Wall Street Climbs a Wall of Tariffs: Why U.S. Markets Are Rising Despite Global Trade Tensions

2025-05-07 12:11:58

Overview

- Wall Street climbs despite tariff tensions, as markets interpret trade threats as political noise, not actionable policy—fueling continued upside in the Dow, Nasdaq 100, and S&P 500.

- Fed pause and soft jobs data ease rate fears, driving flows into tech and growth stocks, with the Nasdaq maintaining higher highs and AI leaders delivering solid earnings.

- Global responses remain mixed, but strategic cooperation from allies (UK, India, ASEAN) signals confidence in U.S. leadership—reducing isolation risk and stabilizing market sentiment.

While global headlines are filled with warnings of trade wars and retaliatory tariffs, U.S. stock indices are showing surprising strength. The Dow Jones, Nasdaq 100, and S&P 500 have remained resilient — even as global trade risks escalate and central banks stay in focus. Here’s how the latest developments are shaping the market narrative.

Trump’s 100% Tariff Proposal on Foreign Films Rekindles Trade Anxiety

On May 5, Trump proposed a 100% tariff on all foreign-made films, citing national security and the decline of the U.S. movie industry due to overseas incentives. The move, while symbolic, ignited alarm across global partners.

- Legal concerns: Experts argue the proposal may violate the Berman Amendment of 1988, which protects informational materials like films from such tariffs.

- UK backlash: London, a major destination for U.S. film production, expressed surprise and concern over the impact on cross-border cultural trade.

- Industry pushback: The Motion Picture Association noted Hollywood brings in $22.6 billion in export revenue and runs a $15.3 billion trade surplus.

The White House later clarified that no final decision had been made, but the signal was clear: trade policy is once again at the forefront of political strategy.

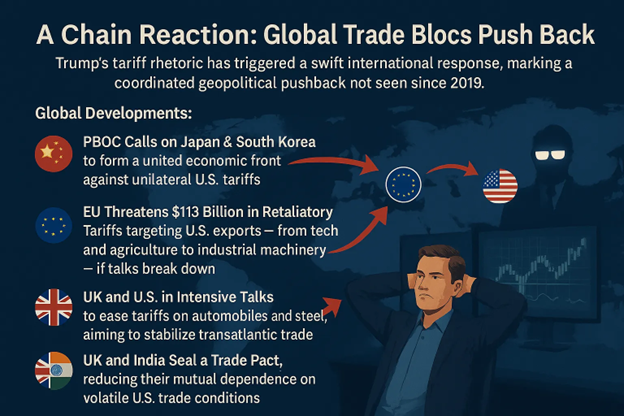

A Chain Reaction: Global Trade Blocs Push Back

Trump’s tariff rhetoric has triggered a swift international response, marking a coordinated geopolitical pushback not seen since 2019.

Global Developments:

- PBOC Calls on Japan & South Korea to form a united economic front against unilateral U.S. tariffs.

- EU Threatens $113 Billion in Retaliatory Tariffs targeting U.S. exports — from tech and agriculture to industrial machinery — if talks break down.

- UK and U.S. in Intensive Talks to ease tariffs on automobiles and steel, aiming to stabilize transatlantic trade.

- UK and India Seal a Trade Pact, reducing their mutual dependence on volatile U.S. trade conditions.

The escalation is not just political—it’s becoming economic infrastructure, with countries recalibrating long-term trade alliances to hedge against future U.S. disruptions.

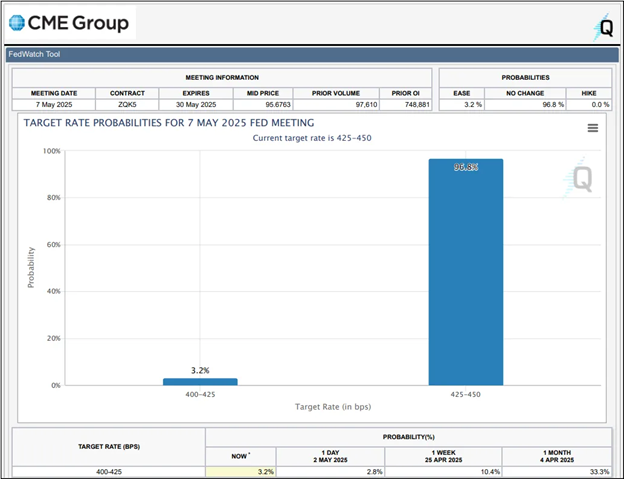

Fed Holds Steady: Monetary Policy No Longer a Drag

Amid the geopolitical noise, the Federal Reserve remains a stabilizing force.

The Fed is expected to hold rates at 4.50%.

- With no rate hikes in sight and inflation cooling, monetary conditions are loosening by default.

- Lower yields make growth stocks more attractive, helping push the Nasdaq 100 back toward its highs.

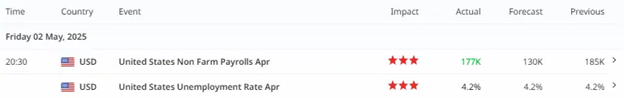

Key Data:

- April NFP: 177K jobs added (vs. 130K expected)

- Wage growth: Slowed to 3.9% YoY

- Unemployment: Steady at 4.2%

This softening labor data reinforced expectations for a rate cut later in 2025, boosting risk sentiment across equities, particularly rate-sensitive sectors like tech and discretionary.

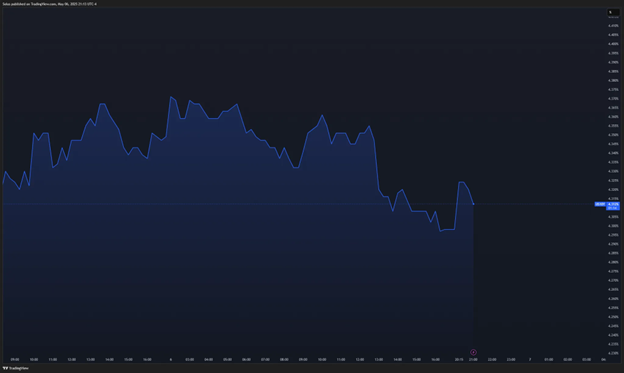

Volatility Index’s Stability

The volatility index continues to trend lower, nearing the 20 levels which can be seen as a signal that the market is slowly adapting to geopolitical tensions and market uncertainties driven by tariffs.

DOW

Dow continues trend higher as traders see a stabilization in the market despite trade tensions. As long as Dow stays above 40908, we could see strength to remain with Dow, and potentially, we could anticipate new highs in sight.

With its exposure to industrials and legacy multinationals, finds some relief knowing trade partners are not uniformly retaliating.

NASDAQ

Nasdaq is in an obvious sustained upside as it trades higher with new higher highs and higher lows, signaling further strength on Nasdaq.

the Magnificent 7 delivered mostly upbeat earnings:

| Company | Highlights |

|---|---|

| Apple (AAPL) | Beat earnings, soft iPhone guidance |

| Microsoft (MSFT) | Strong cloud growth |

| Amazon (AMZN) | AI optimism + cost controls |

| Meta (META) | High CapEx warnings spook bulls |

| Google (GOOGL) | Cloud beat, ad softness |

| Tesla (TSLA) | Margins pressured by price wars |

| Nvidia (NVDA) | Earnings due May 22 |

“AI is still the lifeline of growth—but margin pressures and global exposure risks are becoming a reality.”

While more insulated, still reacts positively to macro stability and the perception that U.S. leadership is being reinforced, not rejected, on the world stage.

S&P

Same case can be seen with S&P 500. Sustained strength is still in the scene without signs of weakness nor reversal.

With market fears slowly dissipating, this paves way for more upside on the US market.

The S&P 500 benefits from reduced global isolation risk — a broad base of companies, from financials to consumer discretionary, gain from smoother bilateral relations.

Why Markets Are Rallying Despite Trade Tensions

The big question: If the headlines scream global trade war, why are U.S. equities still pushing higher?

Here’s the trader’s logic:

1. Markets See Politics, Not Policy (Yet)

- Wall Street is pricing in campaign posturing rather than immediate policy implementation.

- The 2018–2019 trade war taught investors that many threats don’t materialize—or get renegotiated.

- The Nasdaq and S&P 500 are being lifted by sectors less exposed to global tariffs (e.g. software, cloud).

2. The Fed Is Off the Gas

- With no rate hikes in sight and inflation cooling, monetary conditions are loosening by default.

- Lower yields make growth stocks more attractive, helping push the Nasdaq 100 back toward its highs.

3. Big Tech Is Weathering the Storm

- Earnings from Microsoft, Amazon, Apple, and Meta beat expectations, showing resilience despite global uncertainty.

- AI optimism, cloud performance, and disciplined CapEx are keeping institutional money in tech-heavy names.

4. Positioning Shift and Short Covering

- Many hedge funds entered May defensively positioned. Now, with no major bearish follow-through, they’re covering shorts and rotating back into risk.

- Retail inflows remain steady, and passive investment flows continue supporting the S&P 500.

| US Stock Indices | 52W High | 52W Low | Net Positions | Net Change | Long Positions | Change | Short Positions | Change2 |

|---|---|---|---|---|---|---|---|---|

| S&P 500 Micro | 58,280 | -9,909 | 58,280 | 14,970 | 63,511 | 10,503 | 5,231 | -4,467 |

| Nasdaq 100 Micro | 44,367 | -4,759 | 42,568 | 14,445 | 51,646 | 14,288 | 9,078 | -157 |

| Dow Futures Mini | 3,625 | -22,672 | -2,637 | -2,854 | 50,136 | -2,188 | 52,773 | 666 |

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next