A Whopping 6% Fed Funds Rate and Even Higher.

2022-12-05 10:05:12

We have just had one of the most turbulent intra-day trading weeks in US stocks in history.

As the dust settles, for some with joy, for many, both bulls and bears, some mauling wounds, we are left with a little bit of a stare-off between the two sides.

After the vicious rally of Thursday, I was bearish, we have seen significant percentage movements in both directions, ending us back in that immediate post rally range. Making it difficult to decipher which way the next dominant momentum shift will take us. Friday’s close in New York did turn heavy, quite heavy, and after an afternoon session rally at first.

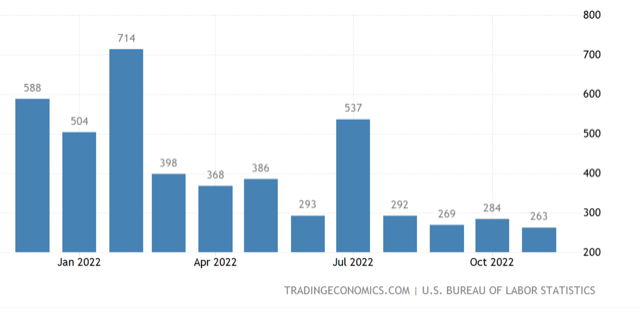

Why does all this price action analysis matter? Because we are trying to figure out just what is the dominant economic sentiment flavour of the moment. We know the true background is one of continuing economic crunch. The US Non-farm payrolls remained above their usual pre-Covid levels suggesting a strong economy. However, employment is the ultimate lagging indicator of where an economy is truly at, and every other economic data series in the playbook is decidedly worrisome and showing further deterioration.

The only true fundamental relief comes from the idea that poor data will mean the Fed's slowing to 50 points, quickly becomes 25 points, and even a complete stop. Don’t get me started on the ‘pivot’, as this was always a complete non-starter and a joke. I mean, I literally laughed every time I heard it, and still do.

Nevertheless, generally poor economic data will at some point give the Federal Reserve greater pause for thought. That point however, is a very long way off. Far off enough to make it nonsensical for any immediate decisions regarding markets. Some continue to argue the nonsense ‘pivot’, but it just ain’t happening.

Today, we have the linger of the NFP, which only actually further encourages aggressive Fed rate hikes. By aggressive, and let there be no mistake, 50 point rate hikes are historically aggressive, I also mean we are going to a whopping 6% for the Fed Funds Rate, and even higher.

Previously, I have mentioned the risk to 7.5%. Based on what the Fed itself is saying loudly and clearly about wanting to slow the economy and jobs, and the evolution of inflationary pressures, albeit moderating, it appears inescapable that we will witness a Fed Funds Rate of 6.00%, and more, in 2023.

Perhaps, they pull up at 5.75%, not wanting to put a 6 handle on it, but even 5.75% is far higher than the market consensus.

In other words, being able to see such high rates for 2023, provides us with a market advantage.

If President Biden follows through on his slowly opening to the idea of talks with President Putin, this could change everything.

While the war rages however, and is currently on track to continue through all of 2023 and into 2024, it remains difficult to find any real reason to buy the US stock market.

Watch this immediate range, outside of Thursday/Friday would be worth respecting in the short term.

My favoured view, remains a 20% fall in the US stock market in 2023.

Clifford Bennett

ACY Securities Chief Economist

The view expressed within this document are solely that of Clifford Bennett’s and do not represent the views of ACY Securities.

All commentary is on the record and may be quoted without further permission required from ACY Securities or Clifford Bennett.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know