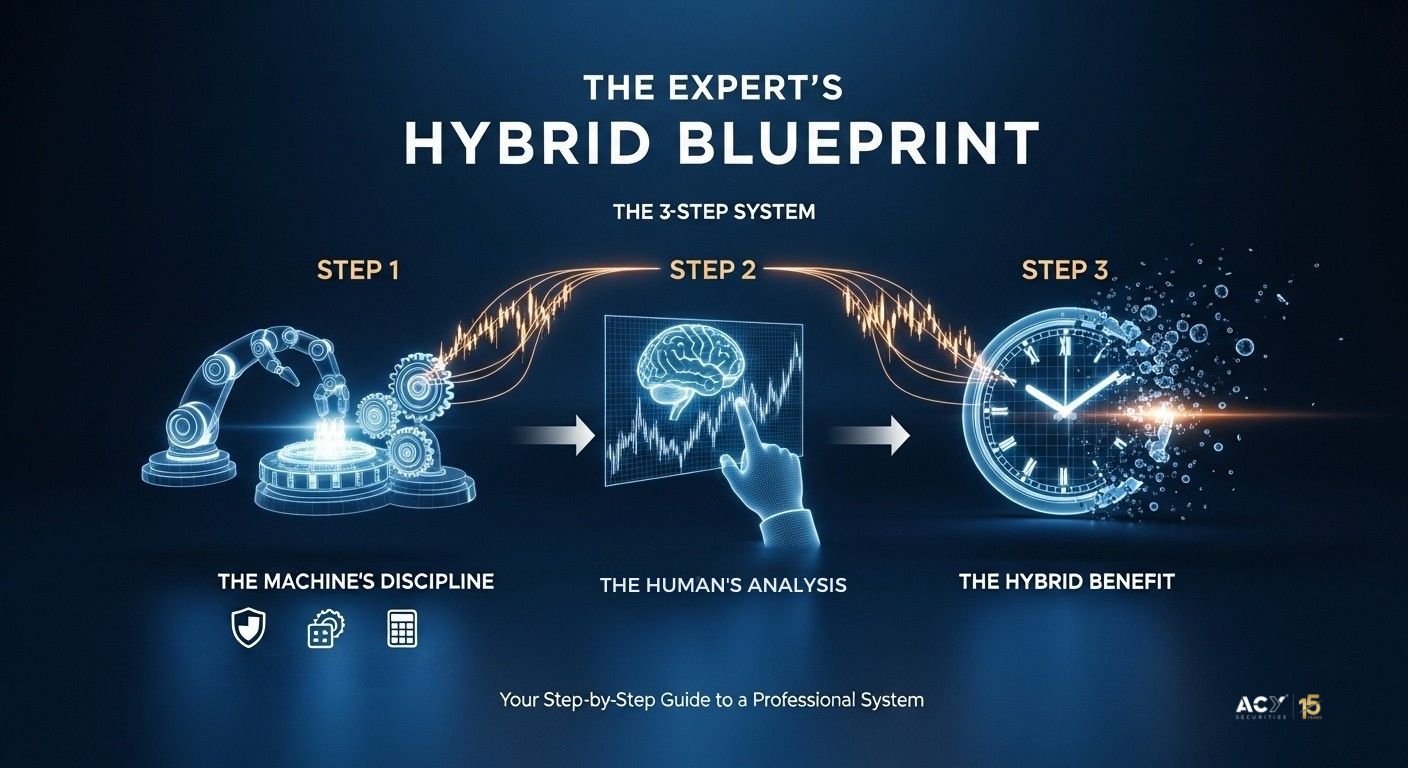

The Verdict: Why a Hybrid Approach Is the Most Effective of All

The debate is over. The evidence is clear: the most effective, resilient, and sustainable trading style is a hybrid synthesis of human and machine.

This model creates the optimal division of labor:

- The Human is the Strategist: Your job is elevated. You perform the tasks of creativity, big-picture analysis, and adaptation. You research new strategies, identify the current market regime, and decide which automated tools to deploy. You set the rules.

- The Machine is the Tactician: The MT5 EA or script is the flawless executor. It monitors the market for the exact conditions you defined, executes orders with precision, and manages risk with perfect, unemotional discipline. It enforces the rules.

This approach transforms you from a stressed-out "button-pusher" into a calm, objective "systems architect." You are no longer reacting to every price tick; you are managing the system that trades the market. This psychological distance is the final, crucial step to becoming a professional.

Your Blueprint for Building an Expert Hybrid System with ACY.com

Historically, building a hybrid system was out of reach for beginners. But platforms like ACY.com have changed the game by providing a full suite of professional-grade MT5 tools for free. You don't need to be a coder; you just need the right blueprint.

Here’s how you can start building your expert-level hybrid system today.

Step 1: Automate Your Discipline (The Machine's Role)

The first and most important step is to use automation to enforce perfect risk and trade management. As you'll learn from our guide on how to use MT4/MT5 indicators for risk management, success starts with defense.

- Automate Position Sizing: Use the Calculate Your Lots indicator to perform perfect, unemotional position sizing on every single trade. It automatically calculates the correct lot size based on your account balance, risk percentage, and stop-loss, neutralizing the #1 cause of blown accounts.

- Automate Your Exits: Use the Script Close All to instantly liquidate all positions before a major news event. Employ a Trailing Stop EA to systematically lock in profits as a trade moves in your favor, conquering the fear and greed that lead to poor exits.

Step 2: Augment Your Analysis (The Human's Role)

Next, use indicators to build an objective framework that supports, rather than replaces, your market analysis. The goal is to see the market clearly, free from bias. Custom indicators are key to becoming a smarter, more objective trader.

- Visualize Market Structure: Use tools like the Auto Trendline and Advanced Pivot Points indicators to automatically draw objective support and resistance levels. This removes the guesswork and subjectivity from your chart analysis.

- Gain Multi-Timeframe Context: Employ the Multi-Timeframe RSI or Moving Average indicators to see the dominant long-term trend on your short-term execution chart. This professional technique ensures you are always trading with the primary market flow.

Step 3: Liberate Your Time (The Hybrid Benefit)

Finally, this system frees you from the screen. By using MT5's native alerts, you can be notified when the price reaches a key level identified by your tools. This allows you to reduce screen time and trade with more freedom. You do your analysis, set your alerts, and let the system do the tedious work of market monitoring.

How to Install Your MT5 Toolkit: A Simple Step-by-Step Guide

Installing these powerful tools from sources like the ACY.Cloud Download Center is simple.

- Download the Tool: Get the .mq5 (source code) or .ex5 (executable) file for your indicator or script.

- Open Data Folder in MT5: In your MT5 terminal, go to File > Open Data Folder.

- Place the File: Navigate to the MQL5 folder, and then place the file in the appropriate subfolder (Indicators for indicators, Scripts for scripts).

- Refresh Your Navigator: Back in MT5, right-click on "Indicators" or "Scripts" in the Navigator panel and select "Refresh."

- Apply to Chart: Drag your new tool from the Navigator panel onto any chart to begin using it.

Your Professional Hybrid Trading Toolkit

The table below outlines some of the essential MetaTrader scripts and indicators available from providers like ACY.com and TradingByte that form the foundation of a professional hybrid system.

| Tool Name | Tool Type | Primary Function | Strategic Benefit for the Hybrid Trader |

| Risk & Trade Management Tools | |||

| Calculate Your Lots | Indicator | Automatically calculates the correct trade volume (lot size) based on stop-loss distance and pre-set risk percentage. | Enforces perfect, consistent position sizing, the cornerstone of capital preservation. Removes emotion and guesswork from risk management. |

| Script Close All | Script | Closes all open positions and deletes all pending orders with a single click. | Allows for instant, decisive risk mitigation during high volatility or before news events, preventing emotional hesitation. |

| Trailing Stop | Expert Advisor | Automatically adjusts the stop-loss level as a trade moves into profit. | Systematically locks in unrealized profits without manual intervention, overcoming the fear of giving back gains or the greed of not taking profits. |

| Close By Profit Or Loss | Expert Advisor | Monitors and closes a basket of trades to achieve a net positive result by offsetting losses with gains. | Provides an advanced, automated method for managing complex positions and recovering from drawdown. |

| Analytical & Contextual Tools | |||

| Auto Trendline | Indicator | Automatically identifies and draws significant trendlines on the chart. | Provides an objective view of the market trend, removing the subjectivity and bias of manually drawing lines. |

| Advanced Pivot Points | Indicator | Automatically calculates and plots key daily support and resistance levels. | Offers a clear, predictive map of potential price reaction zones for objective targets and entries. |

| Multi-Timeframe MA | Indicator | Displays an indicator's value from a higher timeframe on a lower timeframe chart. | Ensures short-term trading decisions are aligned with the dominant long-term trend, a key professional discipline. |

| Colorful MACD | Indicator | An enhanced MACD that uses color variations to visually display changes in momentum and trend. | Makes trend analysis more intuitive and efficient, allowing for quicker assessment of market movements. |

| Periodic Separator | Indicator | Draws vertical separator lines on the chart for different time periods (e.g., daily, weekly, monthly). | Helps in cyclical analysis by making it easy to see and compare market performance across different time intervals. |

| Execution & Efficiency Tools | |||

| Timer | Indicator | Displays a countdown timer showing the time remaining until the current candle closes. | Crucial for traders who need precise timing for entries and exits at the open of a new candle. |

| Delete all Objects Script | Script | Removes all graphical objects from the active chart with a single click. | Instantly de-clutters the workspace, allowing for a clean and focused analysis of pure price action. |

| History Simulator | Script | Allows a trader to replay historical market data tick-by-tick within the MT5 platform. | Provides a powerful environment for manually backtesting and practicing a strategy in simulated real-time conditions without risking capital. |

| Quickly Close Charts | Script | Closes all charts for a specific symbol or all open chart windows at once. | Dramatically improves workflow efficiency and helps traders quickly organize their digital workspace. |

Final Thoughts: Stop Trading, Start Managing

The question was never manual vs. automated. It was about finding a framework that maximizes your strategic edge while protecting you from your own worst instincts. This is the key to simplifying your trading for a stress-free process. A purely manual approach is psychologically brutal, and a purely automated one is strategically fragile.

Sustained trading is found in the hybrid model.

By embracing this synthesis,where your human intellect directs a disciplined, automated tactician, you fundamentally change your role. You stop being a gambler reacting to blinking lights and become the manager of a sophisticated trading business. Ecosystems like ACY.com provide the tools to build this professional framework from day one, giving you the best possible foundation to cultivate the discipline, process, and mindset required to finally become a consistently effective expert.

Frequently Asked Questions (FAQ)

Q1: Is automated trading actually effective?

Yes, automated trading can be highly effective, but it is not a "get rich quick" solution. Its profitability depends on a statistically robust strategy, proper risk management, and an understanding that no system works in all market conditions. Its primary benefit is removing destructive emotions and enforcing perfect discipline, which are key to long-term success.

Q2: Can a beginner use automated trading?

Absolutely. In fact, beginners can benefit the most from automation's discipline. By using tools for automated risk management (like lot size calculators) and trade execution, beginners can avoid the most common psychological errors that cause early failure. The key is to start with a hybrid approach, using automation to enforce rules while focusing on learning market analysis and strategy.

Q3: What is the best trading style for forex?

There is no single "best" style. The optimal style depends on the trader's personality, time commitment, and the current market environment. However, a hybrid approach that combines the strategic flexibility of manual trading with the disciplinary advantages of automation offers the most robust and adaptable framework for consistently navigating the forex market.

Q4: Is manual trading dead?

No, manual trading is not dead, but its role has evolved. Purely discretionary "gut feel" trading is incredibly difficult to sustain. The modern successful manual trader is a "hybrid" trader who uses automated tools to augment their analysis, manage their risk, and execute their trades, freeing them to focus on high-level strategic decisions.

Q5: Where can I find good MT5 indicators and scripts?

Many brokers, like ACY.com, offer a suite of professional-grade MT5 indicators and scripts for free to their clients through portals like the ACY.Cloud Download Center. This is often the best place to start, as the tools are curated and designed to work within their trading environment, helping you avoid the risk of unverified or poorly coded third-party tools.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next