Non-Farm Payroll Report | Learn to Trade NFP Forex Market Moves

2023-07-26 13:55:21

How Pro Forex Traders Use the Non-Farm Payroll Report (NFP) to Trade the Forex Market

Understanding Non-Farm Payroll Data: Impact on Forex Trading & Strategies

Every month, foreign exchange traders worldwide collectively hold their breath as the United States releases its Non-Farm Payroll (NFP) data, typically released on the first Friday.

This critical economic indicator shapes trading strategies, influences investment decisions, and fuels market volatility in ways no other report can. But why is the nonfarm payrolls so pivotal in the forex markets?

Simply put, the NFP report doesn't just reflect the health of the U.S. economy, it casts ripples across the global financial waters, affecting everything from currency pair rates to overall market sentiment.

Watch the video below to learn more about the Non-Farm Payroll Data and how to trade it.

As the most powerful economy in the world, the U.S.'s employment conditions shape global commerce, drive international trade, and, by extension, influence foreign exchange rates.

Understanding the NFP and its implications has become an essential skill for every successful forex trader.

Whether you're a seasoned market veteran or a novice dipping your toes into the world of forex, ignoring the NFP data is like ignoring the warning signs of a storm while sailing the open sea.

It's not just about the numbers—it's about what these numbers represent, the stories they tell, and the trends they signify.

In today's post, we dive deep into the world of Non-Farm Payroll data, exploring its role in shaping forex markets, and dissecting its influence on trading strategies.

Introduction to Non-Farm Payroll (NFP)

Non-Farm Payroll (NFP) data plays an instrumental role in shaping the global foreign exchange (Forex) markets.

It's an economic indicator that significantly influences trading decisions and strategies.

Being a leading indicator, the NFP data tracks the changes in employment numbers in sectors outside the agricultural industry.

This report is crucial in assessing the economic health of the United States, influencing global market sentiment and currency valuation.

The impact of Forex trading is often felt immediately after the NFP release, as traders react to the headline figures.

The employment situation reported in the NFP provides valuable insights into the overall strength of the U.S. economy. Additionally, the average hourly earnings data within the report is closely monitored, as it reflects wage inflation and potential shifts in consumer spending patterns.

Why the NFP Report Affects the Forex Market & Global Economies

The Non-Farm Payroll (NFP) report is the most anticipated high-impact news event for forex traders, often causing significant market moves.

As one of the most closely watched economic indicators, the NFP report offers critical insights into the U.S. labor market, which plays a major role in the world's largest economy.

One of the key aspects of the NFP release (from the US Bureau of Labor Statistics) is the number of paid employees outside of agricultural, private household, non-profit organizations, and military jobs, which helps gauge the strength of the labor force.

Traders react swiftly to any increase or decrease in the NFP number, as it provides valuable information about the health of the U.S. economy.

The most significant market moves typically occur in the Dollar Index (DXY) and the EURUSD pair.

Given that the U.S. dollar is the world's dominant currency, any shift in the employment figures can trigger a market move that influences global financial markets.

Additionally, the NFP report also reviews and adjusts the previous month figures, which can lead to substantial changes in currency market movements as traders adjust their positions based on updated data.

The report sheds light on key factors such as the unemployment rate and labor market conditions in the U.S.

These insights allow traders to anticipate future shifts in the economy, especially when looking at trends in the increase or decrease of jobs across various sectors, excluding farm workers.

This comprehensive data provides a clearer picture of the U.S. economy’s strength and its potential impact on global currencies.

Impact of NFP Data on Forex Markets

The NFP data has a profound impact on Forex markets. Currency traders closely watch these numbers because they indicate the economic health of the country.

A high NFP figure suggests economic growth and typically strengthens the U.S dollar (USD), whereas a low number can weaken the USD.

The speculation surrounding this data release can cause significant currency pair fluctuations.

Trading the News Releases like NFP During live trading contests

Participating in a live trading contest is one of the best ways to hone your trading skills, and ACY Securities' annual Trading Cup event amplifies the traders’ skill with the added challenge of trading the NFP data release.

Since 2018, ACY Securities has been organising this prestigious contest, consistently delivering incredible prizes and unforgettable experiences to its participants.

Each year, the contest reaches its peak with the Grand Final, where the top 10 traders clash in an intense live trading contest during the Forex Market Hours for the release.

These gifted traders trade their live $US5,000 accounts over 1 hour, coinciding with the NFP data release. The goal? To achieve the highest percentage return.

The stakes are high, as each of these talented traders must showcase their skills on a live stage, watched by a global audience of more than 25,000 people.

The immense pressure serves not only as a test of their trading prowess but also their ability to maintain composure in a high-stress, time-sensitive environment.

Reflecting on the 2020 Grand Final, the competition was fierce, and the performances were outstanding. The trader who took home the top honours generated an extraordinary 71.12% return on their live trading account within the one-hour time frame.

The runner-up wasn't far behind, managing to achieve a 50.67% return. The third-place contestant also delivered an impressive performance, generating a 32.76% return.

Please remember that trading leveraged instruments like Forex is risky and the risk is amplified during major news events like and NFP data release.

Those returns you see in the live trading contest will give you some indication of how impactful the NFP data release is and why many traders choose to sit on the sidelines instead of trading it live.

Understanding Forex Market Reactions & Trading on News Releases

The Foreign Exchange market reacts quickly and often dramatically to the NFP data as you will note from the February 2025 release below and the EURUSD reaction to the news.

If the numbers significantly exceed or miss expectations, the U.S dollar (DXY) may either surge or plummet, and along with that will be all the FX Majors.

On the other hand, if the data aligns with market expectations, the reaction might be relatively moderate.

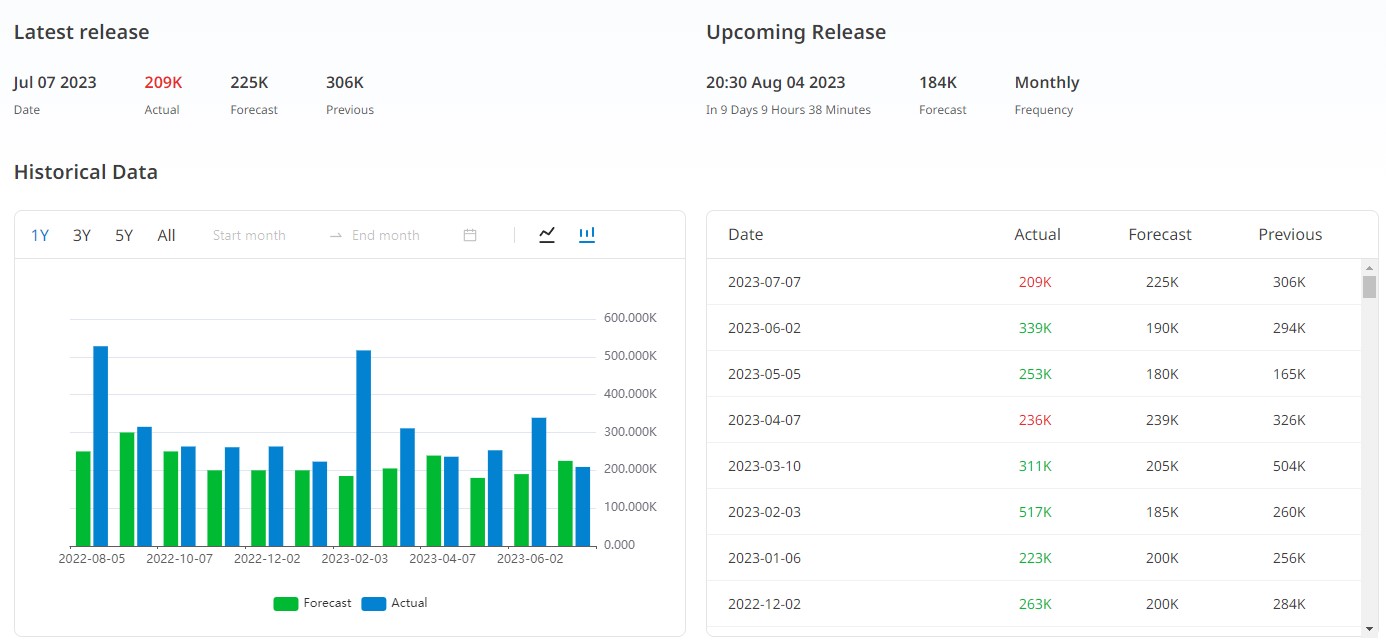

The NFP data release is captured in the table below for reference, showing the result came in lower at 209,000 jobs vs the forecast of 225,000 expected.

As Forex markets are driven by speculations and future expectations, this information is of paramount importance for traders.

You can get immediate updates on all high, medium and low impact news events by going to https://www.finlogix.com/calendar

What’s the Best NFP Trading Strategy to Use After the NFP Release?

Traders use various strategies to leverage the volatility caused by the NFP data release.

One popular approach is 'straddle trading', where traders place orders on both sides of the market, anticipating a significant price movement but unsure of the direction.

Here is an example of using a straddle order before the news release:

But you have to be mindful that liquidity during a major news announcement like the NFP is usually low, which means you have to be mindful of slippage.

Slippage is the difference between where you wanted to enter the trade versus where you entered the trade.

Another strategy is to trade the swings following the announcement using your favourite oscillator like the stochastic or RSI indicator.

These tools oscillate between overbought and oversold. But the strategy here is to trade only in the direction of the trend (which is bullish in this example), and time your entry when the indicator is oversold and the %D line crosses the %K line. As shown in the example below.

Assessing Risk and Reward in NFP-Based Trading

While NFP data presents trading opportunities, it also introduces risks due to the high volatility around the data release.

Traders must carefully manage their risk-to-reward ratios, employing strategies like stop-loss orders to protect their capital. But you also have to be smart enough to ensure they are not placed too close, as the volatility of the release could whipsaw you out.

It's also crucial to understand the broader economic context and not base decisions solely on the data.

Non-Farm Payroll Report and Long-Term Forex Trading

While the Non-Farm Payroll data release creates significant short-term volatility in the Forex market, it is essential to note that this crucial economic indicator also plays a substantial role in long-term Forex trading.

Understanding and interpreting this information can provide long-term traders with an in-depth insight into the U.S. economy's health and the direction in which it is likely heading.

A consistently high figure typically indicates a strong and robust economy. In contrast, a downward trend in this number may signal potential economic weakness.

This data can help long-term Forex traders understand the overall strength of the U.S. economy and formulate strategies for currency pair trading involving the U.S. dollar.

Impact on Monetary Policy and Interest Rates

Moreover, NFP data plays a critical role in shaping monetary policies.

Central banks, such as the Federal Reserve, closely monitor this data as it influences their decisions regarding interest rates.

An increase in employment often leads to potential wage growth, which could, in turn, spur inflation.

To control inflation, central banks might increase interest rates, making the country's currency more attractive to Forex traders.

For long-term traders, understanding these potential shifts in monetary policy based on the data can be the key to predicting long-term trends in currency pairs.

NFP Data and Long-Term Forex Strategies

Long-term Forex traders often employ a strategy known as 'carry trading'.

In this strategy, traders borrow in a currency with low interest rates and invest in a currency with higher interest rates, profiting from the interest rate differential.

The data, by influencing interest rates, can significantly impact this strategy.

Consistent positive figures might lead to higher interest rates, making the U.S. dollar a more attractive currency for carry trading.

The Interplay between NFP Data and Other Economic Indicators: How to Trade NFP Effectively

While NFP data holds a significant role, it's not the only indicator affecting Forex markets. Indicators such as GDP growth rate (GDP), interest rates, inflation rates (CPI), and trade balances also impact currency values.

Traders must analyse these economic indicators together with the employment data to get a comprehensive view of the economy.

Staying Ahead: Regular Monitoring of NFP Data

For successful Forex trading, it's crucial to keep abreast with NFP data releases and interpret the potential market impacts accurately.

Numerous economic calendar tools help traders track these vital data releases, enabling them to plan their trading strategies effectively.

Having said that, the Finlogix economic calendar is one of the most comprehensive reports for all news releases.

In addition to the screen capture above you will get free access to other data points, including:

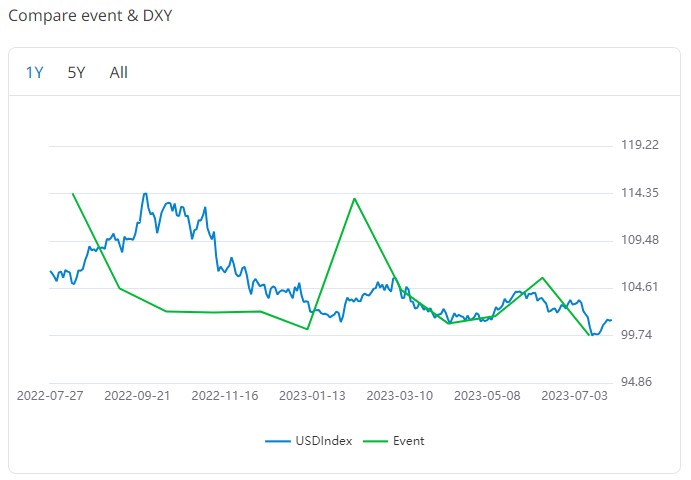

- Market Impact Data – Here you can see the news release time and the market reaction on the relevant currency pair. In this case, we are using the US Dollar index or DXY.

You also get to compare the event on the DXY and the release data on a current and historic basis

You can also view the statistics of the release going back as long as you need, with the main data points captured for you instantly.

Conclusion: NFP Data - A Key Tool for Forex Traders

In conclusion, understanding NFP data is essential for both novice and experienced Forex traders.

It plays a crucial role in dictating trading decisions and strategies, shaping the dynamics of the Forex market.

Whether it's for short-term trading or long-term investment decisions, NFP data serves as an invaluable tool for assessing economic health and currency valuations.

FAQs

- What is Non-Farm Payroll (NFP) data? Non-Farm Payroll (NFP) data is an economic indicator that tracks the employment numbers in the U.S, excluding the agricultural sector.

- How does NFP data impact Forex trading? NFP data can influence the valuation of the U.S dollar, creating volatility in the Forex market.

- What strategies do Forex traders use around NFP releases? Strategies such as straddle trading and swing trading (post-release) are commonly used around NFP releases.

- How does NFP data relate to other economic indicators? Traders typically analyse NFP data alongside other indicators like GDP growth rate, interest rates, and inflation rates for a comprehensive economic view.

- Is NFP data relevant for long-term Forex trading? Yes, long-term Forex traders utilise NFP data to understand the overall economic health and direction, which influences their long-term trading decisions.

Did this article provide you with valuable insights? Stay tuned to ACY Securities for more enriching educational content.

Wishing you the best in your trading endeavours!

Try These Next