Markets are Shifting: Global Investors Seeking Stability in Europe Assets as US Market Weakens

2025-04-22 11:32:45

Overview

This week’s broad USD pullback wasn’t solely about economic data or central bank policy. It reflected something deeper: a global risk re-pricing in favor of environments with clearer policy direction, lower geopolitical friction, and less monetary uncertainty.

- Investor Confidence in U.S. Assets is Fading: Citi and PIMCO downgraded U.S. equities and Treasuries, citing concerns over tariffs, Fed hesitation, and fragile sentiment.

- Capital Flows Shift to Eurozone: European region offer more predictable policy paths, reduced stagflation risk, and relative insulation from U.S. trade disputes.

- Speculative Positioning Confirms the Shift: COT data shows surging long exposure to the Euro, while USD longs weaken and shorts accelerate.

From a weaker dollar bias to bullish sentiment on the euro, the message is clear: Investors are hunting for stability — and they're not finding it in the U.S. anymore.

Diminishing Confidence in U.S. Assets

Recent policy shifts and economic indicators have led to a reevaluation of U.S. investments:

- Citi downgraded U.S. equities to "neutral," citing persistent high valuations and the potential negative impact of tariffs on GDP and corporate earnings. They highlighted the appeal of European equities, upgrading them to "overweight" due to more attractive valuations and reduced susceptibility to U.S. tariffs.

- PIMCO expressed a bearish outlook on the U.S. dollar and long-term Treasuries, pointing to heightened protectionism and the challenge to the traditional perception of U.S. assets as safe havens.

Why Investors Are Moving Away from the U.S.

- Uncertainty around U.S. trade policy, rising tariffs, and inflation expectations have dampened investor confidence.

- Markets are increasingly concerned that U.S. monetary policy is constrained, with the Fed hesitant to cut aggressively despite softening data due to inflation optics.

- The sharp drop in consumer sentiment and rising inflation expectations have added a layer of discomfort for equity and bond investors.

As a result, capital has begun flowing out of U.S. equity and fixed income markets, pressuring the dollar.

Institutional Bias: Bullish Bias Weakens as Shorts Surge

| Commodity | Net Positions | Net Change | Long Positions | Change | Short Positions | Change |

|---|---|---|---|---|---|---|

| U.S. Dollar Index | 1,828 | -1,085 | 15,722 | 235 | 13,894 | 1,320 |

Source: Barchart

This aggressive buildup in shorts outpaced the longs, hinting at growing bearish pressure. The rise in short exposure could reflect concerns over U.S. economic resilience, especially amid tariff tensions, softening growth indicators, and speculation about the Fed's next move.

What This Means for the Dollar

- The net long position is still positive, but only marginally — indicating that bullish conviction is fragile.

- The surge in short interest could be signaling a shift in market expectations, especially if economic headwinds continue to mount.

Short Positions are increasing by 1320 totaling 13894 suggests that a bearish bias is growing against the Dollar.

Where the Flows Are Going: Europe

Amid growing macroeconomic uncertainty, global investors are reducing exposure to U.S. assets and reallocating capital toward regions perceived as more stable and less politically charged — namely, Europe.

Eurozone assets are seeing increased demand — not because they’re thriving, but because they’re relatively more stable in the current environment.

- The ECB, having already started a controlled easing cycle, offers policy transparency and a weaker stagflation risk profile than the U.S.

- In recent weeks, Eurozone equities and bonds have seen net inflows, while U.S. investment-grade bond funds reported outflows — signaling a rotation in positioning.

Europe: A Resilient Alternative

European markets are attracting investors with their relative stability and growth prospects:

- European equities and bonds are attracting renewed global interest. According to EPFR, Eurozone bond funds saw net inflows, while U.S. investment-grade debt reported outflows.

- European banks have delivered strong performances, with net interest income remaining robust and revenue growth outpacing costs, indicating resilience amid economic challenges.

- Despite slowing growth, Eurozone inflation expectations remain anchored, reducing the risk of stagflation — unlike in the U.S.

- The ECB's measured 25 bps rate cut offered policy clarity, making the eurozone a comparatively attractive destination.

Citi Raising Bets on Europe

Citi upgraded European equities to overweight, citing valuations and resilience in the face of global trade tensions.

Insight: The euro is now benefiting from a “less bad” macro outlook — it’s not that Europe is booming, but that the U.S. is no longer seen as the safer alternative.

With Germany and France reporting better-than-expected industrial and services data, and with core inflation moderating gradually, the euro zone looks increasingly attractive for institutional inflows seeking stability over yield.

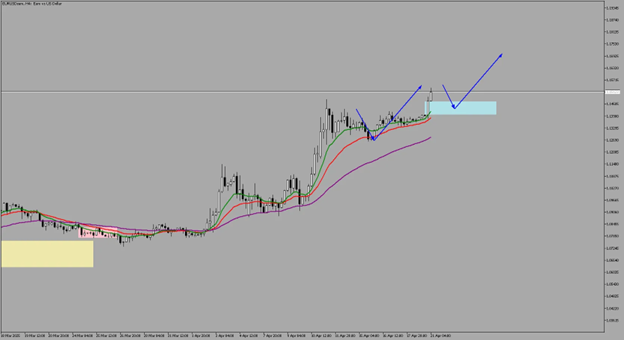

Euro on the Move to New Highs

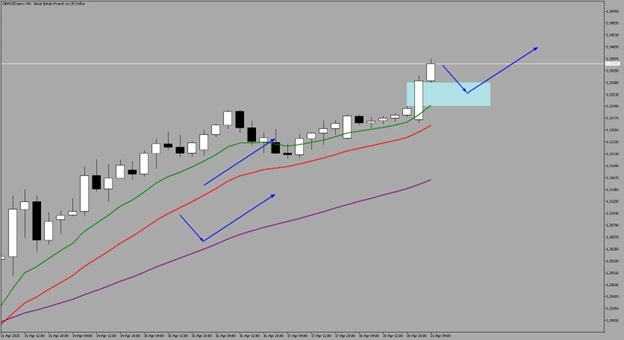

Daily

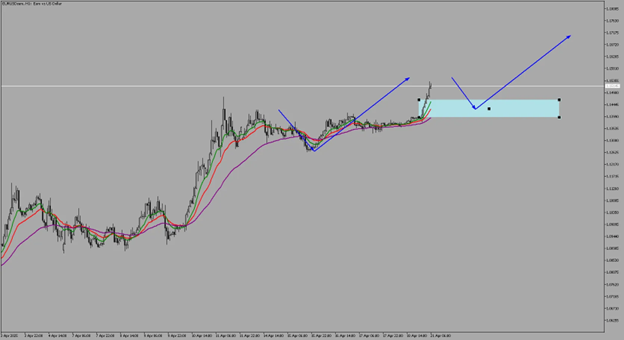

4-Hour

Euro is on a steady move, creating new highs as forecasted: https://acy.com/en/market-news/market-analysis/soft-cpi-hawkish-rivals-dollar-slid-against-eur-gbp-cad-chf-j-o-04152025-110326/.

With Dollar losing traction, we could see further upside on Euro with incoming new highs as investors consider valuable, more than the US market.

Potential Levels for Upside Continuation

- 1.13965 - 1.13965 - Bounce Opportunity

- 1.15 Psych Level - Breakout Opportunity

| Commodity | Net Positions | Net Change | Long Positions | Change | Short Positions | Change |

|---|---|---|---|---|---|---|

| Euro FX | 69,280 | 9,300 | 197,103 | 6,807 | 127,823 | -2,493 |

Source: Barchart

The latest Commitments of Traders (COT) report reveals growing bullish sentiment toward the Euro FX, as traders continue to unwind short positions and load up on longs.

- Net Positions jumped to 69,280, up by 9,300 contracts — a strong signal that institutional sentiment is tilting in favor of the euro.

- Long Positions surged by 6,807 contracts, reaching a total of 197,103, reflecting increased confidence in euro upside.

- Short Positions declined by 2,493 contracts, now totaling 127,823. This unwind of bearish bets adds further support to the bullish case.

This positioning shift likely reflects growing skepticism about the U.S. dollar, possibly tied to Fed indecision, stagflation fears, or relative strength in the eurozone economy.

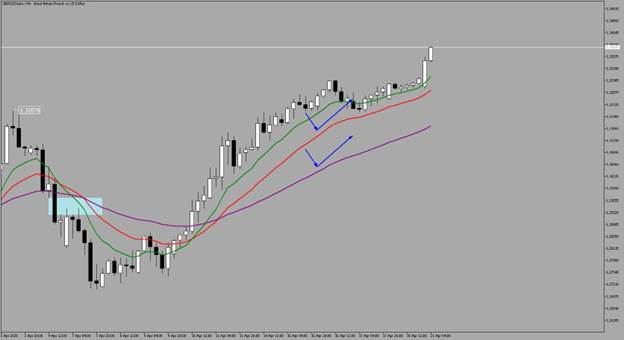

Pound Extends Gains on Softer UK Inflation, Stable Unemployment Rate and Broad Dollar Weakness

The British pound advanced strongly last week, breaking above the 1.33 handle to reach a fresh six-month high against the U.S. dollar.

The move was driven by two converging factors: a cooling UK inflation print and stable unemployment rate, which reinforced expectations of a May rate cut from the Bank of England (BoE), and the broader retreat in dollar sentiment following Fed Chair Powell’s cautious tone.

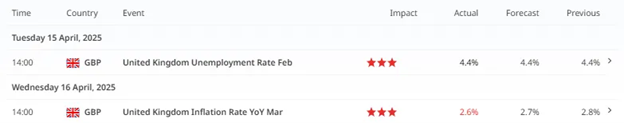

- UK Data Supports a Dovish BoE, but the Pound Strengthens Anyway

- UK headline inflation slowed to 2.6% in March, down from 2.8% in February — below expectations.

- The data gives the BoE cover to begin its easing cycle, with markets pricing in a 25 bps cut as early as next month.

- However, GBPUSD rallied, defying conventional logic where rate cut bets typically weigh on a currency.

Why? Because the move was more about dollar weakness than pound strength. With U.S. inflation expectations climbing and Fed hesitation growing, traders favored currencies where rate paths were clearer — even if dovish.

Additionally, the UK economy appears less exposed to direct tariff fallout compared to the U.S., particularly in the manufacturing and technology sectors. This makes GBP a relative outperformer in a macro environment driven by trade shocks and shifting capital flows.

| Commodity | Net Positions | Net Change | Long Positions | Change | Short Positions | Change |

|---|---|---|---|---|---|---|

| British Pound | 6,509 | -10,801 | 85,708 | -6,025 | 79,199 | 4,776 |

Source: Barchart

Despite relatively stable UK macro data, pound bulls appear to be trimming exposure, especially in contrast to the euro. Several factors could be driving this divergence:

In contrast, the Euro is seeing a surge in long positions (+6,807) and a cut in shorts (–2,493), reflecting a more confident macro and policy backdrop:

- ECB credibility remains intact, and the bloc's export resilience and current account surplus add a fundamental buffer.

- Euro is seen as a safe alternative to the USD, especially amid U.S. stagflation concerns and Fed policy hesitation.

The positioning shift shows a clear favoring of the euro over the pound as investors seek relative stability in FX markets.

4-Hour

Potential Continuation Levels

- 1.32992 - 1.33428 - Pullback Opportunity

- 1.34 - Breakout Opportunity

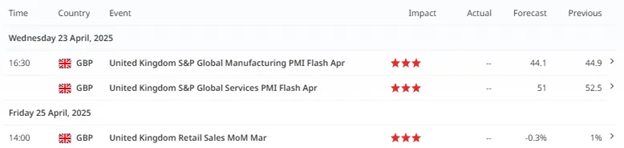

Key Driver This Week

Actionable Approach: How to Trade the Capital Rotation Narrative

- Fade the Dollar on Key Retests

- With sentiment turning, any relief rallies in USD are likely short-lived unless backed by strong data.

- Focus on fade setups around key technical levels where fundamentals disagree with price action.

- Reallocate Bias to Relative Strength

- Anchor Your Strategy in Macro Context

- Manage Exposure, Not Just Trades

- Favor EURUSD, GBPUSD for upside.

- Use multi-timeframe structure: D1 for directional bias, H4 for institutional flow, M15–M5 for entries.

- Don’t overreact to intraday volatility; zoom out and align with macro themes, not just candles.

- Don’t over-leverage just because USD is dropping — instead, diversify across Euro, GBP setups.

- Expect increased volatility as global repositioning unfolds — protect capital, not just profits.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

Join me in Discord: https://discord.gg/G8f7a5RnaF

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next