Gold Surges as Trump Announces 90-Day Tariff Pause

2025-04-10 15:09:38

Overview

Trump’s Tariff Pause Triggers Gold Rally – Market Seeks Safety Amid Mixed Signals

- Gold surged over 5.95%, breaking above $3,060, as markets interpreted the tariff pause and 125% levy on China as a risk, not relief

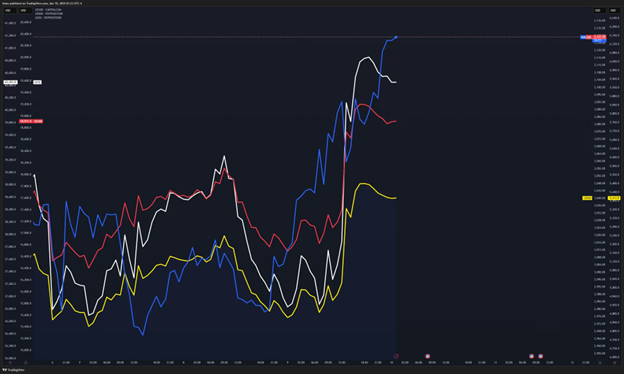

Market Sentiment Shifts Back to Risk-Off – Volatility and Bonds Reflect Caution

- The VIX held above 30, showing sustained fear as geopolitical risk remains elevated

- US 10Y bonds bounced off recent lows, reflecting a defensive rotation into Treasuries

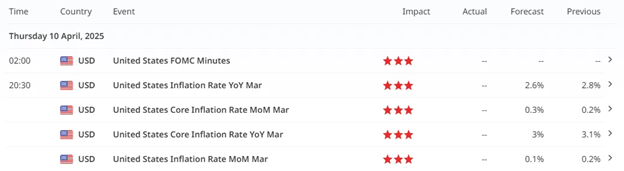

Eyes on CPI – Inflation Data Could Fuel Gold Momentum

- A weaker CPI print may further pressure the USD and drive additional upside for gold

Market Interprets Sudden Trade Policy Shift as Uncertainty, Driving Safe-Haven Demand

Following President Donald Trump's unexpected announcement of a 90-day pause on new tariffs for most nations, gold prices surged, breaking the 3-day highs exhibiting a renewed strength. Investors sought refuge in safe-haven assets, interpreting the policy shift as a source of uncertainty rather than stability.

Price Action: Gold climbed over 5.95% coming from the April 7 lows, surpassing the $3,060 per ounce mark, indicating strong bullish momentum.

Tariff Pause Sparks Mixed Market Reactions

While the tariff pause was intended to ease trade tensions, the inclusion of a substantial 125% tariff on Chinese imports added complexity to the market's outlook. This juxtaposition led to increased demand for gold as a hedge against potential economic instability.

- Investor Sentiment: The escalation of tariffs on China to 125% heightened concerns over prolonged trade disputes, prompting a shift towards safe-haven assets like gold.

- Equity Markets: Despite the tariff pause, major indices experienced volatility, reflecting the market's apprehension regarding the effectiveness of the policy change.

Tariff Pause: Why A Sudden Shift?

"People are jumping out of line. People are a little-bit afraid and yippy. But no president has done it.” - Donald Trump

Andy Sieg, Citi Head of Wealth: “Don’t buy the dip! Don’t invest in risk assets—yet.”

With risks still in play, added global uncertainty fueled by sudden trade policy shift encourages investors to consider safe-haven assets like Gold.

Pressure on Risk-Assets: Bond Bounces

As the US government escalates trade tensions with its trade partners, primarily China, this allowed US-10 government bonds to bounce of the recent lows with a potential rebound ahead.

Fear Gauge: Markets Are Still Fearful

With the VIX or Volatility Index still holding its ground above the 30 level, the coast is not yet clear if the risk-off sentiment is already fading. The tariffs maybe a relief on most economies but an escalation from China and European countries still creates uncertainty and pressure on the US markets.

Flight to Safety: Gold Still King Amidst Global Market Turmoil

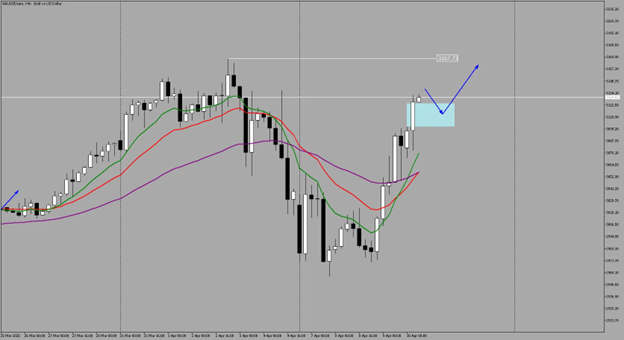

Daily

After a bounce at the $3000 level, gold is now gearing to draw on liquidity near all-time high levels.

With the current price action and market turmoil, gold is moving with little to no sign of resistance.

4-Hour

Potential pullback opportunity with gold can be set at the previous 4-hour volume imbalance sitting at 3101.33 - 3123.83 FVG.

Added Fundamental Confluence

The upcoming CPI release could give gold a kick to the upside if the print comes out negative, numbers against the Dollar.

Final Takeaway: Gold Still King in Uncertain Terrain

Gold's recent surge underscores its role as a preferred safe-haven asset amid policy-induced market uncertainties.

- Gold is leading the charge as capital flows away from risk

- Until volatility drops and inflation data stabilizes, gold remains a key macro barometer

The mixed signals from the tariff pause—alleviating some tensions while exacerbating others with increased tariffs on China—have led investors to hedge against potential economic instability.

In times of policy uncertainty, gold remains a steadfast indicator of investor sentiment, reflecting the market's search for stability amid fluctuating economic policies.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next