Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

2025-06-05 15:51:20

Goal of This Lesson:

To teach you how to properly calculate and control your position size using both automated calculators and manual formulas, so you never risk more than intended, no matter the trade.

By the End of This Lesson, You Should Be Able To:

- Use an automatic position size calculator for any market

- Manually calculate position size based on stop-loss and risk %

- Avoid overleveraging and inconsistency

- Trade with confidence knowing your exposure is controlled

The Hidden Power Behind Every Trade: Risk Management

Most traders obsess over finding the perfect entry or mastering a new strategy. But even the best trade idea can become a disaster without one crucial element: risk management.

What Is Risk Management?

Risk management in trading is the process of identifying, controlling, and limiting the potential financial losses on each trade. It includes:

- Defining how much of your capital you're willing to lose

- Setting stop-loss levels

- Sizing your positions correctly

- Avoiding overexposure to a single asset or bias

Simply put, risk management protects your capital so you can stay in the game long enough to let your edge play out.

Why Risk Management Is Vital

Trading without risk management is like skydiving without checking your parachute. Here’s why it’s essential:

- Preserves capital - Even with a 60-70% win rate, drawdowns are inevitable. Risk management helps you survive them.

- Removes emotional pressure - Knowing your maximum loss allows you to trade with clarity, not fear.

- Builds long-term consistency - Professional traders aren’t just good at winning. They’re elite at managing losses.

- Allows for compounding growth - Small, consistent gains grow faster when you avoid big losses.

Real-Life Analogy: The Backpacker’s Rule

Imagine hiking with a backpack. A smart backpacker only carries what’s necessary to survive the trip, not the entire house.

The same goes for trading-carry only the risk you can survive.

Position sizing is about calculating the right amount to trade based on your capital and risk tolerance.

Position Size Calculators: Your Best Friend or Worst Enemy

One of the most overlooked tools in a trader’s arsenal is the position size calculator. It tells you how many lots, contracts, or shares to trade based on your:

- Account size

- Risk percentage (e.g., 1% of total capital)

- Stop-loss distance

But here’s the truth: used correctly, it protects your account. Used carelessly, it can destroy it.

When Used Properly:

- Keeps your risk-per-trade consistent

- Prevents overleveraging

- Adjusts to different instruments and volatility

When Ignored or Misused:

- You risk far more than your account can handle

- Losses become disproportionate

- Emotional trading creeps in as fear and greed take over

What Is Position Sizing in Trading?

Position sizing is the amount of a security (lot size or number of units) you take in a trade based on:

- Account balance

- % risk per trade (e.g. 1%)

- Distance of stop-loss (in pips or points)

It directly affects your survivability in the markets.

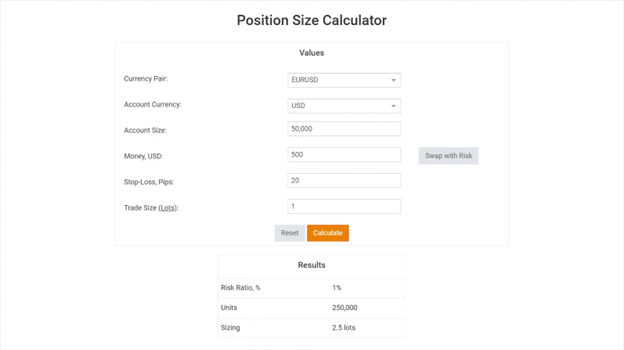

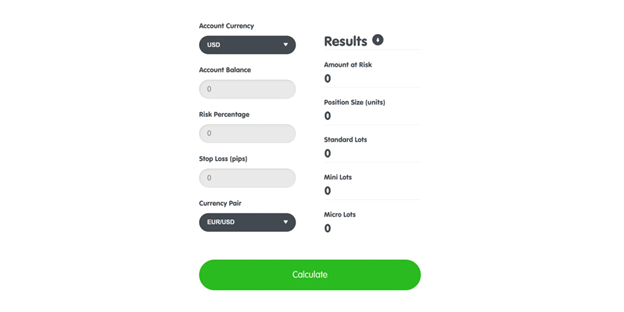

Method 1: Use an Automatic Position Size Calculator

Tools to Use:

- MyFXBook Position Size Calculator

- Babypips Lot Size Calculator

- Forex Position Size Calculator by EarnForex (What I personally use)

These calculators ask for:

- Account currency

- Account balance

- Risk % per trade

- Stop-loss size

- Currency pair / symbol

Pro Tip:

Always round down (not up) your position size to stay conservative.

Method 2: Manual Position Sizing Formula

Here’s the simple formula:

Example (Forex):

- Account: $10,000

- Risk: 1% = $100

- Stop Loss: 25 pips

- Pip Value: $10 (for 1 lot in most USD pairs)

Use this formula for manual chart-based control when you don't have access to a calculator.

Pro Tip:

Many apps are already available for position sizing. Utilize them to lessen human error in calculating.

Risk Management Golden Rules

- Risk only 0.5% to 1% per trade when building consistency

- Never “eyeball” your lot size or trade size

- Let stop-loss and position size work together, not against each other

- Track your risk across open trades too, avoid stacking risk

Combine with Your Strategy

Position sizing isn't standalone. It supports your trading model.

- Found a great FVG? Great.

- Bias is aligned? Perfect.

- Now size the trade so you can survive 10 losses in a row, because that’s what real traders plan for.

Key Takeaway:

“It’s not about how much you make, but how much you don’t lose when you’re wrong.”

If you want to thrive in this game, stop worshipping the strategy and start respecting the risk. Master your position size. Stick to your risk limits. Because in trading, your survival rate matters more than your win rate.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next