RISK-OFF RETURNS AS POLICY SIGNALS COLLIDE WITH TRADE UNCERTAINTY

2025-04-17 07:55:44

The US dollar is once again on the back foot as risk aversion resurfaces across markets, led by a sharp reaction in Asian equities following fresh restrictions from Washington on AI chip exports to China. Nvidia confirmed it has been barred from selling its China-specific H20 chip an effort to comply with prior sanctions citing a potential revenue hit of $5.5 billion. This reignites geopolitical concerns just as markets were starting to regain composure.

DXY H1 Chart

The FX space reflects this mood shift clearly. Defensive currencies like the Swiss franc and Japanese yen are outperforming, and the euro has picked up modest strength. Meanwhile, longer-dated US Treasuries tell a more conflicted story: although yields have softened, the 30-year is hovering near flat, underscoring a market still riddled with doubt about what comes next.

Amid this, the US Treasury is attempting to instil some calm. Treasury Secretary Bessent reiterated that Washington stands ready to support market liquidity, including through the potential revival of bond buyback programs aimed at older, less liquid paper. His deputy, Michael Faulkender, floated the possibility of easing supplementary leverage ratio (SLR) requirements during stress periods to help dealers absorb more supply. These tools, if deployed, could act as stabilizers in a market growing increasingly wary of both economic softness and political unpredictability.

Yet, the broader macro picture remains clouded by the Trump administration’s fluid trade stance. After initially doubling down on tariffs, the administration reversed course on consumer electronics and auto parts moves that might open doors for faster bilateral deals but also signal waning US leverage. Notably, Vice President Vance stressed the importance of the UK relationship, with US-UK trade negotiations being “actively prioritized.” Similarly, Japan’s trade minister is in Washington this week to explore a fresh framework for economic cooperation. However, FX-related sensitivities are expected to be played down during early talks especially as Tokyo remains the only G10 central bank with a hawkish bias and has recently intervened in USD/JPY.

UK CPI SURPRISES TO THE DOWNSIDE, BUT INFLATION REBOUND LOOMS

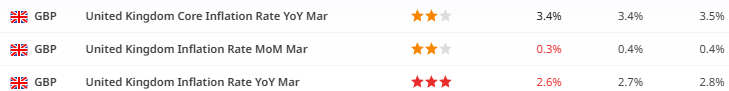

In the UK, the latest CPI print for March underwhelmed expectations and strengthens the case for a Bank of England rate cut at its May meeting. Headline inflation, services inflation, and the broader CPIH index all came in softer than consensus. Particularly notable was the sharp drop in inflation for recreation and culture heavily influenced by computer game pricing—which alone shaved 0.14 percentage points off the headline rate. Motor fuels also posted deeper deflation, falling to -5.6% year-on-year.

However, this reprieve is expected to be temporary. Q2 will usher in higher employer national insurance contributions, a hike in the minimum wage, and a reset of the household energy price cap all of which will likely push inflation back up toward the 4% level. The Monetary Policy Committee’s cautious approach of “gradual and careful” easing looks well founded in this context.

GBP’s reaction has been muted. With EUR gaining ground and the Fed’s trajectory still fluid, sterling may continue to underperform in the near term. However, accelerated progress on a US-UK trade deal especially one that supports the UK’s services sector could offer the pound a meaningful reprieve.

The interplay of fiscal policy, trade dynamics, and central bank signalling remains messy. On one side, markets are pricing in a dovish shift from the BoE and continuing disinflation in core CPI. On the other, the US is stuck between protecting strategic tech dominance and avoiding market destabilization.

Geopolitically sensitive assets, particularly long-dated Treasuries and yen crosses are likely to stay volatile in the days ahead. Should tensions escalate around semiconductor trade or FX intervention risks, we may see another round of haven inflows especially if upcoming macro data shows further cracks in global demand.

For now, markets are once again caught in the tug-of-war between policy flexibility and economic fragility. In that environment, price action will remain reactive and narrative-driven—expect more volatility before any true direction emerges.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know