Dollar on the Edge: Fed Rate Pause Sparks a Global Currency Tug-of-War

2025-02-20 09:59:46

Overview:

- FOMC & Inflation:

- Short-term inflation (3-9 months) shows better trends than 12-month data, though core goods prices are down less.

- A robust labor market and strong consumer spending persist amid tighter financial conditions.

- Fed Policy & Stance:

- The Fed is pausing at a 4.25%-4.50% target range, maintaining a hawkish, data-dependent approach focused on achieving 2% inflation and maximum employment.

- US Dollar & Geopolitics:

- The Dollar is retracing into bearish gaps on the Daily chart since its February 14 break, while 4-hour charts display bullish momentum.

- Ongoing geopolitical uncertainties have weakened the Dollar’s appeal, benefiting other currencies.

- Currency Highlights:

- AUD: Holds support at 0.63305 with positive employment data; expected to target 0.63737.

- NZD: Remains bullish and may target 0.57499 after breaking equilibrium.

- EUR: Maintains its premium; bullish if it breaks above 1.04412.

- GBP: Bullish with potential upside above 1.26062, though rising inflation and tariffs pose risks.

- CAD: Pulls back into a bearish gap (1.41997-1.42555) with a potential target of 1.41195 if the gap holds.

- CHF: Trading at a discount; upside depends on a stronger USD, while continued USD weakness could drive further decline.

Key Insights from the FOMC

The FED held the FOMC meeting on Jan 28-29. Outlined are the insights that would impact the Dollar pairs:

- Shorter-term inflation measures (3, 6, 9 months) show more promising trends than the 12-month figures.

- Core goods prices have not fallen as significantly in recent months.

- The labor market remains robust with stable low unemployment and average monthly payroll gains of 170,000.

- Consumer spending has been strong, buoyed by a solid labor market, rising real wages, and productivity gains.

- Tighter financial conditions are evident with rising Treasury and corporate yields, along with increased mortgage rates.

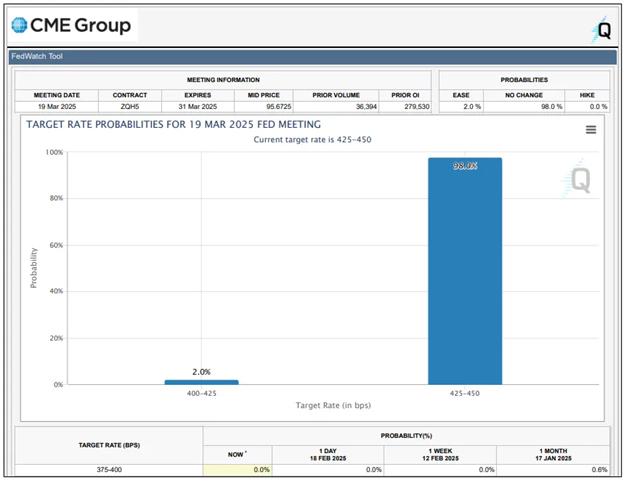

Rate Pause Anticipated

With all of these the Fed will be on a pause on its rate policies on March at a 4.25% to 4.50%.

Fed Stance: Hawkish?

- Inflation Concerns: Despite some progress in short-term inflation measures, inflation remains above the 2% target, with core inflation showing only modest improvement. This reinforces the need for a cautious and restrictive policy.

- Policy Settings: The Fed continues to maintain a target range for the federal funds rate at 4.25% to 4.50% and is still in the process of reducing its securities holdings, both of which signal a commitment to controlling inflation.

- Risk Management: The Committee is attentive to the risks of persistent inflation, and although there’s some optimism regarding the labor market and economic growth, the focus remains on ensuring that inflation does not rebound.

Fed’s policy decision will be data-dependent with a focus on further progress toward 2% inflation and maximum employment

Dollar Testing the Volume Imbalances for Downside Potential

Daily

After a clean break on February 14, the Dollar has yet to generate sustained bearish momentum and is currently retracing into identified bearish fair value gaps.

4-Hour

The Dollar has been steadily climbing on the 4-hour chart, with bearish candles consistently getting engulfed by stronger bullish ones. This pattern signals strength for the greenback, but it’s still unclear whether the Dollar has truly started its recovery. Despite the recent upside retracement, ongoing uncertainties and technical indicators suggest that a more bearish environment could continue for the US Dollar, at least for the time being

Geopolitical Uncertainties

Amid ongoing geopolitical uncertainties especially the war in Ukraine, the US Dollar has lost some of its luster, allowing other currencies to rally against it. As of now, foreign pairs are on a pullback.

AUD: Steady Support at 0.63305 and Positive Employment Data

The AUD continues to hold strong at the 0.63305 level—a key pivot point where previous resistance has flipped into support. This role reversal is bolstering bullish sentiment, and so far, there are no signs of a reversal in the uptrend.

Positive Employment Numbers Boost Economic Confidence

Despite a 25-bps rate cut last Tuesday, the market quickly shrugged off any bearish impacts as positive employment data came in. The employment rate increased by 0.1%, and employment change figures soared to 44k—well above the forecasted 20k. This robust performance suggests that while the economy is stabilizing from inflation, growth is firmly taking hold.

Potential Approach on AUD

Given that the Dollar hasn't fully recovered yet and the Aussie is showing steady upward momentum, we expect the AUD to break past the mid-range level, maintain its premium status, and target the 0.63737 level for additional upside potential.

NZD: Filling the Fair Value Gap Range 0.56793 - 0.57158

NZD is still on a bullish environment with no signs of weakness. We are looking for a break of the equilibrium and potentially, reach the 0.57499 level for an upside move.

EUR: Holding the Premium Level of the Range

For a bullish scenario, we are looking for a break of the 1.04412 level and that price would stay above it.

GBP: Still on a Bullish Notion

A break of 1.26062 could give us an upside potential with GBP if it is sustained.

UK Increasing Inflation

Inflation has risen from 2.5% to 3%, surpassing the forecasted figure. The ongoing threat of Trump’s tariff policies continues to pose downside pressure on the GBP. But technically, we are still on a bullish path.

CAD: Testing the Bearish FVG 1.41997 - 1.42555

The Dollar's upside pullback has caused the CAD to retreat, encountering resistance at the bearish FVG range of 1.41997 - 1.42555.

Intraday, there are still no clear signs of downside potential. However, 1.41195 could serve as a target for a bearish scenario, provided the Daily FVG is respected.

CHF: Going Steady at the Support Level

As of now, the Swissie is trading at the discount level.

For upside potential:

- USD must regain strength.

- Swissie must break equilbrium and stay above it.

- Confirmed strong bullish environment if price reaches 75% level of the range.

For bearish potential:

- Stay below equilbrium.

- Continued weakness with USD.

- Break of the low.

“Plan your trade and trade your plan—it's not about predicting the market, but managing risk and staying disciplined." — Mark Douglas, Trading in the Zone

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know