Trade Tensions and Currency Realignment Asia at the Epicentre

2025-04-09 10:05:01

Risk Appetite Returns, But Unevenly

Currency markets entered the second week of April with a sharp rebound in risk-sensitive G10 currencies. The Australian and New Zealand dollars, along with the Norwegian krone, gained over 1% against the U.S. dollar an impressive reversal from the heavy losses seen last week. This bounce has been supported by a soft improvement in investor sentiment, largely driven by a relief rally in global equities. Japan’s Nikkei 225 stood out, jumping over 6% overnight, though it remains below levels seen prior to recent market turbulence. This renewed risk appetite has not translated equally across markets. While developed currencies benefited, Asian FX continues to feel the weight of escalating trade tensions and shifting policy signals, reflecting a deeper layer of uncertainty in the region.

AUDUSD H1 Chart

Japan Finds a Window of Opportunity

Amid the noise, Japan may be positioned for a strategic reprieve. Recent comments from U.S. Treasury Secretary Scott Bessent offered a rare glimpse of trade diplomacy, hinting that Japan could be prioritized in the queue for new bilateral trade talks. This comes in the context of Washington’s proposed “reciprocal tariff” program, which includes potential levies of 24% on Japanese autos and parts. Bessent acknowledged Japan’s high non-tariff barriers but signalled confidence in a “very productive” negotiation process. These developments have given Japanese equities a boost, though the yen has not benefited in the same way. Instead, improving global risk sentiment has weighed on the currency. For rate markets, however, the shift is significant. As trade tensions with the U.S. appear manageable, the narrative of economic deterioration is being challenged. This may lead to a gradual reintroduction of expectations for Bank of Japan policy normalization an outlook that had been recently abandoned amid global growth fears.

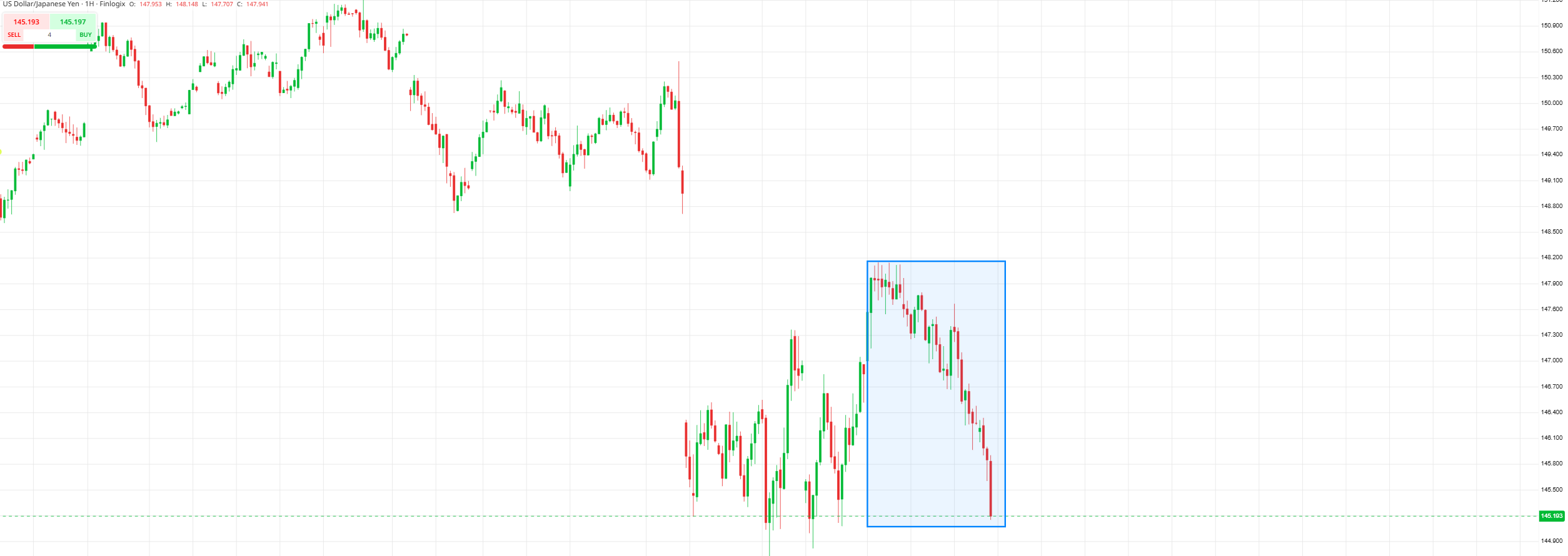

USDJPY H1 Chart

China: Back at the Centre of a Familiar Storm

While Japan looks to negotiate a smoother path, China remains firmly in the crosshairs of U.S. trade escalation. President Trump’s latest threat to raise tariffs by 50% on all Chinese imports if Beijing moves forward with its proposed 34% tariffs on U.S. goods has reignited fears of a renewed trade war. If implemented, the effective U.S. tariff rate on Chinese products would rise to an extraordinary 114%. Beijing’s response has been both defiant and diplomatic. The Ministry of Commerce promised to "fight to the end" but simultaneously emphasized the need for continued dialogue, revealing a two-pronged approach: hard-line resistance balanced with an open channel for resolution. The market’s reaction has been swift. USD/CNH spiked to 7.3651 overnight, moving dangerously close to its year-to-date highs. Importantly, the People’s Bank of China also set the daily fix above 7.2000 a level unseen since September 2023 signalling a potential shift in FX policy.

Yuan Pressure Builds as Policy Levers Shift

This adjustment by the PBoC has fuelled speculation that Chinese policymakers may now be more tolerant of a gradual depreciation in the yuan. Until now, China has prioritized FX stability to avoid capital flight and systemic risks. But with trade pressure mounting and external demand weakening, authorities may see limited options. That said, a full-scale devaluation remains unlikely, as it would risk triggering a global response and undermining domestic confidence. Instead, Beijing appears to be crafting a more nuanced strategy allowing for mild depreciation while also ramping up internal support. Reports suggest China is considering accelerated fiscal stimulus and targeted support for consumer demand. If implemented, this would offer a buffer against trade shocks without forcing an abrupt currency adjustment. For now, markets are watching how far the PBoC is willing to let the yuan weaken before stepping in to prevent disorderly moves.

The U.S. Dollar: Balancing Strength and Uncertainty

At the centre of these geopolitical tensions sits the U.S. dollar, caught between solid domestic fundamentals and growing external risks. Recent data like the Redbook retail index and NFIB Small Business Optimism highlight continued strength in the U.S. economy. However, uncertainty around trade policy and its inflationary consequences is beginning to cloud the Fed outlook. For now, the Federal Reserve remains cautious, but upcoming comments from key policymakers, including Mary Daly later this week, may offer clues on whether escalating tariffs will start influencing the central bank’s policy narrative. Any hint that trade dynamics are feeding into the Fed’s thinking could shift rate expectations quickly.

DXY 15 Minutes Chart

Key FX Pairs and What Comes Next

For FX traders and strategists, attention now turns to several key pairs. USD/CNH is nearing a technical and psychological threshold around 7.3750 if breached, it could signal a broader policy shift from the PBoC. Meanwhile, USD/JPY remains highly sensitive to headlines around U.S.-Japan negotiations. Progress here could see the yen stabilize or strengthen if rate expectations begin to shift. High-beta currencies like the AUD and NZD are likely to remain at the mercy of market sentiment, with further upside possible in risk-on environments but just as easily unwound if trade risks intensify. Emerging market currencies in Asia remain vulnerable, particularly those with close trade ties to China or heightened sensitivity to capital outflows, such as the Korean won, Indian rupee, and Philippine peso.

FX markets are entering a period of heightened sensitivity, where trade diplomacy, domestic stimulus, and central bank guidance are colliding in real time. For Japan, there may be a tactical opening to avoid deeper economic pain, but for China, the road ahead appears more combative. The U.S. dollar continues to walk a fine line between economic strength and external fragility. For investors, traders, and policymakers alike, the coming weeks will be critical. Volatility remains the only constant, and positioning needs to remain agile in this highly fluid environment.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know