U.S. Dollar Outlook: Fed Caution Suggests Pause, Trump’s Tariff Chaos & Upcoming U.S. Data in Focus

2025-05-05 15:41:48

Overview

The U.S. dollar remains resilient amid renewed trade tensions, political pressure on the Fed, and mixed economic signals. As we brace for key data releases this week—Federal Funds Rate, the main event, the ISM Services PMI and weekly jobless claims—the greenback’s strength is being tested by inflation expectations and global uncertainty.

- Fed Holds the Line – Political pressure builds

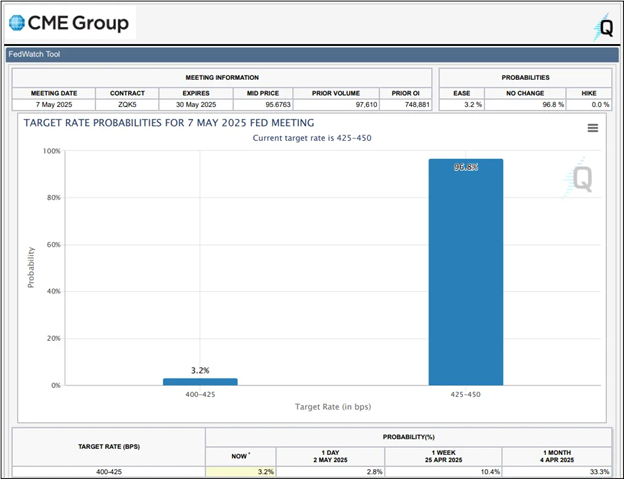

The Fed is expected to keep rates steady at 4.25%–4.50%, citing sticky inflation and global risks, but Trump’s renewed criticism of Chair Powell is adding political volatility to the outlook.

- Trump’s Trade & Powell Drama – Tariffs rise, tensions stir

Trump has ruled out firing Powell—then reversed himself again—while escalating tariffs on China and foreign-made films, all of which stir uncertainty around U.S. policy direction.

- Dollar in Focus – Key data may trigger breakout or breakdown

With the greenback hovering above key technical levels, this week’s ISM Services PMI and jobless claims will be pivotal in deciding whether the dollar extends higher—or falters under macro pressure.

Fed Holds Steady – But Trump Rekindles Pressure

The Fed interest rates is expected to hold rates this week maintaining a neutral stance despite pressures from Trump.

While Jerome Powell emphasized a data-dependent path, political headlines overshadowed the Fed’s calm tone.

Why the Fed Is Holding Rates: Insights from Recent FOMC Meetings

Since late 2024, the Federal Reserve has paused its rate-hike cycle, choosing to keep interest rates at 4.25%–4.50% across five consecutive meetings. Here's what the Fed has consistently emphasized as justification:

- Sticky Services Inflation: While goods prices have eased, inflation in housing, healthcare, and services remains elevated—keeping the Fed cautious.

- Strong Labor Market: Low unemployment and steady job growth suggest the economy can handle current rates without immediate easing.

- Cooling Consumer Demand: High rates are gradually slowing consumer spending and credit activity, signaling restrictive policy is working.

- External Risks: Tariffs, political volatility, and global tensions give the Fed reason to stay flexible without committing to cuts or hikes.

- No Recession Yet: Despite slowdown fears, GDP growth remains positive, giving the Fed no urgent reason to cut rates.

Trump Rules Out Firing Powell—But Keeps Pressuring the Fed to Cut

Just days after suggesting he wouldn’t push to remove Jerome Powell, ”Why would I do that?” Trump said, he revived pressures on the Federal reserve with concerns over the Fed’s future independence and not cutting rates fast enough, “I know more about interest rates” Trump added.

Timeline of Events:

- March 2025: Trump signals he wouldn’t pursue Powell’s removal, calling it “not a battle worth picking right now.”

- April 2025: Following Powell’s FOMC press conference reiterating no near-term cuts, Trump lashes out:

“He’s not a fan of mine. You know, he just doesn’t like me because I think he’s a total stiff.”

While Trump has publicly ruled out removing Powell, the ongoing political pressure for rate cuts adds a layer of uncertainty for traders. Any signs that the Fed may cave—or double down—could trigger sharp repricing in the dollar and bond yields.

Tariff Turbulence Returns – But China Talks Still Simmer

Trump has reignited aggressive trade rhetoric, triggering volatility across global markets—but beneath the headlines, potential trade deals with China may still be on the table.

- De Minimis Exemption Removed: The U.S. eliminated the de minimis exemption for Chinese imports under $800, affecting e-commerce platforms like Shein and Temu, leading to higher consumer prices and potential supply chain disruptions.

- China's Response: China has imposed retaliatory tariffs of up to 125% on U.S. goods and is reportedly considering exemptions for certain American products to mitigate domestic economic impacts.

- New 100% tariffs proposed on foreign-made films, targeting cultural and media industries to incentivize U.S.-based production.

Despite escalating tensions, Trump recently stated tariffs on China “could be reduced at some point,” suggesting room for negotiation.

Trade deals with China could come with this, particularly if Beijing agrees to increase agricultural purchases or ease technology restrictions—paving the way for a potential tariff rollback in exchange for concessions.

Dollar Strength Reinforced by Solid NFP

The U.S. dollar found fresh momentum last week after a stronger-than-expected Non-Farm Payrolls (NFP) report reaffirmed the resilience of the U.S. labor market. With job gains exceeding forecasts and unemployment holding near historic lows, market expectations of imminent Fed rate cuts have faded—supporting the greenback across the board.

Dollar Awaiting Fed Catalyst

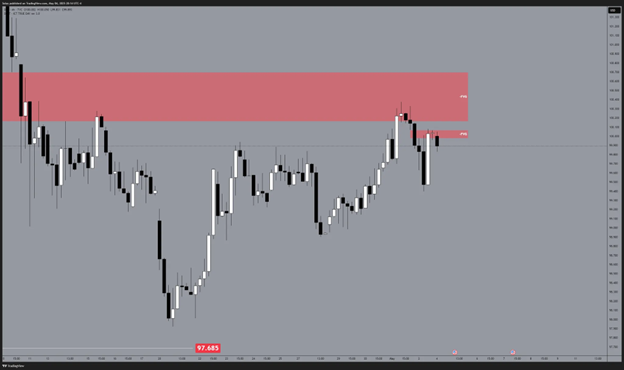

Daily

With a solid NFP print last week, this paved way for the dollar to regain strength, taking out the highs since April 15. As the Dollar awaits the Fed rate decision this week, the greenback is currently holding its ground, hovering back again at the previous daily volume imbalance sitting at 100.163 - 100.700 level.

4-Hour

4-hour is also showing us that it has a potential to trade to and through the daily volume imbalance, as long as, we trade above the 4-hour fair value gap, sitting at 99.978 - 100.068 level.

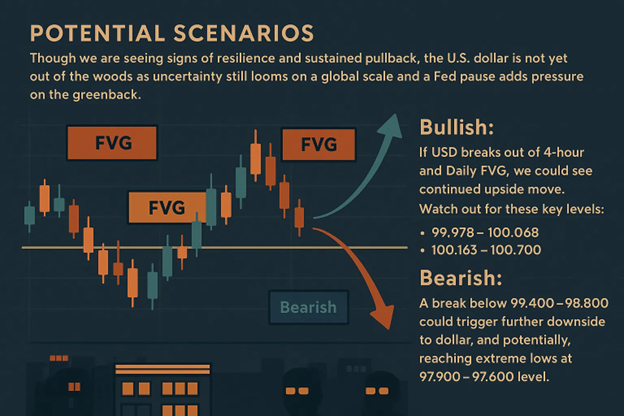

Potential Scenarios

Though we are seeing signs of resilience and sustained pullback, the U.S. dollar is not yet out of the woods as uncertainties still looms in a global scale and a Fed pause adds pressure on the greenback

- Bullish: If USD breaks out of the 4-hour and Daily FVG, we could see a continued upside move. Watch out for these key levels:

- 99.978 - 100.068

- 100.163 - 100.700

- Bearish: A break below 99.400 - 98.800 could trigger further downside to dollar, and potentially, reaching extreme lows at 97.900 - 97.600 level.

What to Watch This Week: Key U.S. Data Releases

ISM Services PMI (Due Tuesday, May 7)

- Forecast: 50.6 (vs. previous 50.8)

- Why it matters: A beat could reinforce the Fed’s hawkish lean and support the dollar. A miss might trigger a pullback as growth concerns rise.

Initial Jobless Claims (Due Thursday, May 9)

- Forecast: 232k (vs. last 241k)

- Why it matters: A surprise jump may weaken the dollar if it signals emerging cracks in the labor market—one of the last supports of the current rate stance.

Trader Outlook:

- Strong prints could fuel a continuation in dollar strength.

- Weaker data may trigger pullbacks, especially against growth currencies like AUD or EUR.

Preparation Over Prediction

This week’s setup is a classic example of uncertainty meeting opportunity. Between the Fed holding rates, Trump swinging between restraint and escalation, and crucial data releases just ahead, the dollar’s next move could be sharp—but unpredictable. In moments like these, many traders fall into the trap of trying to predict headlines instead of preparing for what price actually does.

That’s why the quote from Mark Minervini rings loud:

“In trading, it’s not about being right. It’s about being prepared.”

Rather than guessing whether the dollar will break higher or lower, your edge comes from building both scenarios, mapping your levels, and reacting with clarity when confirmation shows up.

Actionable Approach

- Map Scenarios – Define both bullish and bearish plays around the dollar using the key levels.

- Pre-Set Alerts – Use trading tools to set alerts.

- Wait for Confirmation – Only enter after price confirms direction.

- Trade Data Reaction, Not the Data – Avoid predicting ISM or jobless claims numbers. Trade how the market responds to the release.

- Review, Don’t Chase – After the move plays out, review your execution. Even a missed trade can be a win if it reinforces your discipline.

This week, don’t fight the market’s uncertainty—build a framework that thrives on it.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know