May 2025 Fed Press Con Recap: Fed Holds Steady – What This Means for the Dollar and Your Next Move

2025-05-08 18:31:54

May 2025 Fed Press Con Recap: Fed Holds Steady – What This Means for the Dollar and Your Next Move

The U.S. Federal Reserve has decided to hold its federal funds rate steady at 4.5% as data all points out that the Fed should not be in a hurry to cut rates, while emphasizing growing concerns about both inflation and the labor market. The tone of the statement struck a more cautious and balanced note as the Fed continues to weigh evolving risks in a still-uncertain economic environment.

Key Takeaways at a Glance

- Rate Hold Confirmed: The Fed keeps the benchmark interest rate at 4.25%–4.5%.

- Growth Holding Up: Economic activity continues at a solid pace, despite fluctuations in net exports.

- Labor Market Still Strong: Unemployment remains low and job conditions are stable.

- Inflation Still Elevated: Inflation is above the 2% target, though not surging—keeping the Fed vigilant.

- Risks to Both Mandates: Fed acknowledges increased uncertainty with rising risks of both higher inflation and higher unemployment.

- Balance Sheet Reduction Continues: The Fed will continue to wind down its Treasury and mortgage-backed securities holdings.

Fed’s Message in Plain Language

The Fed is signaling that it’s in “wait-and-see” mode.

While economic momentum hasn’t collapsed, the Fed sees warning signs from both directions—inflation that’s too high, and the possibility of employment weakening if they tighten too far. That’s why they’re holding the line on rates for now, while keeping all options open for adjustments.

Market Outlook

- DXY Watch: If upcoming inflation data cools, the dollar could weaken as expectations shift toward rate cuts in late 2025.

- Treasuries: Long-dated yields may drift lower if markets price in future easing.

- Risk Assets: Stocks may continue rallying on pause hopes—but fragile if inflation surprises.

The Fed is playing the long game—carefully balancing rate hikes and growth preservation. While the current pause may seem neutral, its wording reveals a Fed that's on high alert, not just for rising prices—but for cracks in employment too. For the U.S. dollar, expect range-bound volatility driven by incoming data, especially CPI and job numbers.

How This Impacts the U.S. Dollar

The impact on the dollar depends on how traders interpret the Fed’s tone:

🔼 Bullish Scenario for the Dollar

The Fed's cautious stance is interpreted as data-dependent but not dovish. Inflation remains sticky, labor market stable, and U.S. yields stay elevated—supporting further dollar strength.

- Markets expect the Fed to hold rates longer than peers like the ECB or BOJ.

- Inflation expectations rise, prompting hawkish expectations for future rate hikes.

Daily

The dollar closed on a positive note yesterday following the Fed’s decision to hold rates steady. While a pause might initially seem neutral or even dovish, it’s providing the greenback with a window of strength. The absence of an immediate rate cut gives the dollar breathing room to extend its gains, as markets reassess the timing and pace of future easing. This "calm before the cut" creates a bullish opportunity zone—at least in the short term.

- Fed pause ≠ weakness — No rate cut means the dollar still benefits from relatively high interest rate differentials.

- Short-term relief rally — With no policy pivot yet, USD may attract flows before potential softness later in the year.

- Room before retreat — This gives dollar bulls space to position before markets begin pricing in a full easing cycle.

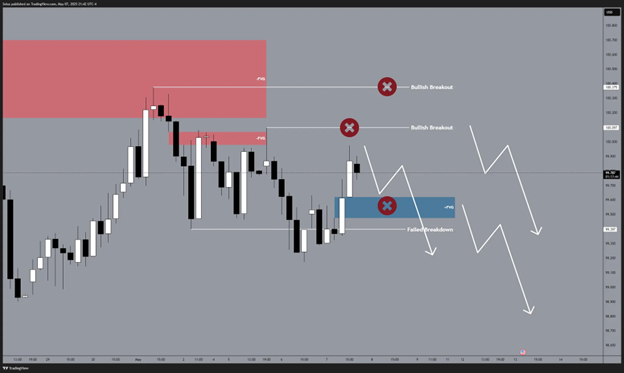

4-Hour

Upside Checklist:

- If 100.097 - 100.375 breaks

- 99.476 - 99.620 bullish FVG holds

- 99.400 still holds

If bullish scenario confirms:

- Look for trades in favor of the Dollar, favor shorts on majors against the foreign currencies.

🔽 Bearish Scenario for the Dollar

Market interprets the Fed’s language as tilting toward a future rate cut, especially if CPI and labor data weaken. Risk-on mood returns, reducing safe-haven flows into USD.

- Traders view the Fed’s “dual-risk” language as a dovish tilt.

- Yield spreads narrow between the U.S. and other economies.

Despite a brief lift post-Fed, the dollar’s upside may be short-lived. The decision to pause rather than hike reinforces growing expectations that the next move could be a rate cut—a clear negative for the dollar in the medium term. This pause may not be a sign of strength, but rather a pivot point toward easing, which could erode the greenback’s yield advantage and trigger broader selling pressure.

- Markets smell a pivot — The pause is being read by some traders as a precursor to rate cuts, not hawkish patience.

- Yield advantage under threat — As Fed easing gets priced in, the dollar could lose support vs. currencies with firmer rate outlooks.

- Risk-on rotation — Lower U.S. yields may drive capital into equities and risk assets, draining safe-haven demand for USD.

- Breakdown watch — A technical rejection at 100 and a daily close 99.200 on DXY would confirm bearish momentum.

Downside Checklist:

- If 100.097 - 100.375 holds

- 99.476 - 99.620 bullish FVG breaks

- 99.400 breaks

If bearish scenario confirms:

- Look for trades against the Dollar, favor longs on foreign currencies.

Build a Bullish & Bearish Scenario

Whether you use Smart Money Concepts, trendlines, support/resistance, indicators, or order flow—this structure works:

Step 1: Mark Key Levels

- Swing highs/lows

- Previous session/day/week highs & lows

- Any relevant structure, supply/demand, or MA crossover zones

Step 2: Build a Bullish Scenario

- What would need to happen for a long bias?

- Where’s the confirmation? (e.g., bounce, BOS, divergence, etc.)

- Where will you enter, exit, and invalidate the idea?

Step 3: Build a Bearish Scenario

- Same as above, but flipped: What signals a short bias?

Step 4: Execute the Side That Confirms

- Trade the plan that plays out. Not the one you want—the one that proves itself.

Caveat to Keep in Mind

While the dollar may have short-term room to rally on the back of the Fed’s pause, it’s essential to stay fluid. Market narratives can shift quickly—especially around inflation prints, employment data, or unexpected policy signals. Whether bullish or bearish, don’t anchor to a fixed bias.

Let the charts, structure, and confirmation setups guide your positioning

—not just the macro headline.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know