JPY Strengthens as Ueda Signals Potential Rate Hike at Upcoming BoJ Meeting

2025-01-16 10:34:34

I’ve noticed that recently the market had some significant shifts, with recent data releases and central bank communications shaping market sentiment across major economies. A key focus remains on inflationary pressures in the United States, evolving monetary policy signals from the Bank of Japan (BoJ), and fiscal adjustments in Europe. Together, these dynamics have triggered notable currency movements and investor expectations.

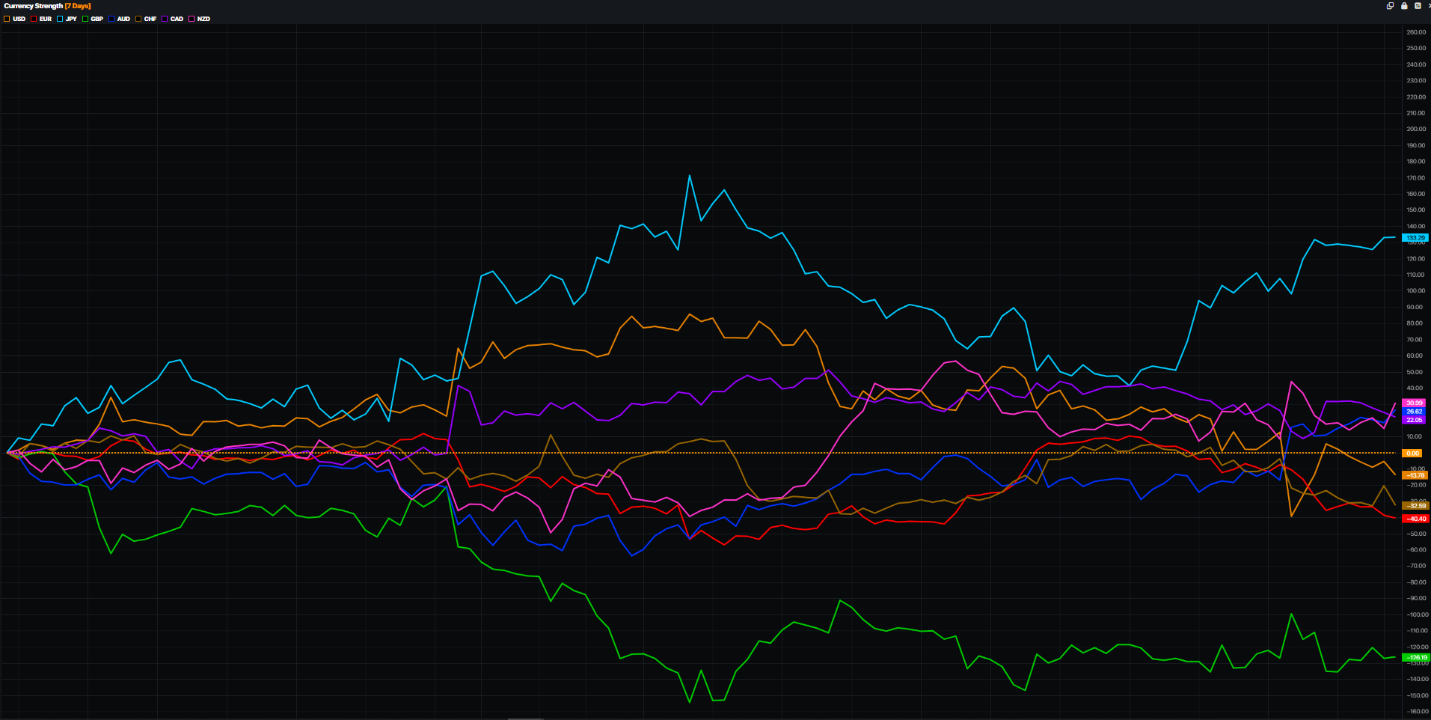

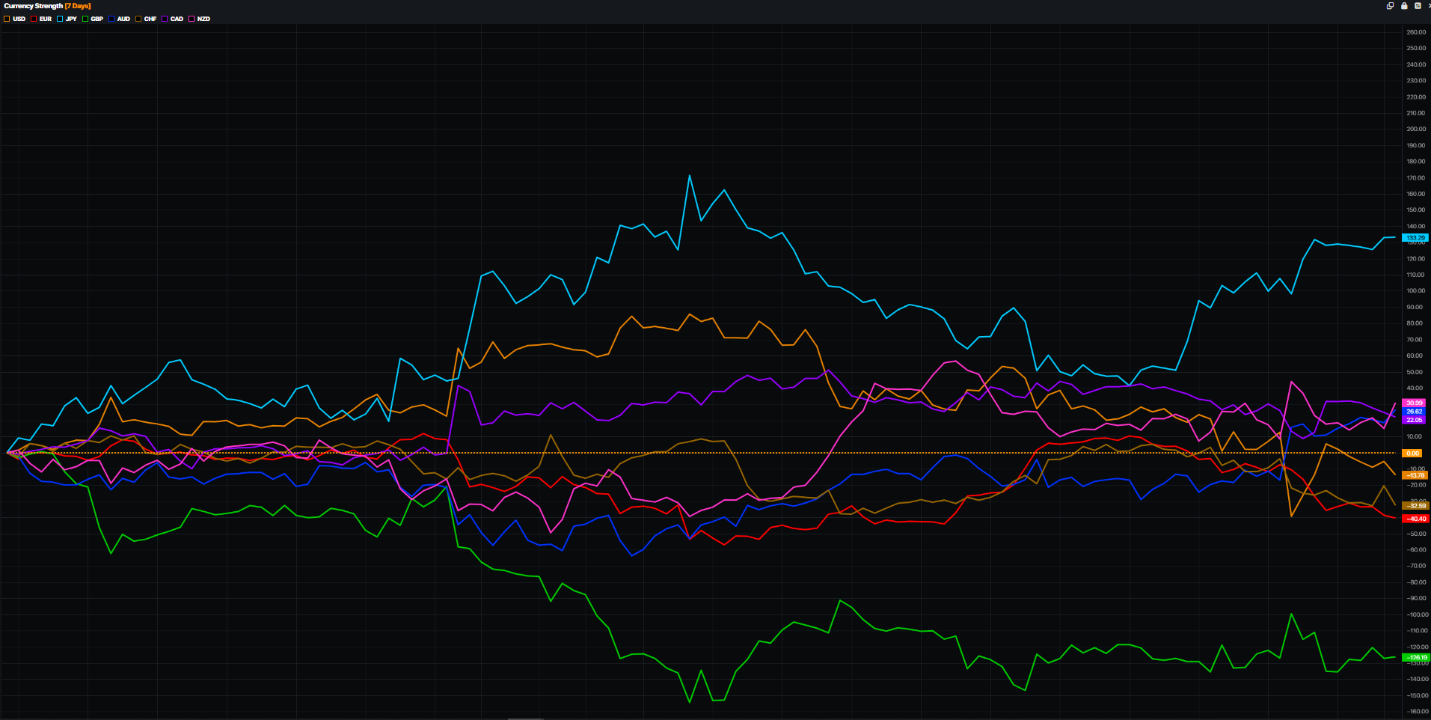

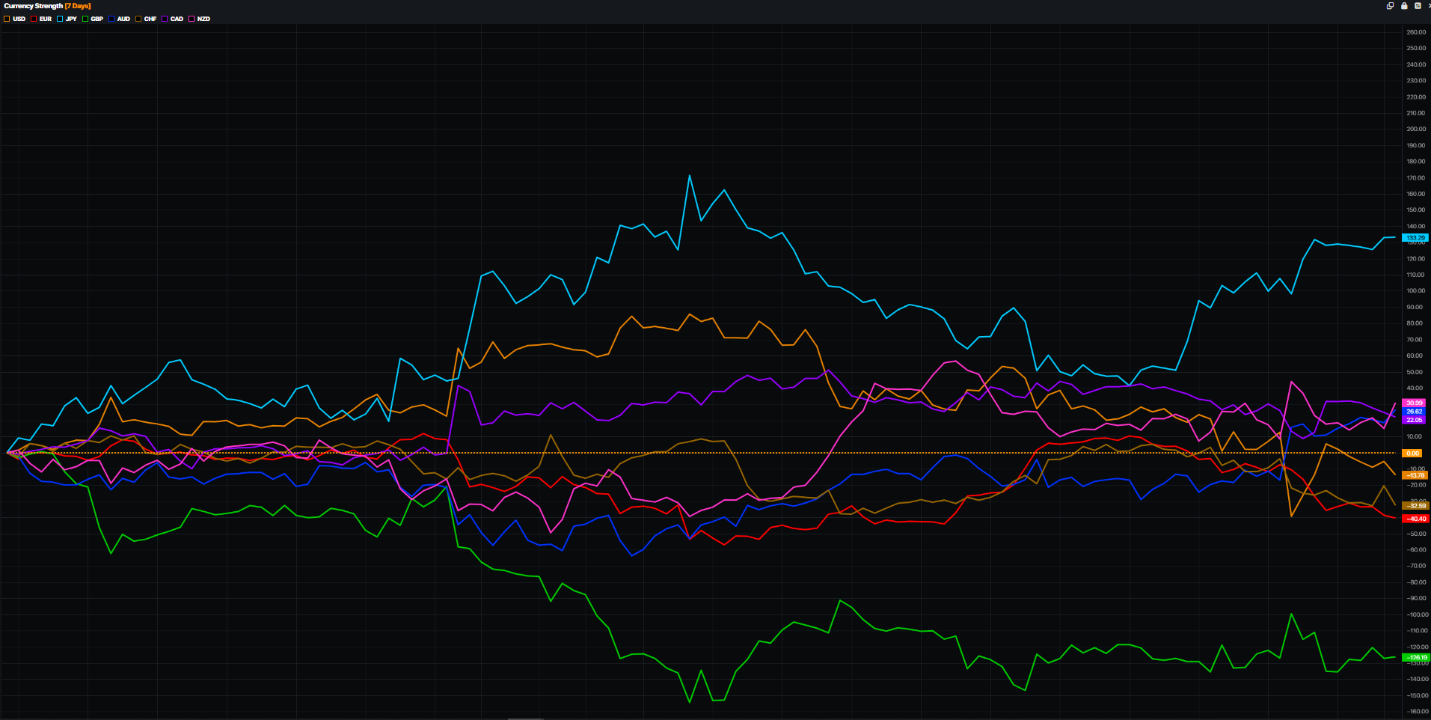

Currency Strength

United States: Easing Inflation but Lingering Concerns

The latest Producer Price Index (PPI) report from the US has introduced fresh concerns about inflationary persistence, despite headline figures falling below expectations. Core and core-ex-trade PPI metrics also weakened, which contributed to a softening of the US dollar.

PPI Release

However, components such as airline passenger services, which saw a striking 7.2% month-on-month increase—the largest since early 2022—highlight pockets of price stickiness. This development suggests the potential for a 0.3% rise in the core Personal Consumption Expenditures (PCE) index, a key inflation gauge closely monitored by the Federal Reserve.

The Federal Open Market Committee (FOMC) is navigating a challenging environment as it eases monetary policy amidst stubborn inflation, you can check my blog about FOMC cutting or not this year; Historically, the current average core PCE inflation of 3.0% is the highest at the onset of a rate-cutting cycle since 1989. Unlike previous easing phases, the 10-year US Treasury yield has risen over 100 basis points since the September rate cuts, signalling heightened market apprehension over entrenched inflation risks.

Japan: Rising Probability of a Policy Shift

Japan's monetary policy landscape is poised for a potential shift as signals from key officials, including Governor Ueda and Deputy Governor Himino, indicate the likelihood of a 25-basis-point rate hike. Comments from these leaders have pointed to robust wage growth as a key factor supporting such a move. Market expectations for a hike at the upcoming January 24 Bank of Japan (BoJ) meeting have surged to 75%. If realized, this decision could strengthen the yen further, though significant pre-decision movements are unlikely due to market caution.

The BoJ's readiness to discuss tightening reflects a broader shift in Japan’s policy stance after years of ultra-loose monetary measures. Additional media reports or official guidance in the lead-up to the meeting could further shape market sentiment.

USDJPY 5 minutes

Europe: Fiscal and Political Adjustments in Focus

In Europe, the spotlight is on France, where Prime Minister François Bayrou delivered a critical policy address aimed at breaking political gridlock. His proposals for the 2025 budget, which target a 5.4% GDP deficit reduction rather than the previously proposed 5.0%, have calmed immediate investor concerns. The narrowing of the OAT/Bund spread by 2-3 basis points reflects this easing tension.

Bayrou's announcement to reopen pension reform negotiations represents a strategic shift, seeking to balance fiscal discipline with political stability. While these measures provide short-term relief, scepticism remains about the credibility of medium-term fiscal projections, particularly as economic growth forecasts have been revised downward. Despite these efforts, the euro's performance is unlikely to see sustained impacts from these developments.

United Kingdom: Easing Inflationary Pressures

In the UK, softer-than-expected inflation data provided a reprieve for Chancellor Reeves, who has faced mounting pressure amid rising gilt yields. The services CPI fell to 4.4%—the lowest since March 2022—undershooting both market expectations and the Bank of England's (BoE) projections. This development strengthens the case for a February rate cut, which is now priced with an 85% probability.

Although rate cuts often weigh on currency values, the pound could benefit in the short term as easing inflation alleviates concerns over a potential gilt crisis. Investor sentiment is further supported by the government's commitment to fiscal discipline, as highlighted by Reeves' assurances of spending cuts to meet self-imposed fiscal rules.

The inflation landscape and central bank actions underscore the delicate balancing act faced by policymakers globally. Upcoming events, including the BoJ meeting and further US inflation data, will be critical in shaping market trajectories. The interconnectedness of monetary policies, fiscal adjustments, and geopolitical developments continues to define the complex dynamics of global financial markets.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know