Forex Market Insights: USD, AUDUSD & NZDUSD Analysis

2025-02-11 12:05:31

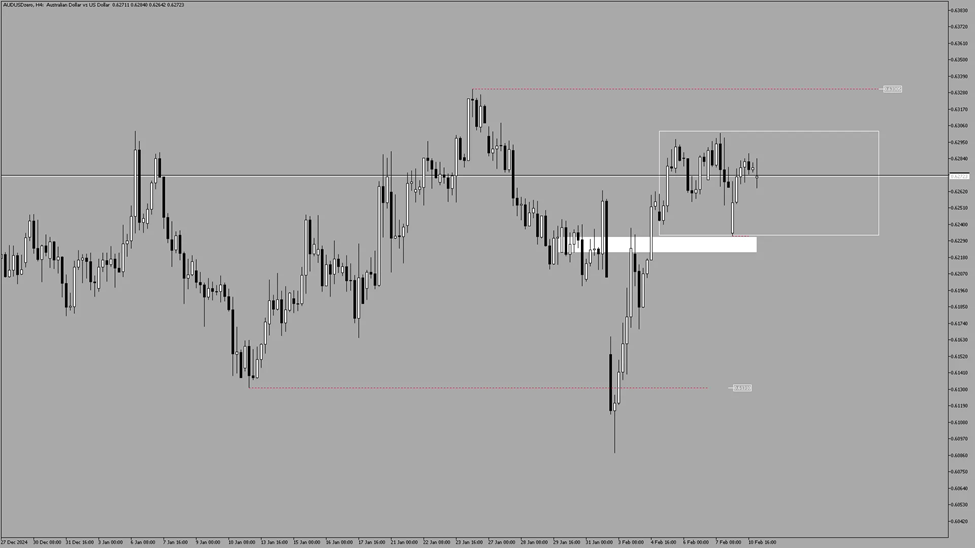

USD Daily Chart

We are still below equilibrium. So far, we are seeing sustained strength for the Dollar.

Previously, we had a strong wick for downside potential but there’s no strong follow-through.

If Dollar was weak last week, we were looking for price to trade to and break through that immediate low on the Daily Chart.

But we haven’t even tapped the low for downside continuation.

We have now invalidated the Volume Imbalance or the Fair Value Gap marked as gray. This is a pocket of price action or a gap that was not traded to for a source of liquidity. Usually, this kinds of gaps are traded to but price must not break above in this case for bearish scenario.

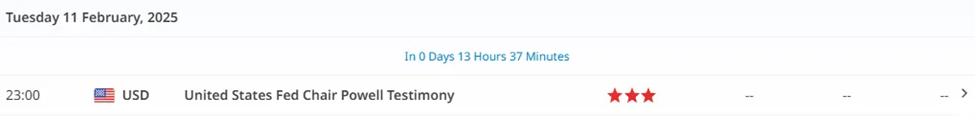

4-Hour Chart

If we are picking up the pace for bullish scenario, we’d like price to breakout of the 4-Hour Consolidation or Range. We might see price getting ready for Powell’s speech.

Potential scenarios that we could anticipate:

#1 - Price breaks out of the range and stays above the lows of the current range.

#2 - Price breaks out of the range but fakes out and goes down further after retesting the previous support turned resistance.

#3 - Price breaks out of the range, takes out the lows and creates a bullish sequence (higher highs and lows).

If we will see a bullish sequence, we’d like to look for shorting opportunities for the Majors.

If we are bearish, we’d like to look for long opportunities.

AUDUSD Market Recap

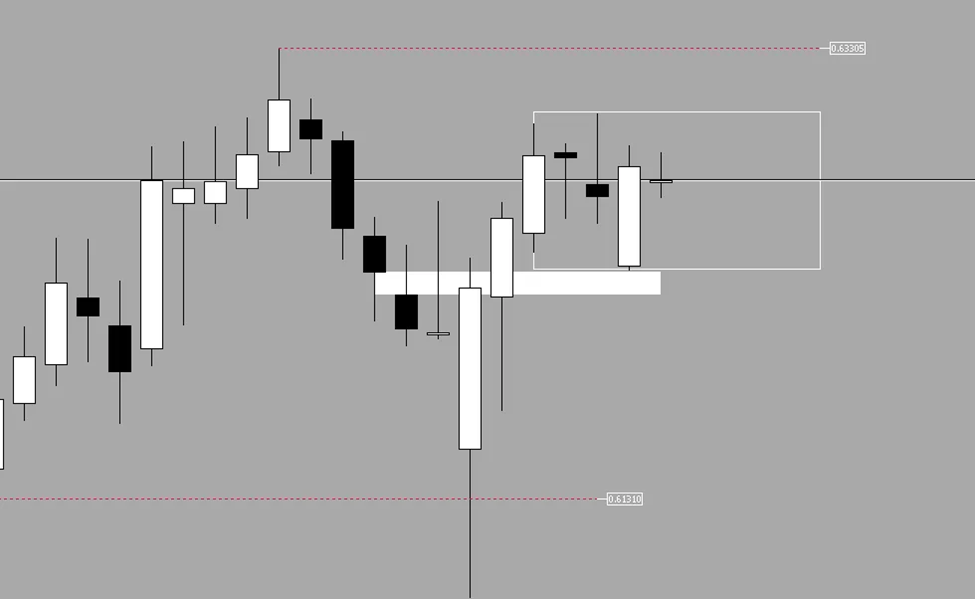

Daily Chart

We had a strong close yesterday after price bounced off that Volume Imbalance shaded in white.

We are still not out of the woods since we wanted that 0.63305 to break first before we transition to a bullish potential.

We may have a strong close yesterday but we have not broken the next high for a bullish potential. As of now, we are still inside the range.

In conjunction with USD’s analysis, if USD breaks out, we’d want AUD to break down the box.

It also makes sense that we are still not transitioning to a strong bullish bias since we have not broken any significant highs for us to transition.

4-Hour Chart

Best approach we could do is to wait for price to test either sides, the support and resistance. We also want to consider the status of USD before making any decision since Dollar is our main baseline.

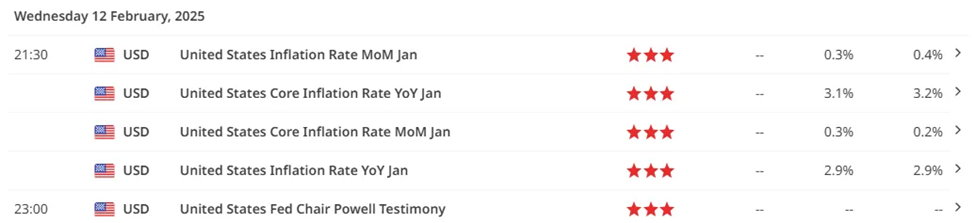

Catalysts that we should wait:

CPI will play a big role in moving AUD this week. This is also applicable with other Majors and other currencies paired with USD.

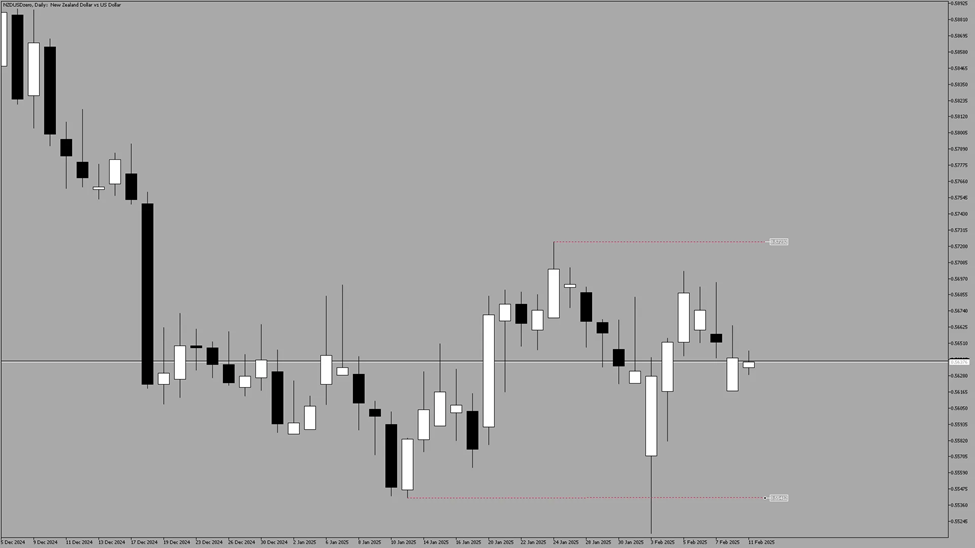

NZDUSD Market Recap

AUDNZD as a weighing scale for AUD vs NZD

Daily Chart

Compared to AUD, we have closed bullish yesterday but not strong enough for an upside potential since yesterday’s candle closed 50% of the body compared to its wick.

Prior to yesterday’s close, the previous daily candles have not shown any strength, particularly candles from Feb 6 up till yesterday.

If you will also observe, NZD has not picked up significant strength for a sustained upside move.

Upticks are frequent and longer vs the ticks on the lows.

This tells us that, during intraday or lower timeframes, NZD created a lot of fake moves for the upside.

This also means that though price may be bullish but it’s not being sustained.

Referencing AUDNZD to choose what pair to trade between AUD and NZD.

Since AUD and NZD are correlated, both do not move with the same momentum or strength as one will always be stronger than the other.

This is what we call the “Triad Filtration”. Wherein we use 3 currencies to weigh, which one to trade.

We can see above that AUD is picking up strength vs NZD. If we are going to reference USD’s analysis, and we are leaning to a long, its easier to pull NZD to the downside compared to AUD.

The same concept applies with USD being bearish.

If we are looking to trade against USD and we see AUD is picking up strength, it’s easier to pull AUD to the upside vs NZD.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next