US Stock Market on Renewed Strength After Trump’s 90-Day Tariff Pause: What You Need to Watch Next

2025-04-11 14:15:27

Overview

- Tariff Pause Brings Relief, But Not Resolution — Markets rebounded after President Trump paused new tariffs for 90 days, easing short-term pressure.

- Fed Holds Steady While Risks Accumulate — The Federal Reserve offered no clear guidance, citing transitory inflation but acknowledging trade-related instability.

- Wall Street Shifts Defensive as Volatility Returns — Institutional players are rotating out of risk amid rising volatility and macro uncertainty.

- Existing tariffs — including a 54% levy on Chinese goods — remain in place, keeping investor sentiment fragile.

- Trump emphasized this is a “recalibration, not a retreat,” as inflation and recession fears linger beneath the surface.

- Market now prices in just one rate cut by September, down from two.

- Fed officials warn that worsening consumer sentiment could justify easing if data turns softer.

- The VIX spiked to 43, reflecting shaken confidence, while Nvidia and Tesla led tech losses.

- Despite the turbulence, US indices (Dow, Nasdaq, S&P 500) show signs of regaining traction at key technical levels.

Markets Rattle, Then Recover on Trump’s 90-Day Tariff Pause — Offers Breather, Not Relief

After triggering widespread sell-offs with sweeping tariff announcements on April 2, President Trump surprised markets midweek by pausing new tariff enforcement for 90 days. The announcement came as global backlash intensified and domestic sectors voiced growing concern about inflation and recession risks.

This caused a relief in the market. But uncertainty is still looming around the corner.

“People are jumping out of line. People are a little bit afraid and yippy. But no president has done it,” Trump said, addressing criticism over the market fallout. He framed the pause as a moment to reassert control, not backpedal.

- "This is a recalibration, not a retreat," he added, stating that the 90-day window will be used for “strategic trade realignment.”

- While the move temporarily calmed markets, investors remain wary. The pause doesn't reverse tariffs already enacted — including the 54% tariff on Chinese goods and the 10% blanket import tax that rattled global supply chains.

Federal Reserve – Not Here To Save the Day

The Federal Reserve’s April FOMC minutes offered no clear path forward, adding to the market’s uncertainty.

- Fed Governor Lisa Cook said the inflation effects from tariffs appear “transitory,” signaling no rush to cut rates.

- Other officials warned the instability caused by trade policies could tighten financial conditions and slow consumer confidence — opening the door for a possible cut later in the year if data weakens.

As a result, the market now expects just one 25 basis point cut by September — a significant shift from the two cuts priced in earlier this quarter.

Wall Street Response – Risk Managers Recalibrate

Financial institutions responded to the pause with caution, not celebration.

- JPMorgan Asset Management: “The tariff pause may cool volatility short-term, but confidence damage has already been done.”

- BlackRock noted a visible shift in asset allocation — with many clients rotating into defensives, cash-heavy holdings, and fixed income products.

Tech stocks, which led the 2024 bull run, were among the week’s biggest laggards:

- Nvidia dropped 4.2% on AI fatigue and macro concerns.

- Tesla slipped 6.5% following soft delivery figures and supply-side fears from Asia.

Volatility & Liquidity – Risk Premiums Return

The Volatility Index (VIX) spiked to 43 level during the height of tariff-driven selloffs — a sharp rise from the sub-15 range seen last week. This exhibits low confidence and fears in the market

- Institutional flows have been risk-off: lower dark pool volume, weaker buying programs, and a notable rise in Treasury demand.

Index Performance - Strong Volatility But Gaining Traction

DJI

Dow has been in a 4-day upside move with no new lows for downside potential.

Currently, Dow has already broken out of the daily volume imbalance or the daily fair value gap resting at 39200.60 - 40387.70 level.

If we don’t break down this level, we might see Dow for a renewed upside direction.

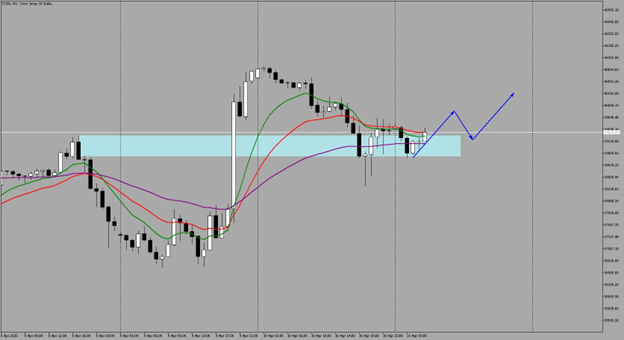

4-Hour

Looking at price action, price is holding at a premium level with the breakpoint level at 39017.14 - 39453.90 is acting as a support for upside.

1-Hour

Unless the 39017.14 - 39453.90 holds, and relief in the markets is still relevant, fears could pull Dow to the downside.

NAS

Daily

Nasdaq has been performing good after the highs since the wave of tariffs last April 2 have been taken out with a huge displacement candle.

This move has also invalidated further downside after price closed above the bearish volume imbalance at 18206.53 - 18443.75.

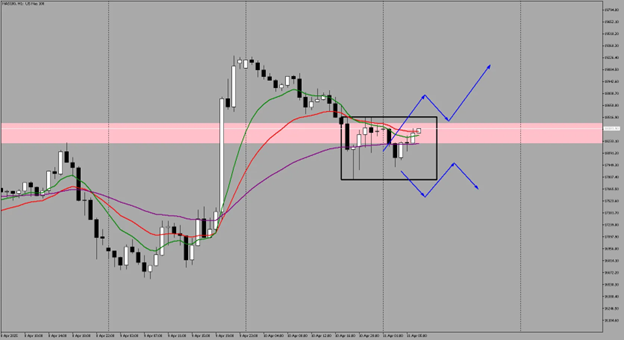

1-Hour

If the lows at 17775.90 remains intact and price breaks out of the 18530.65 level. we could see strength for Nasdaq to remain also with a potential upside on the horizon.

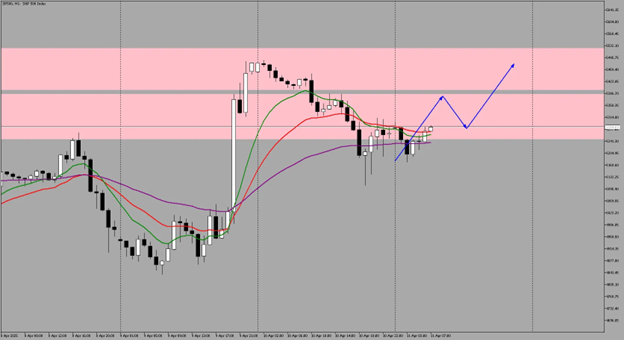

S&P

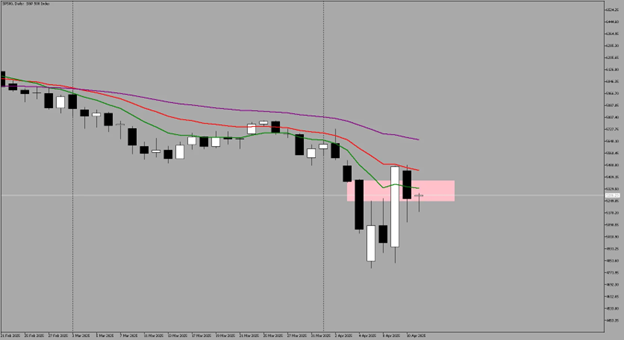

Daily

Same strength is seen with S&P, invalidating the bearish volume imbalance at 5247.21 - 5384.08 and is currently acting as a support for upside potential.

For continued upside and strength build up, the next bearish volume imbalance resting at 5523.69 - 5396.53 level must also be taken out by closing above.

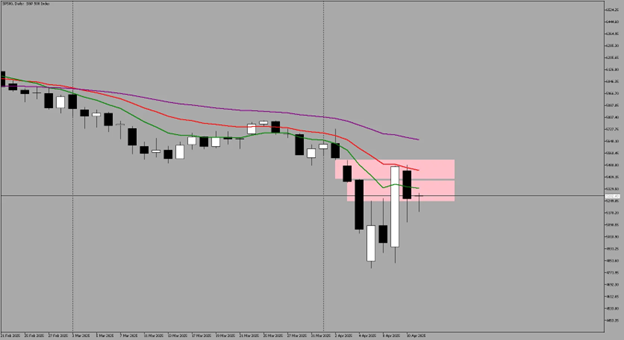

1-Hour

A break at 5311.24 level could be a catalyst for renewed strength for S&P, unless it acts as a resistance or fake-out level and price returns to the 5107 level.

Final Takeaway

“Markets don’t collapse on bad news — they collapse on surprise. The 90-day pause bought time, not trust.”

As Q2 earnings season kicks off and geopolitical risk remains elevated, you should remain selective. Follow volatility closely, trade in sync with structure, and stay anchored to the bigger macro picture.

Lastly, trade with confirmation not emotion.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know