Wall Street Rallies Sharply as U.S.–China Tariff Truce, Fed Hawkish Pause, Sticky Inflation Sparks Risk-On Rebound

2025-05-13 13:10:56

Wall Street Rallies Sharply as U.S.–China Tariff Truce, Fed Hawkish Pause, Sticky Inflation Sparks Risk-On Rebound

The bullish scenario outlined over the past week is finally coming to life — exactly as technicals had been hinting.

- Wall Street's bullish breakout is materializing as U.S.–China tariff truce and strong technical setups align.

- Focus shifts to incoming CPI data, where hotter inflation could challenge the momentum and revive volatility.

- Falling VIX supports equities short-term, but rising yields keep the dollar strong and tactical risks alive.

After weeks of compressing into bullish structures, U.S. indices were coiling, just waiting for a catalyst to ignite the next leg.

Now, with a U.S.–China tariff truce and incoming inflation risks in focus, the breakout is underway.

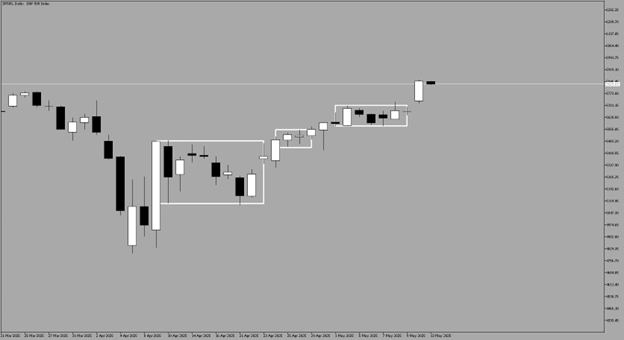

Previous Forecast

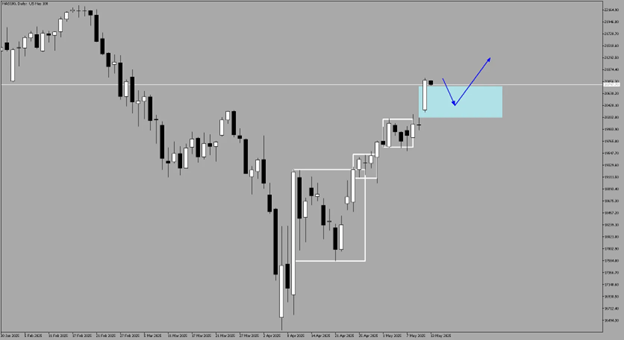

Dow Jones

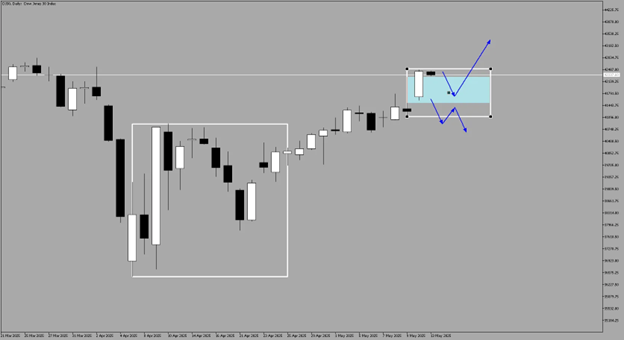

Nasdaq

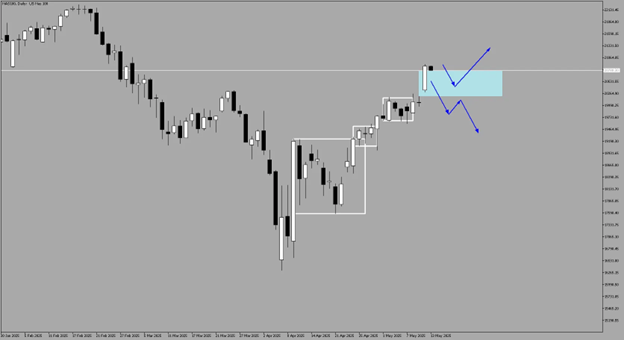

S&P

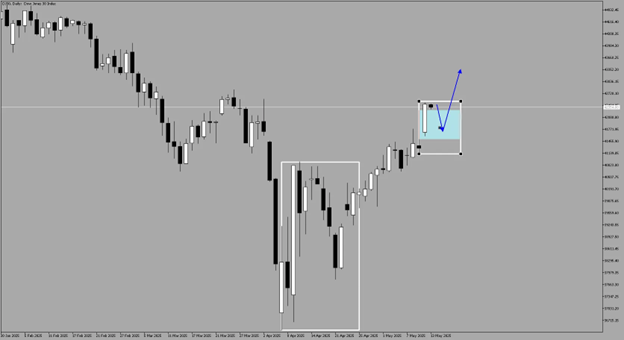

Bullish Scenario Materializing

Dow Jones

Nasdaq

S&P

Since May 9, the Dow Jones, Nasdaq 100, and S&P 500 have posted significant gains, confirming that the technical foundation was already laid — and fundamentals are acting as catalysts for market momentum.

For my previous analysis, checkout my latest contents:

https://www.youtube.com/watch?v=FX7xccXgKjQ&t

https://www.youtube.com/watch?v=2iKxxcnmyLU&t

Key Drivers Behind the US Equities Rally

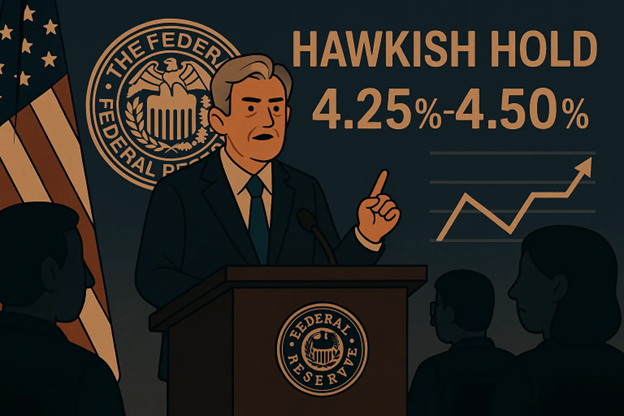

1. May 2025 Fed Decision: Hawkish Pause Holds

The Federal Reserve delivered a "hawkish hold," keeping rates at 4.25%–4.50%.

Chair Powell made it clear: inflation is still the main concern.

Fed speakers reinforce the stance:

- John Williams (NY Fed): "No urgency to ease."

- Michelle Bowman: "Next move could even be a hike if inflation doesn’t slow."

- Neel Kashkari: "Two cuts this year? Maybe none at all if inflation stalls."

Equities initially hesitated post-FOMC, but solid technicals combined with a lack of dovish surprises helped sustain the underlying bullish bias.

2. U.S.–China Trade Truce: Rate Slash Paves Momentum

The true trigger came from Geneva: a 90-day U.S.–China tariff truce:

- U.S. Tariffs: Reduced from 145% to 30% across a wide range of goods.

- China’s Tariffs: Slashed from 125% to 10%.

Global markets, including European futures market, rallied in response to easing trade risks.

DAX

FTSE

STOXX

Technical setups already favored upside — the tariff truce simply unlocked the energy building beneath the surface.

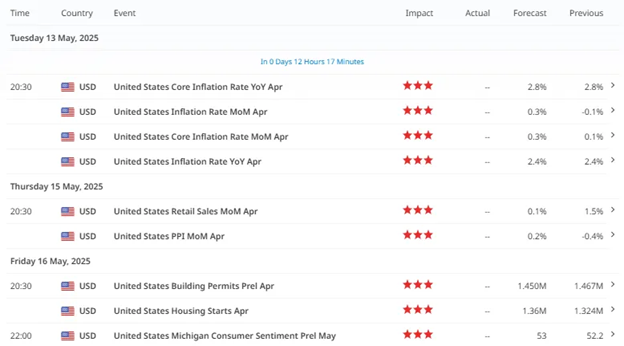

3. Incoming CPI Data: Inflation Could Still Rock the Boat

Markets are now bracing for the U.S. CPI report this week — with upside risks clearly in play:

- CPI YoY Forecast: Expected to tick higher versus April.

- Core CPI: Sticky components like services and housing remain firm.

A stronger-than-expected CPI could briefly rattle the rally, but for now, bullish momentum holds the upper hand.

4. VIX Drops + Yields Rise: Risk-On Equities

The VIX has been steadily falling since early April, but the most notable move is the sharp collapse seen around May 9–13, with VIX now hovering near 20.4 — a major compression from highs above 30 earlier.

| Asset | Performance | Implication |

|---|---|---|

| VIX | Dropping (below 20) | Improving equity sentiment |

| U.S. 10-Year Yield | Rising (above 4.45%) | Sustained USD strength |

The massive volatility unwind seen here supports the rally currently underway in U.S. equities.

Although falling volatility is bullish for now, VIX at lower levels means equities could become more sensitive to sudden negative surprises — like a hotter-than-expected CPI or renewed geopolitical risks.

🟩 Bullish Scenario: Momentum Continues

Catalysts Driving Bullish Outlook:

- U.S.–China Trade Truce: A 90-day tariff freeze fuels optimism for global trade recovery.

- Falling VIX: Risk appetite is improving, supporting higher equity valuations.

- Strong Technical Base: Indices have built higher lows and bullish structures that are now breaking out.

- Earnings Resilience: Corporate earnings have been better than feared, providing fundamental support.

- Incoming CPI Stability (Best-Case): If CPI comes in "hot but manageable," markets could interpret it as inflation plateauing rather than reaccelerating.

Key Bullish Targets:

Dow Jones

➔ FVG Support at 41,506.20 - 42,271.84

➔ Breakout of next high at 42,500.

➔ Push toward 43,000 next resistance zone.

Nasdaq 100

➔ Support at 20,197.50 - 20,766.90

➔ Breakout 20,900 for new highs

➔ Approaching the 20,000–20,200 range driven by mega-cap tech strength.

S&P 500

➔ FVG Support at 5,692.54 - 5,823.67

➔ Breakout of next high at 5,856

➔ Targeting 5,900–6,000 major psychological levels.

🟥 Bearish Scenario: Risk Reawakens

Catalysts Driving Bearish Outlook:

- Hotter-than-Expected CPI: A major inflation surprise could reignite Fed rate hike fears.

- Yield Surge: Rising U.S. 10-year yields above 4.5% could tighten financial conditions abruptly.

- Tariff Truce Breakdown: Political rhetoric or failed follow-up negotiations could revive trade war fears before the 90-day window ends.

- Overextended Sentiment: A rapid equity rally with low volatility can leave markets vulnerable to sharp corrections ("air pockets").

Key Bearish Targets:

Dow Jones

➔ Break of FVG Support at 41,506.20 - 42,271.84

➔ Failure to break 42,500.

➔ Breakdown of the range at 41,119.50

Nasdaq 100

➔ Break of Support at 20,197.50 - 20,766.90

➔ Failure to break 20,900 for new highs

➔ Breakdown of 20,197.50 - 19,590.

S&P 500

➔ Break of FVG Support at 5,692.54 - 5,823.67

➔ Failure to break of the next high at 5,856

➔ Breakdown of 5,692.54 - 5,575.

Trader Takeaways

- Technical Structures Matter:

➔ The market was gearing up for this — the tariff truce simply unlocked the upside already baked into the charts.

- CPI: The Next Big Test:

➔ While the breakout is real, inflation data could test just how sustainable it is.

- Be Tactical:

➔ Ride the momentum, but be ready to adjust if CPI or new trade headlines shift sentiment.

Final Thoughts

The rally unfolding now was no accident — it was built into the technical structure long before the news hit.

The U.S.–China truce, combined with anticipation around CPI data, has triggered a bullish momentum.

Stay sharp:

The bullish move has legs — but key economic data and yield dynamics could create tactical pullbacks.

This is a time to manage winners well, tighten risk when needed, and adapt to fast-moving catalysts.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

Join me in Discord: https://discord.gg/G8f7a5RnaF

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next