5 Major Types of Traders - Which One are You and What Style Will Work Best for You

2020-03-27 20:33:47

You are no doubt aware of the fact that if you had 20 traders in the room, you would have 20 different styles of trading.

But today, we are going to talk about the major types of traders plus the pros and cons of each style.

The goal is to get you familiar with the different styles, so perhaps you can short-track your learning curve, and identify the best method to suit your personality type and timeframe.

Click play on the video below to watch the full video. Otherwise, read the text below for the full transcript and additional notes.

How traders form their initial trading philosophy

We all know that traders make their decisions by forming a theory about whether the price is going to move up or down.

The most accurate way of testing that theory is to place a live trade in the market.

For many, this can be a daunting task. But the goal initially, is to test your trading theories using a small amount of risk. A risk that is relatively speaking, insignificant to your trading account.

Let's dive into the main types of trading styles traders use daily.

1. The technical trader

The first approach is one of the most widely known and is called technical trading or technical analysis.

The technical trader will look at price and volume history and draw conclusions based on indicators, support and resistance and price patterns.

This will involve looking at bar charts or candlesticks, which you can see from the two images of Gold below.

Here is a look at Japanese Candlesticks.

Here is the same chart of Gold using a bar chart on MetaTrader 4.

Many suggest the candlestick chart is more visually appealing.

Not only that, but there are whole books around Japanese candlestick patterns for the technical trader. Steve Nison is recognised as the man who bought the concept of Japanese Candlesticks to the western world.

As a trader, you will want to learn about the many types of candlestick patterns, such as:

- Doji star

- Bullish or bearish engulfing pattern

- Dark cloud cover

- Piercing line

- Rising three periods

- Hammer

- Hanging man

- Evening or Morning star

- Spinning top

Using technical indicators in your trading

Technical traders also love using indicators over their chart.

Trading indicators are mathematical formulas using price (open, high, low and close) and volume to plot a line or price on a chart.

Indicators tend to be broken up into a few main categories, such as:

- Oscillator style indicators showing overbought and oversold levels.

- Trending indicators looking to capture the big trends in the market.

- Momentum indicators are often great to show divergence or price acceleration.

- Volume indicators help you see the strength of a big move up or down, back up by volume.

- Volatility indicators are often used to help identify ideal levels to place your stop loss.

Some of the most common indicators used by technical traders include the moving average, Relative Strength Index (RSI), Stochastic, Bollinger bands, Average True Range (ATR), On Balance Volume (OBV), Parabolic Stop and Reverse (SAR) and the MACD.

Using chart patterns as a technical analyst

Some traders prefer to use chart patterns due to their visual appeal.

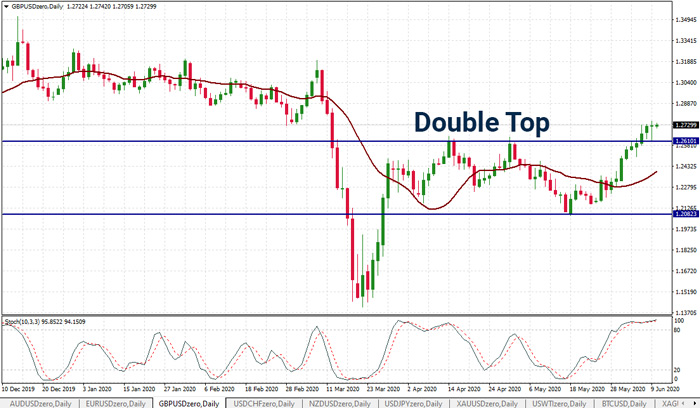

One of the most looked at chart patterns is the double top or double bottom.

The double top highlighted below, shows a common resistance point, like a ceiling, where prices find it difficult to breakthrough. This can be an ideal place to place a short sell order or take profits on an existing long position.

Of course, it is important to use sensible stops with any position you take, to ensure you protect the downside.

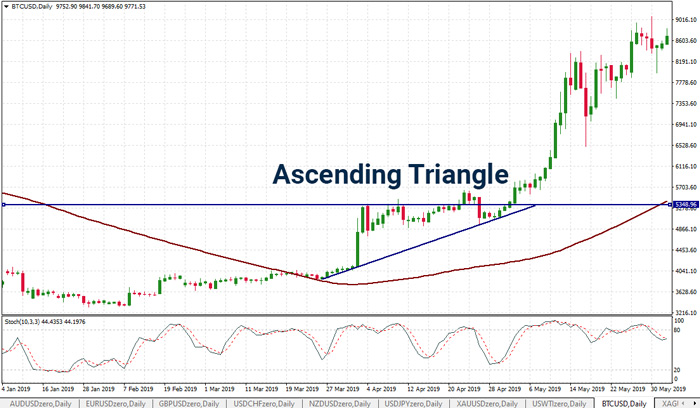

Another key pattern used by technical breakout traders is the ascending triangle.

The ascending triangle pattern is where you have a common resistance point, with the lows getting consistently higher, thereby forming a triangle.

You can see on the Bitcoin chart below, that it broke out and retraced, just before the big breakout higher, rising as much as $2,520 in 10 days.

Another common chart pattern used by traders is the head and shoulders pattern, which you can read about here.

2. Algorithmic Trading

One of the trading methods that continues to gain in popularity is algorithmic trading and recently, artificial intelligence.

Coding your system using Expert Advisor in Metatrader 4

Algorithmic trading is where you code your entire trading system within MetaTrader 4, using the MQL5 code case and then run your system 24 hours a day.

The system is then automatically executed according to your entry, exit and risk management rules.

This is known as mechanical system trading. Your criteria to get in and out of the market is black or white. There are no grey areas.

You have to remember that whatever you code that robot to do is the only thing that's going to be capable of doing.

Your automated trading system doesn't have the eyes that you have. It doesn't have the intuition, and it certainly doesn't have that human element that allows it to know when you're in a trend or when you are in consolidation.

Jim Simons algorithmic trading

One of the most popular stories of algorithmic trading is the huge trading fund by Jim Simons. He is one of the wealthiest billionaire traders, with his 500,000+ lines of code generating staggering returns for his clients.

For many, it is vital to put algorithmic trading in perspective. You may want to use your robot as a trading assistant, not as the trading tool itself.

Using Artificial Intelligence and Machine Learning

When it comes to the Artificial Intelligence (AI) part, I don't want to speculate on what might happen in the future with that.

But it would be fair to say we are going to hear more and more about traders who are using this style to trade their accounts going forward.

We're already seeing many artificial intelligence robots being developed.

We've seen several large bank projects where they are considering the ideas of using algorithmic trading and self-learning (machine learning) abilities of these systems to try and get better results day by day.

Make sure you continue watching this space and do whatever you can to learn more about it.

3.Fundamental Trading

The next aspect to consider is fundamental trading. Now the fundamental trader doesn't care where the price goes.

Traders who use fundamental analysis tend to be focusing less on price and more on the underlying factors that affect the price.

They will then form a theory about whether that instrument will become more or less valuable over time.

Once that theory has been formed, it is possible to compare the theoretical view and to what it is and the recurrent real value.

Then the trader assesses it and whether the current price represents an excellent opportunity to enter the market or not.

Technical trading versus fundamental trading

In the instances of the technical trader, where they are interested in looking for a specific entry at a specific price point, we do not see that with the fundamental trading style.

Fundamental analysts tend to want to look for political events or significant news-driven events.

As a fundamental Forex trader, you must view the Economic Calendar daily.

Fundamental traders want to look for significant news events that are going to be occurring from an economic background.

Some of the most significant market-moving news events include:

- Non-farm payroll data (NFP)

- Gross Domestic Product (GDP) figures

- Central bank announcements

- Consumer Price Index (CPI)

- Unemployment rate

- Overnight interest rate

- Retail sales

You might look at the macro and the marker economics of a certain situation.

You may even consider the idea of wages and job growth and the other things and how that affects the economy as a whole.

When it comes to fundamental analysis, you are building a picture as a person but also creating a picture in your head on what that economy looks like—then forming your ideas and theories around where the price might go.

4.Social trading

The next way of trading that you find this day and age is social trading.

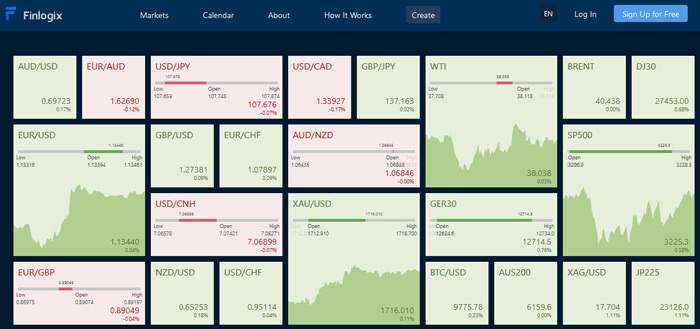

Now social trading is much like what you see on Finlogix.

Finlogix is a social trading platform allowing traders to talk to each other and bounce trading ideas around. You can see the exact trading ideas from your favourite analysts.

You can also comment on other trading ideas, which is where the social element comes into play. Think of it like building your investment team, which cover the specific markets you like to trade.

One of the challenges people do face with the idea of social trading is when the idea from your favourite analyst, conflicts with your beliefs.

In this case, you might like to trade their ideas when you're thinking matches but steer clear of those conflicting ideas.

5.Hybrid Trading

The next trading style to consider is hybrid trading.

Hybrid trading is something I consider myself to be.

I often refer to this style as 'rational trading'. This is the idea of using everything together to form your trading ideas and exit strategies.

I prefer to start with fundamentals and add a layer of technical analysis. Then I look to add other aspects to confirm my initial thoughts, so I have my trade ideas backed by reliable data.

I have to know the technical side, the fundamental side and more specifically, the social side to a degree.

In conclusion

You've now seen the top 5 major types of trading.

The goal of this article was to give you a clear picture of what methods are available so you can start to explore each of them.

By trialling each style, you will see which method works best for your personality and timeframe.

I'm a big believer in finding the style that fits with you. Then hone that style so you can maximise your opportunities and strike when your system is running hot.

All the best with your trading.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know