Nasdaq Holds 25,400 Support as AI-Led Tech Narrative Faces Tactical Pullback

2025-11-05 13:41:04

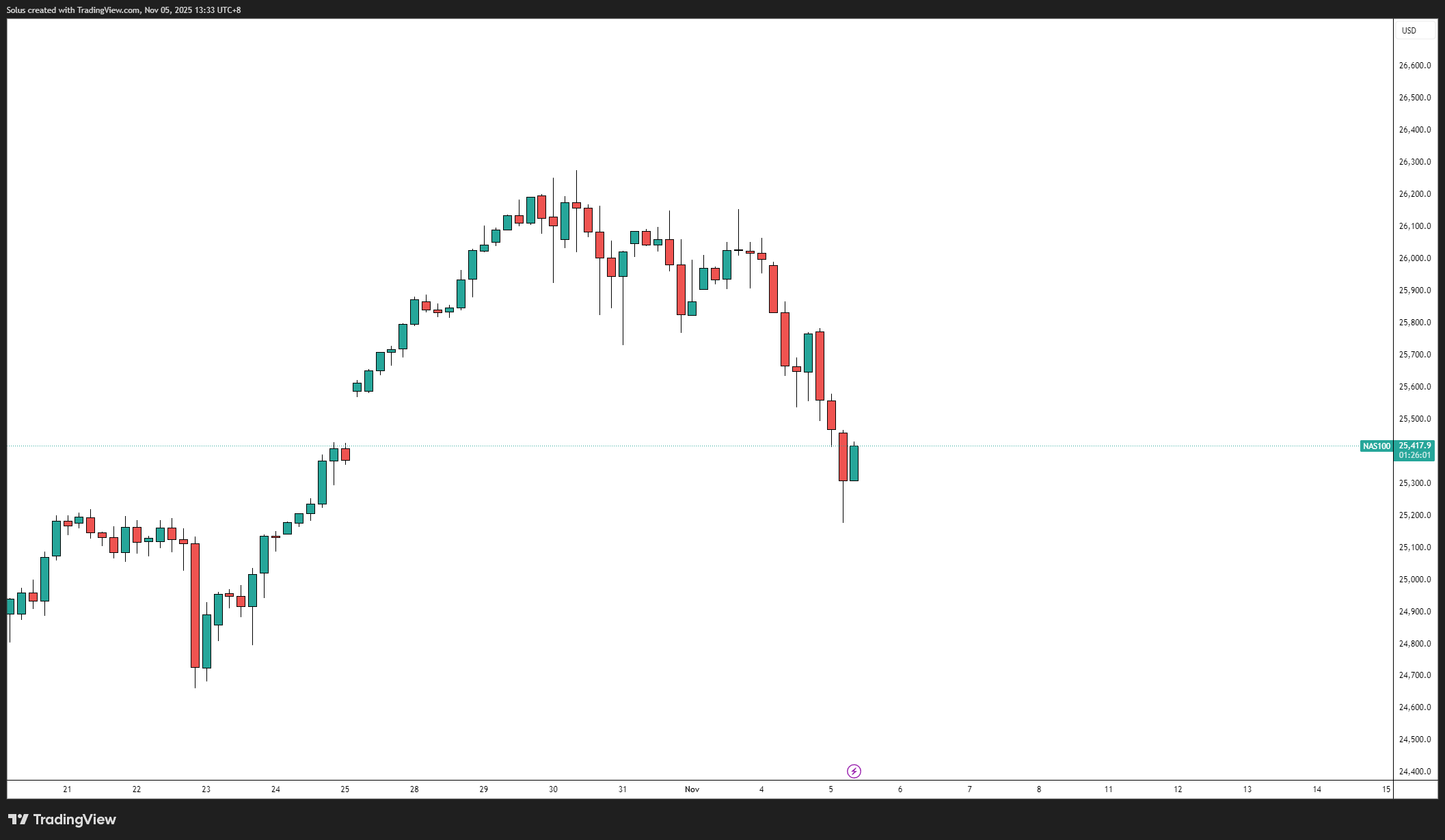

- Nasdaq retreats toward 25,400 support as AI optimism meets short-term exhaustion.

- Despite strong structural tailwinds from AI earnings, near-term technicals point to correction within a broader bullish framework.

- A base may form between 25,200–25,450; recovery above 25,800 reaffirms bullish continuation, while a break below 25,200 opens downside toward 24,800.

AI Strength Meets Tactical Repricing

After weeks of AI-driven euphoria, the Nasdaq-100 is undergoing a healthy correction phase. The move comes as traders lock in profits following a strong October rally led by Apple, Microsoft, and Amazon, all of which delivered resilient earnings anchored in AI and cloud revenues.

The broader story remains intact: the AI Capex Super-Cycle continues to serve as the main driver for tech valuations. However, the current retracement reflects a rotation phase—where investors digest recent gains, reassess valuations, and await confirmation from upcoming catalysts such as Nvidia’s November 19 earnings and the Non-Farm Payrolls (Nov 7) report.

Fed Easing Fades into the Background

The Federal Reserve’s 25 bps rate cut last week offered initial support but has since receded as a dominant driver. Powell’s cautious tone signaled that future cuts are conditional, not guaranteed.

With the U.S. government shutdown still clouding data visibility, the next major inputs for rate expectations will depend on whether the labor market shows further cooling without reigniting inflation.

This policy backdrop allows investors to focus squarely on earnings and AI productivity—not interest rate speculation.

Macro Snapshot

- ISM Manufacturing (Nov 3): 48.7 – contraction persists, easing price pressures.

- ISM Services (Nov 5): 50.7 – mild expansion, no inflation threat.

- Government Shutdown: Continues; data reliability concerns remain.

- Upcoming: NFP (Nov 7) expected to show mild job softening; volatility likely.

Technical Outlook

Current Structure

Price is currently holding near 25,400, reacting off a short-term support zone formed by the October 22 breakout base.

The previous swing high near 26,600 now serves as structural resistance, while the 25,200–25,450 band represents a critical demand area tied to the last impulsive leg’s fair value gap.

Price Action Narrative

The recent bearish leg follows a multi-session decline forming consecutive lower highs, but with the latest daily candle showing wick rejection from support, early signs of buyer re-entry are visible.

Momentum remains soft but constructive if price can close back above 25,600–25,800, which would indicate absorption of sell-side liquidity and potential re-accumulation for another leg higher.

Bullish Scenario – Reaccumulation and Recovery Above 25,800

- Trigger: Clean H1 close above 25,800 after sweeping 25,200–25,400 liquidity.

- Validation: M15 bullish MSS and displacement through the lower H4 FVG.

- Targets:

- 26,000 – 26,200 (short-term retracement target)

- 26,600 (previous swing high)

- Invalidation: H4 close below 25,150; this would shift control to sellers and invalidate near-term reaccumulation thesis.

Bearish Scenario – Breakdown Toward 24,800 Support

- Trigger: Clean rejection below 25,400, followed by close under 25,200.

- Validation: Continuation of lower-high structure with volume expansion to the downside.

- Targets:

- 24,950 – 24,800 (next external liquidity pocket)

- 24,400 (October 17 swing base / unfilled inefficiency)

- Invalidation: Reclaim of 25,800 and hold above the 4H imbalance.

What’s Next: Nvidia and NFP to Define Short-Term Direction

Traders are now awaiting Nvidia’s Nov 19 earnings, which could either reignite AI optimism or confirm rotation fatigue.

Meanwhile, the NFP print this Friday (Nov 7) may inject short-term volatility into the index.

Given the overlap of event risk and ongoing government shutdown data uncertainty, traders are advised to trade confirmation, not anticipation.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know