Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

2025-08-19 10:17:09

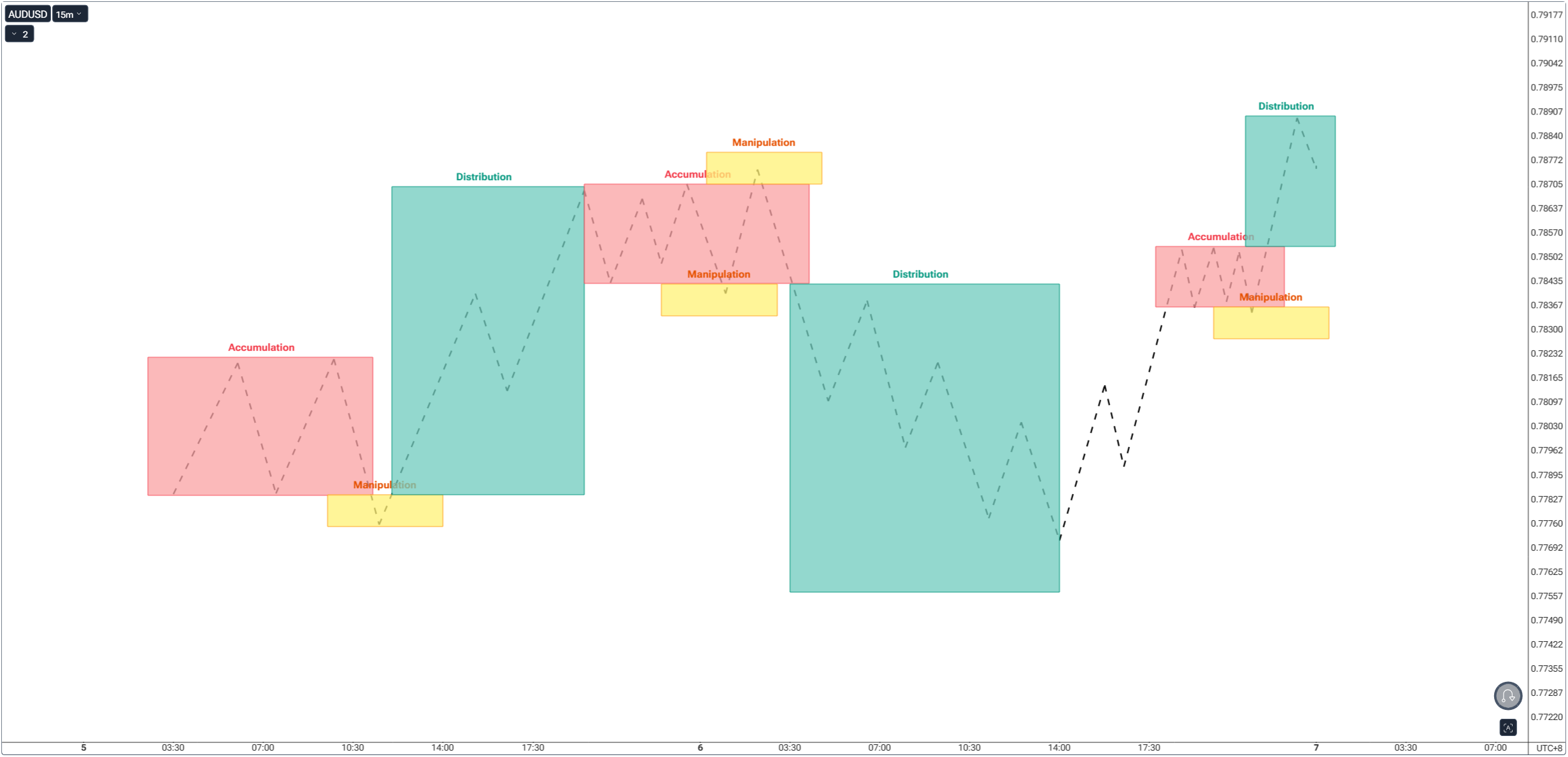

If you’ve ever wondered why the market always seems to “fake you out” before making its real move, you’ve already brushed up against the Accumulation–Manipulation–Distribution (AMD) cycle.

It’s not a theory - it’s the engine of market behavior. Every session, every day, every week, price rotates through this cycle. The difference between losing traders and consistently profitable ones is whether they can spot the cycle in real time.

What Is the AMD Cycle?

Accumulation

- Price consolidates in a tight range.

- Liquidity builds as traders place buy stops above and sell stops below.

- Often happens in Asian sessions or before major news.

Manipulation

- Market makers sweep liquidity - a false breakout above or below the range.

- Retail traders get trapped in the wrong direction.

- Smart Money builds positions in the opposite direction.

Distribution

- The real trend unfolds.

- Price expands directionally, fueled by stop losses and trapped traders.

- This is where the “clean” move happens.

Why AMD Is a Game Changer

Most traders try to predict. Smart traders read the narrative. That’s what makes AMD a game changer - it shifts you from guessing where price might go, to understanding what phase the market is in.

When you master the Accumulation → Manipulation → Distribution cycle, you:

- Avoid false breakouts - no more chasing the first move that’s designed to trap retail.

- Time your entries with precision - waiting for liquidity sweeps and displacement instead of gambling.

- Read session personalities - Asia tends to accumulate, London manipulates, and New York distributes or realigns.

- Trade with smart money, not against it - instead of being the liquidity, you use liquidity.

AMD flips the script: you stop being the hunted, and start trading alongside the hunters.

The Essential Layers of AMD

1. The Timeframe Factor

AMD exists on every timeframe:

- On M1–M15: multiple AMD cycles can form in a single session.

- On H1–H4: each global session may form one AMD phase.

- On Daily–Weekly: whole weeks/months can be just accumulation or distribution.

Always align lower timeframe AMD with higher timeframe delivery. Otherwise, you’re just trading noise.

2. Liquidity Engineering

Accumulation isn’t random - it’s engineered to trap traders.

Buy stops above → fuel for shorts.

Sell stops below → fuel for longs.

Manipulation sweeps this liquidity, then distribution runs the real move.

Once you see this, “stop hunts” stop being frustrating - they become your entry signal.

3. The Psychology of AMD

- Retail mindset: “It’s breaking out, let me buy/sell now!”

- Smart Money mindset: “Perfect, let it grab stops first - then I’ll position.”

AMD is the bridge between technicals and psychology. The difference between being liquidity and using liquidity.

4. AMD in the Session Model

Each global session fits neatly into AMD:

- Asia → Accumulation.

- London → Manipulation.

- New York → Distribution / Completion.

But this is a framework, not a law. News, macro drivers, or thin liquidity can shift the cycle.

5. The Risk Management Angle

AMD doesn’t mean you’ll nail every manipulation perfectly. That’s why risk matters.

- Place stops beyond the manipulation sweep.

- Don’t size up during accumulation ranges.

- Risk small when unsure, scale up when the distribution confirms.

AMD teaches patience - but risk management keeps you alive until it plays out.

6. AMD vs Retail Patterns

Why AMD beats retail technical analysis:

- Triangles, channels, flags → all just accumulation phases.

- False breakouts → manipulation.

- Trends → distribution.

Once you understand AMD, you stop memorizing 50 “patterns.” You see them all as one repeating cycle.

Cautions You Must Know

- Not every range is accumulation. Sometimes price is genuinely consolidating before news.

- Don’t assume the manipulation direction early. Wait for the sweep and confirmation.

- Session bias matters. An Asian accumulation may fuel London’s manipulation - but if London already distributed, NY may just chop.

- Discipline beats prediction. AMD gives probabilities, not guarantees.

How to Apply AMD in Your Trading

1. Mark the range (Accumulation)

- Look at Asia or pre-London price action.

2. Wait for the sweep (Manipulation)

- Don’t trade the first breakout. Let it run stops.

3. Enter on confirmation (Distribution)

- Use FVGs, MSS, or OBs aligned with higher-timeframe bias.

4. Manage risk.

- Don’t revenge trade if manipulation fakes you out. Another AMD cycle is always coming.

Final Word

The Accumulation → Manipulation → Distribution cycle isn’t a trading “hack.” It’s the market’s delivery system.

Every stop hunt, every fake breakout, every sudden reversal - they all make sense when you see the cycle.

When you learn to read AMD across sessions and timeframes, you stop reacting to random moves…

…and start executing the market’s true narrative.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next