Forex Swap Rates & Forex Rollover Rates

2021-05-11 11:04:11

As a Forex trader, it is important to understand what a Forex swap rate is. To keep things simple, the Forex swap rate is the rollover rates you pay or earn to hold your FX positions overnight.

When you trade Forex currency pairs, you are buying one currency and selling the other. When you are long the EUR/USD, you are buying the Euro and selling the US dollar.

If you hold the position overnight, you incur an FX swap or swap charges.

We need to consider the current interest rates of both countries you are buying or selling.

You can get a rough idea if it would be a debit or credit by knowing the interest paid on the currency sold and received on the currency bought.

How does ACY Securities calculate the swap charges?

ACY Securities works with a number of financial institutions, which run their swap calculations daily. These are based on risk-management analysis and current market conditions of the global markets.

It is important to note that each currency pair has its own swap charges based on the exchange rates and interest rate differential of the two countries.

What you need to know about swap rates

- The Forex rollover or swaps are applied to your trading account only when positions are kept open until the next trading day.

- Swaps are applied when the rollover occurs at the end of day, which is 00:00 server time.

- Some currency pairs may have negative swap rates on both sides, both 'long' and 'short'.

- Each currency pair has its own swap charge and is measured on a standard size of 1.0 standard lots (100,000 base units).

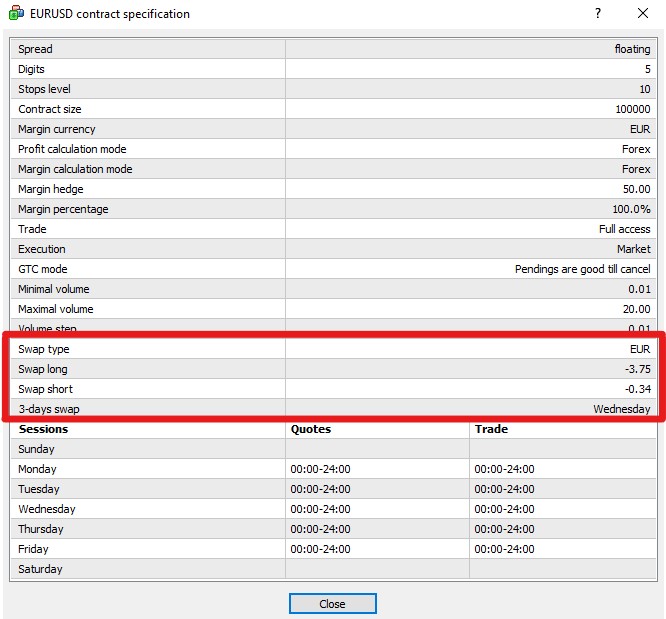

- On a Wednesday, spot FX transactions (2 days settlement) are value date Friday, and the swap incurred will be calculated as three days (Fri-Sun).

How to find the Forex swap rate on the currency pairs you are trading

You can easily access the swap rates for all the Forex markets you are trading.

For the latest Swap rates, please download the ACY Securities MT4 Trading Platform and follow the instructions below:

1. Login to your MT4 platform.

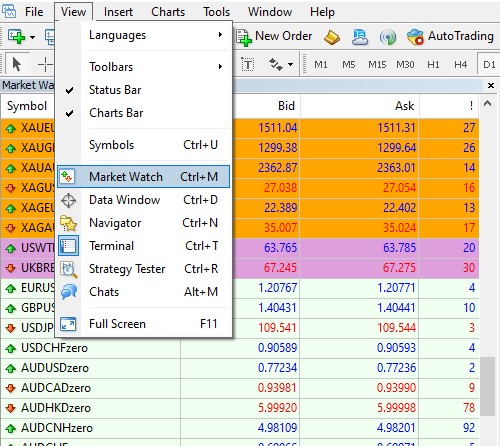

2. You should notice the Market Watch window down the left-hand side. If not, left click on View in the top drop-down menu and left click on Market Watch.

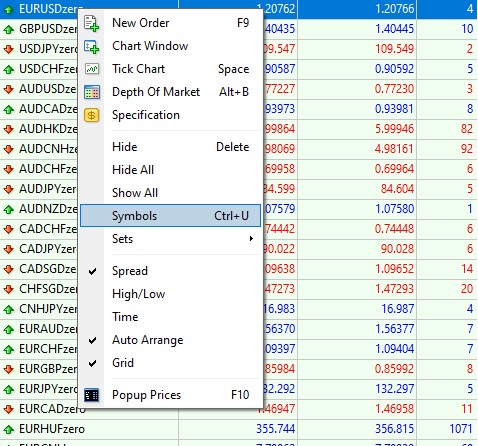

3. Right-click on any symbol in the Market Watch window and select Symbols.

4. Then right-click on the currency pair you wish to check and select Properties.

5. You will see the swap rates as per the highlights below.

The best way to start trading is to open a demo account or a live trading account. You can then access the rates for each currency pair.

The ACY Securities Advantage:

- ProZero from 0.0 pipsUltra-fast order execution speed.

- Segregated accounts with AA rated banks.

- Run your Expert Advisors (EAs) for automated trading using a Forex VPS.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next